Readers Question: How does inflation targeting operate when there is a deflation? and what are the problems associated with this?

It’s a good question to ask at the moment, especially with regard to the ECB and Eurozone.

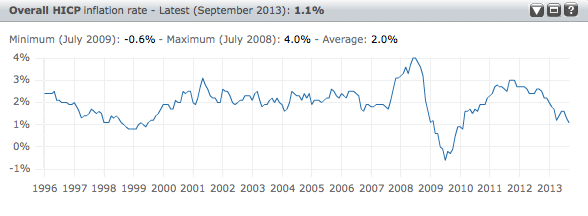

Firstly, the EU inflation target is – below but close to 2%. If inflation falls below 2%, the Central Bank should pursue a loosening of monetary policy – lower interest rates (if possible), quantitative easing and allowing the exchange rate to fall.

The ECB state

By referring to “an increase in the HICP of below 2%” the definition makes clear that not only inflation above 2% but also deflation (i.e. price level declines) is inconsistent with price stability.

Basically, the ECB target is 2%

The UK has an inflation target of CPI 2% +/-1 (i.e an inflation rate of 1-3%)

If inflation falls below the target then this is a problem and Central Banks should be committed to solving it.

How to increase the inflation rate?

If inflation is falling below 1% – or even forecast to be falling below 1% a Central Bank should intervene. There are several things it can try and do.

1. Reduce interest rates. Lower interest rates make borrowing cheaper and should help to stimulate demand. However, for the UK and the EU, interest rates are already at zero. Therefore, interest rates are not an effective tool for fighting deflation.

The ECB themselves mention a problem of deflation

“Having such a safety margin against deflation is important because nominal interest rates cannot fall below zero. In a deflationary environment monetary policy may thus not be able to sufficiently stimulate aggregate demand by using its interest rate instrument. This makes it more difficult for monetary policy to fight deflation than to fight inflation.” (ECB Price stability)

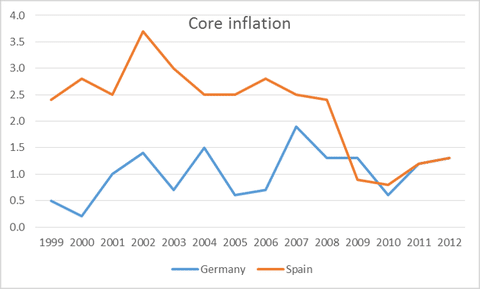

2. Quantitative easing. – Money creation. In the UK and US, the Central Banks have electronically created money to purchase bonds and gilts. This has increased the monetary base and in theory increased the money supply in the economy. The effect of Q.E. is hard to quantify but it does seem that the economic recovery in UK and US has been stronger – with a higher inflation rate than Europe – Europe is reluctant to pursue Quantitative easing and as a result is seeing its inflation rate fall close to 0%.

The problem Europe has is that many (especially in Germany) have an almost irrational fear of creating money. Any policy of Q.E. could see itself challenged in European courts. It is also more difficult when you have a common currency area of many countries, whose bonds do you buy?