Readers Question. We hear much about the “pensions time bomb”, as people tend to live longer and there is a bulge as “baby boomers” reach retirement age. We also hear much about the need to save for retirement. Saving *money* may mean people have more money in retirement but surely the real problem is to ensure there is more output; money is worth only what it can buy. Is there a risk that money saving will simply reduce current output and so reduce the income and incentives needed to ensure we have the investment that will enable us to increase output over time?

It is easy to see how it makes sense for an individual to save for retirement but at the national level, it may be counter-productive.

Basically, is there a concern that higher savings for pensions will lead to lower economic output?

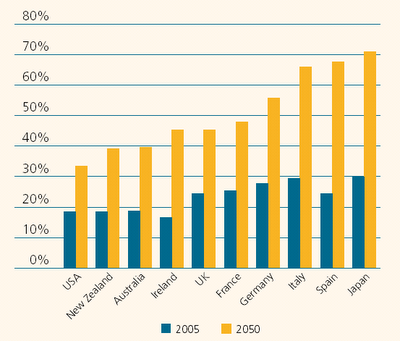

Forecast for Dependency Rates

Source: Dept for work and Pensions

Firstly, western economies do face a pension time bomb. Dependency rates are forecast to rise (though the UK is unlikely to be as badly affected as other countries, such as Spain, Italy and Japan.) An ageing population means state pensions will take up a bigger % of GDP. Higher savings would help with the private sector pension deficit and provide more funds for pensions. But, would higher savings lead to lower growth?