Inflation is a measure of changes in the cost of living. It is calculated by using statistics such as Consumer Price index CPI, retail price index RPI. However, the official inflation rate doesn’t include every price and some consumers may experience different inflation rates. For example, if the price of basic food items increases 50%, the headline rate may still be 5%, but those on low incomes are pushed into poverty.

The process for measuring inflation is broadly

- Creating a weighted basket of goods – depending on how frequently goods are bought

- Measuring monthly changes in prices. Currently around 180,000 items (but set to increase).

- Creating an index from the price change multiplied by the weighting of the good.

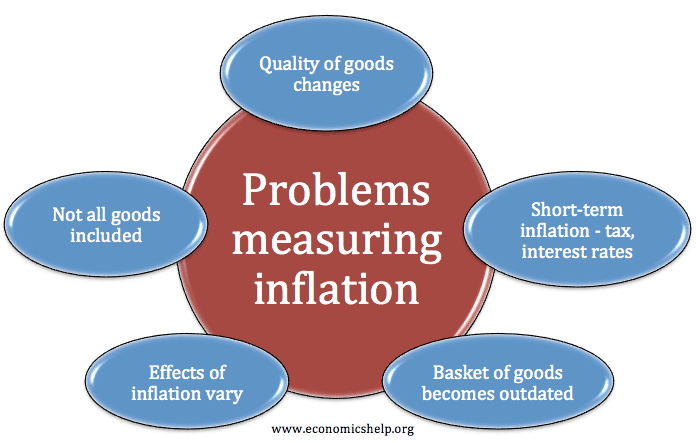

Difficulties in measuring inflation include

- Changes in the quality of goods. Changes in the quality of goods mean that price rises may not reflect inflation, but just the fact it is an improved good. For example, computers have many more features than 10 years ago, so it is difficult to compare prices because they are effectively different goods.

- Shrinkflation. It is also possible goods can deteriorate in quality and size. For example, the price of vegetables may stay the same, but if the size decreases, the price per gram effectively rises. Shrinkflation has often been a response to rising cost-push inflation – firms reduce the size of chocolate bars rather than increase the price. Inflation measures may not pick up on this marginal decrease in size.

- Skimpflation. A similar concept where firms respond to higher costs by reducing the quality of service

- One-off shocks may give a misleading impression. For example, a rise in oil prices will lead to higher inflation. But, this rise in prices may just be temporary. Tax changes have a similar effect.

- Different groups can have different inflation rates. Rising electricity and gas prices may affect old people more than young people. Therefore, old people could have a higher inflation rate than the national average. This is important if pensions are index linked because their cost of living may rise more than prices causing a decrease in living standards.

- Cost of living crisis. In 2022 the cost of living has been rising much faster for basic essentials. For example, food campaigner Jack Monroe pointed out how between 2021 and 2022, basic foods increased much more significantly than the official rate of inflation. Some examples of higher inflation for basic food items.

- Cheapest rice 1kg cost 45p now it’s £1 for 500g.

- Curry sauce was 30p, now it’s 89p.

- A bag of small apples was 59p, and is now 89p.

In response the ONS have said they will try to measure more items in the future. But, this is particularly important because if wages and benefits rise with headline inflation 5% – low income consumers facing 50% increases in food prices will become worse off.

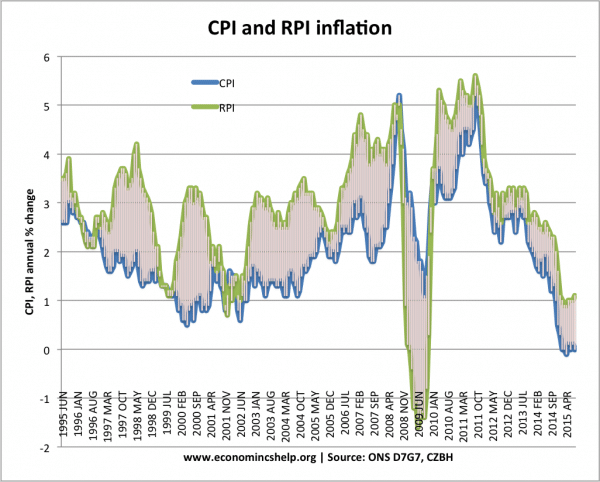

- Which measure to use? – There are numerous different measures of inflation which include different items in the inflation index. Measures of inflation include CPI, CPIH, RPI or RPIX. CPI excludes mortgage interest payments. CPIH includes them. See: Differences between RPI, RPIX and CPI

- Basket of goods can become outdated. In a fast-changing economy, goods people are buying is frequently changing. Trends may cause people to be buying new technology or in different places – and the traditional basket of goods can fail to keep up. For example, if there is a rise in internet shopping, inflation measures should give a higher weighting to online prices, but it takes time to update the basket of goods and which prices should be counted.

- Different measures of Inflation. As well as CPI, the government also calculate different methods of inflation like RPI and RPIX. RPI includes housing costs and therefore, recently has given a higher value of inflation.

- Chain Weighted Index. If the price of one good goes up, it may automatically change peoples spending patterns. Therefore, they stop buying the more expensive goods. Therefore, the price that they actually pay stays the same. A Chain Weighted index takes these changes in quantity into account.

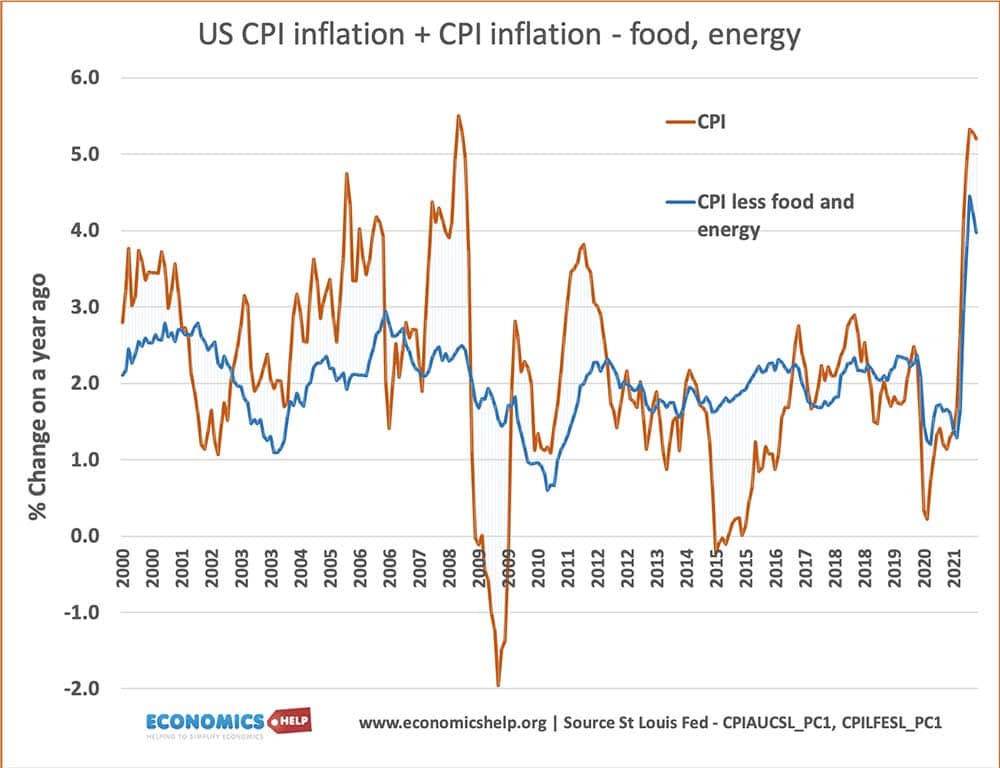

- Core Inflation. Often there may be a temporary spike in inflation because of a rise in volatile goods such as energy prices and food. Therefore, the headline CPI rate may give a misleading impression to underlying inflation. See: difference between CPI and Core CPI inflation

Example of Core Inflation and CPI inflation in the US

In 2008, the US experienced a jump in headline CPI inflation, but this included a temporary increase in oil prices. In 2009, oil prices fell causing a fall in headline rate.

Different Types of Inflation Measures

- RPI – old headline inflation rate

- RPIX – RPI less mortgage payments this is the underlying rate.

- This is used because interest rates are increased to reduce inflation but this higher interest rates increase the cost of mortgage repayments

- RPIY = RPIX less taxes (This is sometimes known as the harmonized rate)

- CPI – Consumer Price Index

- Different measures of inflation

Attempts to overcome the difficulties of calculating inflation

- The Billion price project is an attempt to include a much wider range of published prices across the internet. BPP index at Mit

- The ONS have announced they are currently developing radical new plans to increase the number of price points dramatically each month from 180,000 to hundreds of millions, using prices sent to us directly from supermarket checkouts. “This will mean we won’t just include one apple in a shop … but how much every apple costs, and how many of each type were purchased, in many more shops in every area of the country.” (Guardian Link)

Related