How High Should Interest Rates be?

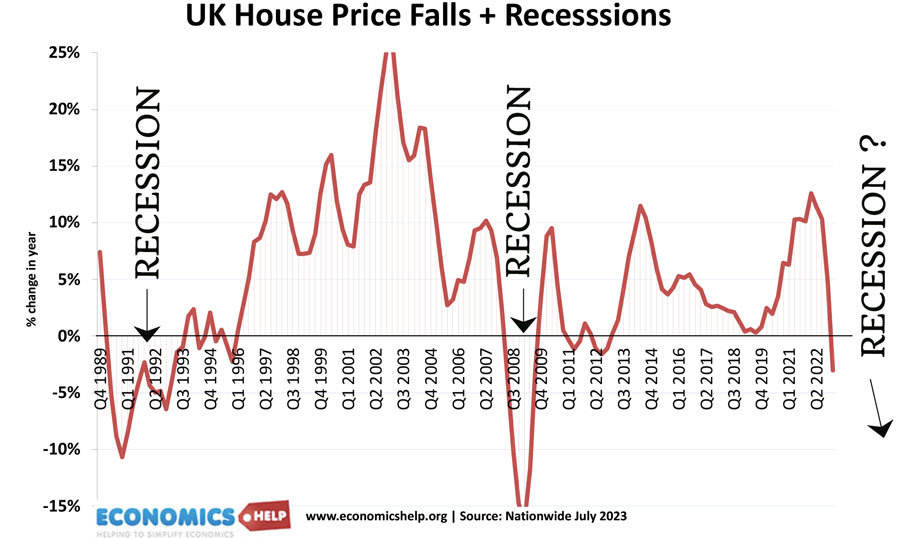

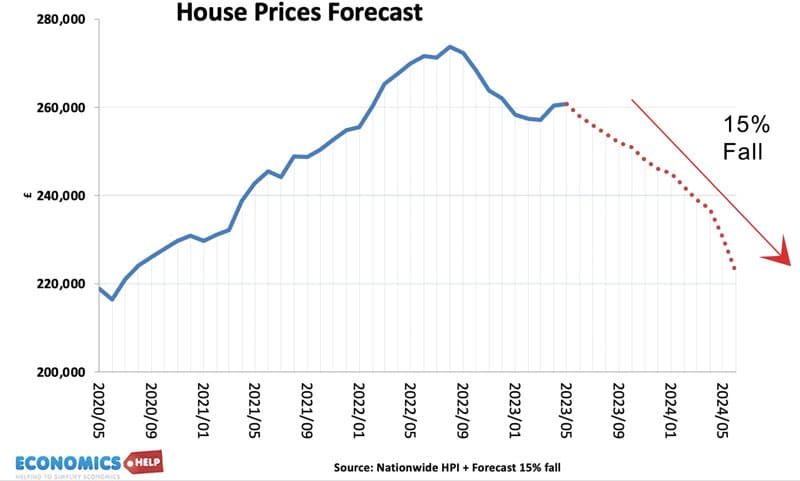

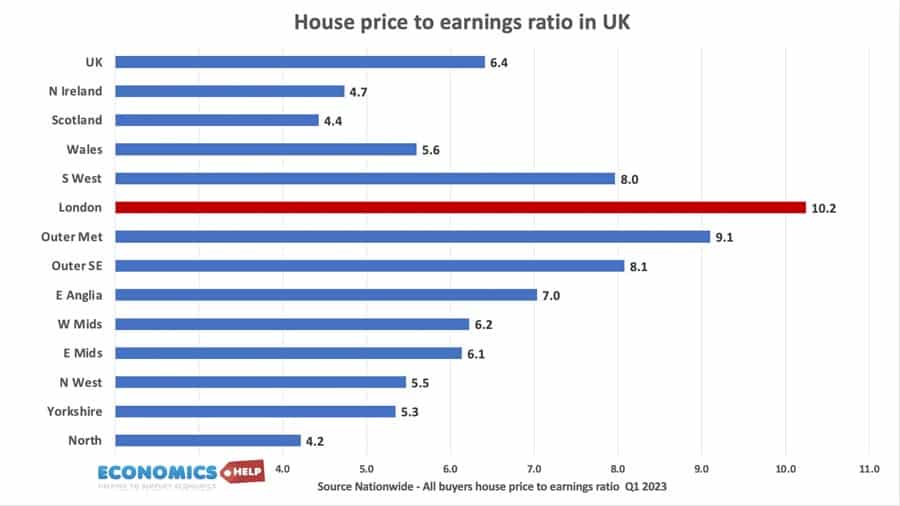

In the space of 18 months, Bank of England base rates have risen from historical lows to 5%, with more expected. It’s a remarkable turnaround for an economy accustomed to ultra-low borrowing costs – the rapid increase in rates have seen soaring mortgage costs and threatens to push an already struggling economy into recession. Yet …