Letter of 365 economists – did they really get it wrong?

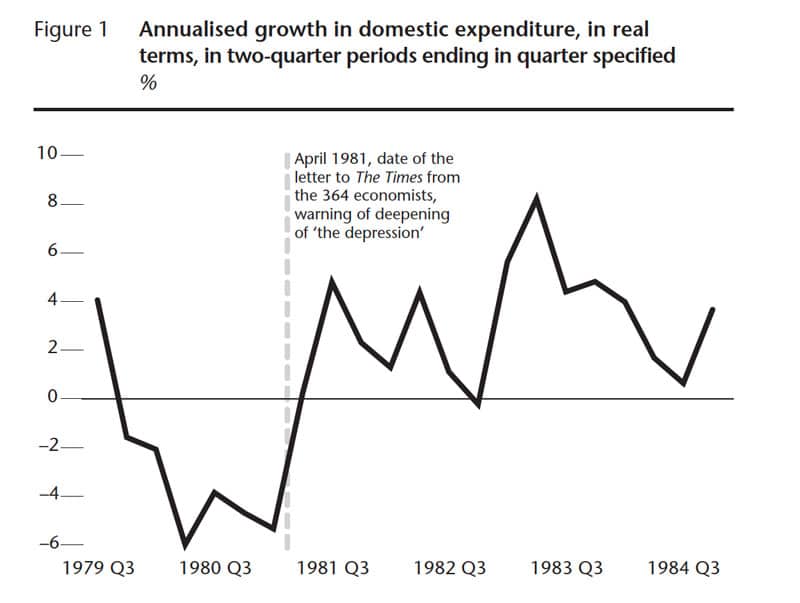

The March 1981 UK budget was controversial. In a period of rising unemployment, recession and high inflation. The government pursued deflationary fiscal policy trying to reduce inflation. The chancellor increased taxes by a total of £4 billion, with the aim of reducing inflation and reducing the budget deficit. Tax measures included A new 20% tax …