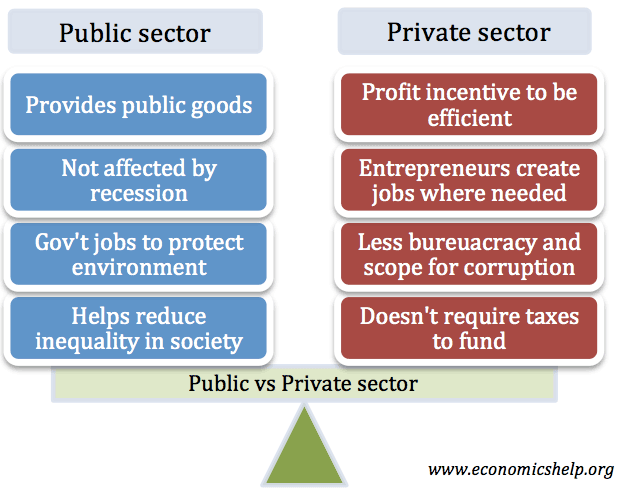

Private Sector vs Public Sector

Readers Question: Does job creation come from public or private sector? The public sector is government (national and local). Public sector jobs include doctors, police, teachers and civil servants. The private sector is private enterprises – retail, manufacturing, local services. Public sector jobs as a share of total employment UK 23.5% (2013) US 14.6% (2008) …