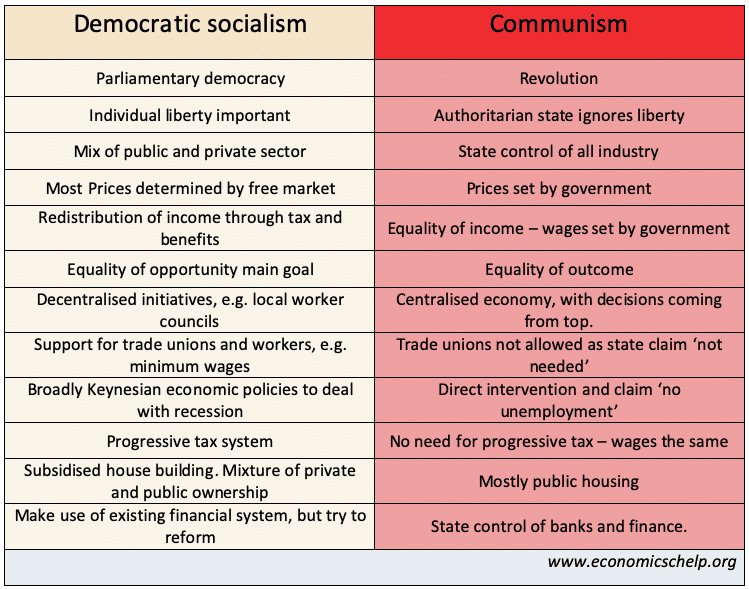

Socialism vs Communism

Both socialism and communism place great value on creating a more equal society and removal of class privilege. The main difference is that socialism is compatible with democracy and liberty, whereas Communism involves creating an ‘equal society’ through an authoritarian state, which denies basic liberties. Democratic socialism in the west involves participating in democracy to …