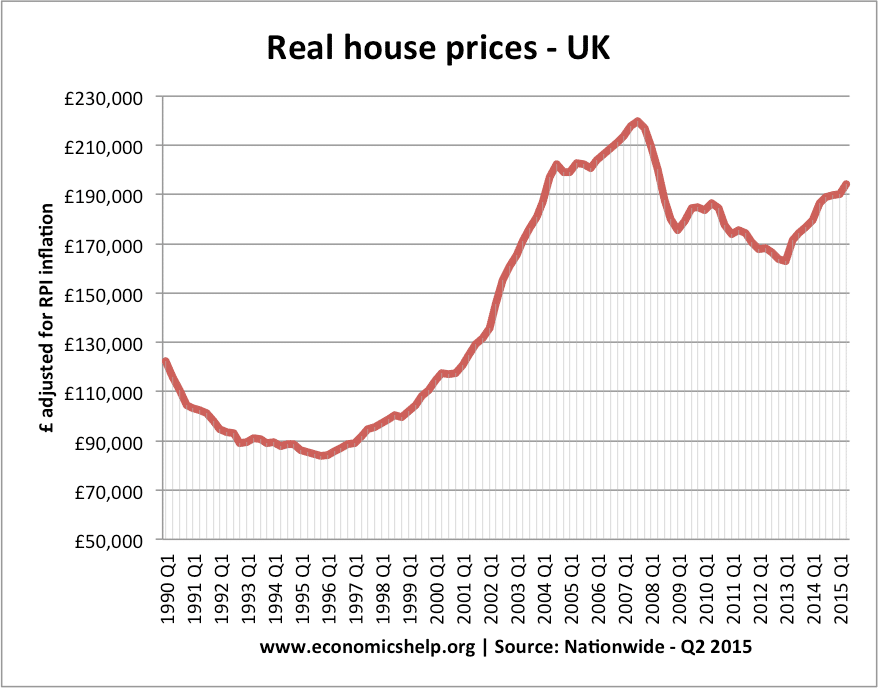

Impact of falling house prices

A look at the economic impact of falling house prices. Readers Question: Explain why a decrease in the price of houses can lead the economy to experience a recession. In summary: falling house prices reduce consumers’ main form of wealth. This tends to cause lower spending and lower economic growth due to a negative wealth …