Benefits and Costs of Fixed Exchange Rates

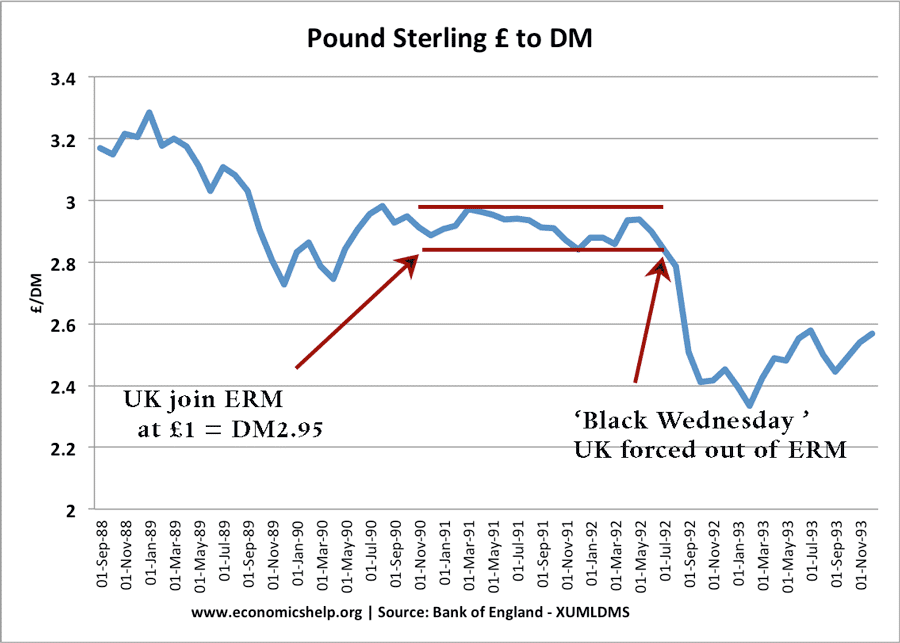

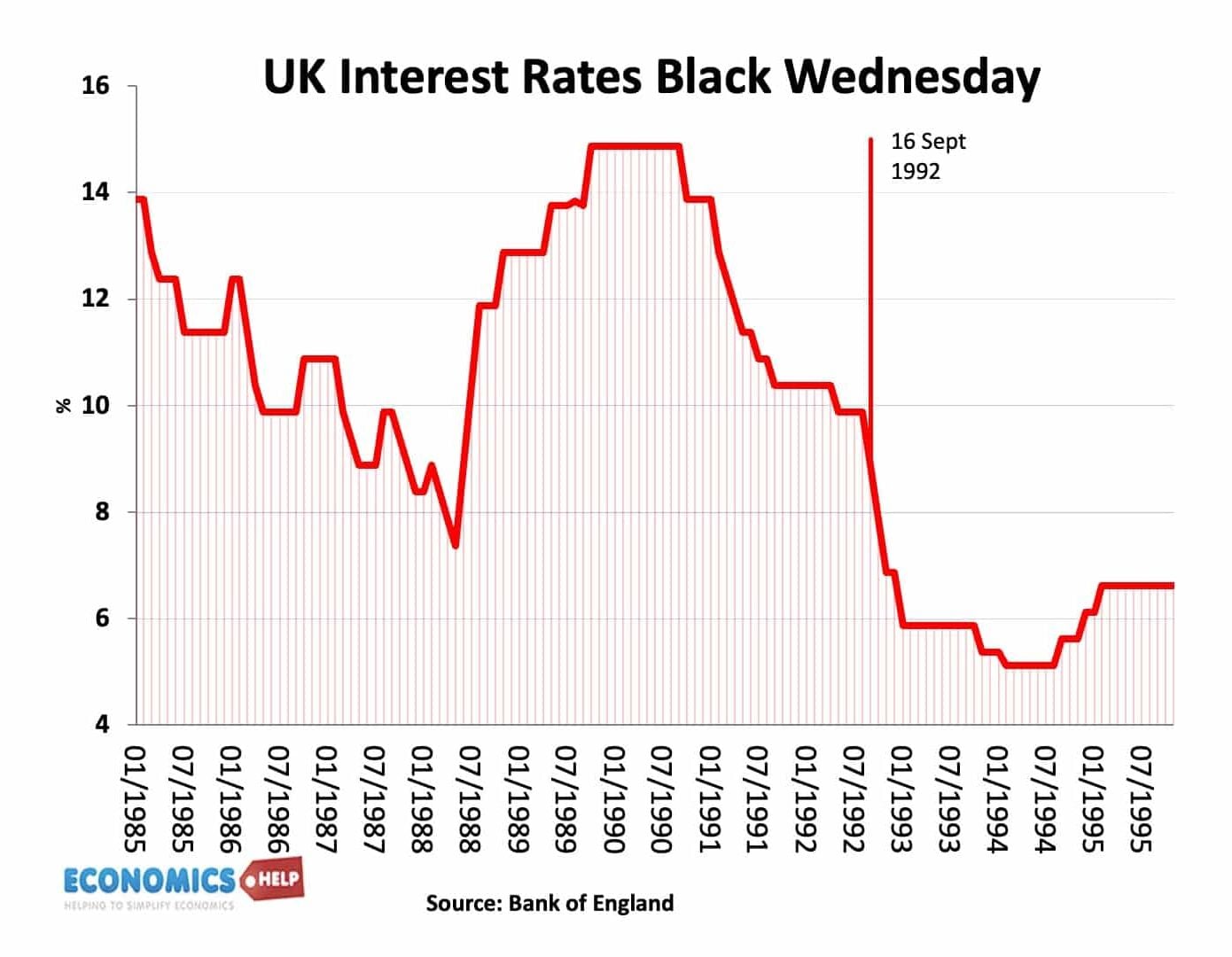

Readers Question: Evaluate the advantages and disadvantages of both a floating exchange rate and a fixed exchange rate. Is there a “better” one to have? A fixed exchange rate occurs when a currency is kept at a certain level compared to other currencies. In practice, many of them are semi-fixed exchange rates like the Exchange …