Irrational Exuberance

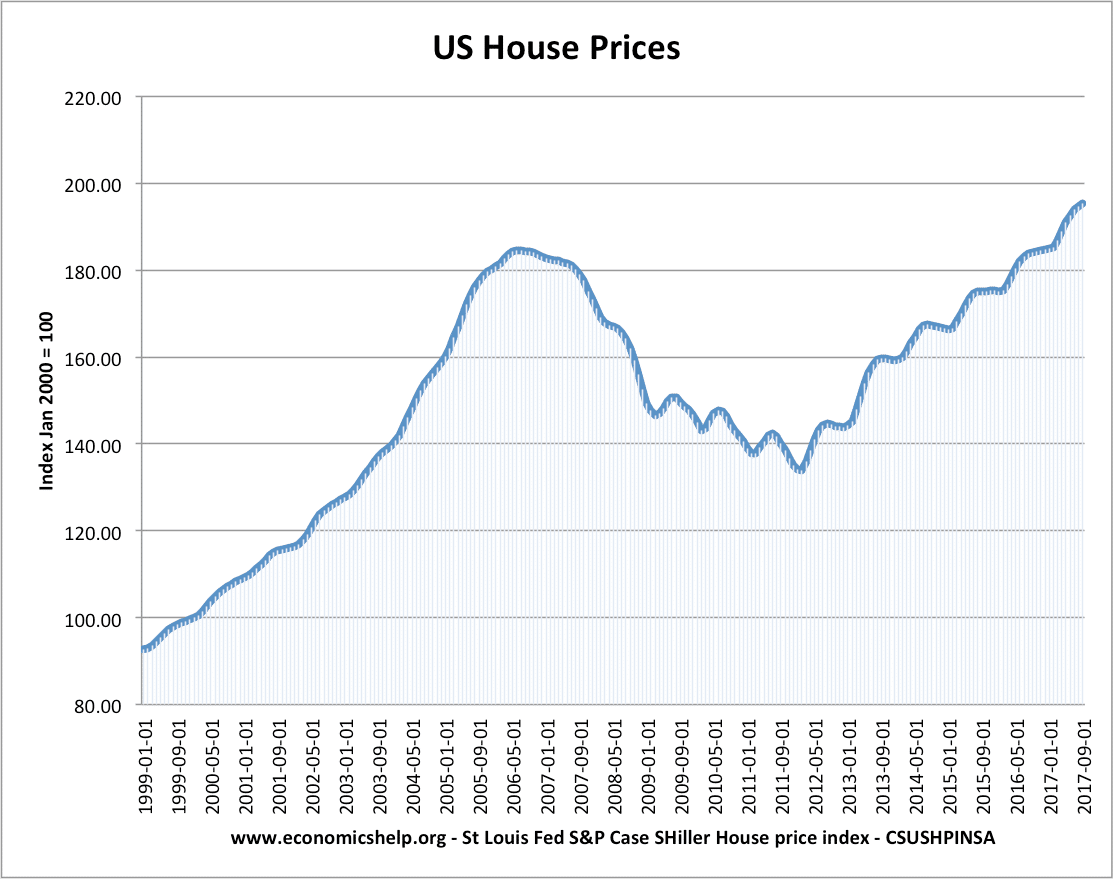

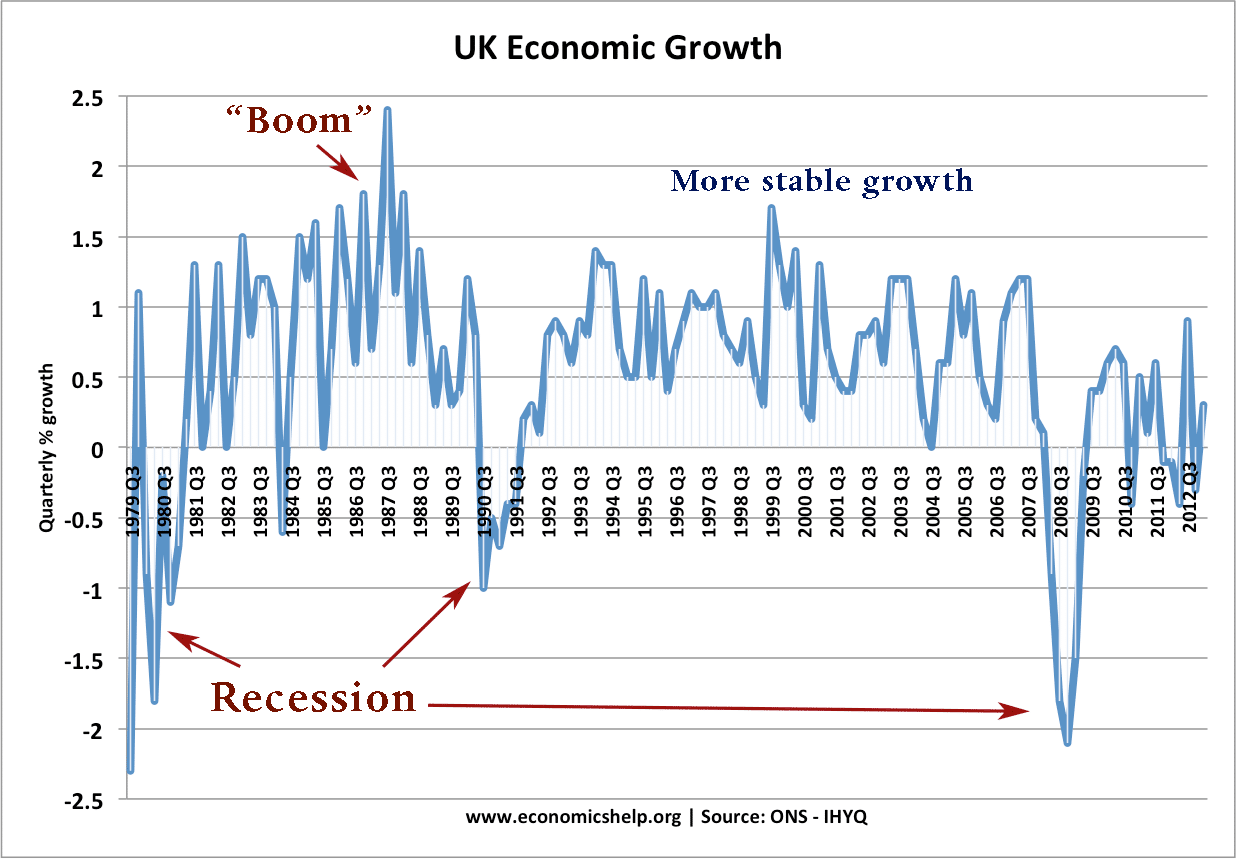

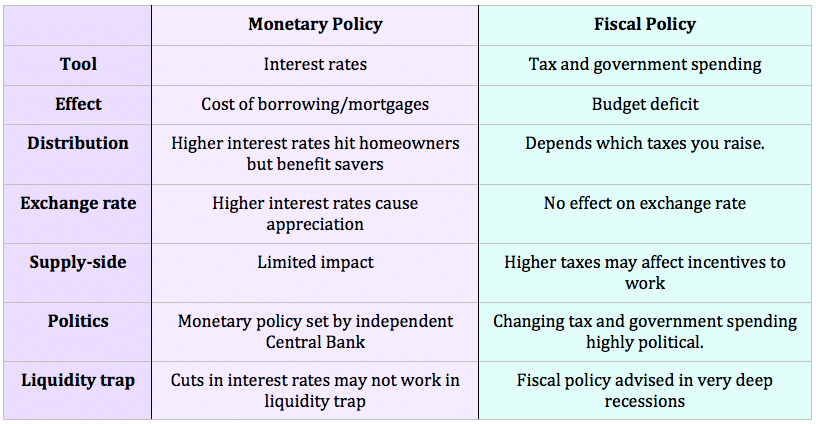

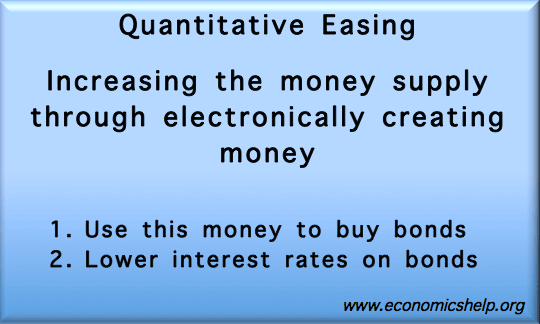

Readers Question: Is there an economic term for the phenomenon of ignoring (or turning a blind eye to) future risk, assuming that the current situation will prevail? I refer to the situation we currently see of both borrowers and lenders who are being caught by interest rate rises, having seemingly assumed that interest rates would …