Who benefits from low interest rates?

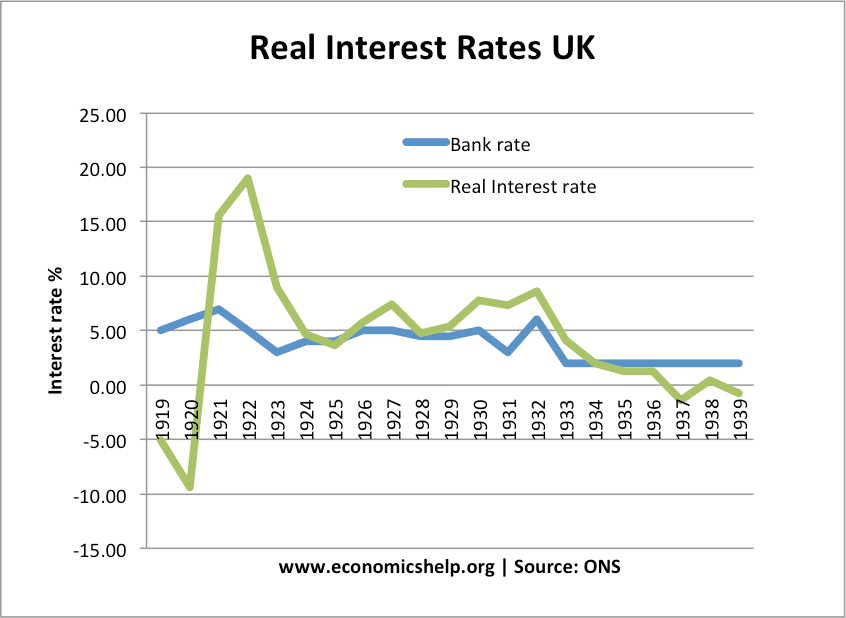

When interest rates were cut to 0.5% in March 2009, few would have predicted that interest rates would have stayed low in UK, US and the Eurozone for so long. Interest rates have stayed at zero for several years – defying several predictions that they will rise soon. Who benefits from low-interest rates and who …