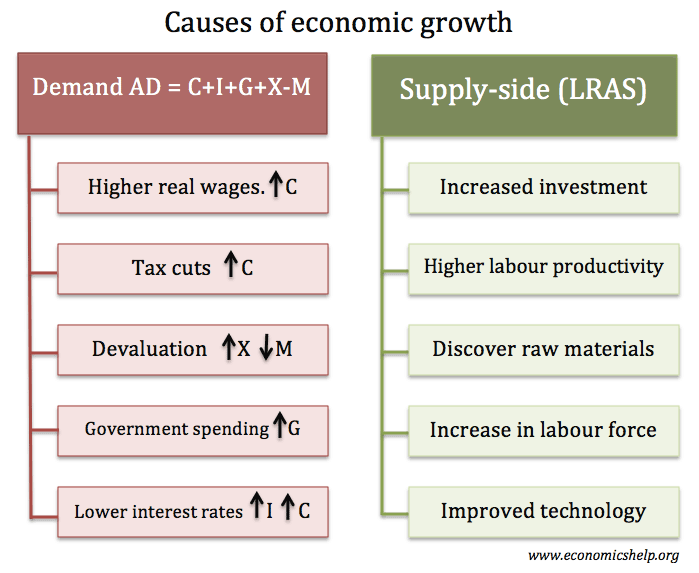

Causes of economic growth

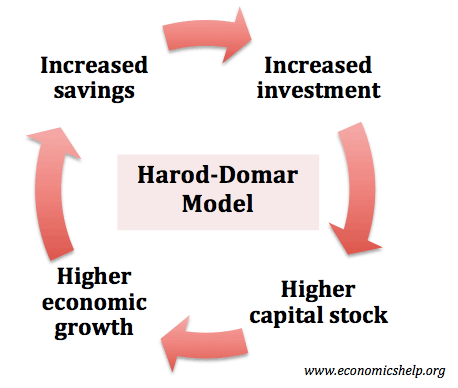

Economic growth means an increase in real GDP. Economic growth means there is an increase in national output and national income. Economic growth is caused by two main factors: An increase in aggregate demand (AD) An increase in aggregate supply (productive capacity) See latest stats on economic growth Demand-side causes In the short term, economic …