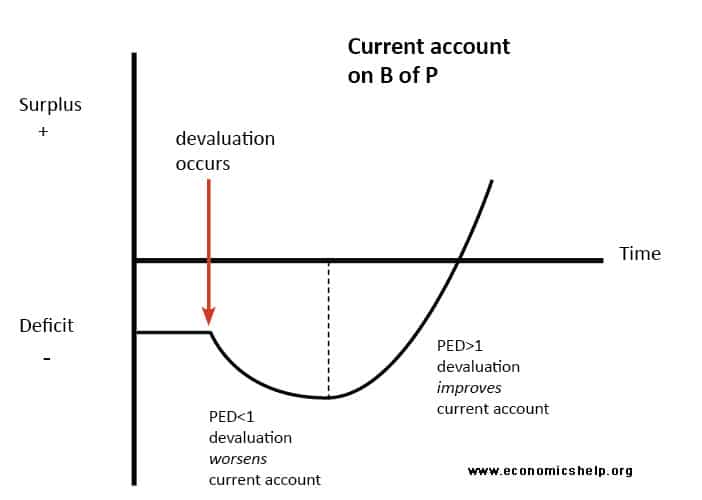

J-Curve Effect

The J Curve effect a depreciation in the exchange rate can cause a deterioration of the current account in the short-term (because demand is inelastic). However, in the long-term, demand becomes more price elastic and therefore, the current account begins to improve. The J-Curve is related to the Marshall-Lerner condition, which states: If (PED x …