Definition – The service sector is comprised of firms offering ‘intangible goods’ such as entertainment, retail, insurance, tourism and banking. The service sector will make use of manufactured goods, but there is an additional component of offering a service to customers.

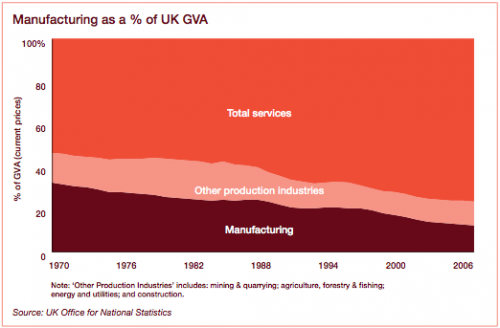

In a developed economy like the UK, the service sector is the biggest component of the economy, comprising nearly 80% of GDP and a similar ratio of employment. In the US, the service sector comprises 70% of the workforce.

In the UK, the main sectors of the service sector include:

- Retail industry

- Computer and I.T. services

- Hotels and tourism services

- Restaurants and Cafes

- Transport – rail, bus, air, sea

- Communication

- Banking services

- Insurance services

- Pension services

- Food and beverage services

- Postal services

Tertiarisation

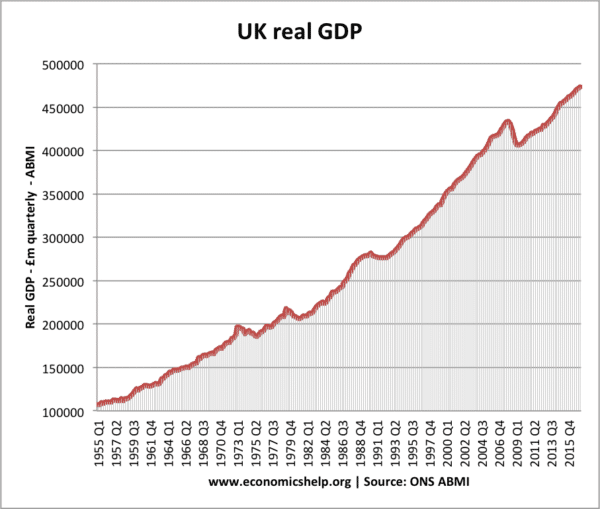

In the past 100 years, developed economies have seen a transition from a manufacturing-based economy to one where the ‘service sector’ or ‘tertiary sector’ dominates. Tertiarisation involves the service sector coming to comprise the biggest element of the economy.

A growing service sector is usually a sign of increased living standards – it enables consumers to enjoy more leisure based service activities, such as tourism, sport and restaurants.

Reasons for growth of the tertiary sector

1. Improved labour productivity. A key factor behind tertiarisation is improved labour productivity. Better technology and improved labour productivity have enabled a higher output of manufactured goods and agriculture with less labour. This increased productivity has led to:

- Increased incomes of workers to spend on services.

- Spare labour to be able to work in the more labour intensive tertiary sector.

2. Globalisation. Globalisation and free trade have enabled UK, US and developed economies to import more manufactured goods. Therefore, an increasing proportion of the economy can be devoted to higher value service sector. Whilst the UK has lost comparative advantage in manufacturing goods, it compensates by specialising in service sector, such as finance and banking

3. Income elasticity of demand. As income increases, we spend a higher percentage on luxury service items – such as holidays, going out to restaurants. Manufactured goods are more income inelastic. As income rises, we spend a little more on household goods, but as we become rich, we can afford to pay someone to wash the car and go out for a meal rather than buy ingredients and cook ourselves.

4. Rising real incomes/ wages

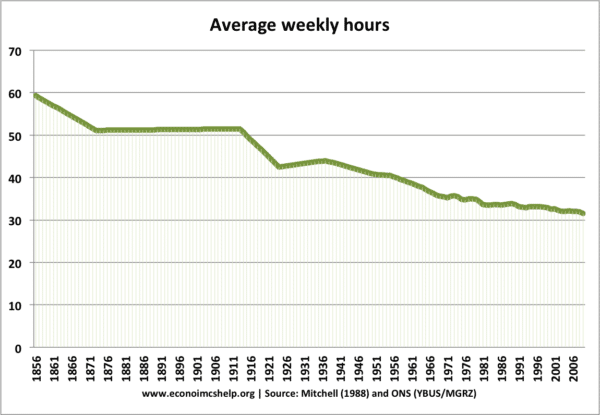

5. More leisure time

Rising real wages have enabled a fall in the average working week. In 1850, the average job took 60 hours, leaving little time for leisure activities. (most people worked a six-day week). By 2009, this average working week has fallen to 32 hours, leaving more hours for leisure activities.

6. Technology

New technology has enabled new service sector industries to develop. Computers, telephones have all been developed in the past 100 years. The growth of the internet has enabled a new range of tertiary services.

Concerns over Tertiarisation

There are some concerns over an economy becoming primarily based on the service sector.

- The volatility of finance. The UK relies on financial services for a large component of its GDP. However, in the credit crunch of 2008/12 – the financial sector was left over-exposed to many losses and it required a government bailout. Iceland had an even more extreme example with the banking sector becoming very large. (Iceland crisis). See also: over-financialisation of the economy.

- Current account deficit. Another potential problem of the service sector is that often it is harder to export the service sector industries. A country with a large service sector may run a current account deficit – importing manufacturing goods and financing the deficit through attracting capital flows. This has often been the case for the UK. However, there is no guarantee that a growing service sector will lead to a current account deficit. Increased globalisation has also enabled more services to be traded, for example, cross-border I.T. support is much easier with the internet.

- Increased inequality. The decline of manufacturing and rise of service sector economy has led to uneven wage growth. Low skilled wages have tended to grow very slowly.

- Regional concentration of the economy. The service sector has seen a sharp rise in migration to big metropolitan cities. Service sector firms prefer to establish in large cities because of external economies of scale – in particular access to skilled and mobile labour. This is causing growing populations in crowded cities – causing rising rents and ‘gentrification’ of former working class areas. In cities like London, it is increasingly difficult for key public sector workers, like nurses and teachers to afford accomodation because of the price of living. On the other hand, rural regional areas are increasingly left behind. Areas of rural America and the Rust Belt are not attracting the same kind of service sector investment. Therefore, when old industries like farming and manufacturing decline, the economy is not being revitalised in the same way.

Related

The article is good but does not elaborate on reasons for the growth of the tetiary sector.

Its given notes satisfy for me ..

Good article. Explain something on sectoral based operations in small businesses

Good article. but can you elaborate more on measures to create employment in this sectors.

Importance of tertiary to secondarly a sectors

Importance of Tertiary sector to secondary sector

I read it all. I got to know about Service sector and how does it function in any economy. And how UK is acting as a service economy much more in financing and Banking.

A good article, as a student this really helped with my studying, one could include more various reasons of the growth of the tertiary sector

Could’ve been a bit more helpful on both the concerns and the growth but anyways still a beneficial article

It is important to invest in tertiary sector because it improved the living standard of more people in the country. It Will increase wages and encourage the workforce to put in the country

I like this article alot and it helped me write things in my assignment. However it talks mainly about luxuries like retail rather than trades such as drainage and how theyre also tertiary.