In theory, there is a strong link between the money supply and inflation. If the money supply rises faster than real output, then prices will usually rise. This means if a Central Bank prints more money, we will often (though not always!) get higher inflation.

Explanation of why increased money supply causes inflation

- The money supply is the amount of money in circulation. This includes notes and coins and bank deposits.

- If the government printed more money, then there would be an increase in cash in the economy. Households would have more money and so their demand for goods and services would rise. With more cash, we wish to buy more goods.

- However, if the amount of goods for sale, remained the same, then firms would see a big rise in demand for this limited supply and so would respond to the higher demand by increasing prices.

- Therefore, increasing the money supply faster than the growth in real output will cause inflation. The reason is that there is more money chasing the same number of goods. Therefore, the increase in monetary demand causes firms to put up prices.

Video explanation

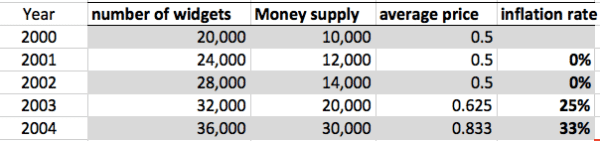

Example of money supply and inflation

- In 2001, the output of widgets increases 20%. The money supply increases by 20%. Therefore, the average price of a widget stays at £0.50 (zero inflation)

- In 2002, the output of widgets increases 16.6% and money supply also increases 16.6%. Prices stay the same and the inflation rate is 0%

- However, in 2003, the output of widgets increased 14% but the money supply increased 42%. With the money supply increasing faster than output, there is a rise in nominal demand. In response to this rise in demand, firms put up prices and we get inflation.

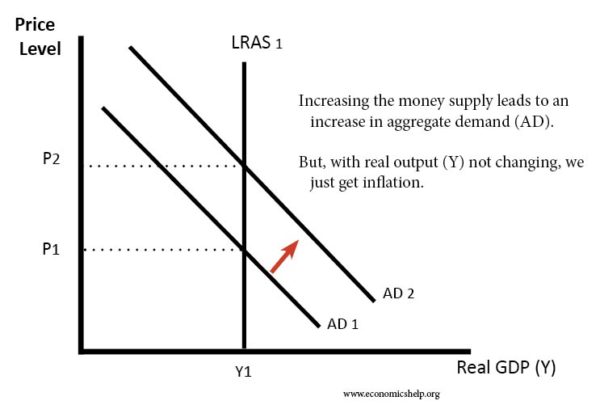

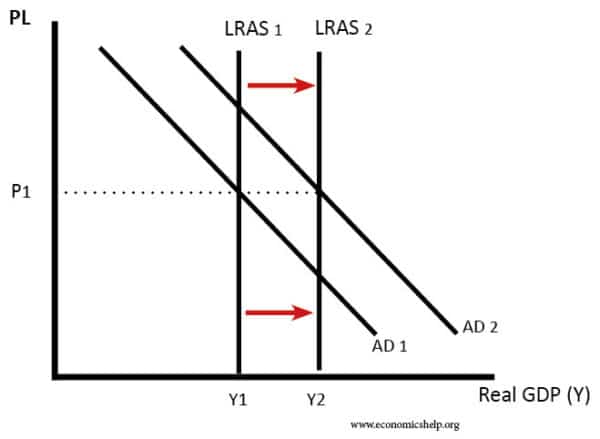

Diagram showing effect of increased money supply

- An increase in the money supply causes higher aggregate demand (AD) and this leads to an increase in the price level.

Historical Examples of increased money supply causing inflation

This link between the money supply and inflation can be seen in many historical cases.

US Confederacy 1862-65. During the Civil war, the Confederacy of southern states found itself short of finance (it could only raise 46% of the cost of war from taxes and bonds) so it increased the printing of money to pay for materials and soldiers. However, with economic output falling, this caused inflation of 700% in the first two years of the war and reached a peak of over 5000% by the end of the war.

German Hyperinflation 1923. In the aftermath of the First World War, Germany faced high reparation payments. To meet these demands, the government started printing more money – so that firms could continue to pay workers. This led to an explosion in the inflation rate. By the end of 1923, printing money had got out of hand, and the economy experienced hyperinflation.

Zimbabwe 2008. Zimbabwe found itself in a similar situation. High government debt, falling output and a need to print money to stave off a short-term crisis. This printing of money led to hyperinflation of an estimated 79,600,000,000% in Nov 2008. A daily inflation rate of 98%

US economy 2020/21

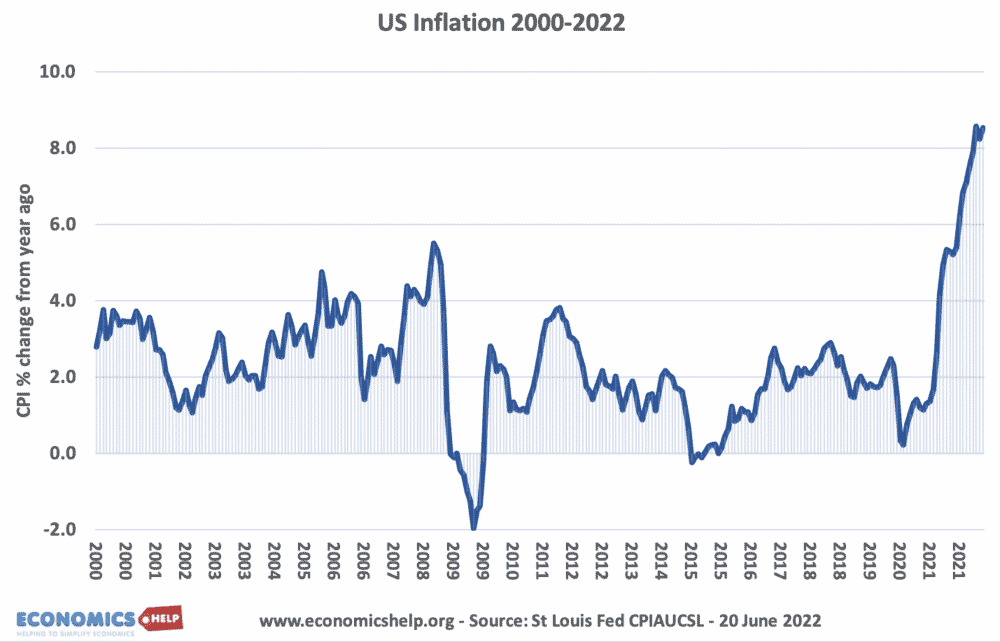

In the Covid Pandemic of 2020, there was a sharp fall in economic activity. The Federal Reserve responded by creating more money electronically. 12-24 months later this led to higher inflation. (Though, it is important to note, that some of this inflation was also caused by other factors such as rising oil prices, and supply chain issues.)

Why increasing the money supply does not always cause inflation

It is possible to increase the money supply without causing inflation. There are a few possible reasons.

1. The growth of real output is the same as the growth of the money supply

Suppose the money supply increased by 4%. In a simplified model, this would lead to an increase in Aggregate Demand (AD) of 4%. If AS (productive capacity of the economy) also increased by 4%, then the price level would be unaffected. In other words, the growth of the money supply is absorbed in the increase in real output.

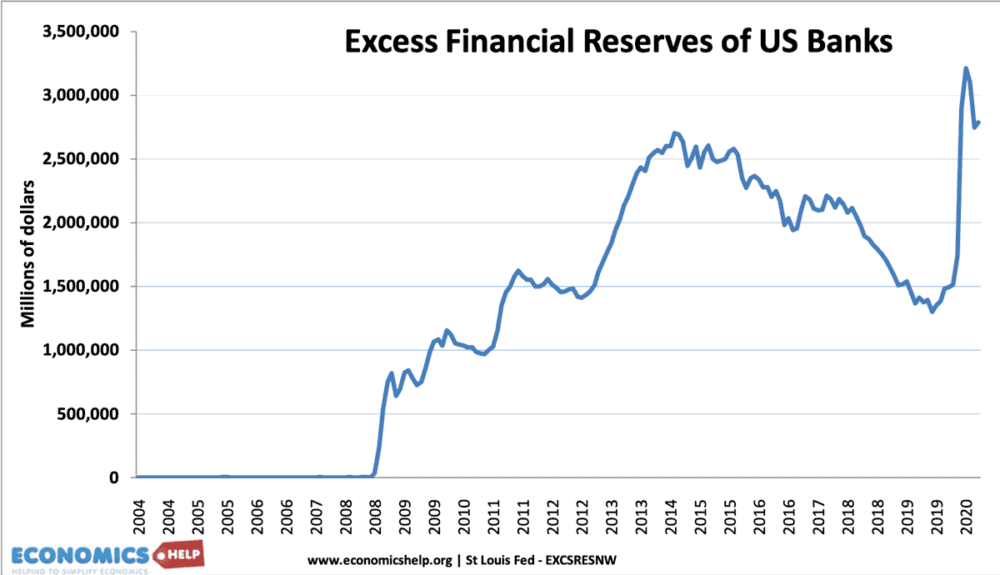

2. Increase in bank reserve ratios

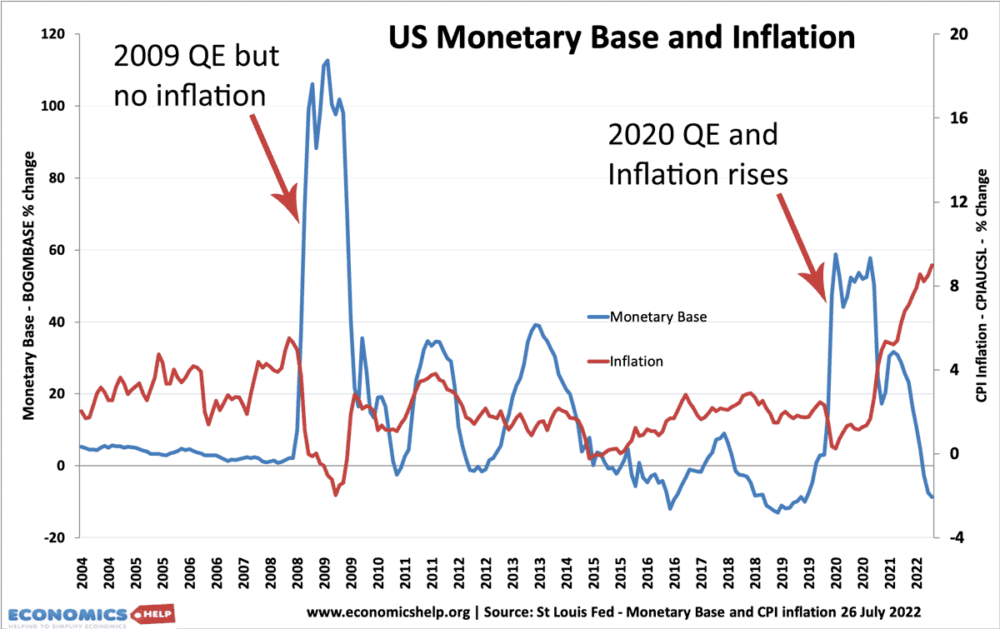

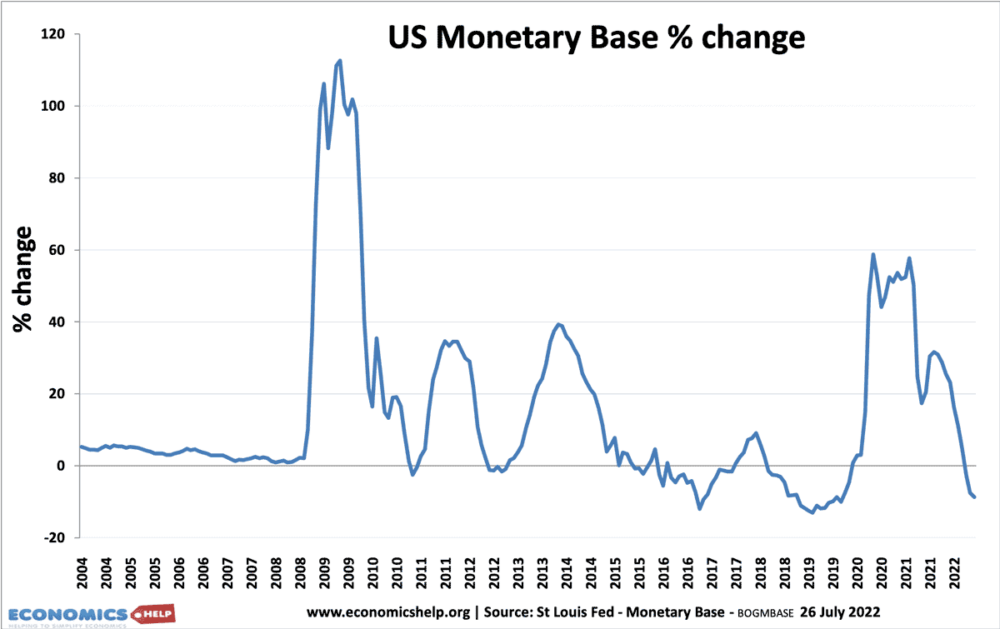

In 2008/09 the Federal Reserve increased the money supply (monetary base) by over 120%. But, this did not cause inflation. In fact, the US experienced temporary deflation. The main reason is that banks increased their reserve ratio. Essentially banks received extra money from Federal Reserve, but did not want to lend it to ordinary firms and households. Therefore, the extra money supply did not reach the wider economy and there was no inflationary impact.

3. Hard to Measure Money Supply

Sometimes the money supply is hard to calculate and is constantly changing. Large increases in the money supply are often just due to changes in the way people hold money. For example, an increase in credit card use may cause an increase in the broad money supply M4.

4. Changes in velocity of Circulation

The quantity theory of money equation MV=PY assumes that an increase in M causes an increase in P. However, this assumes that V(velocity of circulation) is constant and Y is constant. However, in practice, it is not as simple as this equation assumes. There are often variations in the velocity of circulation.

A good example is in a recession, the stock of money may rise 5%, however, people will be making fewer transactions and therefore the velocity of circulation will fall. This is one reason why quantitative easing (increasing the money supply) did not cause inflation between 2009 and 2016.

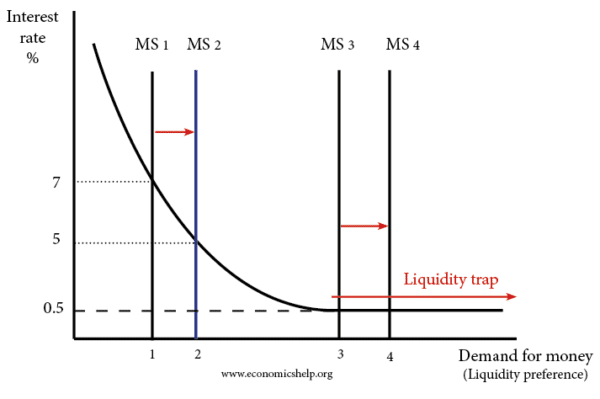

5. Keynesian view – Liquidity Trap

In a recession, there is spare capacity in the economy. Therefore, an increase in the money supply, merely helps to get unemployed resources used in the general economy. Therefore, in the case of a recession, an increased money supply is unlikely to cause inflation.

In a liquidity trap, interest rates fall to zero but this doesn’t prevent people saving. In this situation, there is a fall in the velocity of circulation and this can cause deflation. In this situation, increasing the money supply will not necessarily cause inflation.

For a start, increasing the money supply doesn’t reduce interest rates any further.

Summary of Link Between Money Supply and Inflation

- In normal economic circumstances, if the money supply grows faster than real output, it will cause inflation.

- In a depressed economy (liquidity trap) this correlation breaks down because of a fall in the velocity of circulation and banks wishing to hold more reserves. This occurred in the US and UK between 2008-14

- However, when the economy recovers and the velocity of circulation rises, increased money supply is likely to cause inflation.

Quantitative Easing and Inflation

Quantitative easing was a policy by Central Banks to increase the money supply.

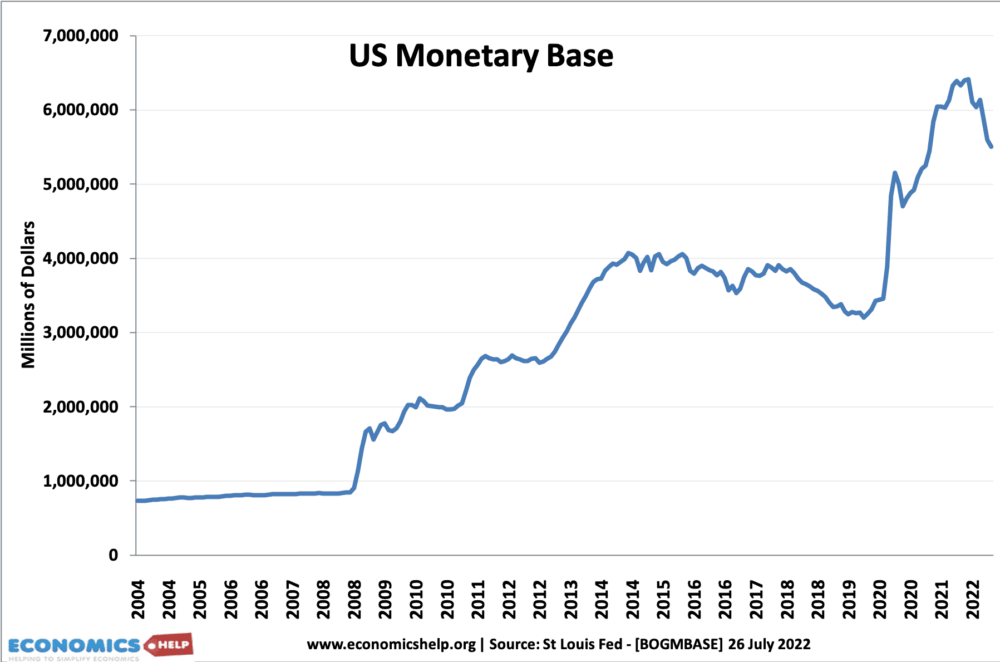

Quantitative easing in 2008/09 led to a big increase in the monetary base (a form of the money supply)

The Federal Reserve created money to buy bonds from commercial banks. Banks saw a rise in their reserves.

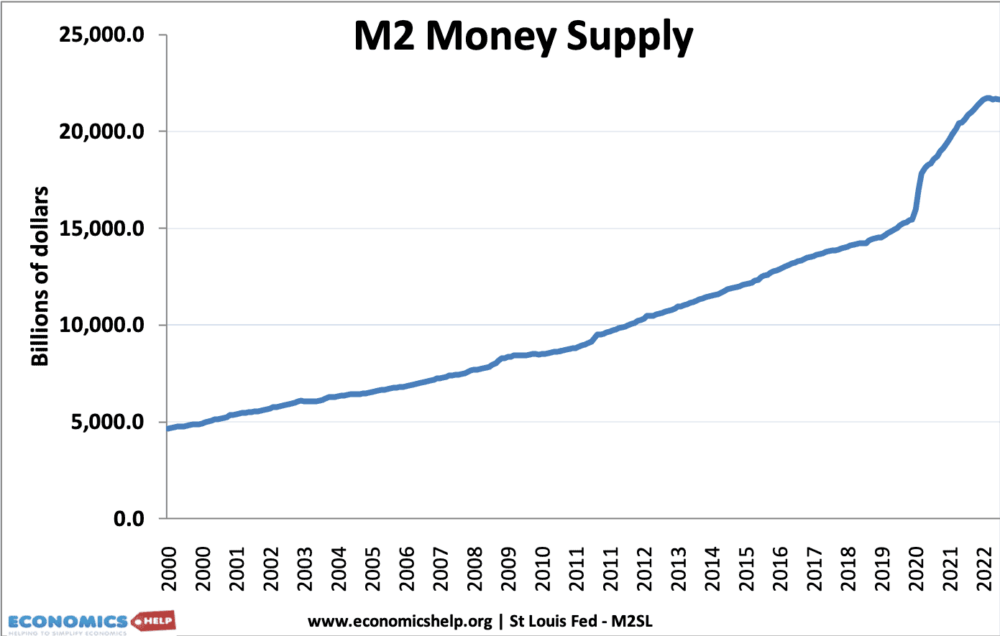

However, commercial banks didn’t lend this money out. Therefore the growth of the broader money supply (M2) didn’t change much.

What happened is that from 2009-2015, commercial banks didn’t want to lend this extra money. They wanted to increase their cash reserves. Many banks had lost money in the credit crunch and needed to take in more cash to improve their balance sheet. Their confidence was also very low.

The US inflation rate was largely unaffected by this increase in the monetary base. Stripping out volatile cost-push factors (food and fuel), core inflation remained below the 2% inflation target.

It was only in 2022, that the US started to see inflation. This 2022 inflation was due to a few factors:

- Increase in money supply in 2020.

- Expansionary fiscal policy and strong recovery from 2021 Covid slowdown

- Rise in oil prices

Further reading

Well i think you were right in saying that all the money that was printed is kept in the banks for now. But what happens when the banks start lending again. What happens when this money starts to change hands in the economy. The answer is simple inflation.However, the people who are doing this are not the ones who have to worry about it as by the time this mess is sorted out and the banks start lending again they will all be out of office. On the other hand, those who will be in office at the time will have no other choice by to suck this money out of the economy and the result will be a dramatic increase in interest rates that would probably leave the economy crippled. Think Paul volker and the sluggish growth rates of the early 1980s. Now, no one knows exactly how interest rates will need to rise or how sluggish the economy would be. This is not to say that QE was a bad idea. QE was probably the only way out. However, this is just to say that QE has a price and sooner or later those countries that engaged in QE will need to pay that price. The only way to see whether or not this price was worth paying is to wait until these economies start functioning again.

Interesting to see how wrong your prediction was with the benefit of hindsight. In 2020 the EU is still providing QE and we still see low inflation.

Well yes and no. Inflation may not have moved but that was only because the cost of QE was shifted through long-term interest rates to pension funds, social welfare and insurance companies – actuarial valuations will support that. 2020’s massive money supply surge exceeds the ability of the aforementioned institutions to absorb it by a long shot which will almost certainly create runaway inflation considering where interest rates currently are when output recovers.

Let the 2020’s play out son…. Roughly around August 2022 you will start to see the the raising of interest rates. The general public and those who do not specifically work in tech/engineering did not benefit from the “recovery” of 2008. Tech growth, efficiency, and increased output in that sector has effectively masked the GDP that was lost from that lower end working class. The QE we engaged in on a global level has led to an asset price spiral. This combined with low interest rates from 2004 to today, has essentially led to led to the rapid increase in the cost of houses, and the increase in luxury goods. The QE has also largely supported the wealthy which has driven the stock market to all time highs. The output required to actually sustain such valuations is lacking, and the benefactors of that are only the highly skilled and those who were already wealthy. Due to this, the rest of the QE has not actually increased the money supply as it has sat stagnant, and thus inflation has not occurred.

However during this time we have also depressed wages, as the average individual is earning wages that are 15 years behind, yet the cost of goods has increased. When the cost of goods rises, you have inflation. Yet all the metrics that are reported show 0-2% inflation.

Because we have defunded our own education systems, much of the talent required to fuel the tech industry is being recruited from overseas, further depressing wages, increasing profits for the wealthy, and driving the stock market up.

The QE was never used, thus inflation has lagged. Now we have an all time disaster on our hands: YOU ARE NOT SUPPOSED TO HAVE SKY HIGH UNEMPLOYMENT, UNDEREMPLOYMENT, AND INFLATION.

Because the theory is: print money, support the businesses, they can produce goods, to do so they have to hire people, people earn money, they spend money, and over the course of a few years it all circulates . If this happens, there is no inflation as the money was re-used. Now that employment is in check, you are supposed to REDUCE the deficit spending that was supporting us through the rough times by increasing taxation. Banks are supposed to pay more interest, as people should now have increased deposits on account, and then the money supply will contract as more folks deposit money, and it will reach it’s own equilibrium.

Now look outside the window, no one has large deposits, taxation did not increase, banks do not pay higher deposit interest, and the loan rates have stayed at near 0.

Inflation is lagging, government demand will only continue to grow over the coming years, and once the breaking point hits the economy, we will be smashed by runaway inflation. Somehow we are failures of learning from the past, so we will waste at least 4 years, and possibly 8 years because the public will blame one president, vote for the other party, and they will be dumb as rocks as well.

Can’t employ anyone because we gutted the education system to make them useless, add that with increased automation and industry disruption due to tech advances, and all the sudden you need to print more money to support those who need it. Guess what, it’s now 2026-2036 and we just had essentially 25 years of low interest rates and individuals buying homes they cannot afford, while financing their entire pay for luxury items. The government will be forced to raise interest rates, and because these people couldn’t afford the house in the first place, you will see people who just walk away from their homes.

The end result is a minimum of 4 years high interest to shake the country from its decades long slumber to realize that the common person has been gamed since 1960. Due to stagflation we will enter another recession, however this time it will be real, and we will not “fake” recover like before.

TL;DR: We did NOT recover from 2008. We did not learn from the 60’s and 70’s. The textbooks and theories taught in Universities across the globe regarding Economics and money police is hilarious at worst, retarded at best. Ridiculous assumptions, and justifications using perfect world settings that do not take into account the actual impact and game theory involved in Capitalism. We don’t learn from the past, and we will waste at least two elections until someone Paul Vockers the steaming pile of shit and fixes it.

You make some good points. Many I agree with. However, some of the statements you make I believe to be your opinion, that you state as fact. IE.: “The general public and those who do not specifically work in tech/engineering did not benefit from the “recovery” of 2008.” (I know many people who do not work in tech that benefitted. So, the best you can *assume is that *the information that you have received leads you to believe that people who benefited from QE are 1.)not in tech and 2.) are outliers. I feel as if, if you had the actual #’s, you would have included them.) I could go from there but why? Once I come across a person who states opinion as fact, I have to question EVERY SINGLE fact they state. And I just don’t have that much time. The maximum amount of time I am willing to spend on “Righteous” people has now come to an end.

You (Johnie) and YAADF are bright guys, and I enjoyed your comments, but I question whether you’ve seen the trees for the forest.

The MAIN problem is with the definitions and you accepting Keynesian thinking. Inflation, as originally defined, is NOT a price increase, but an increase in the money supply. Price is discovered and is a reaction to whatever is going on in the market.

Yellan saying inflation will be transitory in the middle of the biggest increase in money supply in US history is laughable, because it’s clear Janet doesn’t understand how money works, and how individuals do what they do (their preferences) in the market place. When cheap money (and that can be taken in many ways) drives up prices and encourages people to speculate and invest, human nature ensures these people will try to shelter value in the inevitable downturn that will follow. That’s what we’re now experiencing in wake of the massive 2020-2022 monetary increase.

I could also go into a long diatribe about money quality and why the US was so prosperous and wealthy during the middle 20th century, but it would be pointless, I fear. But I will point out that when you’re intentionally debasing the currency at the same time you’re inflating the amount of money washing around in the system (and our chicken little administration is doing all it can to destroy the productive sector of the US), imbalances, shortages, tyranny, poverty, and civil unrest will follow.

The metrics (how “inflation” is calculated) are obviously bogus. Saying real estate or the cost of medical care have little or nothing to say about “inflation” tells me someone is hiding a big lie.

Look at the money supply first, then try to discover how changes in the numbers and economic policy react to each other. Cause and effect work, but there are lots of variables and unknowns involved that the layman has a difficult time wrapping his head around. What we can all count in is an ever-increasing role of the state (and Deep State) in all economic matters, but we know the government never gets anything wrong.

yes and no. No, because since the 2009 crisis and QE that followed, the housing prices in Germany (at least) have been skyrocketing. I mean really skyrocketing. And housing prices are not included in the inflation calculations.

It is more important since it helps alot

i think one could argue that the price for QE is being paid by those who are ‘left behind’. the quality of life in North America for example has not increased since the 80s. nor has relative wages for the working class.

essentially, i think QE just makes the initial climb steeper for the have nots. it’s likely that the health of an economy will be measured by the resilience of your workforce. however, with mass immigration you can continually replace your workforce.

furthermore, those with assets feel more rich than they are [for example, a house is not productive. it has value and contributes to the bottom end of productivity but it’s not making anything], and when the levee breaks and citizens can’t afford any upward mobility no matter how hard they work, i think that’s when you’ll see some sort of reckoning.

unless we put a long bet on the blissfulness of ignorance.

Its not just how much money you print, it’s who you give it to, and what they do with it.

If the new money goes to people who just sit on it, there is no increased demand and thus no inflation.

Even if they do spend it selectively, there is only increased demand and thus inflation for the things they spend it on, and it can take a long time to trickle out to affect other markets.

It looks like the most of the new money went to wealthy investors who have just fuelled the stock and property markets to new heights without stimulating inflation (or production) of anything else.

I the cases of Weimar Germany and Zimbabwe, the author would do well to look at cause and effect

The French occupied the Ruhr valley and stifled production. This led to shortages and prices went up, so more money was printed. 180 degrees from the description above

Zimbabwe started killing white farmers who left the country. Output went down, prices went up – the same outcome. Same wrong causation mentioned in article

Why is inflation so low around the world at the moment?

What has Japanese inflation been so low for decades

This approach has been debunked SO many times!

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around the banks will deprive the people of all property until their children wake-up homeless”

-Thomas Jefferson

Sir Josiah Stamp, president of the Rothschild Bank of England and the second richest man in Britain in the 1920s, said the following in 1927 at the University of Texas:

“The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented.”

Sir Josiah Stamp, president of the Rothschild Bank of England and the second richest man in Britain in the 1920s, said the following in 1927 at the University of Texas:

“The modern banking system manufactures money out of nothing. The process is perhaps the most astounding piece of sleight of hand that was ever invented.”

Thomas Jefferson has been alleged to say:

“If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless”