Readers question: In all the media coverage of the UK deficit / debt / recovery, two aspects are rarely highlighted / quantified / contextualized.

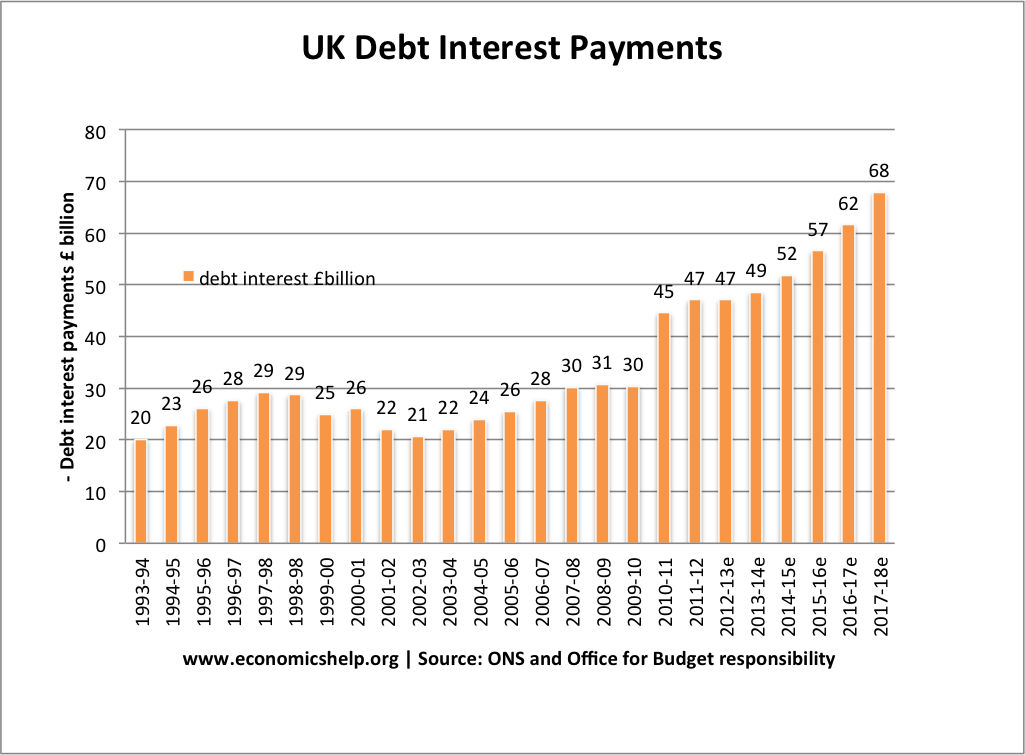

1. The £50bn interest payments on the debt (opportunity cost / %)

2. UK productivity (output per head / sector / history)

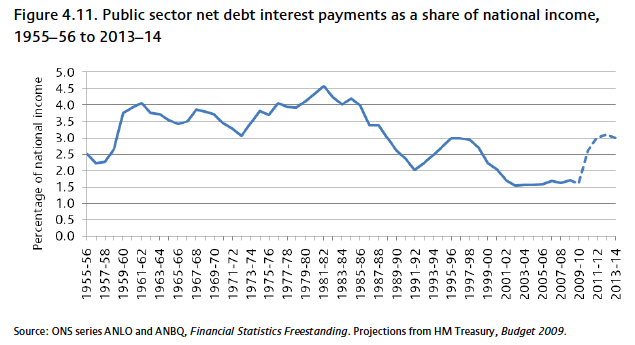

I think interest payments on debt are an important metric. The interesting thing is that they have been relatively stable as a % of GDP in the past few decades – and lower than say late 1970s.

It is not just how much you borrow, but also the cost of borrowing – and the % of national income (or tax revenues) that are used to pay the debt interest payments

For example, in a recession, when borrowing goes up – quite often bond yields fall. Bond yields fall because there is greater demand for saving and greater demand for buying government bonds, which are seen as a relatively safe investment.

In 2010, there was widespread global panic that borrowing was unsustainable / too high – and this was used to justify ‘panic’ austerity measures. Yet, at the same time bond yields in the UK and US were falling and the cost of interest payments relatively low.

The exception was Eurozone countries, where bond yields did go up. But, this was not so much borrowing levels, but the lack of a Central Bank to provide liquidity. Since the ECB is now more willing to provide the necessary liquidity, bond yields on Eurozone debt has plummeted. Bond yields in Eurozone countries, like France are close to record low levels.

At the same time, with economic recovery, you will see rising bond yields and the cost of debt interest payments will rise, so this is a factor for the UK in the coming years – debt interest payments are forecast to rise. But, with economic recovery, you should see an improvement in cyclical receipts (e.g. higher income tax revenues). The economy should also be able to better withstand efforts to reduce borrowing.

Another consideration is that if the government can borrow at 1%, they could finance public sector investment, that could give a return of say 5%. In this case, we are paying interest payments on debt, but from the investment, we are getting higher growth and higher tax revenues. Having zero debt interest payments, isn’t necessarily desirable.

So debt interest payments are important.

UK Productivity

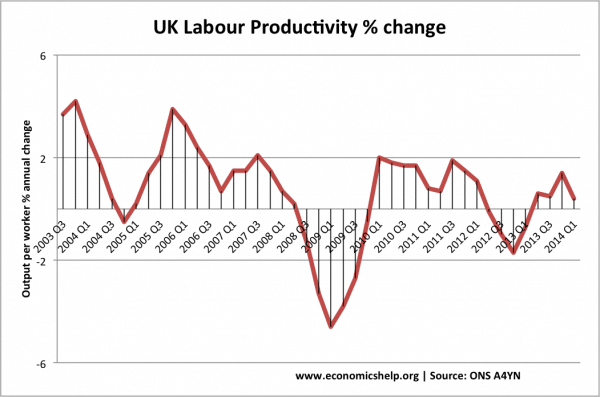

UK labour productivity is important for determining long term economic growth. Rising productivity enables higher rates of economic growth – which will help improve the tax revenues, and contribute to deficit reduction.

However, UK productivity has been a bit of a puzzle in recent years. Basically productivity growth has been very poor since the onset of the recession. This poor growth in productivity is somewhat of a concern. But, ironically productivity tends to be influenced by short term factors. In an economic downturn, productivity falls as spare capacity increases and workers have less to do. Also, the poor productivity growth is also related to the bigger than expected fall in unemployment. Firms have been willing to take on more workers, rather than try to get more productivity from them. Productivity growth is poor, but as a mitigating factor unemployment has fallen by more than expected too.

I don’t think that recent short-term trends in UK productivity are a major influence on UK debt. But, if a country has very poor prospects for productivity and economic growth, then this would be a concern for markets about long-term debt sustainability.

Related