An explanation of the inverse relationship between bond yields and the price of bonds

Readers Question: Why does buying securities reduce their yield?

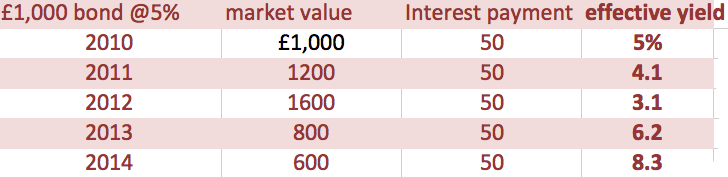

- Suppose the government issued a £1000, 5-year treasury bond at an interest rate of 5%.

- This means that if you bought the treasury bill at £1,000 you will receive a fixed interest rate of £50 every year.

- You can hold onto a government bond until maturity. At the end of the fixed period, 5,10 or 20 years, the government will repay your £1,000.

- However, bonds are often bought and sold on the open market.

- If the government buys bonds, demand rises and so the price of bonds rises to reflect the increased demand.

- Suppose the price of bonds rises from £1,000 to £1,500. This bond is being sold for more than its face value, but, the interest payment remains the same at £50 a year.

- This means that now bonds have a market price of £1,500, the effective interest rate is £50 / £1,500 = 3.33%

- Therefore because demand for bond rises, the price of bonds rises and the effective interest rate (yield) falls.

If Government cut Interest rates

- Suppose when the bond is issued, the Bank of England base rate is 5%. This means that the bond with a yield of 5% is a competitive interest rate.

- However, if interest rates were cut. to 2%, these bonds would look more attractive because they are paying an interest rate above the market equilibrium.

- Therefore more people would buy bonds causing the price to rise. If the price of bonds rose to £2,500. The effective interest rate would be £50 / £2,500 = 2%.

- So a cut in interest rates is likely to increase the price of bonds. A rise in interest rates is likely to reduce the price of bonds.

- In the real world, it is much more complicated. Many factors affect the price of bonds such as expectations, confidence, relative risk e.t.c. But, these simple examples, should explain the basic principle of the inverse relationship between bond yields and bond prices.

Video on Bond market

The Bond Market Explained - Why the Bond Market can force government's to do U-Turns

See also:

Hello !! ^_^

My name is Piter Kokoniz. oOnly want to tell, that your blog is really cool

And want to ask you: will you continue to post in this blog in future?

Sorry for my bad english:)

Thank you:)

Piter Kokoniz, from Latvia

how the effective interest rate deckline as the price of the bond increases?

B4 reading this block, I didn’t have clear idea about the inverse relationship between price and yield of bond. Now the concept is clear 2 me. Thnx 4 ur easy explanation.

further mails on this topic should be sent to the abave e-mail address.

Quite intellectual