Monetary policy (mainly interest rates) used to be managed by the government. However, in recent years, there has been a trend to give monetary policy to independent Central Banks. The idea is that Central Banks will be more independent of political considerations and willing to keep inflation low – even if there are political costs to raising interest rates. The Central Bank officials are appointed by the government and are given broad guidelines (e.g. target low inflation).

Political business cycle

The feeling was that when the government was responsible for setting interest rates, there was a political business cycle. This means that the incumbent government sought to influence the economic cycle to coincide with elections.

Shortly before an election, there is a temptation to reduce interest rates. This helps to boost disposable income, increase economic growth and reduce unemployment. A strong economy makes it easier for the governing party to gain re-election.

However, this loosening of monetary policy can cause the economy to grow faster than the long-run trend rate leading to inflationary pressures. Once the election is won, the government can increase interest rates to reduce inflation. If it causes a recession, there is still time for the economy to recover before the next election.

Lawson boom and failure of monetary policy

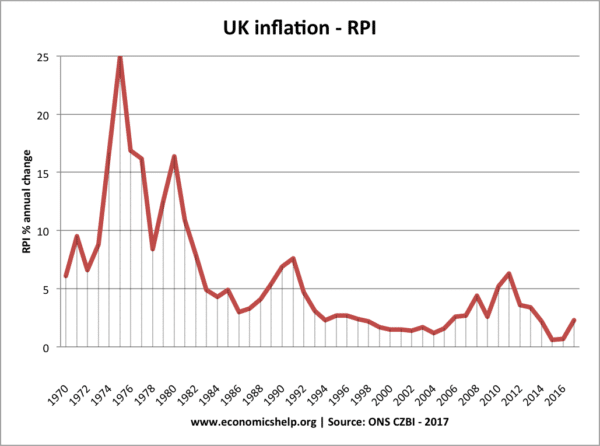

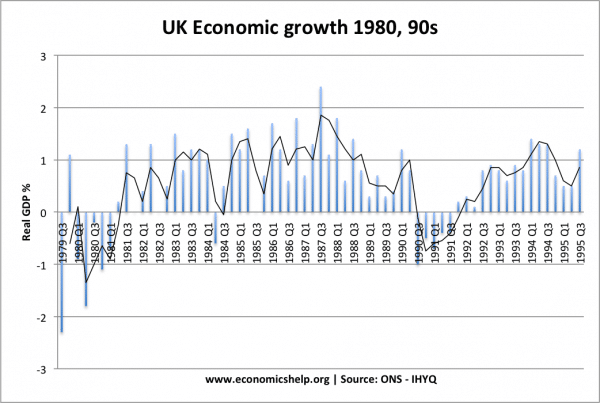

This graph shows two booms – The Barber boom of 1973 and the “Lawson Boom” of the late 1980s.

In the late 1980s, the government pursued expansionary fiscal and monetary policy, causing economic growth to exceed the UK’s long-run trend rate of 2.5%. The government felt their supply-side policies had created a supply side miracle. But, the above trend growth caused inflation and the government had to increase interest rates to reduce inflation. It caused a classic boom and bust.

Quarterly growth of 1-2% is an annualised rate of 4-8% – well above UK’s long-run trend rate of 2.5%

An independent Central Bank with inflation mandate would most likely have avoided this over-exuberance and kept growth at a more manageable level.

Arguments for Central Bank Independence

- Governments tend to make poor decisions about monetary policy. In particular, they tended to be influenced by short-term political considerations.

- Before an election, the temptation is for a government to cut interest rates, making boom and bust economic cycles more likely. Therefore arguably, it is better to take monetary policy out of the government’s hands.

- If the government has a track record of allowing inflation, then inflation expectations start to creep up making inflation more likely.

- An independent Central Bank may have more credibility. If people have more confidence in the Central Bank, this helps to reduce inflationary expectations. In turn, this makes inflation easier to keep low.

Bank of England’s Independence 1997

- In 1997, the Labour party gave the Bank of England full independence in setting Monetary Policy. However, the government did give the Bank of England an inflation target of CPI 2% +/-1

- If the inflation rate goes outside this range the Bank of England has to write an explanatory note to the chancellor.

- Between 1997-2007, the Central Bank did a reasonably good job in keeping inflation low, enabling a long period of economic expansion. From 2007-2011, the Bank struggled with the combination of credit crunch, deep recession and cost-push inflation.

- In 2010 and 2011, the Bank had to tolerate inflation going above target (e.g. CPI inflation 5.2% in October 2011) because of the risk of pushing the economy back into a double-dip recession. It was a difficult economic situation because the inflation was primarily due to cost-push inflation. The Bank had a worse trade-off than usual

Bank of England and Quantitative Easing

The 2009 recession was so serious that cutting interest rates failed to boost economic growth, therefore the Bank of England pursued an unconventional monetary policy of quantitative easing. This involved creating money and buying government bonds. The aim was to reduce interest rates and increase the money supply. It is quite controversial because

- Involves creating money ‘printing money’ with risk of creating future inflation

- Makes the bank more political, e.g. decision to buy government bonds arguably helps the government to borrow more at a lower interest rate cost.

- Benefits of quantitative easing mainly go to top financial firms and bankers. Only a small fraction of extra money filtered through into loans for small companies.

However, the policy helped to offset the deflationary impact of government spending cuts. It gave the UK greater flexibility compared to Eurozone

There is concern that quantitative easing has unwarranted side effects on equity. With Q.E. Pushing up asset prices and helping to make the rich richer.

Concerns over independent Central Banks

- Stick rigidly to wrong targets. The ECB has been criticised for sticking too rigidly to the target of low inflation when Europe has much bigger problems with unemployment and low economic growth.

- Economic policy is set by unelected officials.

- Concerns about the wider impact of monetary policy, e.g. impact of low-interest rates on the distribution of income between savers and borrowers.

- Since Central Banks were made independent there has been a change in economic climate. Inflation and booms are no longer major issue. Instead, the issue is one of secular stagnation and prolonged liquidity trap.

Conclusion

Since the Bank of England was made independent in 1997, it has been widely regarded as better than the alternative (e.g. Chancellor setting interest rates and monetary policy) There are valid concerns about equity effects of monetary policy, but there are ways for the government to deal with these – other than taking back control of monetary policy.

Although Central Banks are independent, it is important to bear in mind, that the targets can be reset. Arguably, the ECB should be given wider brief than just focusing on inflation.

Related

- An evaluation of the MPC in controlling inflation

- Criticisms of Bank of England

- ECB v Bank of England

- UK Monetary Policy

- Bank of England – monetary policy (external link)

Interest rates could be set by the market rather than a central bank or the government. This would lessen malinvestment

How do you know?

In developing countries, we still can’t recognise the independence of central bank. The government is seen taking the mantke instead?

Is it possible?

I think that’s undemocratic

Forget independence. The evidence is extremely weak and revolves around one paper which has now been debunked. Central banks should be held accountable. Nominal GDP targeting would seem far more sensible.

This would ensure that they do not continue to oversee boom/ bust policies of credit creation flowing towards financial markets. I recommend watching ‘Princes of the Yen’ on YouTube.