Fiscal rules are attempts by the government to limit public sector debt and annual borrowing to certain criteria. For example, a simple fiscal rule might state a government should have maximum annual deficit of 3% of GDP. Alternative, the government may plan to run zero deficit over the course of the economic cycle.

Generally, economists are sceptical of fiscal rules – especially those that are lacking in flexibility. The reason is that in economic downturns – with falling private sector spending – public sector debt can provide a counter-balance to falling demand in the economy.

If we have a fall in private sector spending (and fall in private sector debt) – then attempts to reduce government debt, at the same time, could cause a steep fall in demand – and be counter-productive to goal of reducing debt to GDP (See also: Is austerity counter-productive?)

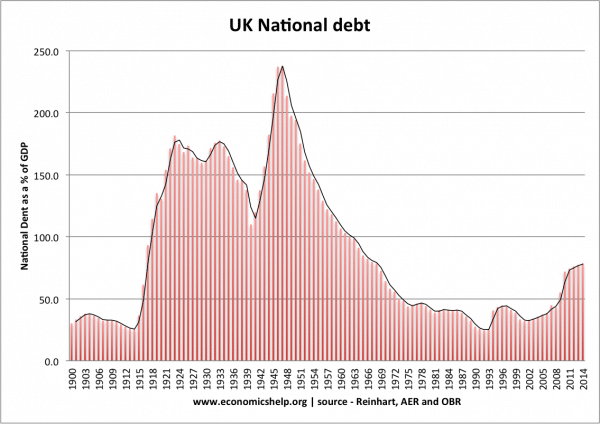

If we look at the history of UK debt in the Twentieth Century, there have been many occasions when the UK has broken potential fiscal rules, but – on its own – this has been a poor indicator of economic performance. Periods where the UK have strived to run budget surplus, e.g. 1920s was a decade of low growth, high unemployment and deflation.

The UK has rarely followed fiscal rules

Often forgotten, UK post war debt broke many potential rules. Yet it was consistent with a long period of economic expansion.

The interesting thing about UK post war debt is that debt to GDP fell – despite the UK very rarely having a budget surplus.

Danger of cherry picking

There is always a danger of ‘cherry-picking’ and pointing to a period of rising debt and poor economic performance (and vice versa). There are circumstances when rising budget deficits would be inappropriate and damaging to the economy. The corollary of running budget deficits in economic downturns is running current surplus in boom periods. Though running a current budget surplus doesn’t mean you can’t borrow to fund public sector investment

Economic theory behind debt and fiscal rules

Politics of austerity

Why is austerity politically popular? – One issue is that from an economic perspective it can make sense to borrow for investment and borrow in a downturn. But, in recent decades there has been a strong ‘fear’ of debt. Keynesian economics is not necessarily a vote winner.

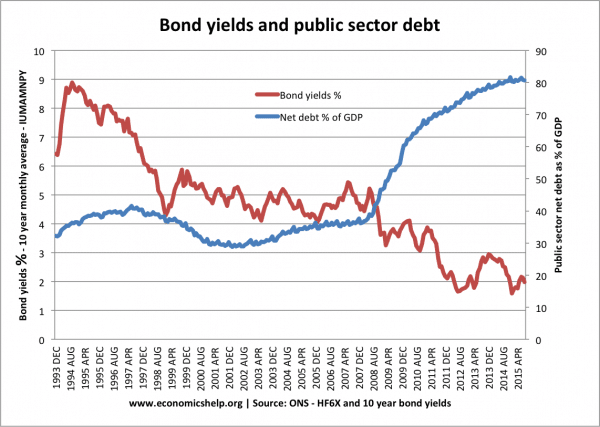

How much can the government borrow?

There is no straight forward answer to the question of how much a government borrow, but these are some of the factors which will influence – how much can government borrow?

External link

- A much better fiscal rule – Mainly Macro a good read to understand the politics and economics of fiscal rules in the UK.

Other links