Joining the Euro is supposed to be an irreversible decision. But, individual countries could always pass individual acts of parliament to leave the Euro. However, leaving aside all the political issues, there are many economic stumbling blocks.

One problem is that countries generally would only consider leaving when there was a real economic crisis – but, it is during an economic crisis when it would precisely be most difficult to leave.

Essentially the problems of leaving the Euro include:

- Possibility of capital flight in anticipation of Euro exit and subsequent devaluation. This was a major issue for Greece when it toyed with the idea of leaving at the height of the Greek crisis. In the end, the risk of capital flight and substantial devaluation meant the political cost was too risky.

- Transaction costs of converting cash and machines.

- The difficulty of deciding the exchange rate to leave at (though this will be ultimately be determined by market forces.

- The difficulty of converting all contracts, mortgages, bank accounts from Euro to native currency.

- Issues of loss of confidence in the economy.

Current account deficit

The greatest difficulty of leaving the Euro would come for those economies which are uncompetitive, with trade deficits, large budget deficits and who need to devalue to restore competitiveness. (i.e. the likes of Greece, Spain, Italy).

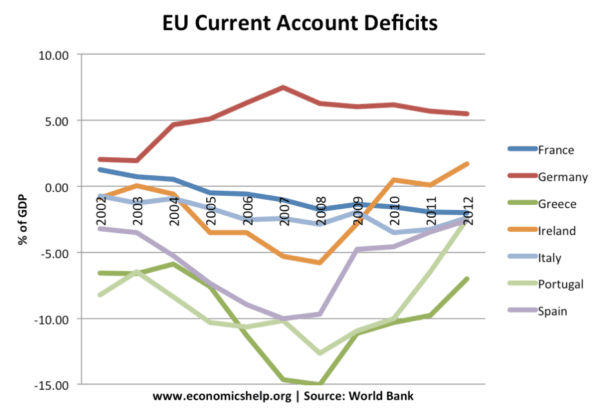

In this decade several countries in the south of the Eurozone were running large current account deficits. This shows that their economies were relatively unbalanced with uncompetitive exchange rates. This is a reason to contemplate leaving the Euro. The uncompetitive Euro will lead to lower demand and higher unemployment. In a floating exchange rate, their currency would devalue to restore competitiveness. This would make exports cheaper and boost demand.

Capital flight

The problem is that if an economy like Greece announced it was going to leave the Euro, investors and savers would withdraw from Greek banks to protect against the upcoming devaluation. If Greece did leave, assets would fall in value (in terms of Euros). This would be good for Greek exporters, but it would take time to regain export demand. In the short term, an expected devaluation of 20-30% gives investors an incentive to change Greek assets for Euro assets. A large devaluation would also create a knock-on effect of encouraging more people to consider putting money in Euro bank accounts.

Therefore, leaving the Euro could create capital flight – which is a very challenging economic (and political) event to manage. The extent of the capital flight is hard to know. But, for a politician who wishes to avoid bad news, there is little incentive to risk exiting the Euro. The benefits of leaving the Euro (flexibility in exchange rates) higher growth, less necessity to pursue austerity could take quite a few years. But, politicians have an incentive to think of short-term costs rather than long-term costs.

A strong economy like Germany would find it easier to leave. A new D-Mark would appreciate so there would be no capital flight, in fact, they would benefit from capital inflows. The disadvantage for Germany is that exports would become less competitive and it would lead to lower growth.

In the long-term, Germany leaving the Euro would help its neighbours to devalue, regain competitiveness and reduce the imbalance in the Eurozone.

Germany’s current account surplus reached a peak of 8.5% of GDP in 2015, It is projecting 7.1% for 2019.

Related

Thank you for the post. Exactly what I looked for, the recent situation and the costs of leaving the euro. These are in my opinion small, especially if you consider the ‘good’ news to the zone, compared to the already dismal Greece. see my blog on “flexible euro” where I try to show that exit to the euro is a good option, but maybe not the best

Your opinion is welcomed