Readers Question: What are the benefits of “supply-side” economics, particularly for the working class, the middle-class if you will?

Supply-side policies encompass a range of different policies that seek to reduce tax rates and government intervention in the economy. In the US, supply-side economics has become synonymous with the Laffer Curve theory and the Reagan tax cuts of the 1980s. It is also referred to as ‘trickle down economics‘.

Examples of free market supply side policies include:

- Privatisation – selling state-owned assets to private sector

- Deregulation – opening state-owned monopolies to competition.

- Reducing power of trades unions

- Reducing minimum wages

- Reducing income/corporation taxes

- Greater labour market flexibility – e.g. easier to hire and fire workers.

- see also: supply-side policies

As an economist, it is daunting to try and give an overall assessment of supply-side policies because it really depends on the policy and how it is implemented.

For example, privatisation and deregulation can have benefits for lower-income workers. Some inefficient state-owned industries have benefitted from private ownership and increased competition. This has been a factor in lower telecom prices and lower electricity prices. But, at the same time, privatisation can create private monopolies which exploit the consumer even more than inefficient state-owned monopolies. Rail privatisation in the UK has led to increased fragmentation and higher prices for consumers (though also some benefits on some services).

Greater labour market flexibility can be a mixed blessing for workers. On the one hand, it can lead to a more productive economy which creates more jobs. On the other hand, it can lead to greater wage inequality and higher job insecurity.

In the late 1970s, British unions were very powerful, many days were lost due to strikes, Britain’s competitiveness suffered as a result. To some extent, reforms to unions did help create a more flexible economy in the UK.

However, the Conservative government grossly overestimated the impact of their ‘supply-side miracle.’ In the Lawson boom, they allowed the economy to grow by 5% a year, thinking there had been a supply side miracle. But, actually, there was no miracle. The UK’s long-run trend rate was stuck at 2.5% and the Lawson boom led a bust and recession of 1991.

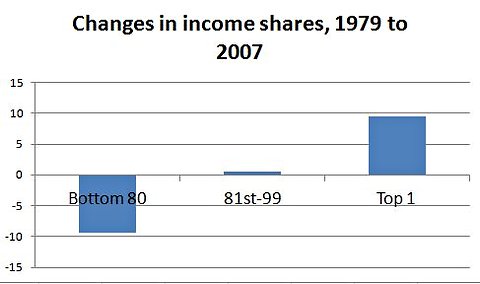

On the other hand, the US labour market has gone to the other extreme. Workers have very little protection, minimum wages are low and there has been a widening of inequality, with little evidence of a trickle-down effect to workers.

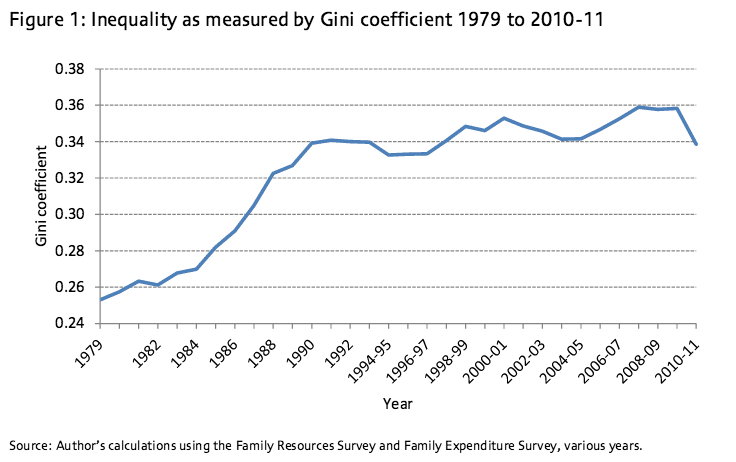

UK inequality increased during the 1980s – it was a similar story in US.

Europe has much greater labour market protection. This helps minimise economic pain in a recession but is also a factor in Europe’s higher level of structural unemployment.

Supply Side Economics and Tax Cuts

The strongest supporters of Supply-side economics argue that cutting income tax rates can boost labour supply, increase economic growth and even increase government revenue. (though tax rates fall, because more people work, overall tax revenue increases). Needless to say, it becomes a popular policy.

Some argue the Reagan tax cuts for high earners showed that lower income tax rates could increase labour supply and help increase tax revenue (supporters of supply-side economics)

Others dispute the extent to which tax cut actually increases labour supply. A study by Randall Mariger, an economist at the Federal Reserve Board, found that tax rates cut increased the labour supply by less the 1% between 1985 and 1986. In other words, labour supply is quite inelastic. – However, you could find studies which suggest labour supply is more elastic in the long term.

Empirical evidence suggests, the 1993 Clinton increase in the top marginal tax bracket to 39.6% had no effect on the labour supply of the rich. The tax increase wasn’t a barrier to a strong period of economic growth. Combined with fiscal restraint, it also led to one of the few US budget surpluses in recent decades.

However, it depends on the marginal tax rate. For countries like Sweden with an 80% marginal tax rate or the marginal tax rates which were a legacy of WWII in US and UK, there is a much stronger case that these kinds of marginal tax rates do create disincentives to work.

I would say the Bush tax cuts for the high-income earners was a poor choice of policy. It cut tax for those who needed it the least. It contributed to the long-term deficit and gave little if any benefit in terms of increasing productivity. There was very little ‘trickle down effect’ from this tax. It would have been better to have kept the taxes as they were – meaning the US would have more scope for fiscal expansion when they faced the recession of 2009-2011. It is a similar criticism of the Trump tax cuts – tax cuts at the wrong time, for wrong people – leading to higher borrowing – without any investment in the economy.

Related

- Impact of tax cuts on jobs

- Supply-side Economics N.Roubini

- UK Supply side policies in 1980s and 1990s

3 thoughts on “Supply Side Economics – Pros and Cons”

Comments are closed.