The business or trade cycle relates to the volatility of economic growth, and the different periods the economy goes through (e.g. boom and bust). There are many different factors that cause the economic cycle – such as interest rates, confidence, the credit cycle and the multiplier effect. Some economists also point to supply side explanations, such as technological shocks.

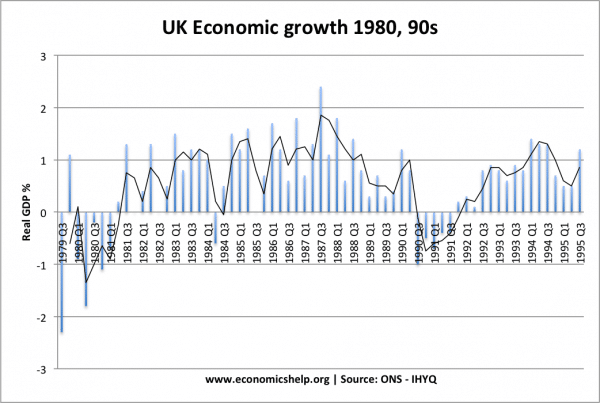

This graph shows quarterly economic growth in the UK 1979 to 1995. It shows two recessions 1980 and 1990/92, and the periods of recovery and boom. The stats are quarterly figures.

In the UK, the average rate of economic growth is about 2.5%, and therefore we say that the UK long-run trend rate of economic growth is around 2.5%. However, the actual growth rate can vary from this average, as it passes through different stages of the business cycle.

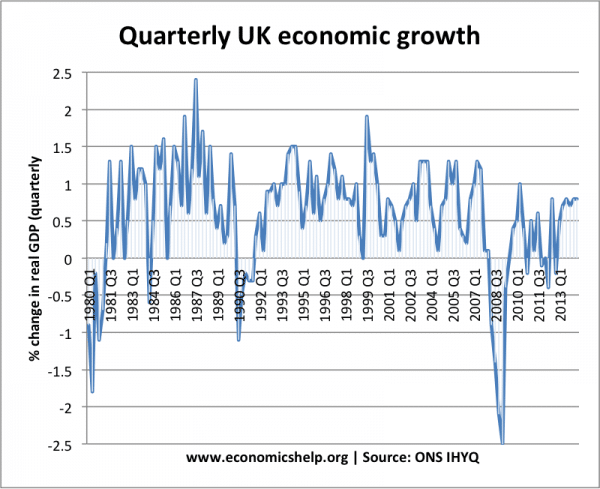

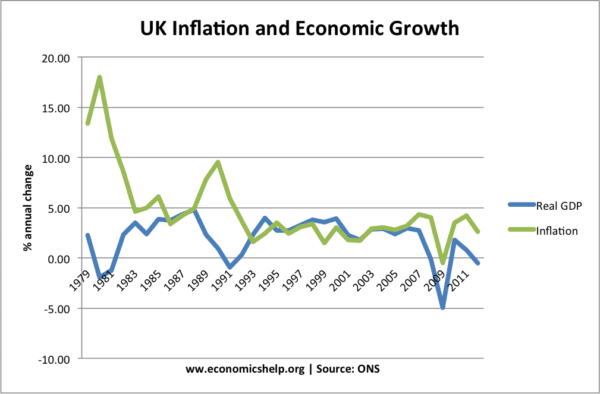

Graph showing the UK economy cycle – including three recessions of 1981, 1991 and 2009.

For example, in the late 1980s, we experienced rapid economic growth of over 4% a year. However, this growth proved unsustainable leading to inflation and then a recession in the early 1990s.

Phases of the business cycle

- Economic growth – when real output increases.

- Economic boom – fast economic growth which tends to be inflationary and unsustainable.

- Economic downturn – when the growth rate falls and the economy heads towards recession

- Recession – when there is a period of negative economic growth, and real output falls.

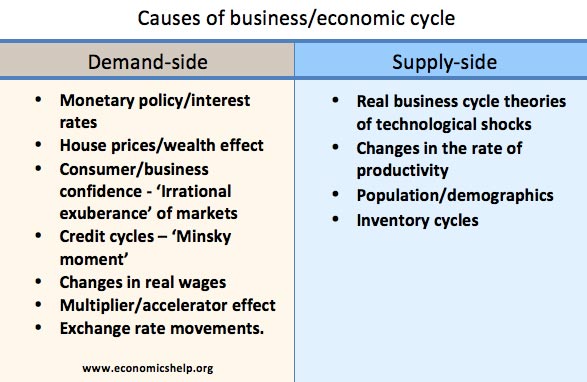

Causes of the business cycle

- Interest rates. Changes in the interest rate affect consumer spending and economic growth. For example, if interest rates are cut, this reduces borrowing costs and therefore increases disposable income for consumers; this leads to higher spending and economic growth. However, if the Central Bank increase interest rates to reduce inflation, this will tend to reduce consumer spending and investment, leading to an economic downturn and recession. See: Interest rate cycle.

- High-interest rates in 1991-92 were a major factor in the recession of that year. The cut in interest rates post 1992, helped the economy to recover.

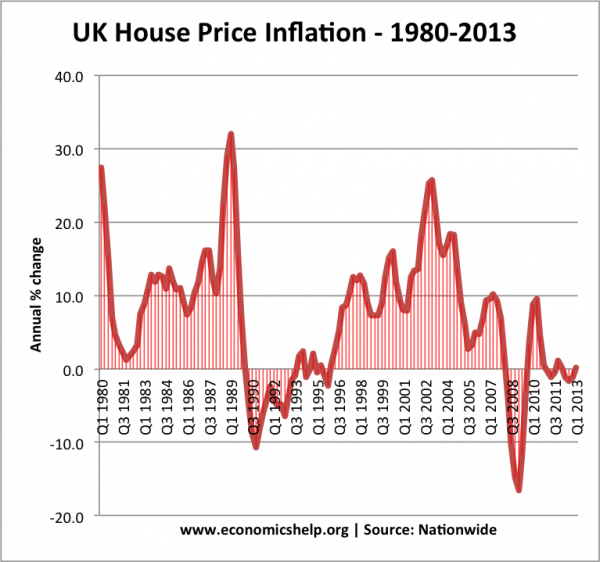

- Changes in house prices

A rise in house prices creates a positive wealth effect and leads to higher consumer spending. A fall in house prices causes lower consumer spending and bank losses. (house prices and consumer spending) In the late 1980s, the boom in house prices caused an economic boom. The drop in house prices in the early 1990s was a significant factor in causing the recession of 1991-92.

- Consumer and business confidence.

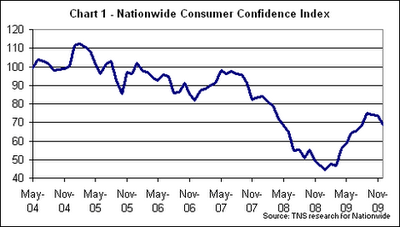

Fall in confidence in May 2008, contributed to the deepest recession for a considerable time. People are easily influenced by external events. If there is a succession of bad economic news, this tends to discourage people from spending and investing, making a small downturn into a bigger recession. But, when the economy recovers this can cause a positive bandwagon effect. Economic growth encourages consumers to borrow and banks to lend. This causes higher economic growth. Confidence is an important factor in causing the business cycle.

- Multiplier effect. The multiplier effect states that a fall in injections may cause a bigger final fall in real GDP. For example, if the government cut public investment, there would be a fall in aggregate demand and a rise in unemployment. However, those who lost their jobs would also spend less, leading to even lower demand in the economy. Alternatively, an injection of investment could have a positive multiplier effect.

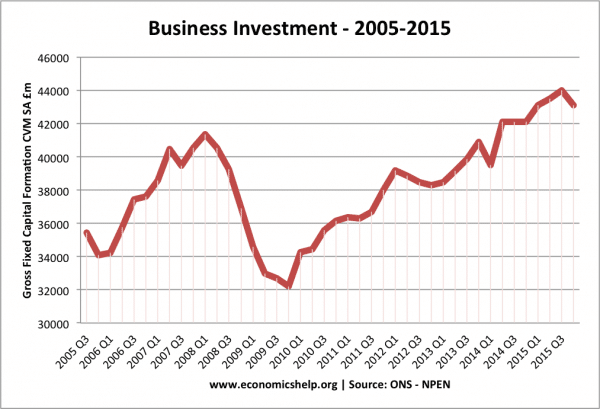

- Accelerator effect. This states that investment depends on the rate of change of economic growth. If the growth rate falls, firms reduce investment because they don’t expect output to rise as quickly.

Drop in business investment caused by lower growth and credit crunch made the recession deeper. This theory suggests investment is quite volatile and small changes in the rate of growth have a big effect on investment levels. This contributes to a more volatile business cycle.

- Lending/finance cycle. Up until the 2008 recession, less emphasis had been placed on the state of the financial system. However, the credit crunch of 2008 was the primary cause of the 2008/09 recession. A boom in credit and lending (especially sub-prime mortgages in US) was a factor in promoting economic growth during the 2000s. But, when banks became over-stretched and needed to call in loans, the financial system was short of liquidity. After the credit crunch, more attention has been given to theories of financial instability. For example, H. Minsky ‘Financial instability hypothesis‘ as a cause of business cycles.

- Inventory cycle. Some argue that there is a natural inventory cycle. For example, there are some ‘luxury’ goods we buy every five years or so. When the economy is doing well, people buy these luxury items causing faster economic growth. But, in a downturn, people delay buying luxury goods, and so we get a bigger economic downturn.

- Real business cycle theories. Real business cycle theories – e.g. Kydland and Prescott (1982) – emphasise supply-side causes of the business cycle. For example, periods of technological change can go in cycles, leading to variations in rates of growth. Real business cycle theories tend to assume rates of unemployment reflects changes in people’s willingness to work. See more at Real Business Cycle models

Causes of recessions

The business cycle can go into recession for a variety of reasons, such as:

- Falling house prices causing negative wealth effect and lower consumer spending

- Credit crunch causing an increase in the cost of borrowing and shortage of funds

- Volatile stock markets and money markets undermining business and investment confidence.

- Higher interest rates – causing lower spending and investment.

- Tight fiscal policy – higher taxes and lower spending.

- Appreciation in the exchange rate.

- See: causes of recessions

Examples of business cycles

In the post-war economy, there appeared to be a simple trade-off between unemployment and inflation, shown by the Phillips curve. There were several economic booms, followed by an economic downturn.

In the late 1980s, there was a classic boom and bust, with economic growth exceeding the long-term trend rate and causing inflation. Eventually, the government tried to reduce inflation, and the boom turned into a recession. See: Lawson Boom and Bust

The end of the business cycle?

During the great moderation (1992-2007), some economists hoped we had seen the end of the business cycle because we experienced a long period of economic expansion without inflation. However, in 2008, the global credit crunch pushed the world economy into recession, showing the business cycle hadn’t ended. For further reading see Financial instability hypothesis – why economic stability can cause financial instability.

Impact of business cycle on economy

- A volatile business cycle is considered bad for the economy. A period of economic boom (rapid growth in GDP) invariably leads to inflation with various economic costs. This inflationary growth tends to be unsustainable and leads to a bust (recession).

- The biggest problem of the business cycle is that a recession represents a large wastage of resources. A prolonged period of unemployment can also lead to a loss of labour productivity as workers get discouraged and leave the labour force altogether.

- The uncertainty created by a volatile business cycle tends to cause lower investment, and this can lead to lower long-term economic growth.

- However, other economists, such as J.Schumpeter argue that the creative destruction of capitalism can be a good thing. In a recession, inefficient firms go out of business and it acts as an incentive to cut cuts.

Moderation of business cycle

- Monetary authorities tend to try and minimise fluctuations in the business cycle. They seek to avoid an inflationary boom and also avoid a recession. In the UK, the primary tool to smooth the business cycle is the use of interest rates. The government may also use fiscal policy. In a recession, the government could try increasing government spending and cutting tax.

- However, the effectiveness of monetary and fiscal policy depends on a few factors; Central Banks are not always able to overcome a recession. For example, cutting interest rates in 2008 and 2009 was insufficient to end the recession and return to normal growth. This was because the recession was very deep and banks reluctant to lend.

Is the business cycle inevitable?

Some economists argue that the business cycle is an essential part of an economy. Even downturns have their role to play as it tends to ‘shake-up’ the economy and weed out ‘inefficient’ firms and creating greater incentives to cut costs and be efficient. However, this view is controversial, and other economists argue that in a recession, even ‘good efficient’ firms can go out of business leading to a permanent loss of productive capacity.

Related

Thanks ,I loved reading this work and y have really understood