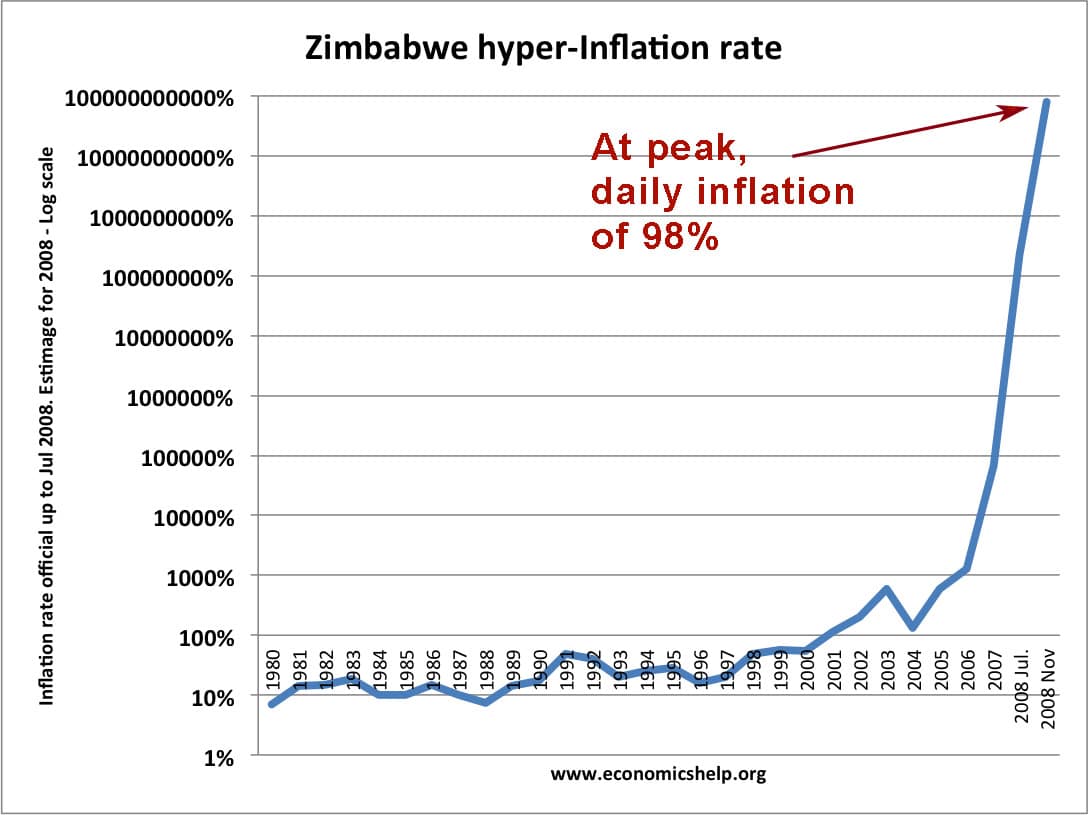

In 2008, Zimbabwe had the second highest incidence of hyperinflation on record. The estimated inflation rate for Nov 2008 was 79,600,000,000%

That is effectively a daily inflation rate of 98.0. Roughly every day, prices would double. It was also a time of real hardship and poverty, with an unemployment rate of close to 80% and a virtual breakdown in normal economic activity. The hyper-inflation was caused by printing money in response to a series of economic shocks.

(The highest hyperinflation rate was Hungary 1946 with a daily inflation of 195%)

Causes of hyper-inflation in Zimbabwe

- Government printing money in response to:

- High national debt

- Decline in economic output.

- Decline in export earnings.

- Price controls which exacerbate shortages.

- Lack of confidence in government, economy and political life.

- Expectations of hyperinflation

- In the late 1990s, the Zimbabwe government introduced a series of land reforms. This involved redistributing land from the existing white farmers to black farmers. But, with little experience, the new farmers struggled to produce food, and there was a large fall in food production.

- The economy experienced a sharp fall in output (both agricultural and manufacturing), and this caused a collapse in bank lending.

- The government began increasing the rate at which they were printing money and increasing the money supply. This started with printing money to finance a war in the Congo and also to increase the salaries of officials and soldiers. But, as the economic crises worsened, printing money became a very short-term solution to try and placate people relying on government pay.

- With the economy in decline, government debt increased. To finance the higher debt, the government responded by printing more money, which caused more inflation. Inflation meant bondholders saw a fall in the value of their bonds and so it was hard to sell future debt.

- The economy also experienced many shortages of goods.

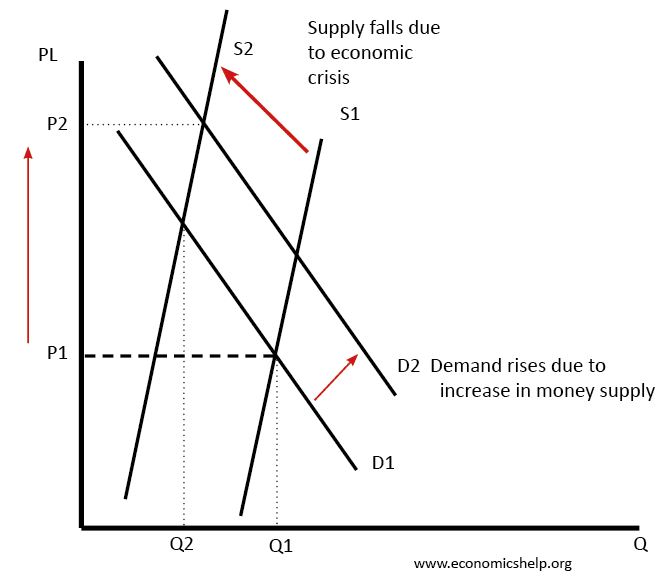

- Due to the decline in output, there were shortages of goods, which pushes prices up. Nominal demand was rising because people had more paper money. This combination of more money chasing fewer goods caused very rapid rises in price. When there is a shortage – prices rise. Combined with printing more money and this shortage of actual goods, prices rose rapidly.

Price control

Ironically, this shortage of supply was made worse by the imposition of price controls. Price controls set the price for basic goods (the idea was to keep prices affordable and stop inflation). But, because the cost of production increased faster than prices, suppliers had little incentive to supply the goods (at least through the official channels). This made the shortage worse and the actual inflation worse.

Expectations

Zimbabwe had high inflation since the mid-1960s. People became accustomed to expecting more inflation. This then becomes self-fulfilling. If people expect hyperinflation, they demand higher wages and push up prices in anticipation of higher inflation in future.

Inflation Rates in Zimbabwe

| 1996 | 16% |

| 1997 | 20% |

| 1998 | 48% |

| 1999 | 56.90% |

| 2000 | 55.22% |

| 2001 | 112.10% |

| 2002 | 198.93% |

| 2003 | 598.75% |

| 2004 | 132.75% |

| 2005 | 585.84% |

| 2006 | 1,281.11% |

| 2007 | 66,212.30% |

| 2008 Jul. | 231,150,888.87% |

| 2008 Nov | 79,600,000,000% |

Costs of hyper-inflation

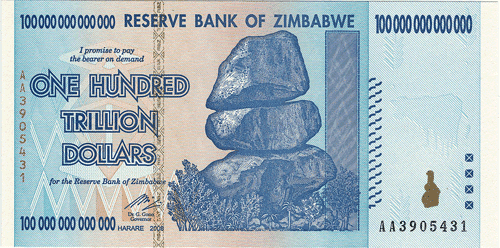

- People couldn’t afford basic goods. Zimbabwe had the worst of both worlds – prices rising faster than wages and incomes. People became “poverty billionaires’ It was no good having a salary of One billion dollars if a loaf of bread cost two billion.

- No credit available. The entire financial system became undermined, banks closed and were unwilling to lend any money. Due to rising prices, the value of debt could be soon wiped out. But, this meant business and individuals had no access to credit. Normal business activity closed down and investment was cut back.

- Menu costs. With inflation almost doubling through the day, anyone who received money had to exchange into foreign currency or spend straight away. Bus commutes were one price in the morning, and much more expensive on the way back. People had to spend time adjusting prices, but more importantly get rid of Zimbabwean currency as soon as you received it.

- Switch to a barter economy. With money becoming worthless, people found ways around the official economy, paying for goods in kind (e.g. using agricultural produce to get a haircut) The problem is the barter economy is only useful if you have goods to exchange. Business increasingly switched to the use of foreign currency – the US dollar as the only way to survive inflation. In 2009, this practice became more widespread.

- Lost savings. Anyone with savings lost everything – unless they were able to exchange with foreign currency. Even people with assets and property often saw the value shrink. Foreign exchange controls make it very hard to take money out of the country.

- Damage to business confidence. The extent of hyperinflation and fall in output disrupted normal economic activity and saw Zimbabwe GDP shrink. It affects investors for a long time.

Solving hyperinflation

The government eventually stopped printing Zimbabwe dollars and normalised the practice of using the US dollar.

Causes of Inflation MV=PY

The Monetarist explanation of inflation is that prices are linked to growth in the Money Supply. The quantity theory of Money states MV=PY. If we assume a constant V (velocity of circulation) and Constant Y, an increase in the Money supply leads to an increase in prices. In practice, the link between the money supply and inflation is not as simplistic as this formula states; but, as a rough rule of thumb if the money supply increases by 1000% and Real GDP stays the same you can expect inflation of around 1000%

Mugabe’s Explanation of Inflation

I believe Mugabe once blamed inflation on ‘Greedy businesses’ demanding price rises. This encouraged him to set up price controls. But, as mentioned these have been ineffective in preventing inflation.

Other Mugabe supporters have tried to blame inflation as a ‘Western import’. Although this assertion was rather bizarre given that inflation is relatively low in Western economies.

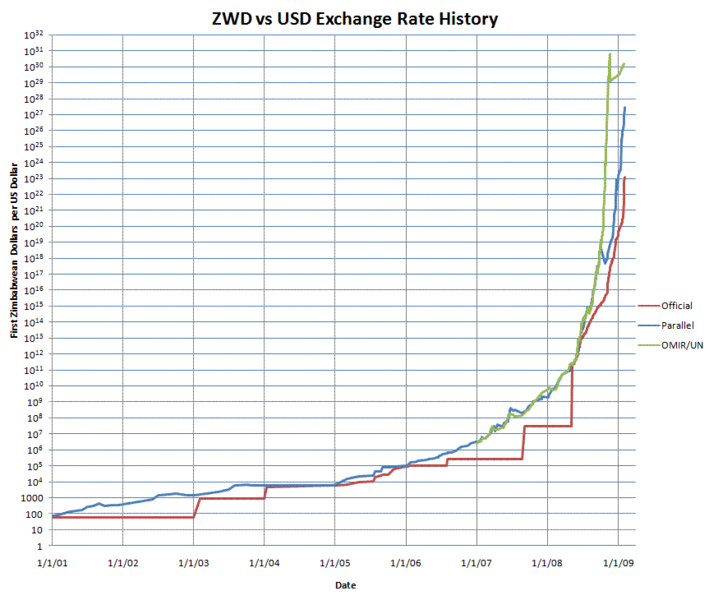

Hyperinflation and Exchange Rate

Hyperinflation causes a rapid decline in the value of a currency. This graph shows how inflation in Zimbabwe led to a steep decline in the value of the Zimbabwe currency.

Question related to hyperinflation in Zimbabwe

Readers Question: I do not understand the responses. If prices are rising by 1000% and unemployment is 80% then WHO is buying the goods? It cannot be the people unemployed as they would not have the money. If the answer is ‘no-one is buying the goods, hence starvation’ then why would prices be so high as if there’s no demand….

Usually, in the West, inflation is caused during periods of rapid growth; it is termed demand-pull inflation. However, this particular case of inflation is not caused by an economic boom, but, a collapse in the economy where the money supply is growing despite a fall in output and number of goods available.

Although unemployment is close to 80%, there are still people with money. There are many groups of workers who have rising nominal wages because the government is printing more money, but, because the output of goods is falling, the value of money is decreasing rapidly.

Basically, even if only a small % of the population has any money that is sufficient to cause inflation if the output is falling. The real problem is that many people have more cash/money, but have declining real incomes.

Because there is a shortage of goods and the printing of more money it is inevitable that inflation occurs.

Note printing money does nothing to increase Real output, Real GDP. It is a basic economic paradox that you can’t get richer by printing more money. But, it doesn’t stop people in desperate situations trying.

We cannot apply economic theories in Zimbabwean economy

looking at phillips curve analysis which states that high inflation and high unemployment never core exist, rather we can develop our own economic theories which explain Zimbabwean economy

some economists may apply those theories but it will be based on their economy, thats why we cannot apply them to Zimbabwe because in Zimbabwe now we are facing high inflationary rate as well as high unemployment

wait for the ‘invisible hand’

Great explanation…as an undergrad student, it was really easy for me to understand and the concepts were easy to grasp. Thanks a lot!

Switching to a Foreign currency makes sense for the people alright, but how does it help to revive the economy?

The production is still insufficient, people still demanding more salaries and thus creating more demand as compared to the resources available.

Even if monetary help is granted to such economies in a Foreign currency, it would only lead to another vicious cycle of creating employment and thus pulling demand back up again and also of course, inflation.

I’m unable to figure out a way how such hyperinflationary situations can be dealt with.

Although this assertion was rather bizarre given that inflation is relatively low in Western economies.

This might not hold true today?