A ‘fat tax’ is a specific tax placed on foods which are considered to be unhealthy and contribute towards obesity. The tax could be placed on foods high in sugar/fat, such as crisps, chocolate and deep fried takeaways.

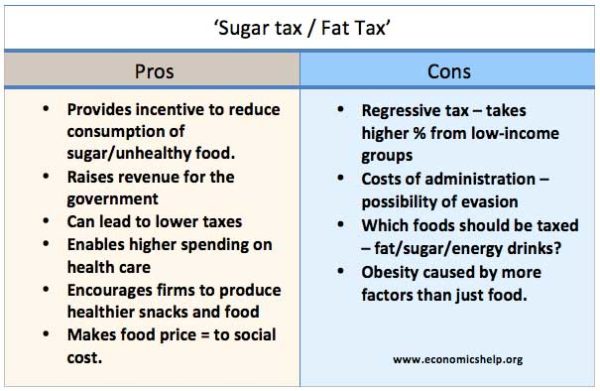

The argument is that a fat tax would encourage healthier eating and raise revenue to be spent on public health care. Critics argue the tax will be regressive – taking more from low-income groups.

It would be similar in principle to a cigarette or alcohol tax.

Pros of a Fat Tax

- Social cost. A fat tax would make people pay the social cost of unhealthy food. Consumption of fatty foods have external costs on society. For example, eating unhealthy foods contributes to the problem of obesity. Obesity is estimated to cost the UK economy around £6.6–7.4 billion a year. (Blackwell-Synergy) . These costs are due to

- NHS costs of treating disease related to obesity, such as heart disease, angina, diabetes, strokes.

- Time lost at work due to obesity issues.

- Lost earnings from obesity-related disease and premature death.

- Those who are obese are 25% less likely to be in employment, leading to lower tax revenue and higher welfare spending on benefits. A tax on fatty foods would make people pay the social cost of these foods. Increasing the cost of unhealthy foods, would reduce demand and play a role in reducing obesity levels. Making people pay social cost would achieve a more efficient allocation of resources. (see theory of tax on negative externality)

- Encourage a healthier diet. A tax on unhealthy foods would encourage people to choose healthier foods which lead to improved health and would help reduce related disease. A fat tax would also encourage producers to supply foods lower in fat and sugar. Fast food outlets would have an incentive to provide a wider range of foods.

- Raise revenue. Through increasing tax on fatty foods, the government could raise substantial sums of money. They could use this revenue to offset other taxes – such as decrease the basic rate of VAT. Therefore, a fat tax could be revenue-neutral (no overall increase in tax revenue). Alternatively, the money raised from ‘fat tax’ could be used to spend treating health costs of obesity.

- Equity neutral. Also, a fat tax could be equity neutral. Some may say a fat tax is regressive (takes a higher % of income from low-income families), but if other regressive taxes are reduced the overall impact on equality should be unchanged.

- Similar taxes such as cigarette taxes have been widely accepted and contributed to long-term fall in cigarette smoking rates.

Cons of Fat Tax

- Which foods? Difficult to know which foods deserve a fat tax. e.g. cheese has high-fat content. Many foods could contribute to obesity if consumed in sufficient quantities.

- Many factors behind obesity. Obesity is caused by more factors than just over-consumption of ‘high fat’ high sugar foods. It includes issues such as the size of portions, levels of exercise and genetic factors.

- Administration costs in collecting tax from unhealthy foods.

- Likely to be regressive. Often people on low-incomes spend a high % of their income on ‘unhealthy foods’.

- Costs of obesity may be over-estimated. Obese people have lower life expectancy and so save government pension costs and health care costs in old age.

- Political costs of introducing a new tax – people dislike the idea of ‘nanny-state’ discouraging certain behaviours.

Related

- Sugar Tax – arguments for and against

In my opinion i think it would be a terrible idea to tax food and drinks as this affects the country overall. For instant people who are not over weight will also have to pay these taxes and most people are in poverty. furthermore this would be unfair to the overall community as britain has around 23% of obese people out of the other countries.

If you tax ‘fatty’ foods – healthy foods will be relatively cheaper. In theory tax on sugar could be used to subsidise cheaper vegetables for population.

Yeah

I think you are totally correct.

But what about the increased amount of money you spend to cur the various illnesses like heart disease and cancer which is more expensive to treat than all cancer treatments combined, so therefore it is a much better idea to eat healthy and not pay extra hospital bills,

A fat tax sounds very wrong and I found myself joining in to complain about it. But on further thoughts and seeing all the health problems resulting from obesity, I would think it’s the most logical thing to do. Why should the tax payers support those who wish to enjoy their food rather than control their diet for good health.

Quit complaining

“Obese people have lower life expectancy and so save government pension costs and health care costs in old age.”

Not sure the evidence bears this out.

Fat people tend to have a similar life expectancy to healthy weight people, but have less healthy lives, and hence are a burden on healthcare for longer.

http://bmjopen.bmj.com/content/2/3/e000940.full

Quote from the article you gave the link to. “Conclusions According to the point estimate, lifetime medical expenditure might appear to be higher for obese participants, despite their short life expectancy. With weight control, more people would enjoy their longevity with lower demands for medical care.” So it seems medical expenses for obese people are still higher, despite their shorter life expectancy.

Why would we have to be pushed to eat healthier when the healthy food they want us to eat is far more exspensive then the regular, fatty, junk food that every average person can afford. They except the low income parents ( which is about 100% to 199% of the poverty level or promixity 97.3 million people in just the US) to feed their children healthy…..HOW how can they do that when jobs dont pay enough, food is more exspensive then ever, and the government doesnt seem to notice or if they do they dont care.

When unhealthy/fatty foods get taxed and gets pricer, people will eat more healthy food as they might remain the same price or be cheaper. People will definitely come up with more healthy food business and due to the increased quantity of healthy foods business the price will usually be reduced. Some people may even start planting their own crops and increase the green rate of their country, later on, Earth; slowing down the rate of global warming and providing fresher air and environment.

But isn’t this a exception in case of poors? Most poors only eat unhealthy foods because they are cheap. What happens if government tax them? For middle or high income people, they can think that ‘ha, one dollar is nothing, we can still buy these foods’, but for poors, they don’t have enough money to afford them.

Because the healthy food is better for you.

are u serious !!!!!!!!!!!!!1

Yes I am serious lol

If you tax unhealthy food, people would not want to buy it near as much making the company lose money. However, if they either keep it the same or lower the price. You’re gonna see business sky rocket.

Taxing unhealthy food will lead to lower demand, which will make the company lose money. But it will create incentives for the company to create healthier alternative food which will be more likely to be affordable to most people, encouraging people to adapt a healthier diet, therefore it will result the business in making more money and contribute to decreasing the cost of medical care; obesity leads to a higher risk of death and lifts the burden of the healthcare.

I think that these major fat taxes are trying to get us broked

would any of the sin tax on junk food help schools

In my opinon, they might help a bit but kids may not like it so they would bring home lunches

yes, poor individual choices that cost society should be punished and good individual choices that benefit all should be rewarded.

sit around all day eating, pay more tax.

excercise and eat right, pay less tax

i favour a mixed system of consumption taxes along with higher or lower income/wealth taxes depending on the result of a health MoT

While I’d be mostly* in favor of a fat tax, there are many ways junk food sellers could counter it, e.g. they could lower their prices so that the tax doesn’t seem so bad, they could make their junk even more addictive, they could get more aggressive with the marketing (as if they weren’t enough already), etc. These companies selling chocolates, chips, sodas, etc. are HUGE. They’ve become very powerful. There’s no way they’d let a tax get them out of business.

*: There are certain healthy, natural fats that I’d hope would not be taxed, e.g. olive oil, fatty fish, nuts, etc. If they were, then I’d have a problem with the fat tax.

By this logic, all foods will cost a lot more making foods less accessible to low income families.

There truly are benefits and downsides to this fatty food taxing situation. Honestly, I don’t like sugary, fatty foods myself, plus it’d would be nice to prevent obesity among us.

Yes but there is a good cause because it can make vegetables cheaper