During the 1990s and early 2000s, Spain enjoyed rapid economic growth and became the 5th largest EU economy. In particular, the rapid economic growth encouraged a boom in property. In 2006, Spain started building 800,000 new homes – more than Germany, Italy, France and UK combined. (Euro Challenge.org)

However, in 2008, Spain was badly affected by the global credit crisis. The Spanish property market collapsed leading to a deep recession, that persisted for several years.

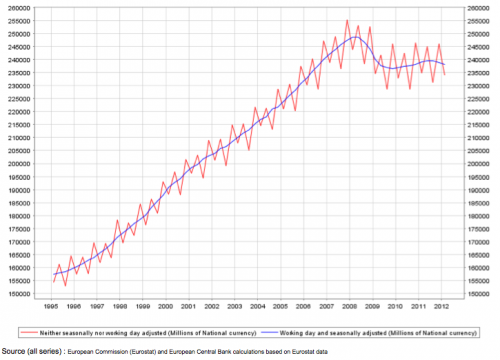

Spanish Nominal GDP

Since 2008, Spain has seen a sharp fall in GDP due to a combination of:

- Overvalued exports

- EU recession

- Austerity policies (government spending cuts)

- Collapse in Property Market and banking crisis

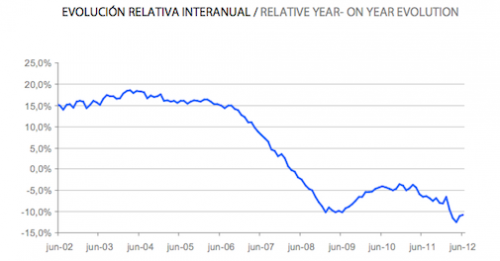

Spanish House Prices

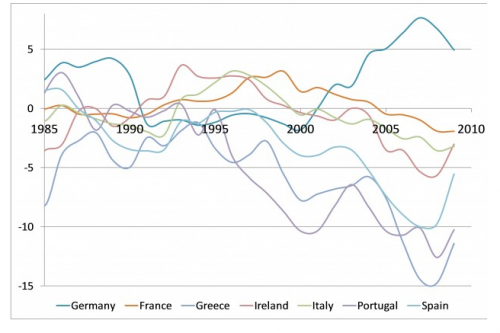

Current Account deficits in Eurozone

Spain was a founder member of the Euro. However, over the past few years, Spain has seen a relative decline in competitiveness compared to the Eurozone average. This has made Spanish exports more expensive. Being in the Eurozone means they can’t devalue, and therefore there is no quick fix to their uncompetitive exports.

After peaking at 10% of GDP, Spain’s current account deficit has fallen to 5% of GDP, but this partly reflects a sharp drop in consumer spending on imports. To restore competitiveness through internal devaluation will require a prolonged period of high unemployment.

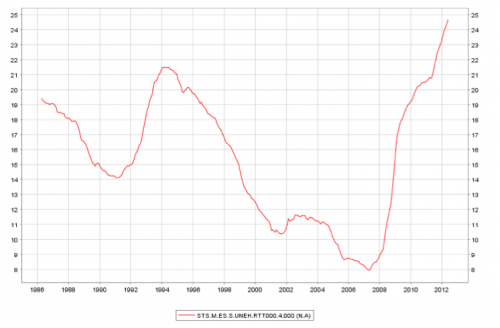

Unemployment in Spain

Even during the economic boom, unemployment remains stubbornly high in Spain, especially youth unemployment. Commentators have pointed to an inflexible labour market creating long-term structural unemployment.

Since the recession of 2008, unemployment has increased to record levels. In April 2012, 5.6 million were unemployed. (BBC)

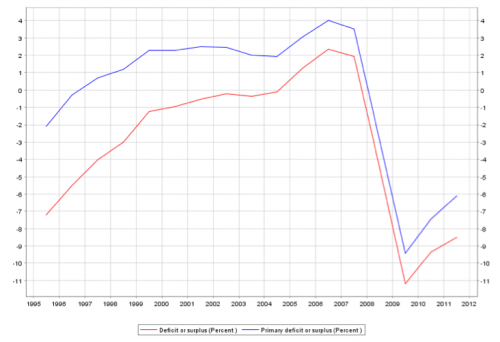

Budget Crisis

The primary deficit excludes debt interest payments. The gap between the primary and actual deficit is increasing because bond yields are close to 7%.

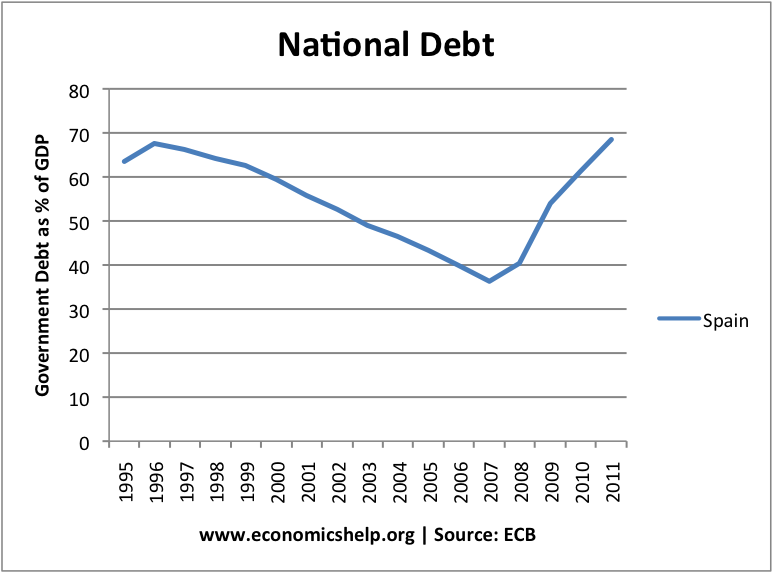

At the start of the credit crisis in 2007, Spanish government debt was very low 34% of GDP. However, this rapidly increased post-2007. This was due to:

- Recession causing fall in tax revenues and higher spending on unemployment benefits

- Collapse of property sector leading to evaporation of property taxes

- Banking crisis causing Spanish government to have to bailout Spanish Banks

- Spain’s credit rating has been cut from AAA before crisis to BBB

National Debt Spain

source: ECB stats

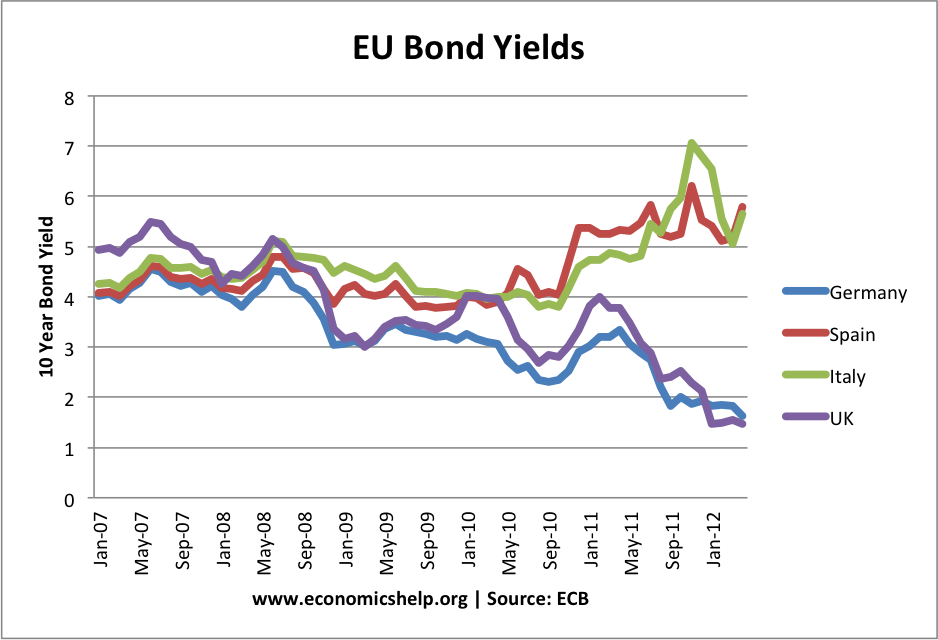

Spanish Bond Yields

Bond yields in Spain have since increased to just below 7%. Source: ECB long-term interest rates

- Due to rising government debt, markets become worried about the Spanish government’s ability to repay the debt. In 2012, Spanish bond yields have been hovering just below the critical 7% level.

- One of the main reasons for the Spanish government debt crisis is the banking crisis which has put pressure on the government to bail out Spanish banks.

- Like other Eurozone economies, Spain had no ability to devalue or print money. Therefore, markets feared liquidity crisis and this pushed up bond yields.

- In response to rising bond yields and need of bailing out banks, under pressure from the EU, Spain began a series if austerity measures aimed at reducing the budget deficit and reducing the high bond yields.

Austerity and Recession

Unfortunately, the austerity measures contributed to a rise in unemployment and further double dip recession. The scale of the government cut banks and wage freezes have led to social unrest and protests in major Spanish cities.

Also, austerity measures have not succeeded in reassuring markets. Despite several austerity measures, Spanish bond yields remain very high. Also, the budget deficit has shrunk by a smaller amount than expected. Debt to GDP ratio has been difficult to reduce because nominal GDP is falling.

The recession is so deep that when you take one step forward on austerity, it takes you two steps back”

Stephen King Chief economist, HSBC

No Measures to Promote Growth

Spain has pursued a tightening of fiscal policy, but has been unable to devalue the exchange rate. Also, monetary policy, set by the ECB has done little to accommodate the deep recession. Therefore, Spain faces a prolonged period of economic depression.

What Next for Spain?

In order to qualify for EU funds to bailout Spanish Banks, the Spanish Prime Minister recently announced €65bn of further cuts and tax rises. This is in order to meet a budget deficit ceiling of 8.7%. Unfortunately, given the depressed state of the economy, this combination of spending cuts and tax rises will be likely to prolong the recession and add to the mass unemployment.

If the Spanish economy persists in negative economic growth, it is hard to see anything but a very slow improvement in debt to GDP.

In a recent report S&P pointed to some positive signs on the economy.

We believe that the new government has been front-loading and implementing a comprehensive set of structural reforms, which should support economic growth over the longer term,” BBC

However, with a persistent deficiency in demand, supply side policies will not be sufficient for tackling the unemployment problem.

Should Spain Leave the Eurozone?

Some Spanish economists have suggested that the economic future is so bleak for Spain, that they would be better off leaving the Eurozone. This would enable them to devalue and boost exports to provide some economic stimulus. There would be less pressure to meet exacting EU budget targets.

However, leaving the Eurozone would also create danger of capital flight as Spanish savers sought to protect their Euro savings by investing abroad. This would further weaken the Spanish banking system, already weakened from the collapse of the property bubble.

Comparison between UK and Spain

Firstly, the degree of austerity is far greater in Spain than the UK. UK budget cuts are relatively mild compared to Spain. Only 1.5% real cuts in UK during 2012. Spain by contrast has experienced much deeper cuts. Also, Spain is not able to benefit from an independent Central Bank printing money and devaluation of the currency.

The UK has been able to tackle long term debt issues, without severely harming the economy.

In 2012/13, the UK should be able to recover. However, Spain is likely to be pushed into a deflationary spiral and a very deep and damaging recession. Unemployment in Spain is already critical, this recession will make it even worse.

Spain had structural problems before the crisis hit. There is labour market inflexibility and a real problem with youth unemployment. But, this has been aggravated by a combination of factors reducing nominal GDP. It is an unenviable position.

Related

SPAIN WAS NOT A FOUNDER MEMBER OF THE EURO!!!

Spain was not a founder member of the European Union (EU). But, it was in the Euro (Single currency) from the start.