A look at the future prospects for the Pound in the coming months of 2013.

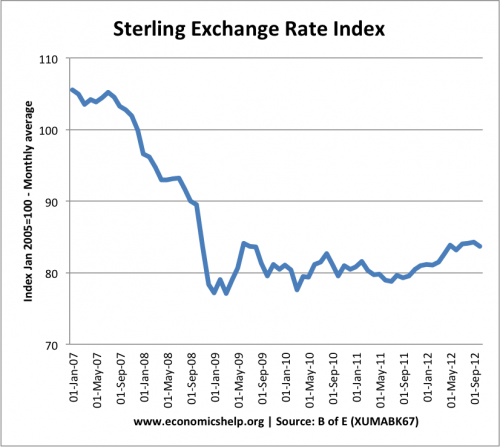

The Sterling index measures the value of the Pound Sterling against a basket of trade weighted currencies.

- In Dec 2011 the index was 80.4

- By Oct 2011, the exchange rate index has increased to 83.6

This modest appreciation in the Pound has occurred despite:

- Double dip recession in UK

- UK Inflation remaining above target

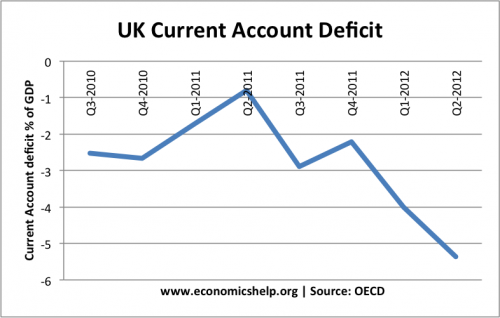

- Growing current account deficit

- Quantitative easing increasing money supply.

- One of largest budget deficits in OECD

Therefore the appreciation in the Pound is not so much a reflection of the strength of the UK economy – but a reflection of market nervousness about other currencies. In particulary, given the Euro crisis and difficulties of Eurozone economies, the Pound offers a greater semblance of normality and confidence.

However, given the weak state of the UK economy, it is likely that the fortunes of the Pound could deteriorate in 2013 – especially against the dollar and currencies other than the Euro.

In particular, the growing UK current account deficit (now over 5% of GDP) suggests underlying lack of balance between imports and exports.

The UK has one of the largest current account deficits in the OECD. There are other reasons to explain the current account deficit, but the widening of the deficit to over 5% of GDP, suggests the Pound is becoming more uncompetitive against its main rivals. In a floating exchange rate, this is likely to lead to some depreciation in the future.

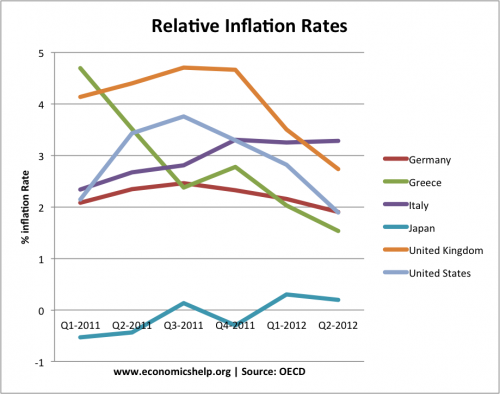

Relative Inflation Rates

The UK has had one of the highest inflation rates in Europe and is still above many other countries. This has contributed to the relative decline in competitiveness. It also makes the sterling’s recent appreciation look unsustainable.

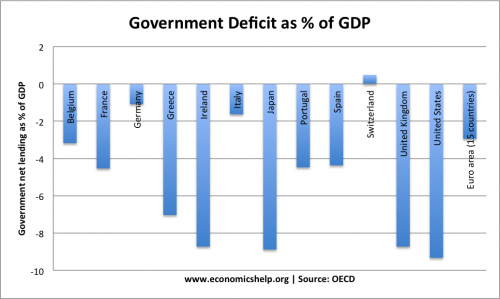

Budget Deficits

In 2012, the UK has one of the highest budget deficits. I don’t think this will have a huge impact on the exchange rate because bond yields in the UK remain low and markets aren’t worried about a default in UK, at the moment.

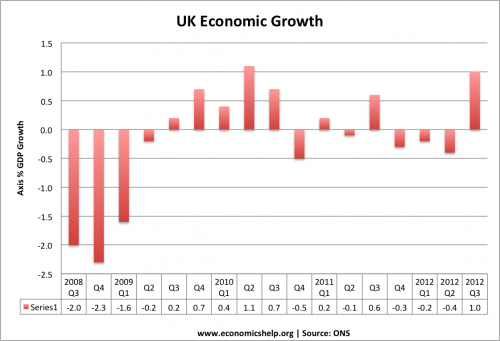

Economic Growth

The Bank of England’s recent inflation report, suggests the good performance in Q3 2012, is likely to be a one off. They are pessimistic about the future prospects for UK economic growth. Interest rates will remain low for the foreseeable future, and we may even have more quantitative easing to try and provide greater economic stimulus.

This continued economic weakness will worry markets as it may encourage the Bank of England to pursue more varieties of quantitative easing which has the impact of reducing the value of Sterling.

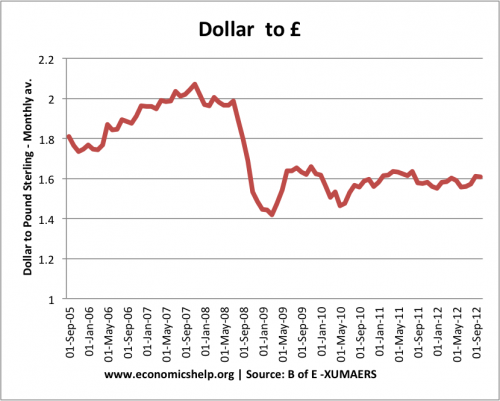

Pound Forecast against the US Dollar

In 2012, the Pound has been relatively flat against the dollar, as uncertainties over the US election have kept the dollar weaker. However, the US is showing signs of much stronger growth and could be one of the economies with the fastest rates of economic recovery.

I would expect the Pound to depreciate a small amount against the dollar in 2013 to perhaps £1 = $1.5.

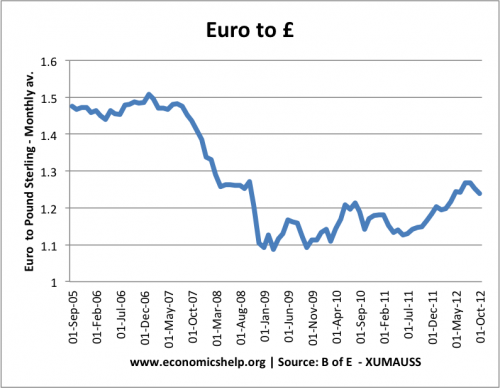

Pound to Euro in 2013

Despite the weakness of the UK economy, the Eurozone faces even greater structural problems, with large countries still facing high bond yields and the prospect of several years of austerity and stagnant growth. Given the uncertainties within the Eurozone area and prospect of continued nervousness about the plight of the Euro, the Pound could buck the economic fundamentals of the UK economy and continue to appreciate to 1.35 Euros

Some economists suggest that the best fair value of the £ is around

- £1 to €1.30

- £1 to $1.60 -which is pretty much the current rate.

Is appreciation of Sterling good for UK?

It makes our trade deficit harder to reduce. Especially so if it arises from weaker European economies.

The pound is likely to depreciate significantly in 2013 owing to the lack of UK gold reserves (310 tonnes); the Eurozone countries have over 10,000 tonnes of gold stock, and may decide to use their bullion reserves to back the euro, either directly through a euro gold-based currency, or through issuing gold bonds.

The Eurozone’s gold reserves equal around $600 billion, but with gold looking likely to rise, this value could go up.

Recent indications of European countries assessing their gold reserves and bringing some of these back home from vaults in other countries, appear to substantiate the idea of a coming gold-backed euro.

And yet, a depreciated pound would work wonders for the British economy.

This is a mistaken notion – that a depreciating pound, will boost UK’s exports. UK does not produce anything like China or Korea to export. The only area where increased revenue can be seen, is the Tourism Sector. For this, various Tourism Boards have to market the entire UK vigorously, across the globe. Even tourism numbers are shifting towards Asia, and Africa.

Exchange rate of 1.50$ to a pound, is too optimistic. US continues to be the innovator, has a manufacturing base that UK cannot even dream of, Tesco cannot compete with Google/Apple/Oracle, to name a few. We are traders, and are not willing to dirty our hands going in to manufacturing. Price for this, can be heavy in a rapidly changing world.