Earlier in the year, many were speculating the Euro was a risk of breaking up. Up step Mario Draghi with his promise to ‘save the Euro whatever it takes’

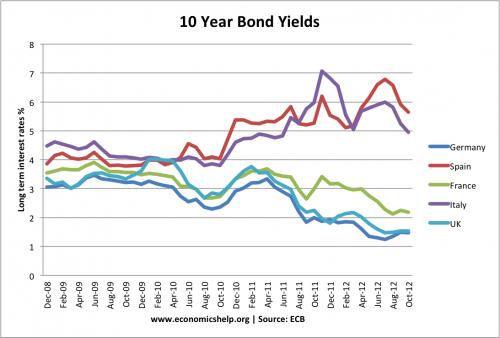

Under Mario Draghi, the ECB have done two things to help reassure bond markets:

- Long term refinancing for banks – helping to avoid liquidity crisis in banks spilling over into sovereign debt crisis.

- Outright monetary transactions – the willingness to buy an unlimited amount of bonds (in exchange for a country implementing strict fiscal rules)

These policies have helped see bond yield differentials narrow, and there is now more optimism the Euro will survive.

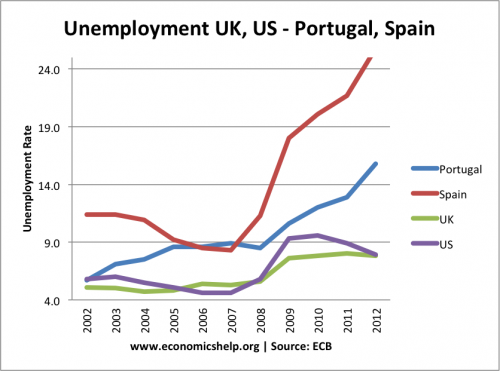

However, it’s curious in the FT article on the Euro crisis FT Person of the year – Mario Draghi , that there is not a single mention of the word ‘unemployment’ or ‘recession’. Just a repetition that Mr Draghi insists austerity can work.

“To give up now, as some suggest, would be tantamount to waste the great sacrifices made by the citizens of Europe,” he says. He also has no time for suggestions that surplus countries such as Germany should inflate away some of their competitive edge. “Inflation is not a policy tool; one does not toy with inflation.”

It does leave you wondering, how exactly do European policy makers judge success?

25% unemployment – don’t worry, Spanish bond yields have fallen and that must be good news.

The ECB recently downgraded growth forecasts for the Eurzone, expecting growth of 0.1% in 2013.