For those who like to keep track of the myriad different rates of inflation, the ONS will shortly be publishing a new measure – RPIJ.

- RPIJ will be basically RPI, but calculated in the same way as CPI which uses a geometric mean.

- CPI = official household inflation measure (CPI) – calculated using a geometric mean.

- RPI = CPI + Mortgage interest payments and council tax. RPI is also calculated using an arithmetic mean. (The RPI doesn’t mean international standards for calculating inflation.)

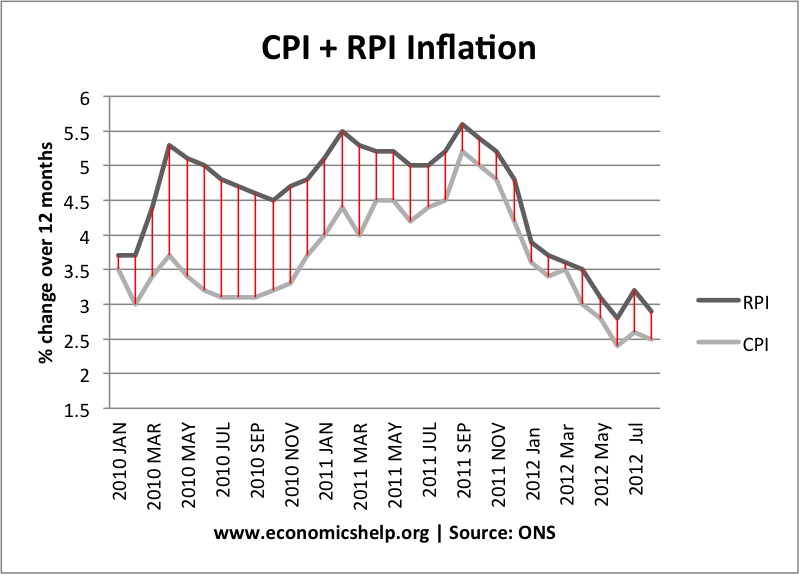

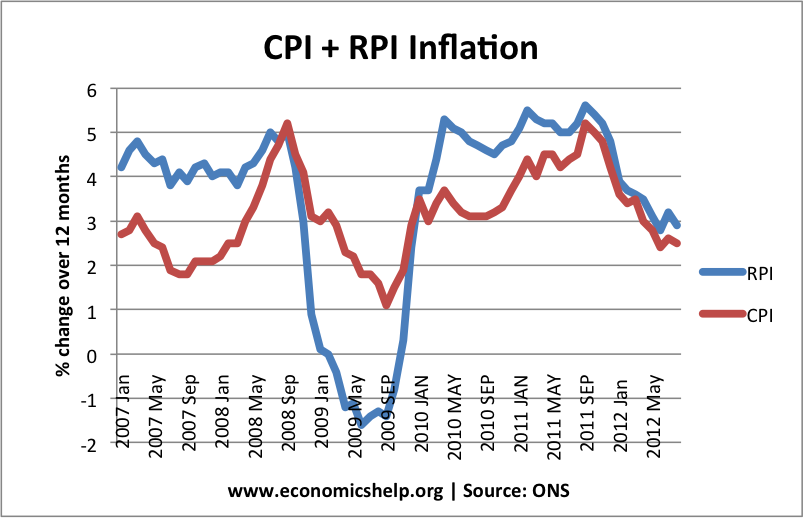

RPI is traditionally higher than CPI. The DWF state since its introduction in 1988, the RPI has averaged 0.73% more than the CPI which is mainly attributable to the “formula effect”. Some argue, because of the way it is being calculated, the RPI is over-estimating inflation. However, with pensions often linked to RPI, changing the way it is calculated could lead to lower annual increases in pensions. Therefore, the decision was taken to introduce a new measure RPIJ and keep the old measure RPI going.

RPI also tends to more volatile than CPI. A cut in interest rates in 2009, led to sharp fall in RPI because mortgage payments were lower.

Why not just change the way RPI is calculated rather than create a new one?

Some want to keep RPI measure because the time series goes a long way back and it makes comparisons easier. In particular, those who have pensions linked to RPI wouldn’t want to use the RPIJ measure because it would lead to lower income.

Is it not confusing to have many different inflation measures?

Yes. Especially when the differences are due to different arithmetic methods of calculation. There is an argument for just biting the bullet and changing the way RPI is calculated rather than creating a new measure.

Will RPIJ help give a better insight into inflation?

Possibly because it will reduce the ‘calculation effect’ of current RPI, but on the other hand, there is another measure to add confusion. But, then most people will concentrate on just the CPI – the headline rate. RPIJ is I guess for those with time to look at several inflation measures.

Will government and pension funds be tempted to just choose the most convenient inflation rate?

Yes, possibly. Though the government has already moved benefits to be linked to CPI inflation. It is unlikely to change this. We could see rail fares linked to RPIJ rather than RPI.

What other measures of inflation are there?

- RPIX = RPI – mortgage interest payments

- CPI-CT = CPI at constant taxes

- CPIY = CPI – indirect taxes

- See: different measures of inflation

What inflation measure would be most useful to publish

I would like the ONS to publish a core inflation measure – which strips out volatile energy prices, taxes and gives a useful guide to underlying inflationary pressures from any output gap. This would be useful for monetary policy. CPI and RPI are often misleading (e.g. Bank of England criticisms)

2 thoughts on “RPIJ – a new inflation measure”

Comments are closed.