Reader’s Question: Why does printing money cause inflation? Does this always occur?

Summary

- If the money supply increases faster than output then, ceteris paribus, inflation will occur.

- If a government prints extra money, households will have more cash and more money to spend on goods. But, if the amount of goods stays the same, the extra cash will just cause firms to put up prices.

Explanation of why printing money causes inflation

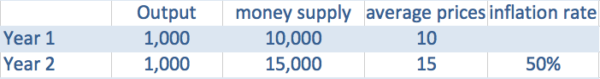

- Suppose the economy produces 1,000 units of output.

- Suppose the money supply (number of notes and coins) = $10,000

- This means that the average price of the output produced will be (10,000/1000) = $10

- Suppose then that the government prints an extra $5,000 notes creating a total money supply of $15,000; but, the output of the economy stays at 1,000 units.

- Effectively, people have more cash, but, the number of goods is the same. Because people have more cash, they are willing to spend more to buy the goods in the economy.

- Ceteris paribus, the price of the 1,000 units will increase to $15 (15,000/1000). The price has increased, but, the quantity of output stays the same.

- People are not better off, and the value of money has decreased; e.g. A $10 note buys fewer goods than previously.

Therefore, if the money supply is increased, but, the output stays the same, everything will just become more expensive. The increase in national income will be purely monetary (nominal)

If output increases by 5% and the money supply increases by 7%. Then inflation will be roughly 2%.

The Quantity Theory of Money

The Quantity theory of money seeks to establish this connection with the formula MV=PY. Where

- M= Money supply,

- V= Velocity of circulation (how many times money changes hands)

- P= Price level

- Y= National Income (T = number of transactions)

If we assume V and Y are constant in the short-term, then increasing the money supply will lead to an increase in the price level.

Printing money and devaluation

If a country prints money and causes inflation, then, ceteris paribus, the currency will devalue against other currencies.

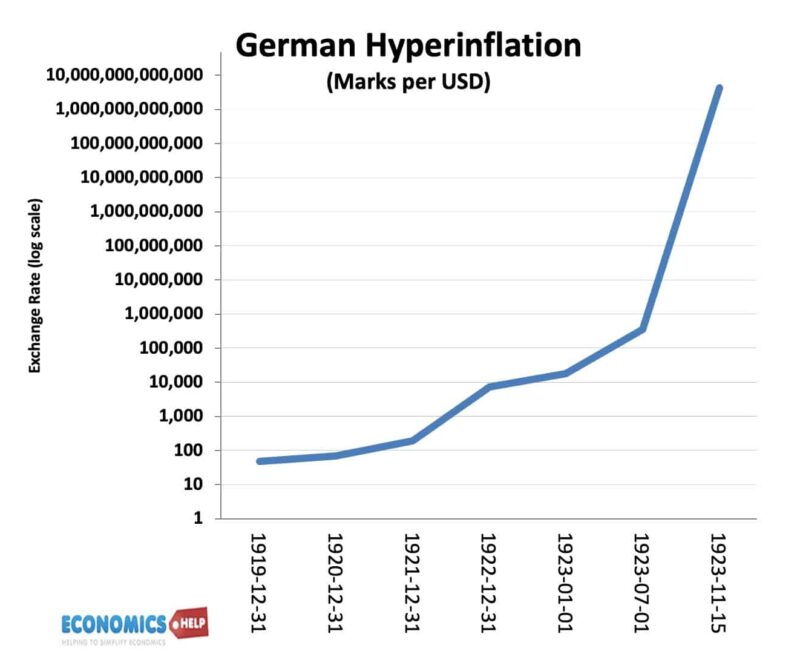

- For example, the hyperinflation in Germany of 1922-23, caused the German D-Mark to devalue against the currencies that didn’t have inflation.

- The reason is that with the German currency buying fewer goods, you need more German D-Marks to buy the same quantity of US goods.

Examples of inflation caused by an excess supply of money

- US Confederacy 1861-64. During the Civil War, the Confederacy printed more paper money. In May 1861, they printed $20 million notes. By the end of 1864, the amount of notes printed had increased to $1 billion. It caused an inflation rate of 700% by April 1864. By the end of the Civil War, the inflation rate was hitting over 5,000% as people lost confidence in the currency.[“Inflation in US confederacy. Encyclopedia.com]

- Germany 1922-23. In 1921 one dollar was worth 90 Marks. By November 1923, the US dollar was worth 4,210,500,000,000 German marks – reflecting the hyperinflation and loss in value of the German currency.

Evaluation – Link between money supply and inflation in the real world

- It is possible that if the government printed money, people could just decide to save the extra money and therefore, prices wouldn’t automatically rise.

- It is also possible that increasing the money supply could stimulate more output. For example, in a recession, there is unemployment of resources and a lack of demand. If a government prints more money and households start spending more, this may encourage firms to start increasing output and investing in future capacity, which helps to cause an increase in real output. Therefore, the link between increasing money supply and inflation will be weaker.

- Also in the real world, it is hard to measure the money supply (there are many different measures from M0 narrow money to M4 wide money)

However, the above provides a rough explanation why printing money usually reduces the value of money causing prices to increase.

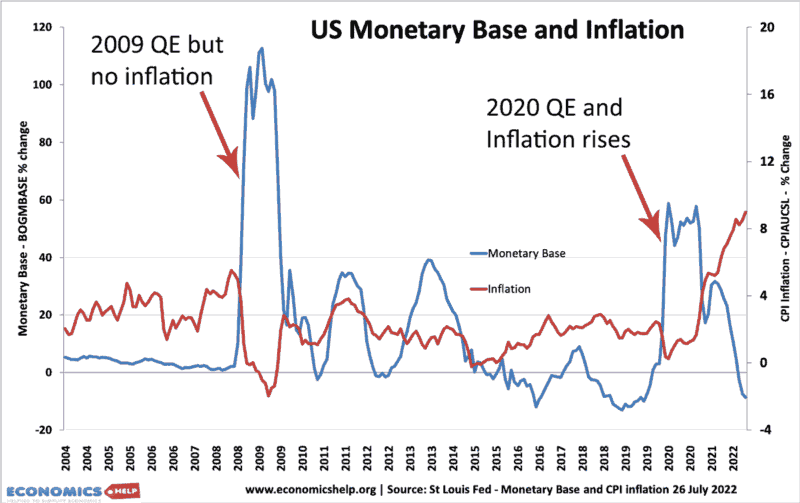

Does Quantitative Easing cause inflation?

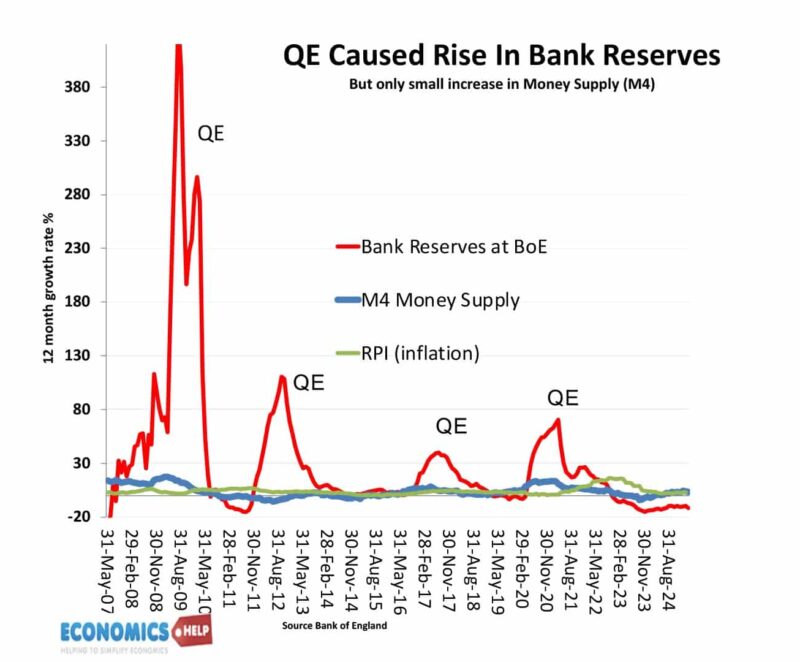

Quantitative easing involves Central Banks creating money electronically and buying bonds from commercial banks. (This is not printing money, though, it is causing a large increase in the monetary base (M1). However, this does not necessarily lead to increase in broader money supply M4. It depends on the actions of commercial banks. If they just keep the excess financial reserves, impact on inflation is limited. Don’t forget in a modern economy, it is commercial banks who create most of the money supply through lending. The amount of notes and coins in circulation is around 3% of total M4 money supply

QE – no inflation – then inflation

By 2015, the US monetary base had increased 600%, but the consumer price index has only increased 15%, an average inflation rate of 2%. It was the same in the UK, inflation remained relatively low, despite the Central Bank creating all this extra money. However, 13 years after quantitative easing started, we did see the return of inflation. So was it just a delayed effect or was something else causing inflation?

QE

When a central Bank creates money and buys bonds. It doesn’t actually print money. The important thing to understand is that it creates money for commercial banks who now hold more cash reserves with the Central Bank. But, here’s the really important question: between 2009 and 2015, did the Central Bank create any money in your bank account? The answer was no. So on the one hand there is more money created in the economy, but it was not really reaching the average household. Some argue that quantitative easing helped fuel asset inflation. Because of all these cash reserves, banks were more willing to lend mortgages and more able to invest in stocks. Certainly, UK house prices rose in this period. But, there were also other factors pushing up house prices, mainly the ultra-low interest rates.

This is the money supply in the UK. The monetary base includes reserves held in the Bank of England. M4 is the broader money supply which includes all the notes and coins plus different types of bank accounts. Basically, quantitative easing didn’t have much influence on this broader money supply. Which is why quantitative easing can have a very limited impact on inflation.

Further reading

supposing a government printed more money but only used to to finance the cost of imported goods, what then would be the effect on the domestic economy? supposing the price of these imported goods was the same as before the extra money was printed, there is just a larger quantity of them now.

also same question but exchanging spending on imports with general government spending ie on defense etc. if the public doesnt see the direct effect of this extra printed money how can inflation occur, all they will see is more missiles etc…..

this has always confused me, any responses would be greatly appreciated

great article by the way

thanks

j

Given that most things are falling in price and value now, it makes sense to infuse the domestic market with dollars because there is little risk that the negative affects of inflation are going to override the need for Americans to have cash to spend. I’m thinking a $10,000 to $25,000 rebate for every taxpayer making less than $100, 000 per year is a good start.

What if increase in money supply ( printing money) is done to accomodate an existing hole of debt. For example the Fed printing money to pour into the debt created by synthetic motgage products? Surely then effectively the money supply was increased in the the past- diriving inflation historically, and now the money supply only mitigates the effect of the lack of supply?

not understandable

Thanks very much for explaining this. I thought I must be dumb to even wonder about it, but the very intelligent questions show it to be more complex than I realised. I think many people just take this for granted without thinking it through. Thank you.

this web site is very beneficial for students of economics and finanace as well.

hi ,amazing really

but my question is ,sometimes it can also be happened that government print money just to start the new developmental projects.or to pay off the debt.then in such situation how it cause inflation?

Is there any thing that limits printing of money by the central bank .If a economy is in extreme debt status, why cant it print more money and pay off debts , how would this impact inflation. Debt servicing by tax policies reduces income of households ,it somewhat has similar effect as inflation. i.e less income and lower purchasing ability.can any throw light on this

because the banks are the only entity that can print the currency in the united states. they only print the money when the government gives them bonds, thus making the money debt. it is created out of virtually nothing. however there is interest attached to the debt, and it perpetuates a endless cycle of borrow, pay back, borrow, pay back, and while that is going on, the overall debt is rising. the only way to pay back the debt, is to add more debt.

I am still puzzled by one aspect of this process. After

the government prints the money how does it, in practical terms, get into the hands of the spending

public.

I fail to see how more printing needs to be done when we live in a 95% CASHLESS SOCIETY !!!

Most transactions done (that matter) are done via electronic means… (ie. Credit Card, EFTPOS, T/T). Even Cheques are NOT cash.

And people don’t eat Cash, they spend it. So that means much of the cash that is out there, gets recycled back to the banks and when they are ripped or damaged or just plain past expiry date… And of course, more money needs to be printed to replace that. Are they considering the cash that was returned?

What if cash is printed in indestructable plastic and doesn’t need to be replaced every so often, only every 10 years… would that mean that inflation would increase every 10 years? Because in a CASHLESS society, I fail to see how cash has any relevance in inflation… You could have used this excuse 20 years ago but now since most transactions are electronic, it just doesn’t stack up!

Really, this is just an excuse to increase inflation… higher inflation, government gets more money from tax. Higher price = more tax. Simple calc and an easy excuse to put over most of the people that aren’t thinking.

You’re completely right about the fact that many of our transactions are no longer done with actual cash, but instead using bank accounts. However, to increase the supply of money in the economy the government does not necessarily have to print more. Nowadays, they can simply add money to the account, and this does not require such a massive waste of paper.

How do evaluate the decision taken by Obama Administration to print 600 billion dollar on a small open economies

If you take a 1 Dollar amount of Gold, and a 1 Dollar note, then you have equality. The paper money is really only a promisory note for said value. The Gold is used to back those notes.

If you have 1000 Dollars worth of Gold, then you can have 1000 Dollars in promisory notes, to spend.

Take 1 Dollar worth of the Gold, and one 1-Dollar note. If you then print another 1 Dollar note, for the same piece of Gold, you now have a 1 Dollar piece of Gold, but 2 notes now worth only a Half-Dollar each.

You have reduced the value of the Dollar notes against the Gold Standard.

But, since the value of itemms is based on the value of the Gold, your 1 Dollar loaf of bread now has to cost 2 Dollars.

That’s how printing more money affects inflation.

If you just use it for imported goods, the cost of those goods goes up. Same for military or government spending – the source material has to come from Somewhere, so somebody would get shorted.

Printing fresh money is not a fix for a troubled economy. It just makes it worse.

we are not on a gold standard.