- Definition of Household savings ratio: The percentage of disposable income that is saved. (1)

- Total savings = Disposable income – Household consumption

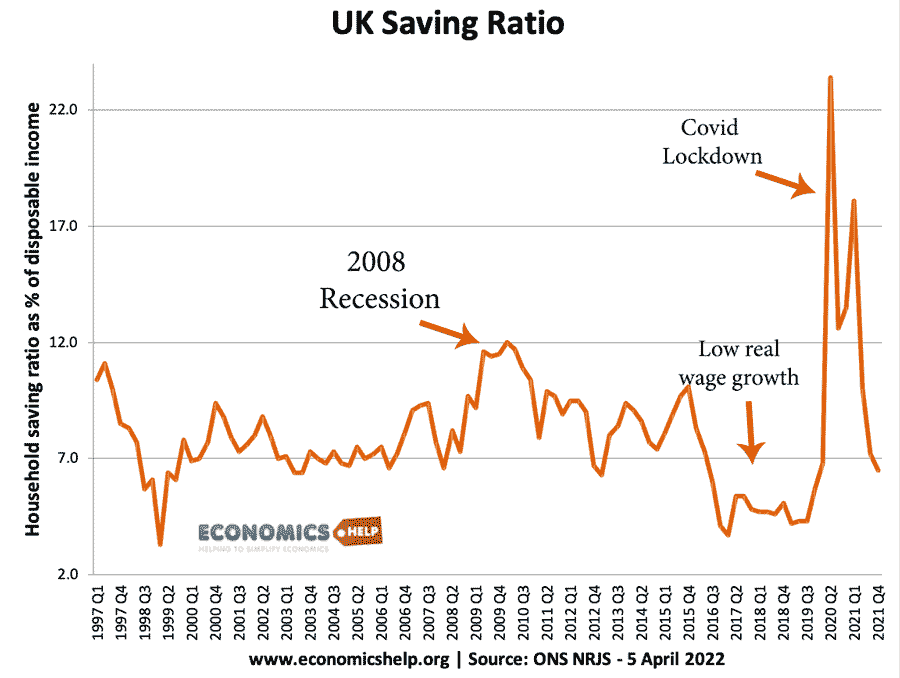

UK Saving Ratio

- Latest UK household savings ratio: 2021 = 10% But, by 2021 Q4 the saving ratio had fallen to 6.2%

- By contrast, the average savings ratio in the past 54 years is 9.2% of disposable income.

Rise in savings during Covid Pandemic

2020/21 saw a spike in the savings ratio due to the unusual circumstances of the Covid Pandemic. With normal economic activity curtailed many households were unable to spend on usual items like holidays, leisure and going out. Therefore, household savings rose sharply. With the end of covid lockdowns, the savings ratio fell. The forecast for savings in 2022 and 2023 is for savings to fall sharply due to the cost of living crisis, with many households seeing a fall in real income. This will cause households to run down savings to meet the rising cost of fuel and energy.

UK Saving ratio. Source: National income accounts NRJS dataset

NRJS = Households + NPISH (Non-Profit Institutions Serving Households)

Low saving ratio 2017-2019

This period saw a significant fall in the UK savings ratio to a record low. This fall in the savings ratio has been caused by

- Fall in real wages

- Depreciation in Sterling post-Brexit – pushing up the cost of living and contributing to falling in real wages

- To maintain spending, consumers have borrowed and dipped into savings

- Temporary factors (high tax payments on dividends)

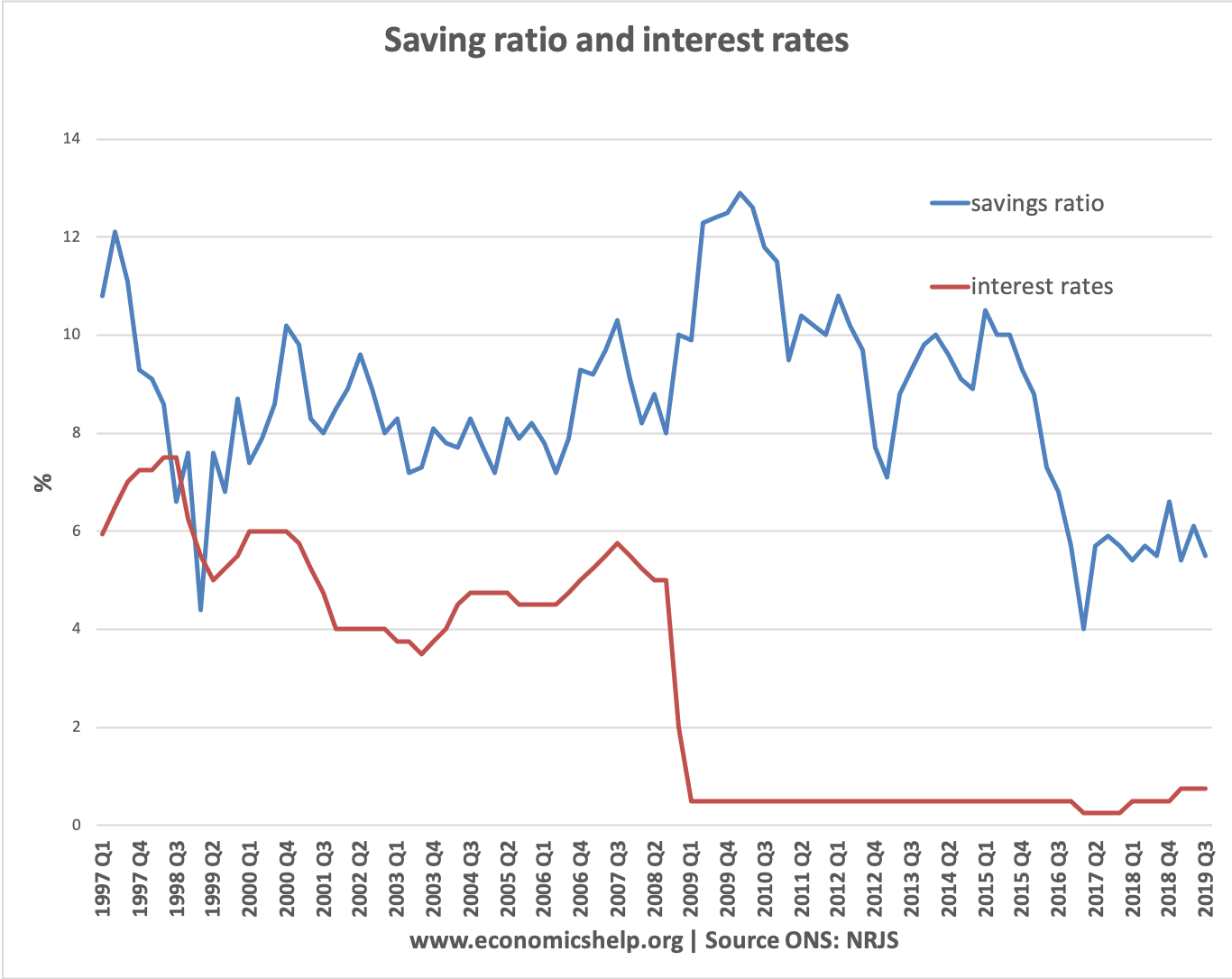

Saving ratio and base interest rates

In theory, lower interest rates reduce the incentive to save. But, the interest rate is only one of many factors influencing decisions to save. The most important factor is the state of the economy. In 2009, we saw a rapid rise in the saving rate because of the recession – despite interest rates cut to zero.

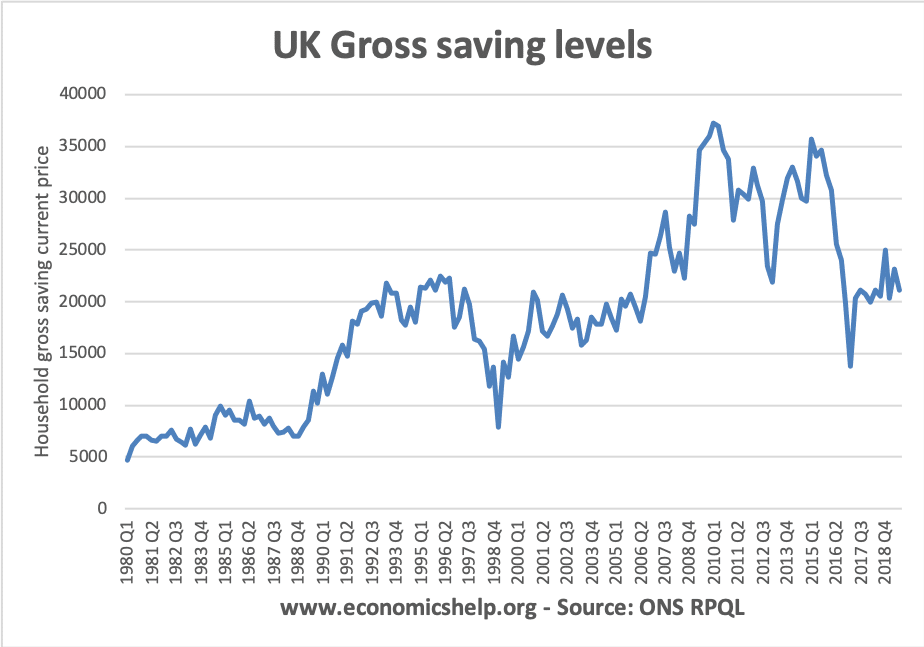

Gross savings

Source: RPQL, ONS

This shows total quarterly gross household + non profit savings.

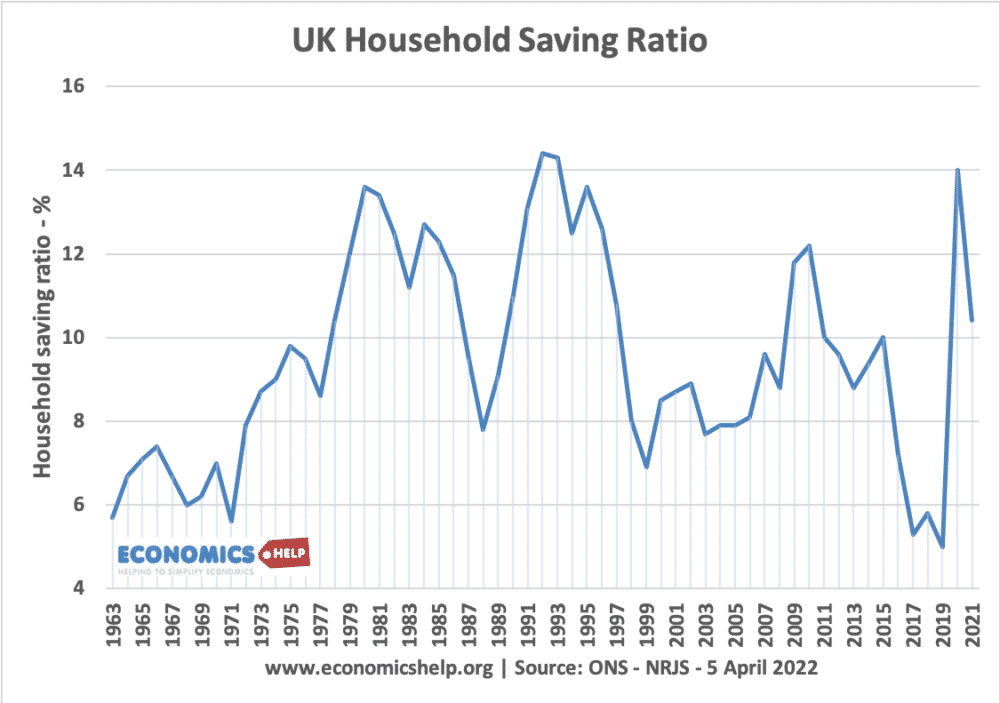

Savings ratio since 1963

In the post-war period, the UK savings ratio was on an upward trend. Between 1964 and the early 1980s, we see a long-term rise. There was a peak in the recession of 1980/81.

However, between 1992 and 2008 (in a period known as the great moderation), the saving ratio fell to an all-time low of 4.6%.

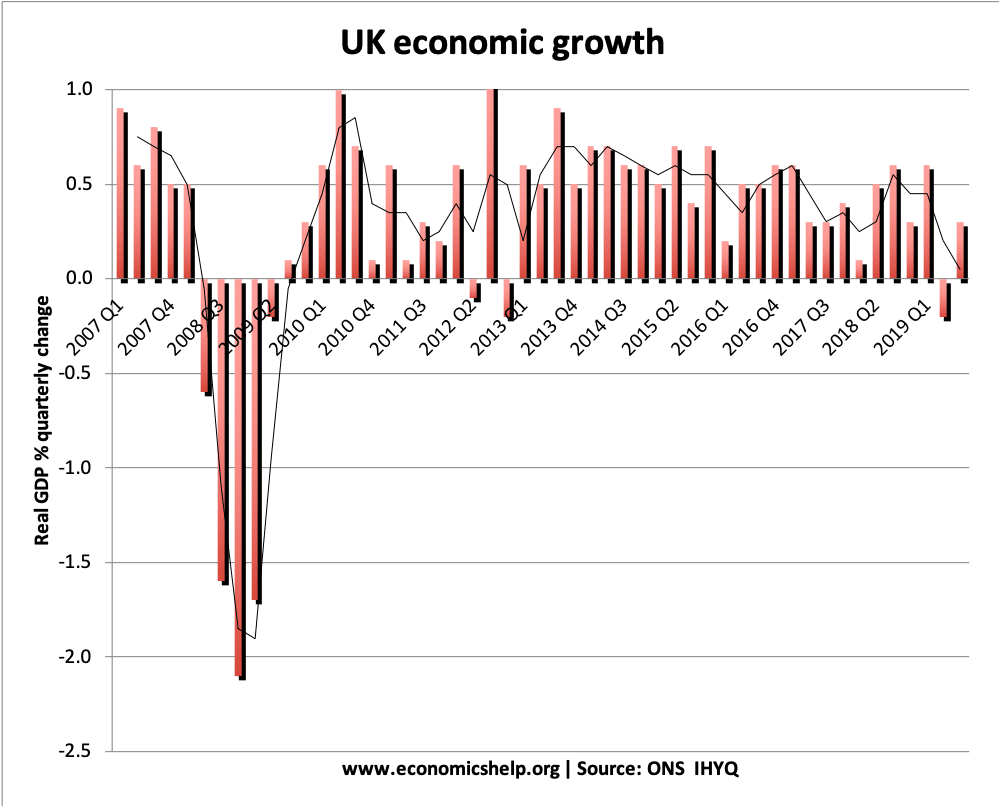

At the start of the credit crunch and recession of 2008-10, the saving ratio rose rapidly as consumers became more risk averse and wanted to pay off debts and increase savings. This rise in the saving ratio contributed to a fall in consumer spending and negative economic growth.

The sharp fall in real GDP in 2008/09 mirrored the sharp rise in the savings ratio.

The concern is that economic growth post-2012 is partly driven by a falling saving ratio, that is unsustainable without a rise in real wages.

Saving ratio in 2008-12 recession

The saving ratio in the 2008-12 recession didn’t rise as much as during the 1990-92 recession. This is because:

- In the 1991-92 recession, interest rates were much higher (reaching a peak of 15%). Since 2009, interest rates have fallen to 0.5%. Therefore, from the perspective of interest rates there is a lower incentive to save in 2012

- The 2008-12 recession has caused a bigger long term squeeze on real incomes (due to higher tax, rising energy prices and falling real wages). Therefore, people have had less room to increase savings and pay off debt. They have been struggling to meet bills and so they don’t have the same luxury of increasing saving.

Reasons for a fall in savings ratio during 1992-2007

- Availability of credit until 2007 encouraged people to take out loans.

- Rising House prices encouraged people to borrow because of their positive wealth effect. Home-owners could re-mortgage

- Cultural/social trends encouraged an attitude of borrowing and spending.

- Low-Interest rates. E.g. in 1991-92 interest rates were over 12%. In the 2000s interest rates fell to 3%. Interest rates are currently 4.5% and less than inflation. This negative real interest rate discourages saving.

Note: There was also a fall in the savings rate in the Lawson boom of the 1980s

Why do saving ratios tend to rise in a recession?

- In a recession, people worry about unemployment and so are likely to be more cautious about borrowing and spending. If you fear unemployment, you don’t want to be saddled with debt repayments on a new car. People tend to delay big purchases during economic uncertainty. Saving ratios rose during a recession such as 1991-92 and 2008-12.

- Banks are trying to improve their balance sheets by attracting more deposits and lending less. It is often hard to get a loan during a recession.

- During 2008-12 real interest rates were often negative which, in theory, reduces the incentive to save. However, low real interest rates can be outweighed by more important factors, such as the fear of being made unemployed. In other words, people are saving more – despite the poor returns from saving.

Saving ratio and the paradox of thrift

The paradox of thrift is the idea that if everyone saves at once, it can cause macro-economic problems (i.e. recession). From an individual perspective, it makes sense to save and pay off debts in a recession. But, if everyone pursues the same course of higher savings, it causes a fall in aggregate demand.

See: Paradox of thrift

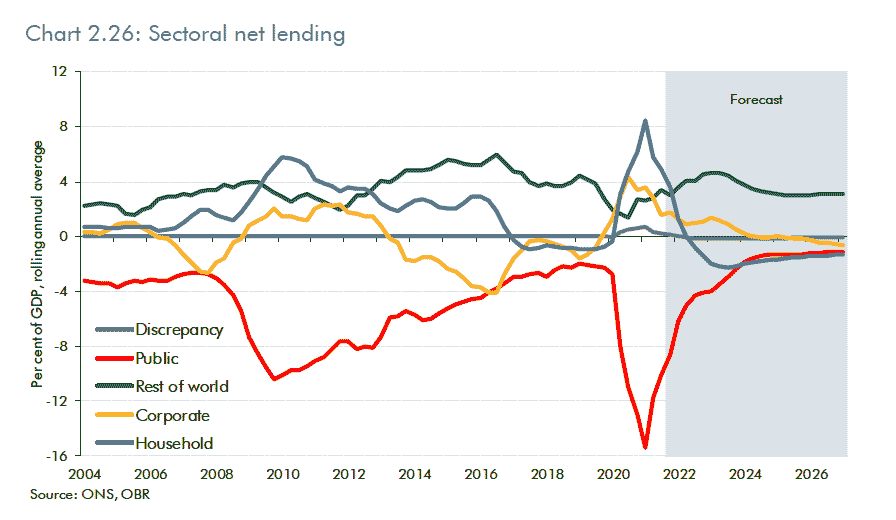

Savings ratio and fiscal policy

In a recession, a sharp rise in the savings ratio means that consumer spending will fall significantly. In Keynesian economics, this is a reason for the government to borrow and increase spending. The logic is

- If the saving ratio rises, government spending needs to take the place of private sector spending and investment. Otherwise, the recession will be deeper.

- If the saving ratio rises, the private sector has more available funds to purchase government bonds.

Benefits of a higher saving ratio

A rapid rise in the savings ratio can cause a fall in aggregate demand and recession. However, in the long term, a higher savings ratio is often considered to help promote more sustainable economic growth.

Higher savings enables more private sector investment. Many see this level of investment as a key factor in determining the long term economic growth rate.

Problems of low savings ratio

A very low savings ratio can indicate:

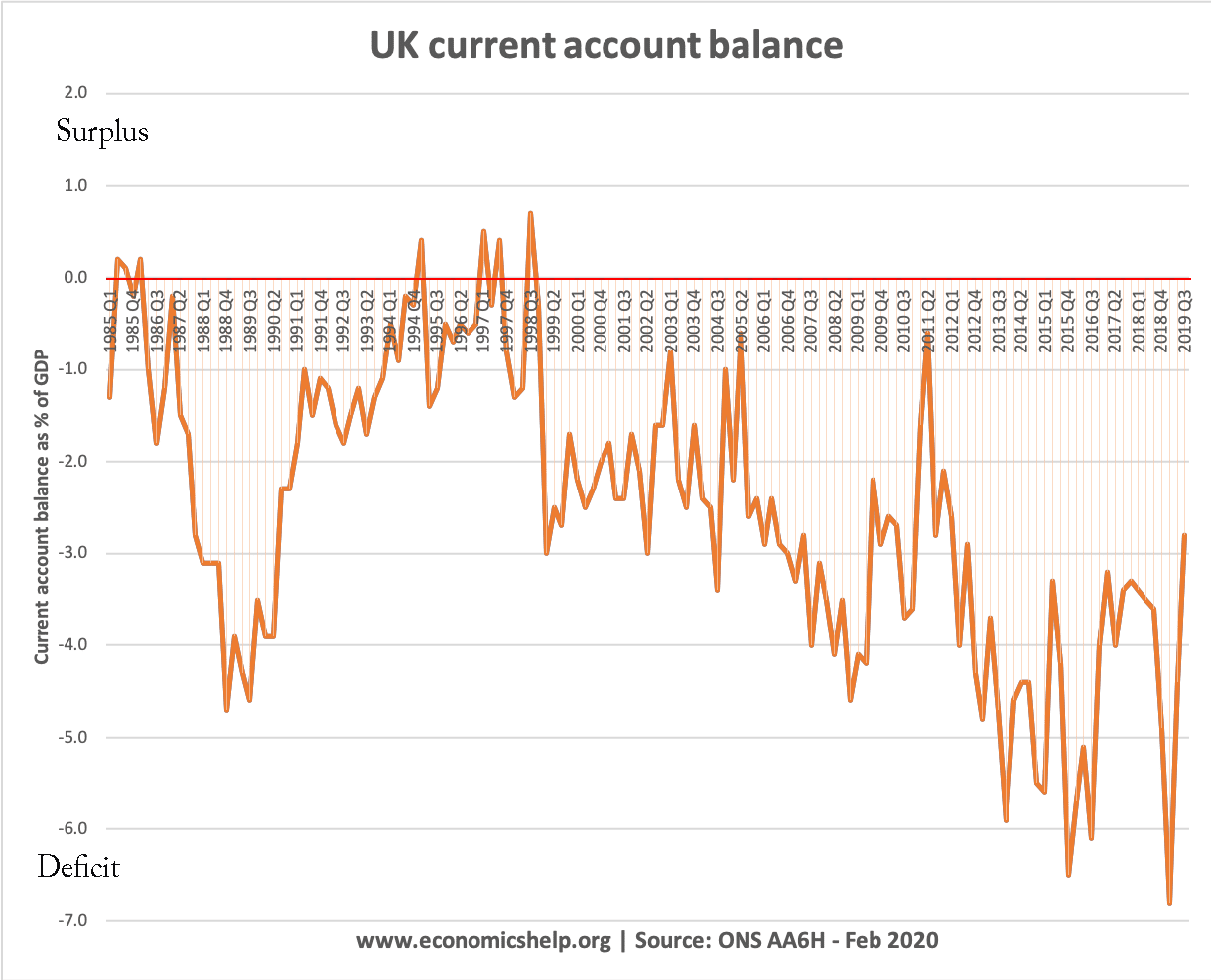

- Unbalanced economy with over-reliance on consumer spending.

- Build up of personal debt.

- Current account deficit, (with imports greater than exports.)

Since 2010, the fall in the savings ratio has occurred during a widening of the current account deficit.

Related pages

- Paying off debt and savings

- Difference between saving and investment

- Paradox of saving – why people save more when they say it is a bad time to save

- Definition of disposable income

Notes:

(1) The ONS define the savings ratio (NRJS) – Households’ saving as a percentage of total available households’ resources.

(2) The saving ratio is subject to be revised at a later date.

Thanks for sharing this article .I get more ideas from this article .

It’s pretty obvious that savings rates are being held artificially low. House prices are far too high relative to income and are being propped up with govt subsidies both in rental and purchase terms.

The “working poor” are fed up paying taxes to subsidise those who know the system and work less than 16 hours to get enough in benefits to afford themselves a better life than those who work over 35 hours.

it is also difficult for those on 16 hrs to transfer from the easy life to working full time – because they will be worse off due of the loss of subsidies.

The gravy train has pulled into the station and the govt is blatantly robbing the old of their hard earned pensions. This is not the solution to encourage people to work hard or save money into a pension – those who don’t will be just as well off as those who do, so why bother?

Socialism has gone too far and is now penalising those who work.

Excellent comment Lynne; I would be hard pushed to put it better myself.

To improve the savings ratio in the UK the ever growing attitude of “Live for today, for tomorrow we may die” & “You are worth it”, has to be turned around. The PR / marketing / advertising machines, need to be countered by sound & simple economic education (without the heavy Keynesian bias), utilising T V documentaries, advertising, internet. If we don’t do something as a nation, the UK will continue to head into a bottomless economic pit, lacking investment, over-consumption, short-term thinking. The consequence could cause the UK to fall out of first-world category, relative to other nations that have better policies & better aggregate attitudes.

Lynne but this is how the economist thinks the UK is best to work. The best way to increase the value in the economy is to take from those that have saved and this is achieved by reducing interest rates. This encourages people to buy houses and the value of those houses subsequently goes up. you then encourage to take more loans until one day, the mechanism will stop working as it will go out of control or just be stagnant.

If they increase interest rates, people will buy more houses and the values of those houses will need to go up even more as you pay more interest and that way, economy has a stronger balance sheet and even more overseas investors come.

Thanks for sharing this helpful information. Another one of the best site is missing. Last week I used saveji.com coupon site. Saveji offering trending coupons and offers for all categories of products. Its really helpful and trustable site for saving money.