Readers question: Why cannot politics and economics be seen in isolation?

Economics is concerned with studying and influencing the economy. Politics is the theory and practice of influencing people through the exercise of power, e.g. governments, elections and political parties.

In theory, economics could be non-political. An ideal economist should ignore any political bias or prejudice to give neutral, unbiased information and recommendations on how to improve the economic performance of a country. Elected politicians could then weigh up this economic information and decide.

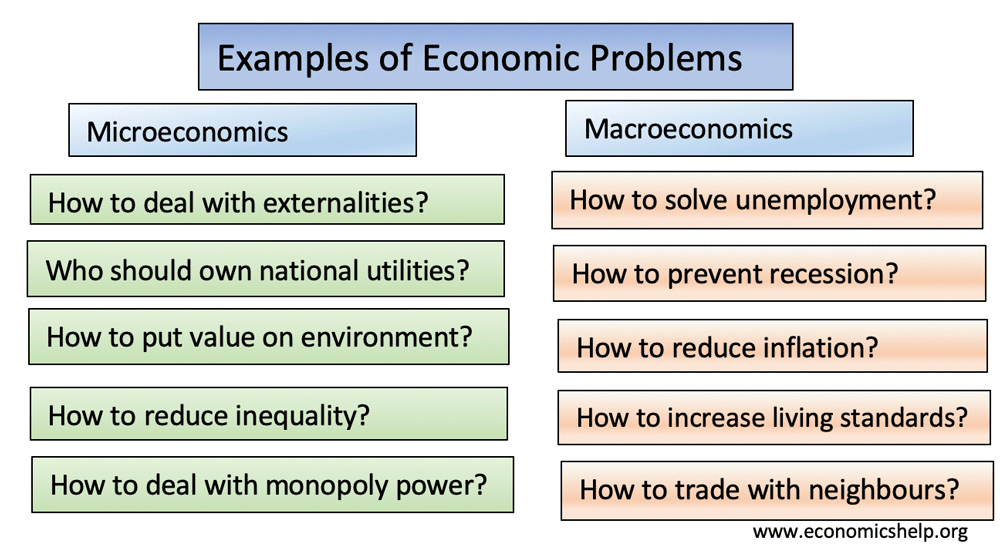

In practice there is a strong relationship between economics and politics because the performance of the economy is one of the key political battlegrounds. Many economic issues are inherently political because they lend themselves to different opinions.

Political ideology influencing economic thought

Many economic issues are seen through the eyes of political beliefs. For example, some people are instinctively more suspicious of government intervention. Therefore, they prefer economic policies which seek to reduce government interference in the economy. For example, supply side economics, which concentrates on deregulation, privatisation and tax cuts.

On the other hand, economists may have a preference for promoting greater equality in society and be more willing to encourage government intervention to pursue that end.

If you set different economists to report on the desirability of income tax cuts for the rich, their policy proposals are likely to reflect their political preferences. You can always find some evidence to support the benefits of tax cuts, you can always find some evidence to support the benefits of higher tax.

Some economists may be scrupulously neutral and not have any political leanings (though I haven’t met too many). They may produce a paper that perhaps challenges their previous views. Despite their preferences, they may find there is no case for rail privatisation, or perhaps they find tax cuts do actually increase economic welfare.

However, for a politician, they can use those economists and economic research which backs their political view. Mrs Thatcher and Ronald Reagan were great champions of supply side economists like Milton Friedman, Keith Joseph, and Friedrich Hayek. When Reagan was attempting to ‘roll back the frontiers of the state’ – there was no shortage of economists who were able to provide a theoretical justification for the political experiment. There were just as many economists suggesting this was not a good idea, but economists can be promoted by their political sponsors. In the US, the Paul Ryan budget proposals were welcomed by many Republicans because they promised tax cuts for better off, cutting welfare benefits and balancing the budget. (1) A popular selection of policies for Republicans.

Economic thought independent of politics

On the other hand, economists who stick to data and avoid cherry picking favourable statistics may well come up with conclusions and recommendations that don’t necessarily fit it with pre-conceived political issues.

Many economists may be generally supportive of the EU and European co-operation, but the evidence from the Euro single currency is that it caused many economic problems of low growth, deflation and trade imbalances.