Readers Question: Does inflation causes unemployment?

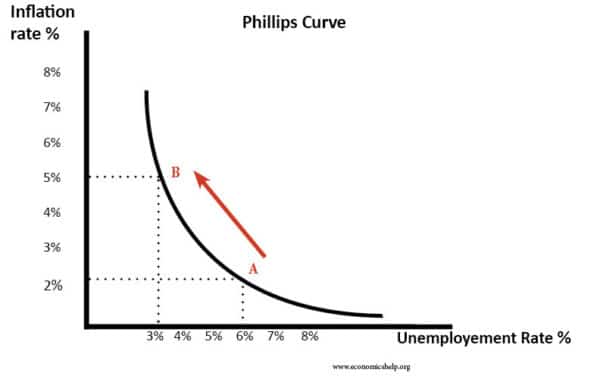

There are a few different scenarios where inflation can cause unemployment. However, there is not a direct link. Often we will notice a trade-off between inflation and unemployment – e.g. in a period of strong economic growth and falling unemployment; we see a rise in inflation – see Phillips Curve.

Also, it is important to bear in mind, (especially in the current climate) If the economy has deflation or very low inflation and the monetary authorities target a modest rate of inflation, then this may help boost growth and reduce unemployment.

Inflation can cause unemployment when:

- The uncertainty of inflation leads to lower investment and lower economic growth in the long term.

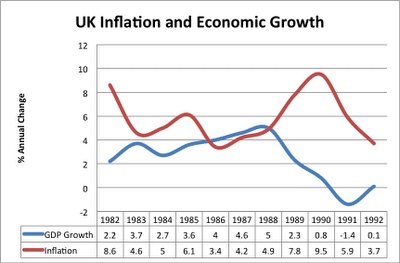

- Inflationary growth is unsustainable leading to a boom and bust economic cycle.

- Inflation leads to a decline in competitiveness and lower export demand, causing unemployment in the export sector (especially in a fixed exchange rate).

Inflation creates uncertainty and lower investment

One argument is that a period of high and volatile inflation discourages firms from investing. Because inflation is high, firms are less certain investment will be profitable. It is argued that countries with higher inflation rates tend to have lower investment and therefore lower economic growth. Therefore, if there are poor levels of investment, this could lead to higher unemployment in the long term.

It is argued that countries with low inflation rates, such as Germany have enabled a long period of economic stability which helps to attain a long-term low unemployment rate. Low inflation in a country like Germany also helps them to become more competitive within the Eurozone, which also helps create employment and reduce unemployment.

See also: costs of inflation