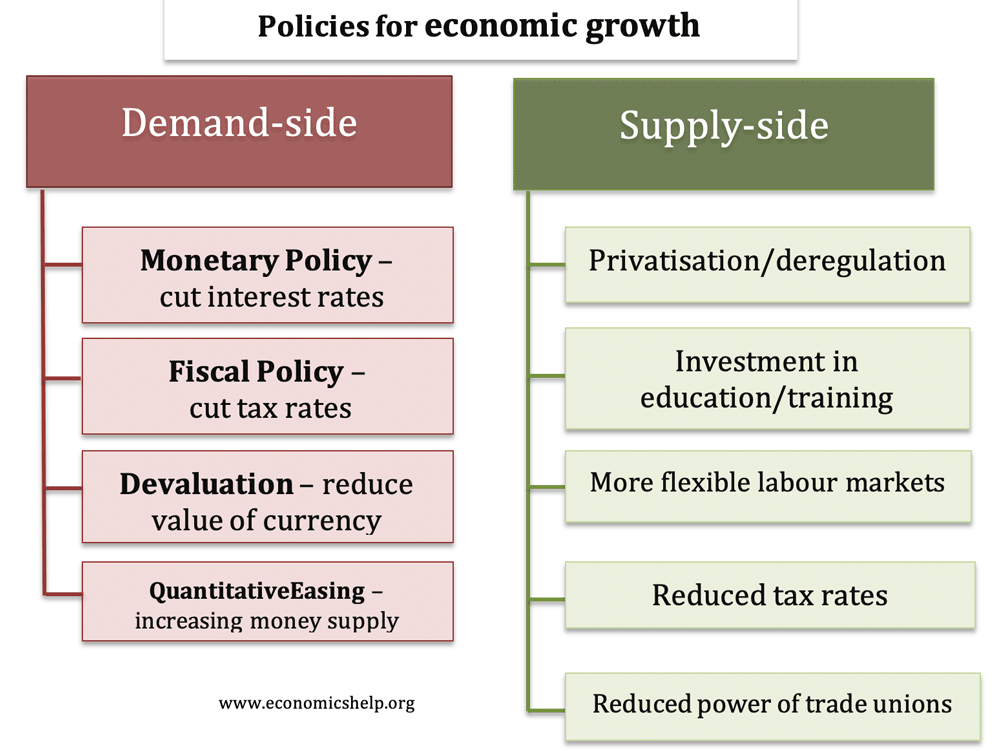

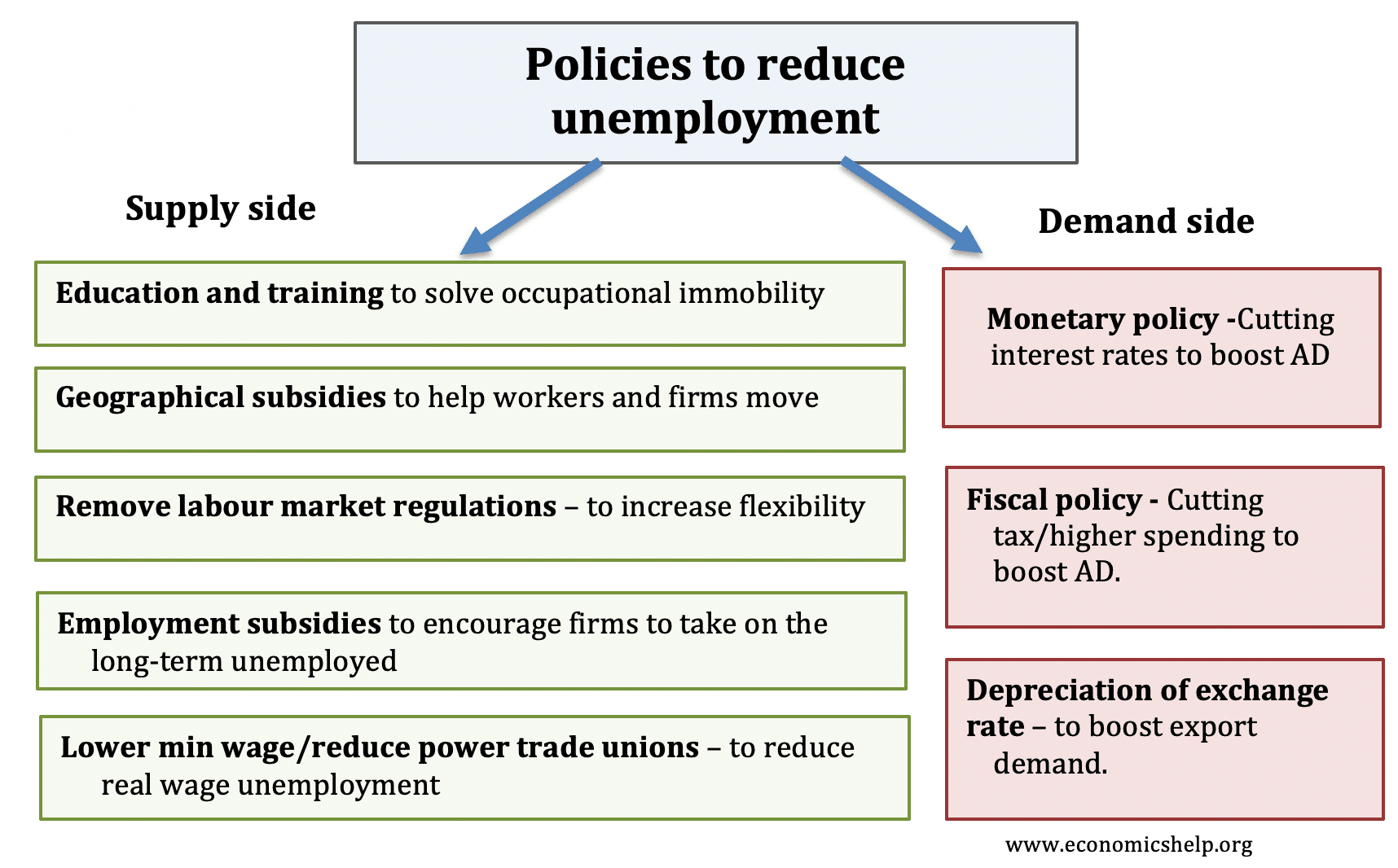

There are two main strategies for reducing unemployment –

- Demand side policies to reduce demand-deficient unemployment (unemployment caused by recession)

- Supply side policies to reduce structural unemployment / (the natural rate of unemployment)

A quick list of policies to reduce unemployment

- Monetary policy – cutting interest rates to boost aggregate demand (AD)

- Fiscal policy – cutting taxes to boost AD.

- Education and training to help reduce structural unemployment.

- Geographical subsidies to encourage firms to invest in depressed areas.

- Lower minimum wage to reduce real wage unemployment.

- More flexible labour markets, to make it easier to hire and fire workers.

Video summary

Demand side policies

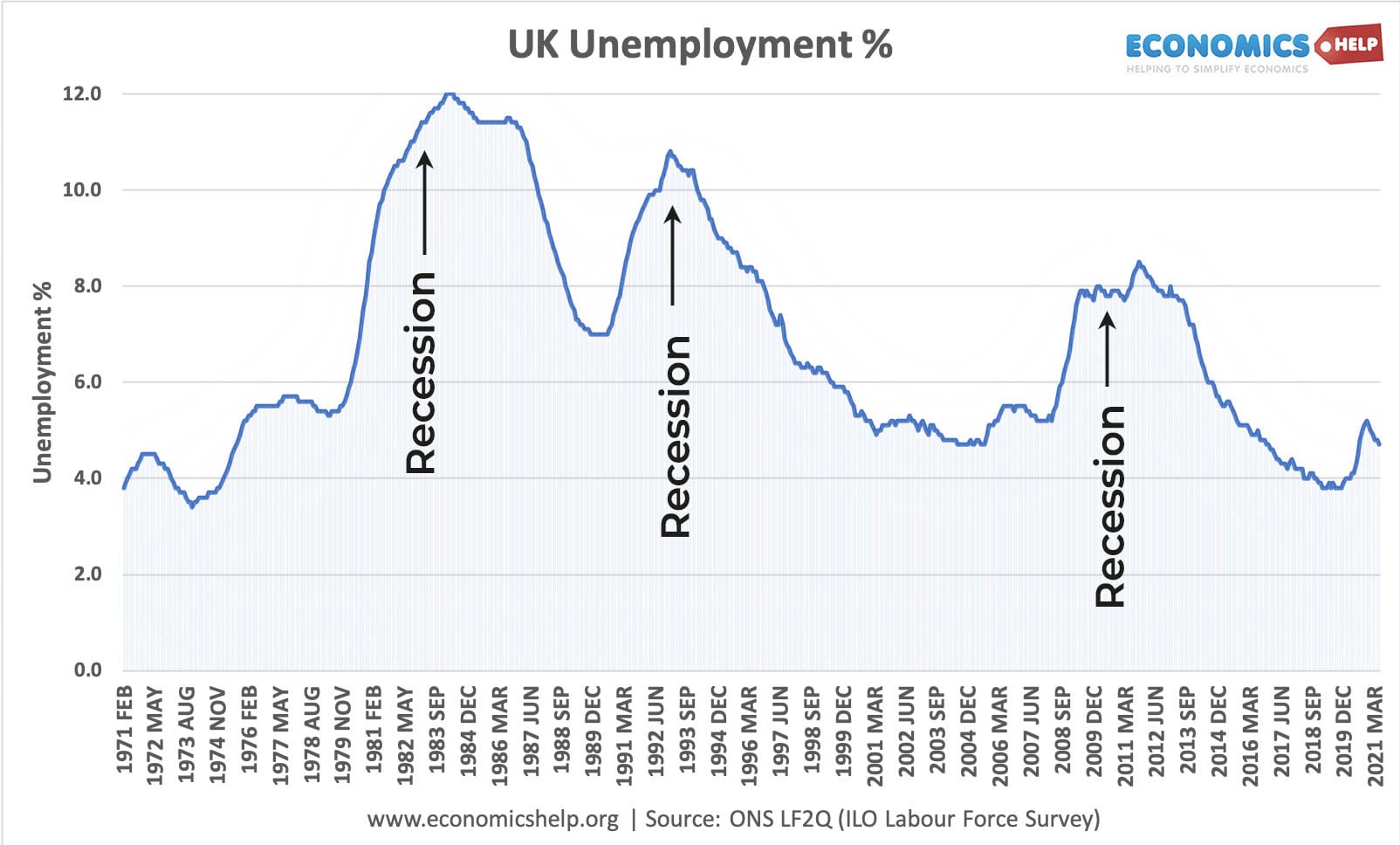

Demand side policies are critical when there is a recession and rise in cyclical unemployment. (e.g. after 1991/92 recession and after 2008 recession)

1. Fiscal Policy

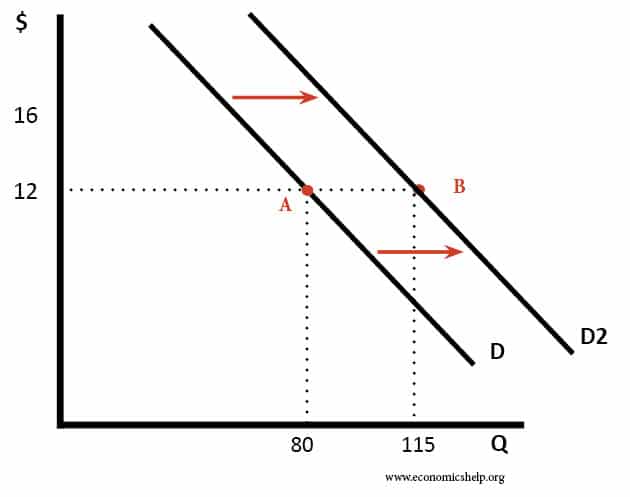

Fiscal policy can decrease unemployment by helping to increase aggregate demand and the rate of economic growth. The government will need to pursue expansionary fiscal policy; this involves cutting taxes and increasing government spending. Lower taxes increase disposable income (e.g. VAT cut to 15% in 2008) and therefore help to increase consumption, leading to higher aggregate demand (AD).

With an increase in AD, there will be an increase in Real GDP (as long as there is spare capacity in the economy.) If firms produce more, there will be an increase in demand for workers and therefore lower demand-deficient unemployment. Also, with higher aggregate demand and strong economic growth, fewer firms will go bankrupt meaning fewer job losses.

Keynes was an active advocate of expansionary fiscal policy during a prolonged recession. He argues that in a recession, resources (both capital and labour) are idle. Therefore the government should intervene and create additional demand to reduce unemployment.