Readers Question I’ve recently been looking up on the Eurozone financial crisis for random reasons and i don’t understand the statement in an FT article about what we must acknowledge in order to overcome the Eurozone problems. The statement goes ‘no country can be expected to generate huge primary surpluses for long periods for the benefit of foreign creditors’. Please can you help?!

Firstly, it is not an easy article – there is a lot of jargon! To quote:

“A fundamental shift of tack is required, towards an approach focused on avoiding systemic risk, restarting growth and restoring arithmetic credibility rather than simply staving off disaster”

To answer your question:

A primary budget surplus is the government budget balance excluding the cost of interest payments on government debt.

- Suppose the UK budget deficit is 11% of GDP.

- But, interest payments on the government debt cost around £40bn or 3% of GDP.

- Therefore, the primary budget deficit of the UK is 8%.

- Suppose Italy’s budget deficit is 2% of GDP, but interest payments are 7% of GDP. In this case Italy actually has a large primary surplus of 5% (even though an actual budget deficit of 2% of GDP)

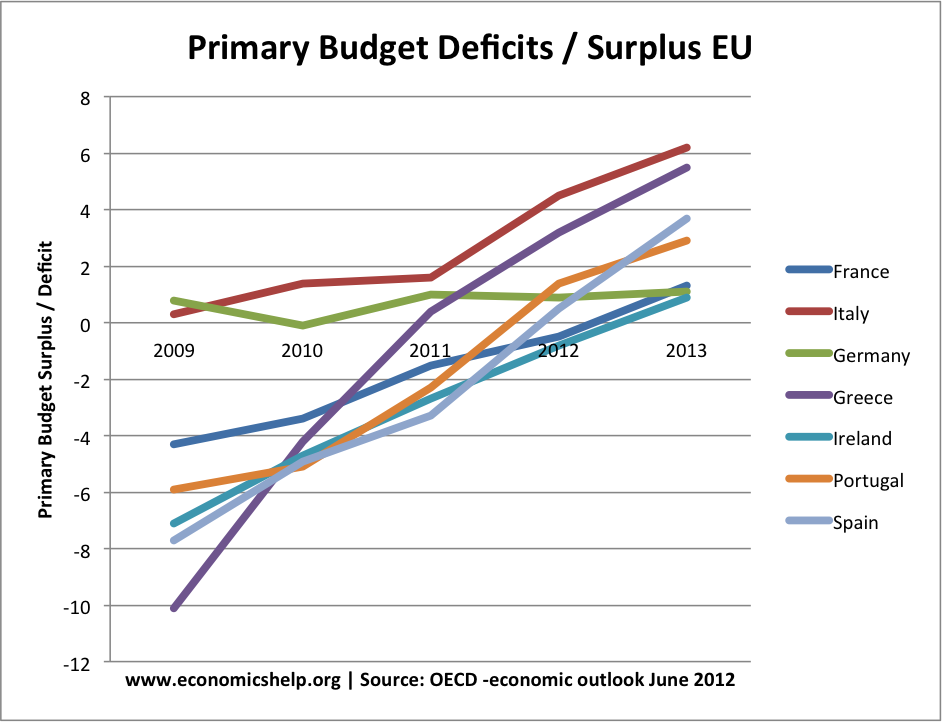

This graph showing changes in primary balances shows how countries in the Eurozone have pursued fiscal tightening (spending cuts and tax increases) to reduce their budget deficits. Excluding interest payments, many now have a primary budget surplus.