Readers Question: Do you think the help to buy scheme is fuelling a housing bubble? Only about 3% of houses are bought through this method but do you think that it is likely that a bubble will develop?

In a way, I think you answer the question yourself in stating that only 3% of houses are bought through this method

With such a small percentage of homes bought through this scheme, it is not going to be a major cause of a housing bubble; however, in a relatively significant way, it will add to housing demand. Given the inelastic nature of housing supply, it will make a contribution to pushing up house prices.

Without the help to buy scheme would people have bought houses anyway? I’m not sure. I think the scheme will definitely help some to get a mortgage, and therefore buy rather than renting. In that regard it is adding to housing demand, and therefore pushing up prices, but only a small amount.

Will a housing bubble develop?

This is a more difficult question. There are different types of housing bubbles.

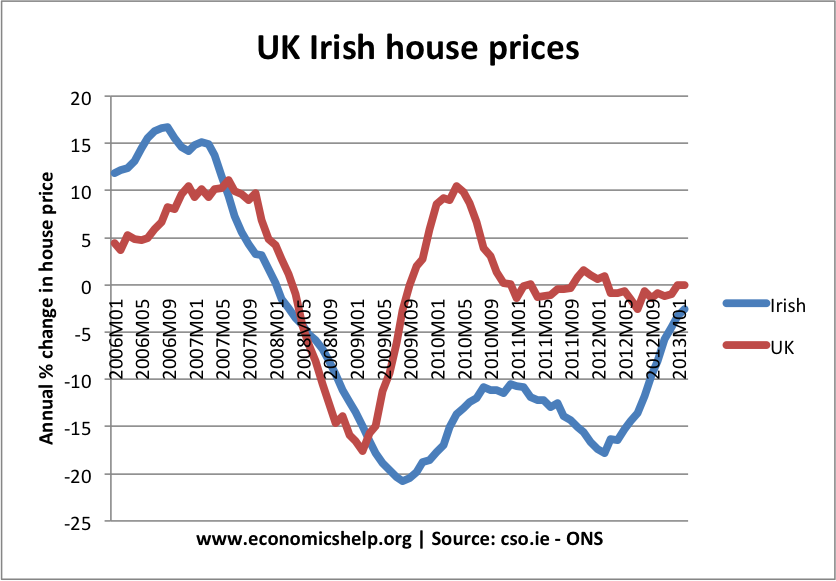

One is the housing bubble experienced by US, Ireland and Spain – where property prices rose substantially above average earnings, and then fell by up to 50%. This is because house prices in these countries became divorced from the fundamentals of housing supply and demand. When the mortgage market experienced difficulties, demand fell and prices fell significantly. The crucial thing about US, Ireland and Spain was that after the housing bubble and bust, there was a large excess supply of housing. Therefore, when demand fell, prices fell considerably.

See: Ireland Housing bubble and bust

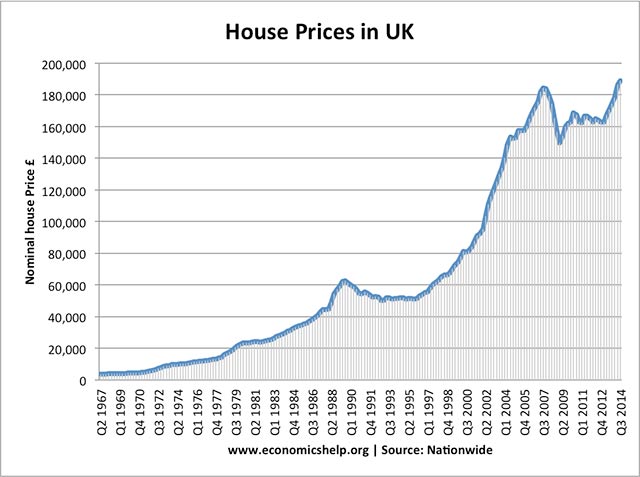

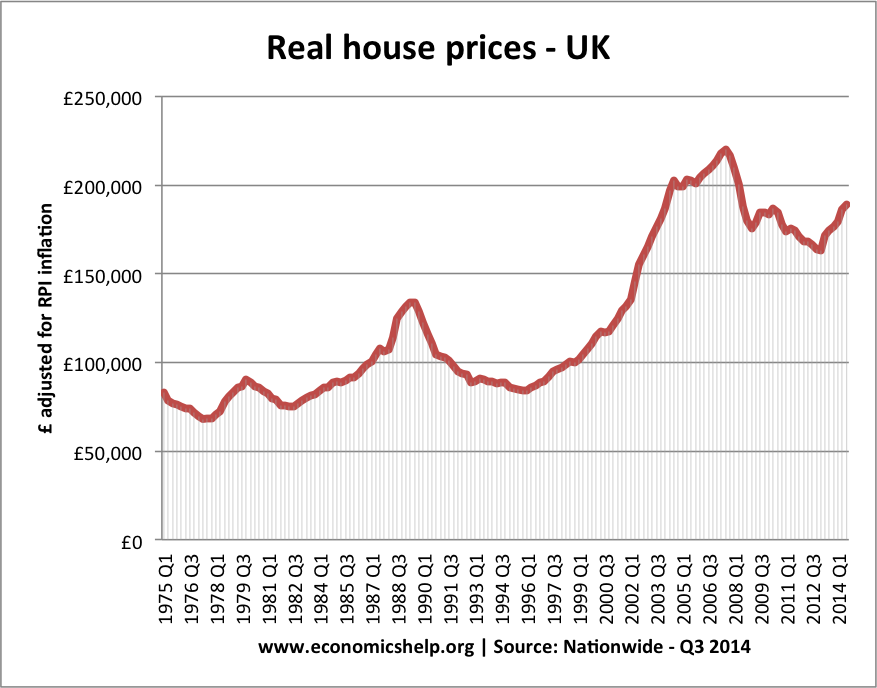

The UK housing market behaved differently. When demand fell in 2007/08 because of the credit crunch, prices did drop by 20%. But, house prices stabilised much quicker, and then – defying many predictions – began to rise quite rapidly. Meaning that in the UK, house prices in many areas are higher than before the crash.

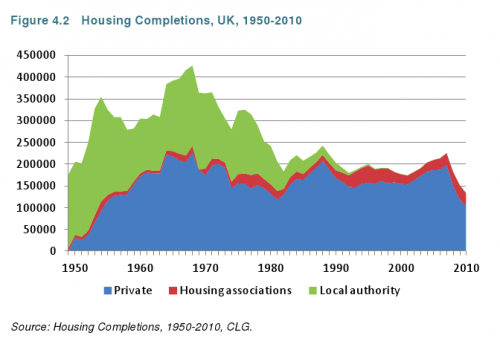

The main difference is that in the UK, there was no excess supply of housing; there was no boom in home building. Therefore, when the crash came, there was still this fundamental shortage of housing, which keeps prices ‘artificially’ high.

Why UK property prices may be overpriced

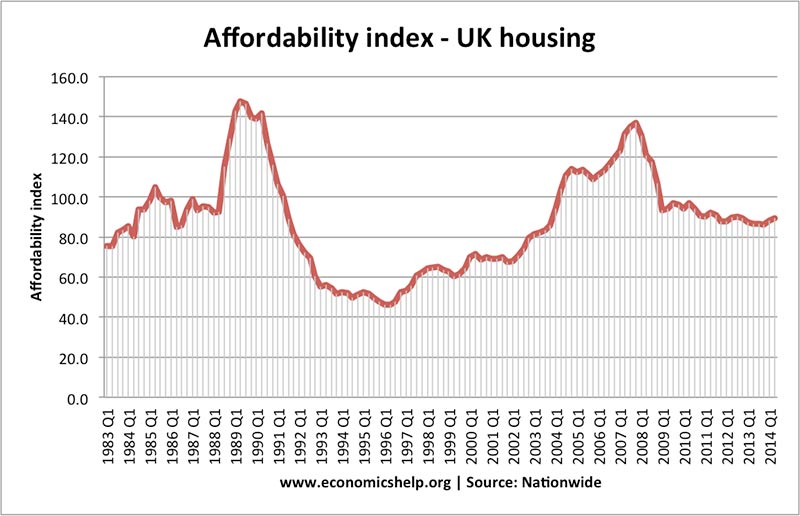

- Interest rates set to rise. UK interest rates have stayed at zero since early 2009; this period of ultra low interest rates has benefited the property market and kept mortgages affordable. If interest rates rise back to ‘normal’ rates (e.g. around 5% – many homeowners will see a sharp rise in the cost of mortgages, causing demand to fall. The Bank of England recently did a survey and found a two-percentage-point rise in mortgage interest rates would likely raise the proportion of mortgagors with a debt service ratio (DSR) of at least 40% from its current level of 4% to about 6% (360,000 to 480,000 households)

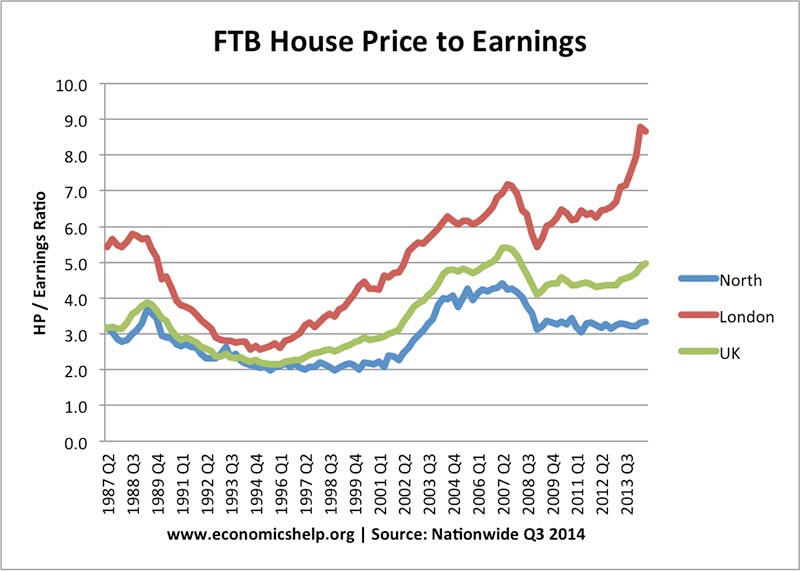

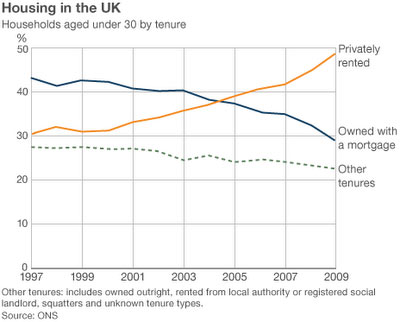

- House price to income ratios. House prices have risen much faster than incomes, meaning the younger generation are not able to get a mortgage. The average age of mortgage holders has increased, and the deposit required has also gone up. Because house prices are so expensive, there are many who cannot consider buying.

House price to earning ratios for first time buyers. The ratio is 5.0 significantly higher than previous decades.

- Buy to let market. With home ownership rates falling, the growth in demand for housing is coming from investors.

These investors are more likely to be sensitive to changing house prices. If there is a sustained drop in prices, this may be magnified by investors leaving the UK housing market.

- Economic growth is still fragile. Although the UK recovery is reasonably strong, the Eurozone looks weak with anaemic growth and the threat of deflation; there is a strong possibility that a weak EU economy could act as a drag on UK growth.

Real house prices in the UK

Why the housing bubble may never end?

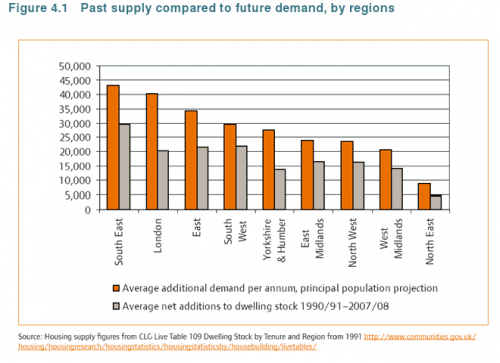

The UK housing market will always have potential for temporary falls in prices – especially, if we get a bad combination of falling economic growth, rising interest rates and the sustained lack of affordability. However, all projections suggest that the UK is likely to continue to fail to build enough homes to meet rising demand. As a rough rule of thumb, the UK needs to build on average 250,000 homes a year to keep pace with rising population and increased numbers of households.

Yet, in the past few years, average home builds have averaged 100,000 – 150,000. It is politically difficult to build 10,000 new homes – let alone 250,000. UK Governments (of all political shades) always promise to build more houses, but the reality of building houses is always significantly different to making promises.

Demand growing faster than supply in all regions

Is there bubble behaviour? Is there irrational exuberance?

One feature of a housing bubble is irrational exuberance. People buying on the expectation of permanently rising house prices. There are definitely investors buying UK property in the hope of making capital gains. But, I don’t think it is divorced from reality. If nothing else, housing will provide a steady income stream from very high rents. Given the very high rents in London, it makes sense to try and get on the property ladder if you can.

Conclusion

Given demographic changes, I think demand is likely to outstrip supply – even though house prices to earnings are very high. The long-term consequence is that UK house prices are likely to be very expensive for a considerable time. Within this long-term period of high prices, there will be periods of volatility. But, I can’t see any housing crash like Ireland, US or Spain. House prices will continue to be high.

Related

It may be more accurate to say that London (rather than the entire U.K.) has a housing bubble. Or rather, a bipolar housing bubble.

Ref URL: http://tinyurl.com/nb58cqh