Readers Question. Can Labour be blamed for the economic crisis (i.e. did they really ‘overspend’)? My view is that the global economic crisis is to blame, and that Labour could have spent less but that this is easy to say with the benefit of hindsight.

I don’t think there is any economist who would try to blame the global financial crisis and global recession on the fact the Labour government increased spending on the NHS / education by a relatively moderate amount.

The global recession of 2008-13 was caused by the great financial crisis/credit crunch. The cause of this lay in several factors but was primarily due to:

- Excess mortgage lending, especially in the US.

- Housing markets experiencing a boom in prices that was unsustainable

- Banks around the world taking an excess risk with the purchase of risky sub-prime mortgage debt, rebundled debt – leading ultimately to the credit crisis.

- Deregulation of the financial sector in the 1980s and 1990s which made it easier for banks to increase lending, and reduce reserve ratios.

This is only a very brief summary because I have written on this in more detail previously. But, it was essentially a failure of the financial sector.

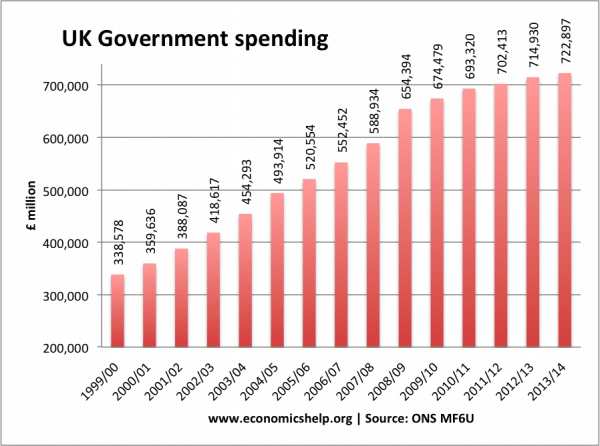

It is true real government spending under Labour increased significantly. (see more detail at Government spending under Labour)

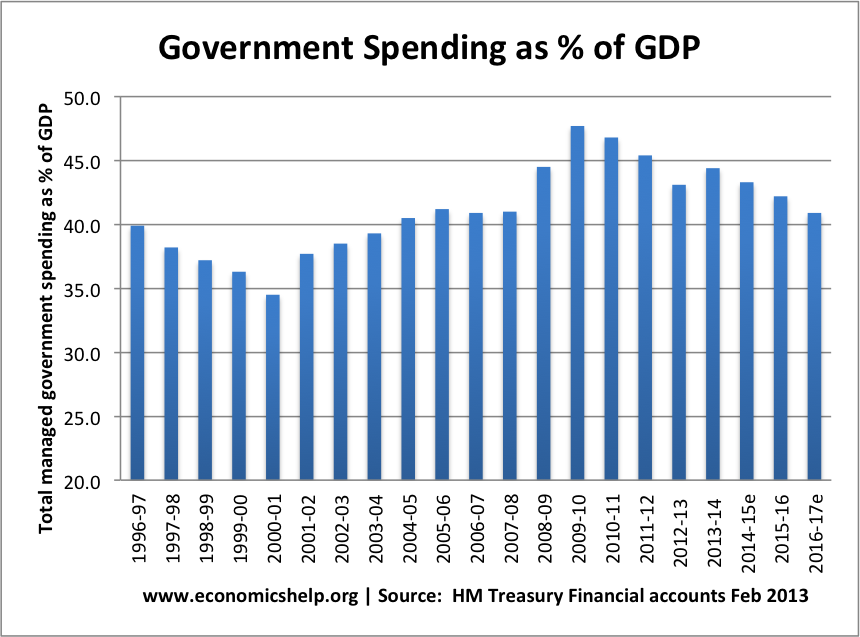

But, as a percentage of GDP, the rise is far less significant – at least until the recession (2008-09) when GDP fell 6%. (causing spending/GDP to rise)

Was it a mistake to run a budget deficit during the boom years of 2000-07

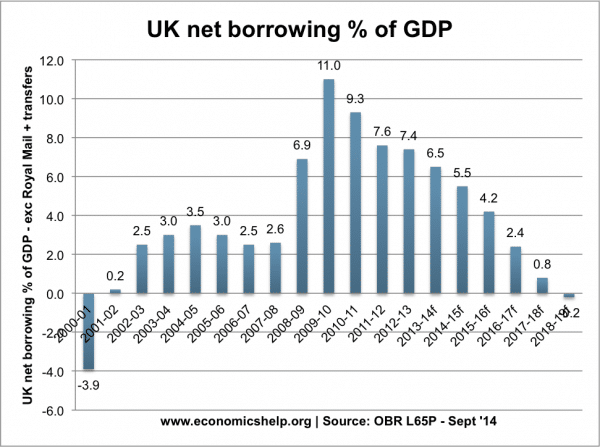

I would say it was a small mistake to run a budget deficit of 3% of GDP during the boom years. From a Keynesian perspective, it would have been more desirable to have run close to a balanced budget.

However, it is also worth mentioning

- I don’t think a balanced budget would have done anything to prevent a recession. The recession would still have occurred with the same impact, even with a balanced budget. This is because the global recession had nothing to do with UK government spending/government borrowing.

- I don’t believe governments have to run a budget surplus during boom years. Borrowing to fund investment in improving long-term infrastructure can reap long-term benefits. (I will write more on this in the future)

Tax receipts based on boom economics. One criticism about the UK finances (like many other countries) in the 2000s was that UK tax revenues were quite reliant on a booming financial and housing sector. When the financial market fell, tax receipts were very hit hard (and have struggled to recover). In other words, the UK fiscal position was not as good as it looked.

Borrowing and room for manoeuvre

One argument is that if the UK had run a balanced budget in the 2000s, public sector debt would have been lower and the UK would have had more room for manoeuvre in pursuing expansionary fiscal policy when the recession hit and we needed expansionary fiscal policy.

There is some credence to this, with a balanced budget and lower public sector debt to start with, governments may have felt greater confidence to borrow even more in the recession – when the UK economy needed expansionary fiscal policy.

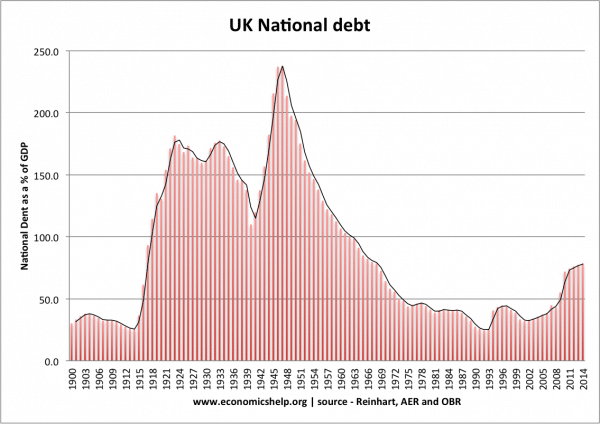

However, it is also worth being sceptical. Public finances in the UK were very good in 2007; by comparison with the past 100 years, we were near a record low.

The UK did have room for expansionary fiscal policy in 2008, bond yields were falling – there was never any fiscal crisis in the UK.

The lurch to austerity post-2010 was unnecessary driven more by Micawber economics and the strong political appeal of austerity. My feeling is that even if the UK had run a balanced budget in 2000-07, there would still be the same strong calls for austerity. People who think £180bn is ‘too much borrowing’ – would probably think – £80bn borrowing is too much as well.

The real economic mistakes of pre-crisis period

The real mistakes of the pre-global recession period were not government spending or government borrowing (which were both pretty good by post-war standards). The missed opportunities were:

- Failure to regulate the financial system. The 1980s saw a period of financial deregulation, building societies became profit oriented banks willing to take extravagant risks (e.g. Northern Rock, Bradford & Bingley) In the US mortgage companies behaved with complete irresponsibility. The lax controls on mortgages and bank ratios was a great mistake.

- Failure to build up a bank bailout fund. In the boom years, it would have been a good policy to make banks pay into a fund for their potential future bailout should the market turn. This would have curtailed some of the bank’s risky expansion and meant that there was a government fund to use to bail out banks – rather than just relying on general taxpayers money.

- Housing market. The boom and bust in the US and European housing markets was a significant issue.

- The Euro. The Euro is a deeply flawed economic policy, which has a very strong deflationary bias. The pre-crisis period saw massive imbalances in the Eurozone area with countries in the south running current account deficits running into 10-12% of GDP. Without currency fluctuations, without a lender of last resort – in retrospect, this was a disaster waiting to happen.

- Greek debt. The one country with a real debt problem was actually Greece. Other European countries, such as Ireland, Spain and Portugal had very low levels of government borrowing at the start of the crisis but were forced into a debt crisis through the mechanism of the Euro.

Was anyone calling for regulation of banks / mortgages / housing market?

To be fair to Labour, they were not alone in ignoring the shadowy world of financial markets – just about everyone, including the majority of economists, didn’t realise what a hidden problem the financial markets were.

For example, I don’t think even the most ardent Conservative supporter would claim that the Conservatives would have taken on the banks and prevented the financial crisis.

Conclusion

On a personal note, I’ve found it quite difficult how it has become accepted the conventional wisdom that somehow Labour economic mismanagement was responsible for the great recession. It is a bit worrying how the banks have got off very lightly with the blame rather disingenuously put onto this vague idea of Labour economic mismanagement.

Related

Interesting.I found the texts useful.

Do feel Labour should have coped through the crisis better?

no and they made it worse by borrowing even more, also no one told them to repay the banks however they still did

I admit I did not read the full artical it seemed a little simplistic and bias.. I understood Labour in part deregulated the banks, so they could lend more easy and also used things like banking reserves (gold) to fund their spending, using the overdraft so to speak? If this is not true I would love to know.

In recent times when the Tories had dips in the stock market (Brexit) the reserves reassured investors they had substantial funds to inject if needed, so the Tories Austerity , has to some extent corrected some of the mess Labour made?

You do realise that it was the tories that deregulated the banks?

The problem with new Labour in the 90s and early 00s was that they were taking advantage of the boom year, with little regard for potential bust years (which eventually came due to unregulated banks). The problem is that during the deregulation, banks gained power and couldn’t be controlled until the crisis.

The issue is that because they were centralist, new labour missed the opportunity to do the socialist thing and re-regulate the banks when they bailed them out. If they had taken more control, they may not have lost so much support as they would have been seen to be for the people, protecting them against the crooks that took over the banking system. Instead they allowed them to continue, without much state intervention other than buying shares.

Maybe you should read the article, if it’s soooo simple, it wouldn’t be that difficult to read? Also, how is it bias, it’s answering the question posed. Not saying whether it was one party or the others fault? Seriously, this comment might be too lengthy for your low attention span to read…

So hang on let’s repeat that: You didn’t read the article, but you think it’s biased. And you spent I assume at least 5 minutes drafting a comment guessing (incorrectly) what the article might have been about, so you did have time.

That doesn’t make a lot of sense to me and I doubt it will to anyone else reading your comment. Read the article.

It was Thatchers government that deregulated the banks in 1984. As far as selling gold went…

https://www.ft.com/content/5788dbac-7680-11e0-b05b-00144feabdc0

The amount of unsecured lending by the banks was the prime cause of the financial crash, mainly on mortgages and mainly in the US, but credit in general was far too easily obtained. That this was happening should have been apparent to anyone at the time. Whatever the shortcomings of the Labour government, to blame them for what was happening elsewhere in the world is ridiculous. In addition, it was never a socialist government, with many of the policies of the previous Tory administration left in place. I do not consider that Tony Blair ever comfortably fitted the image of a Labour politician. His whole background and upbringing was clearly rooted in a Tory outlook.

Similarly with the pension crisis; Labour took the blame for that when Gordon Brown tried to rectify the problem that arose due to Nigel Lawson allowing firms to take the surpluses in their employee pension schemes during the good times when market returns were abundant. Brown told firms to make up the deficits in their pension schemes following the bursting of the dot-com bubble and they responded by using it as an excuse to close down their defined benefit final salary schemes and replace them with money purchase schemes. He was blamed for something that Lawson was responsible for. Were it not for Lawson’s folly, the pension schemes would have had their large surpluses as a buffer for when market returns declined.

Labour under Miliband simply allowed the conservatives to blame them for that as well as the financial crisis. As the article indicates, the crash occurred because of the deregulation of the financial system under the conservatives in the 1980s and ’90s which set up the conditions that facilitated it. It was aided by the irresponsible repeal of Glass-Steagall in America, an Act specifically introduced in the early 1930s to prevent casino banking following the Great Depression.

Sadly, Labour under the leadership of Miliband ( who was just a wee boy in the mid 1980s but should have checked the history) sat back and accepted the Tory mantra that “it was all the fault of the previous government” instead of throwing the blame back at them. As a result of that “leadership” Labour has been in freefall ever since. Like Richard Leonard in Scotland (where under his leadership they are now down to one MP), and Kezia Dugdale and Joanne Lamont before him, Miliband (and Corbyn) couldn’t lead lemmings over a cliff! Sadly for Scotland, that has allowed the incredibly incompetent SNP to replace them and put the Union at risk. One can only wonder what would have happened to Scotland if it had been independent when the financial crash occurred. It would probably have been bankrupted. It is ironic that Nicola Sturgeon blames all Scotland’s social and economic problems on Westminster austerity, when it was the bail-out of the banks, particularly RBS and HBOS, that precipitated that austerity!