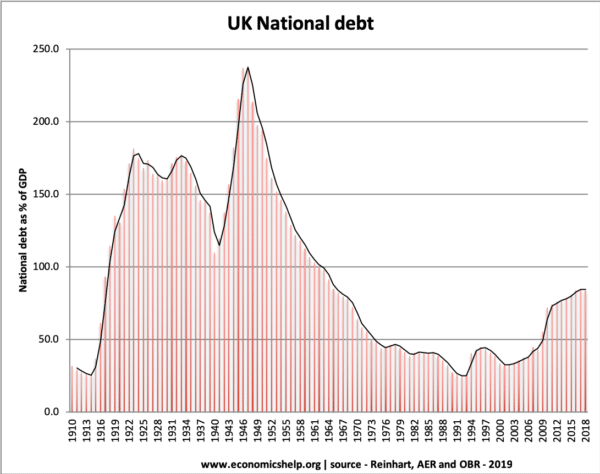

Readers Question If one looked at the UK’s Historical Debt to GDP ratio; at the time austerity was introduced; the Debt to GDP ratio was last at this 2010 level in 1966. Having lived in 1966 there was no massive economc requirement to reduce public spending at that time ie everything was fine. So was this “need” to take drastic action just all rubbish?

Yes. The ratio of debt to GDP in 2010 was similar to 1966. To a large extent, there was no need to panic about debt to GDP as we did in 2010.

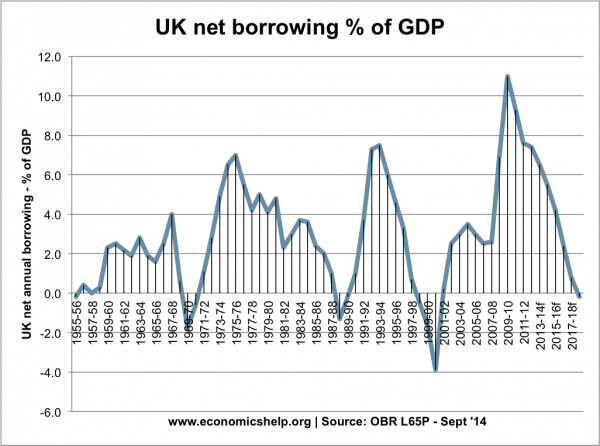

However, there is a difference between 1966 and 2010. In 2010 debt to GDP was rising sharply and the annual budget deficit was very high by post-war standards.

In 2010/11, the governments annual borrowing requirement shot up sharply. It was at a record for peacetime borrowing. This was a difference with 1966. In 1966, debt to GDP was on a downward trajectory because of strong economic growth in the post-war period.

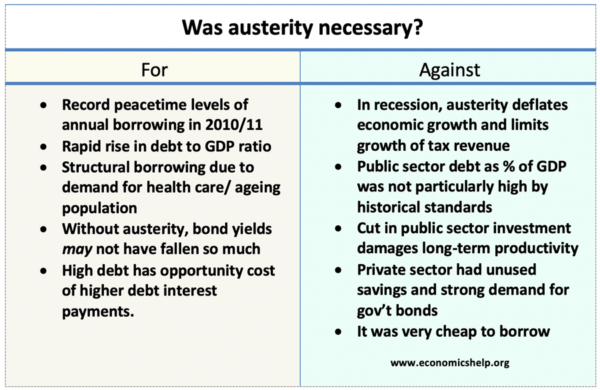

There is a debate at the extent to which austerity was necessary.

Reasons why austerity was unnecessary

- The recession saw a rise in private sector savings – and hence willingness to buy government bonds. In this case, government debt wasn’t spending money the economy didn’t have. It is the public sector making use of unused private sector savings.

- The high budget deficit was the correct response to the recession. VAT tax cuts helped boost demand and provide economic stimulus during economic slump.

- In a recession, higher spending is required on unemployment benefits, income support. Without these cyclical fiscal stabilisers, the recession would have been deeper and more people would have experienced poverty.

- This rise in government borrowing is a classic Keynesian response to a drop in private spending and a rise in private sector saving.

- In this period interest rates were cut to 0.5% – but that failed to cause growth and recovery – hence there was a greater need for fiscal policy to be expansionary at that time.

- There is strong evidence to suggest the austerity of 2010-12 contributed to a weak economic recovery – which hurt the growth in future tax revenues. See: Is austerity self-defeating?

- Public sector investment was cut to very low levels, damaging investment in public transport and new environmental projects. This has long-term costs for the economy.

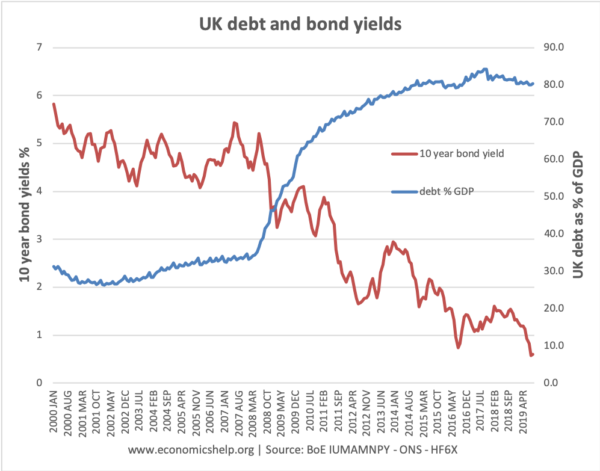

- Bond yields have fallen sharply since 2010 – indicated strong demand for buying bonds. The cost of borrowing has been very low. Debt interest payments as a % of GDP have remained low.

Evaluation – why austerity may have been necessary?

Other economists may disagree with this analysis. They might suggest

- Link between high debt and low economic growth. A 2010 paper “Growth in a Time of Debt,” by Carmen Reinhart and Kenneth Rogoff seemed to suggest that GDP growth significantly falls once government-debt levels exceed 90% of GDP.

- However, this paper was highly controversial for errors in including data and also the causation of whether high debt causes low growth or low growth causes high debt. (Does gov’t debt cause low growth?)

- Bond yields fell because annual borrowing was reduced. You could argue that if the government hadn’t reduced the growth of public spending, bond yields may not have fallen so sharply and the cost of borrowing would have risen.

- Long-term demographic changes. Like many western economies, the UK faces long-term demographic changes – ageing population, rapid growth in demand for health care. Therefore, borrowing wasn’t just cyclical but also structural long-term factors. For example, arguably raising the pension age was a solution to this issue of rising long-term demands on government spending.

- Confidence effects of cutting budget deficit. There is an argument that high debt levels may create low confidence amongst business and consumers and they may fear future tax rises to pay back debt. Cutting deficit boost confidence.

- Other economists argue this is the ‘confidence fairy‘ argument.

- Crowding out of the private sector. Another argument for austerity is that cutting government spending enables the private sector to have more resources to invest in private sector projects.

- The question is whether the private sector will respond to austerity by increasing private sector. The difficult economic circumstances of 2010-18, let to relatively low levels of private sector investments.

Evaluation

It is useful to separate short-term cyclical borrowing and long-term borrowing. Ideally, in a recession, the government should focus on economic recovery and not obsess about short-term borrowing targets. However, that doesn’t mean the government shouldn’t target stabilisation of long-term debt to GDP ratios. In addition to a cyclical deficit, there were elements of structural borrowing, so some decisions, e.g. raising taxes or cutting spending (through higher retirement age) may be necessary.

This is really interesting! Hopefully, we’re never in a position where this level of austerity is considered again. Thanks for sharing!