The recent history of the Pound to Euro, and forecasts for the next few months.

Latest Sterling exchange rates at Bank of England

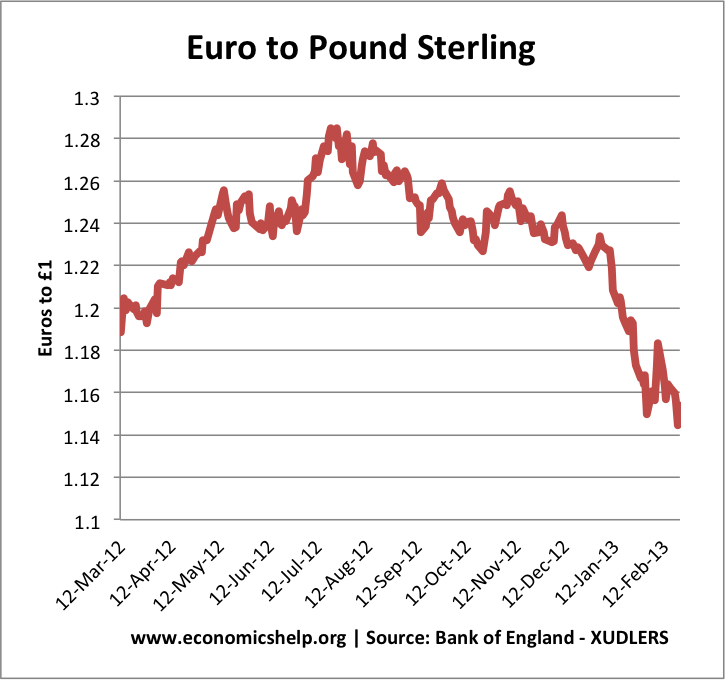

Since the summer of 2012, the Pound has fallen nearly 11% against the Euro. The main reason is that the intervention of the ECB has helped to stabilise the Euro and EU debt fears have temporarily receded. As a consequence, money has started to flow into the Eurozone again, and there is less reason to see the UK as a safe haven compared to the Euro.

Secondly, the UK economy has been stagnating. In 2012, we entered a double dip recession, and there is a chance of a triple dip recession in 2013; the UK might avoid a technical recession, but the overall outlook is grim (see: economic growth). Because the UK is experiencing a very slow recovery, it makes it difficult for the government to reduce its debt to GDP ratio.

In Feb 2013, Moody reduced the UK debt rating to AA1 for the first time in history. Moody’s downgrade occurred because they were concerned at the stagnant growth in the UK, which meant tax revenues will be less than expected making it difficult to reduce the debt to GDP ratio. The downgrade was largely expected and won’t have a direct impact on exchange rate, but it is a reflection of the disappointing economic performance.

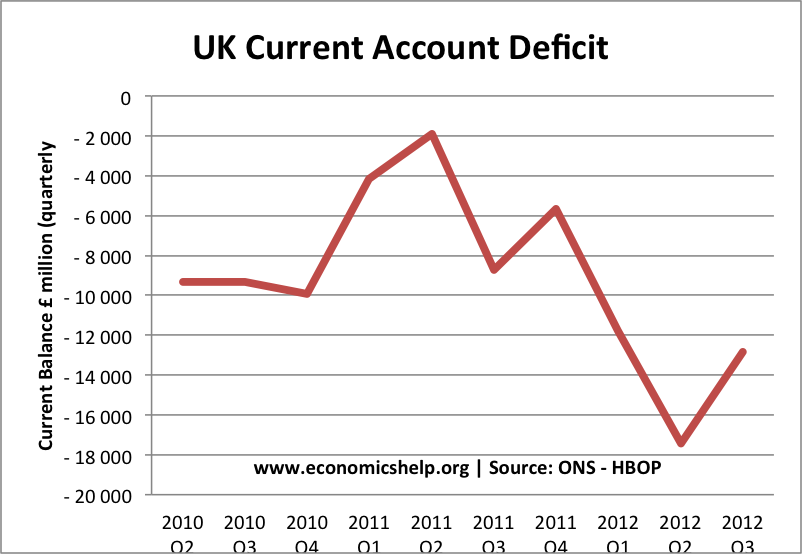

UK Current account deficit

Some fear that given the significant current account deficit (UK deficit is around 3% of GDP), the Pound may continue to fall against the Euro. Some commentators feel that the pound will need to fall to £1 =€1 to restore competitiveness and rebalance the economy.

The logic of this negative outlook for Sterling against the Euro, is that there is now nothing about the UK economy which deserves to give it a ‘safe haven status’ compared to the Euro. With the ECB now more willing to intervene against liquidity shortages, the UK has no real value as a safe haven alternative, which is seemed to at the start of 2012. Furthermore, with a credit rating downgrade and poor prospects for growth, the UK economy is likely to struggle, keeping interest rates low and making it less attractive as a place to attract investment.

Weak growth and quantitative easing

The weak prospects for economic growth raise the prospect of extended quantitative easing in the UK. Further monetary easing will contribute to inflationary pressures and weaken Sterling. In recent years, the UK has been more susceptible to cost-push inflation than the Eurozone, the extent of quantitative easing in the UK means that this relatively higher inflation in the UK may continue. Ironically, depreciation of the past few months itself will cause some cost-push inflation, like in 2009.

However, bear in mind underlying weaknesses in the Eurozone

Before, we write off the Pound, bear in mind, that the Eurozone still faces significant structural problems, which have only been temporarily averted by ECB intervention since last year. There is no guarantee that there will remain satisfactory ECB intervention. Also the bond purchases haven’t resolved the more deep-seated problems of low growth and very high unemployment within the EU economy. Markets may worry about the inflationary impact of quantitative easing in the UK, but arguably this is a stronger long-term position than being locked into deflation debt spirals that many southern Eurozone economies are facing. The Eurozone bond crisis has been temporarily been put on the back burner, but it is far from solved.Long-term Eurozone economic problems may return to haunt the Euro.

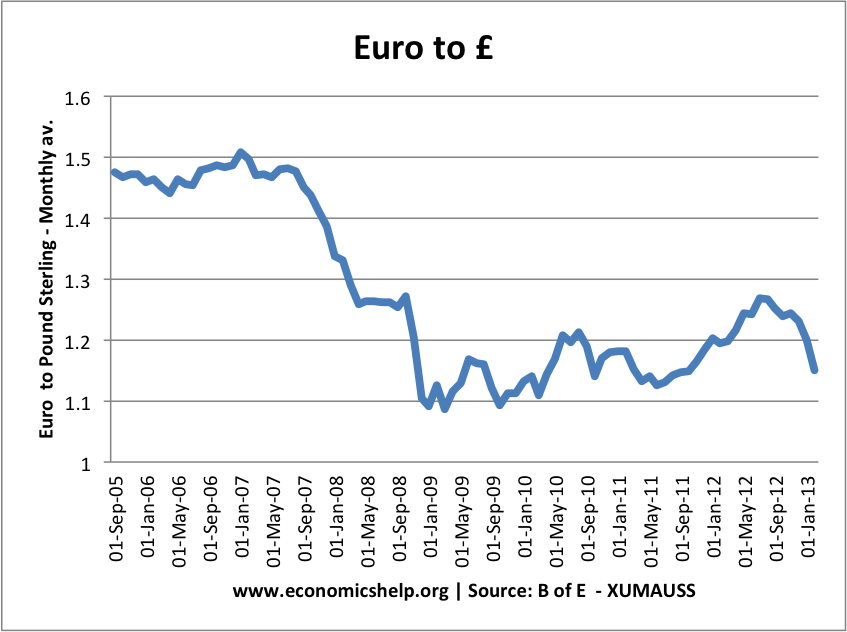

Euro to £ since 2005

The appreciation from 2009 to Aug 2012 has been wiped away by recent depreciation

Outlook for Pound to Euro in 2013

The Pound may continue to fall closer to 1.0 as we rebalance the UK economy, but any resurgence of problems in the Euro, could lead to a reversal of the Pound’s fortunes.

These are the economic factors which will influence the future value of the Pound.

Factors which Influence Pound

Interest Rates. When UK interest rates are low, it is less attractive to hold savings in UK banks. Therefore, there are less hot money flows into the UK. The sharp drop in UK interest rates from 5% to 0.5% made the UK a less attractive place to hold savings, so the value of Sterling has gone down. Slow growth in the UK mean interest rates are unlikely to rise in the near future.

- However, interest rates are low around the world. The country to exit recession first and increase interest rates may see significant hot money flows as investors look for better yields.

Relative Inflation rates. If UK inflation is relatively higher than the Eurozone, then UK goods will be relatively less attractive. This will cause British people to buy more Eurozone imports. It will make it harder to export UK goods. Therefore, in the long-term higher inflation will reduce the value of Pound Sterling to regain competitiveness.

Relative Productivity and competitiveness. In the long term, productivity growth will have a significant bearing on the exchange rate. Productivity growth will make UK goods more competitive and increase demand for UK exports (and hence Sterling). The UK’s poor productivity growth in recent years is undermining Sterling.

Quantitative Easing. The UK has embraced quantitative easing and is effectively increasing the money supply. This increases the chance of inflation and therefore a reduction in the value of the exchange rate. The ECB (heavily influenced by the German anti-inflation sentiment) are much more reluctant to embrace an increase in the money supply. This has stregthened the Euro.

- However, the fact the UK is pursuing quantitative easing increases the chance of a quick recovery and a rise in interest rates to deal with the inflationary pressure. Therefore, this prospect of a rise in UK interest rates could increase the value of the Pound. It is likely UK rates will rise before ECB rates.

Government Borrowing. The size of UK government borrowing and the forecasts of a rise in public sector debt as a % of GDP has worried markets. There is a fear that this could be inflationary (or unsustainable). Though at current levels, it shouldn’t be a major cause for concern. The UK is not alone in having large debts.

Current Account A current account deficit means that the value of exports is less than imports. Therefore, there is a net outflow of money on the current account. This requires a surplus on the financial / capital account. But, if these capital flows dry up, it will cause a depreciation in the Pound. Generally, a large current account causes a depreciation in the exchange rate to restore competitiveness.

Fair Value of the Pound to Euro?

With a Pound = 1.0 Euros, items on the continent seem expensive (except alcohol, petrol and cigarettes). Places like Spain and Greece are no longer cheap for the British tourist. A fairer value may be closer to 1.` Euros. (However, this is very subjective and purchasing power parity values often don’t influence exchange rates in short term)

The UK economy was initially hit hardest by great depression. But, the combination of quantitative easing, zero interest rates and large government borrowing means it is likely to recover sooner than the Eurozone economy which looks increasingly grim. This points to a tentative rise in the value of the Pound, unless the UK were to experience a double dip downturn.

Related

Stats

- Latest Sterling exchange rates at Bank of England

Why is it that the value of the exchange rate falls when there is higher inflation?…in the quantitative easing section

Creating money out of thin air devalues… The process was done incorrectly.

Quantitative easment means the central bank passing to the other banks new notes which were not to be injected into the economy. This does nothing to solve the main problem confronting the banks namely defaulting debtors.