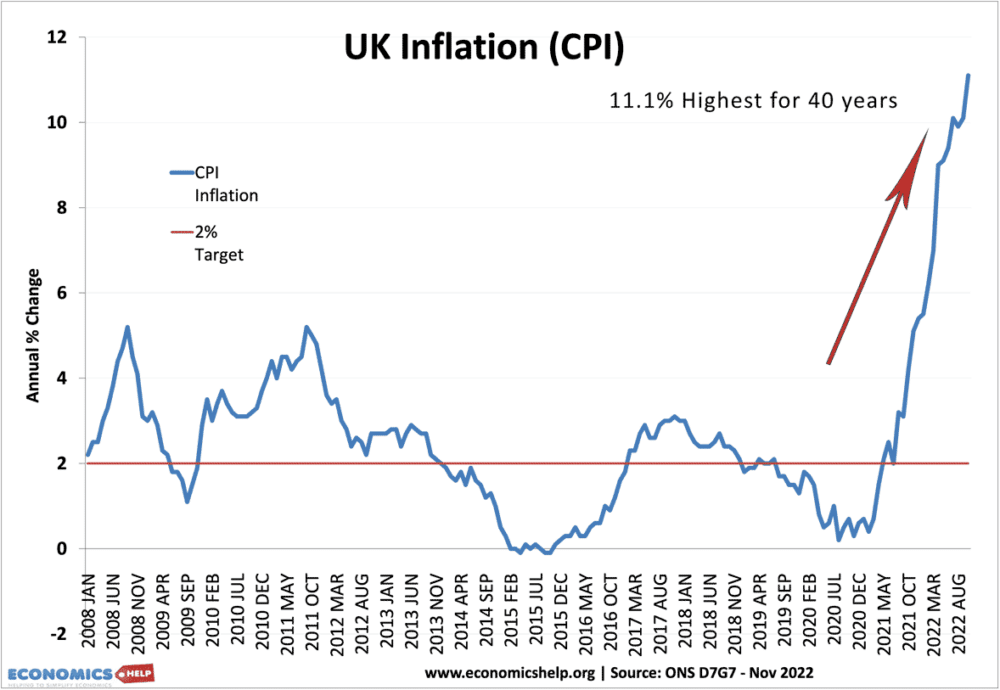

Inflation in the UK rose to a 40 year record of 11.1% in Nov 2022 – why is inflation so high and will it come down soon?

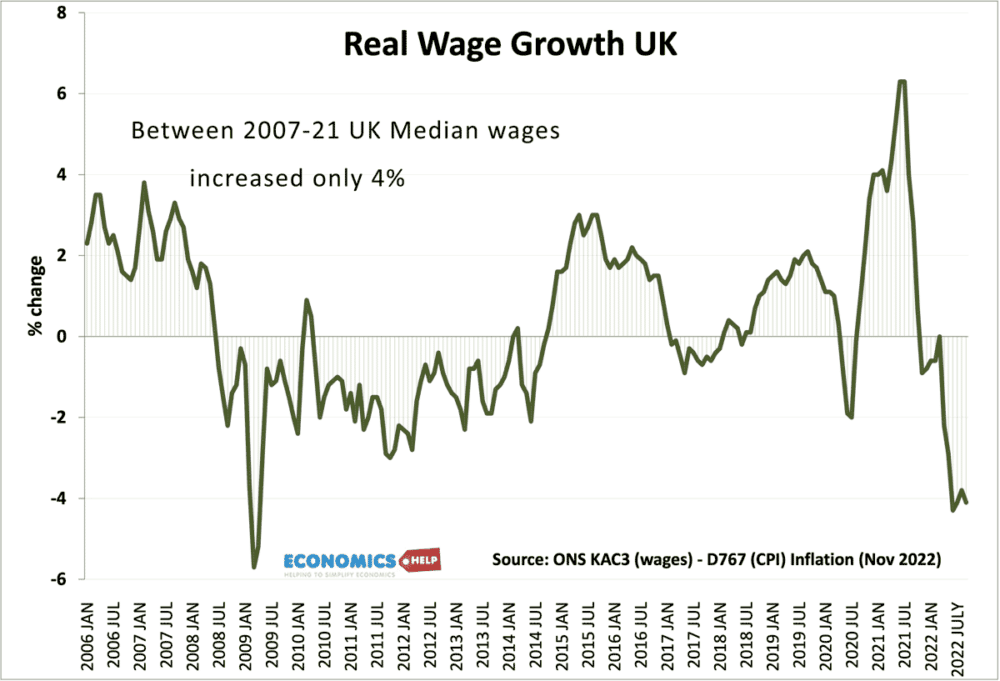

The last time inflation was so high was in 1981. But, inflation of the 1980s was different in that at least wages were keeping up with inflation. Now we have the unwelcome combination of higher prices and falling real wages.

For many years, inflation appeared to be tamed; apart from a few temporary periods, low inflation lasted from the early 1990s to 2021. Yet, as the world emerged from the Covid Pandemic in 2021, we saw our first sustained period of inflation in a generation.

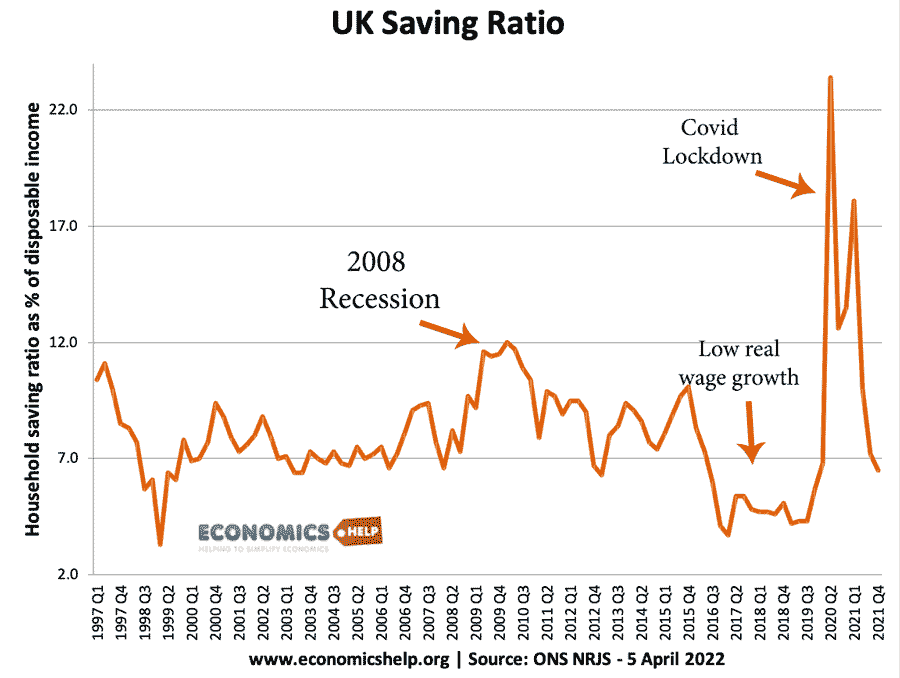

The undoubted start of global inflation was related to the ending of the pandemic. Firstly, during the pandemic, the savings rate rose as households cut back on usual spending. In the US this was magnified by stimulus checks which increased incomes. Then at the end of the pandemic, as restrictions were loosened there was an increase in spending as households dipped into their big savings.

However, real inflationary problems occurred when shipping routes because congested causing a rise in the price of shipping. Also, continued lockdowns in China meant a shortage of supply of key components causing producer prices to rise. Inflation was also exacerbated by the switch in consumption from services to durable goods – causing shortages of certain goods.

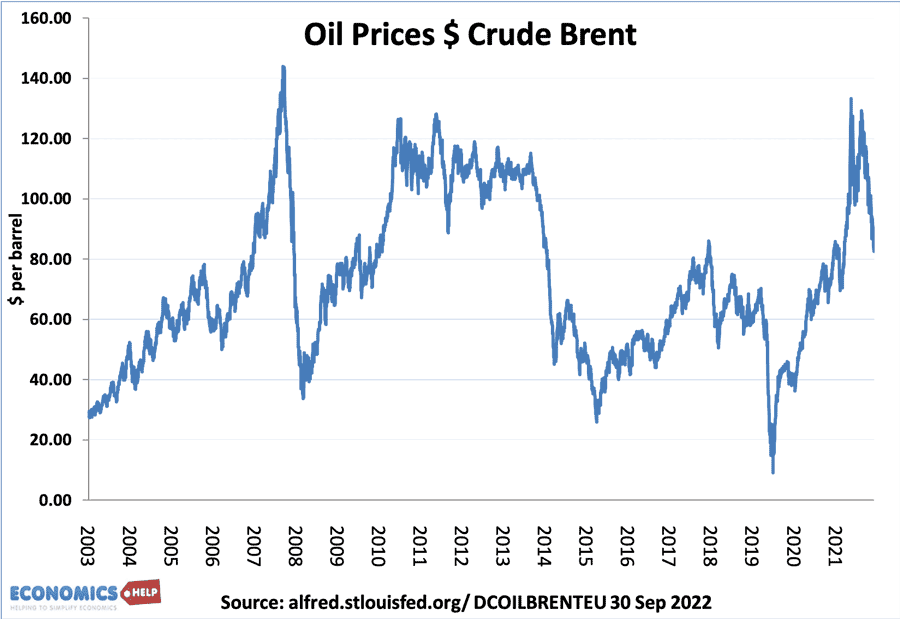

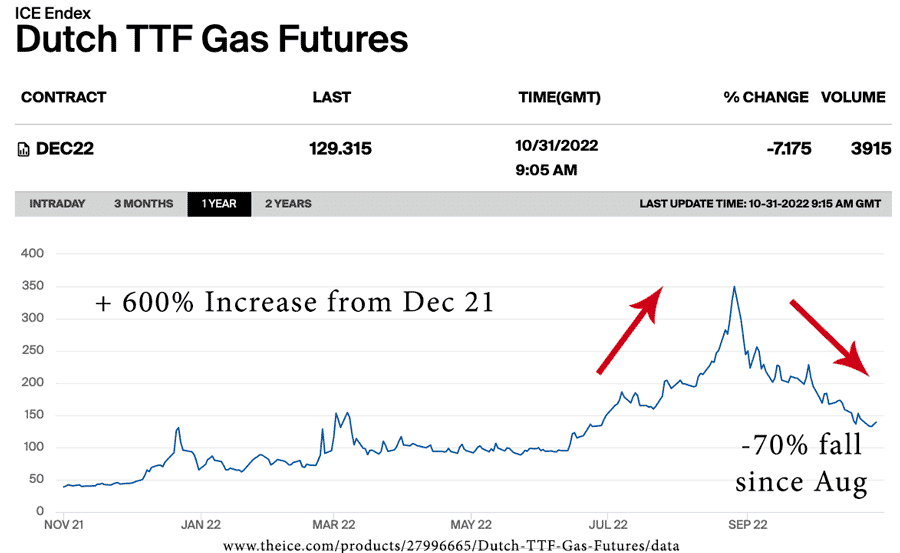

This supply-side inflation might have resolved itself if it wasn’t for rising oil and gas prices. Initially, rising prices were due to global recovery and tight production. Producers had cut back on investment in 2021 when oil prices dipped negative.

However, the Russian invasion of Ukraine in Feb 2022, sent the price of oil and gas soaring, causing the bulk of the inflation we see today.

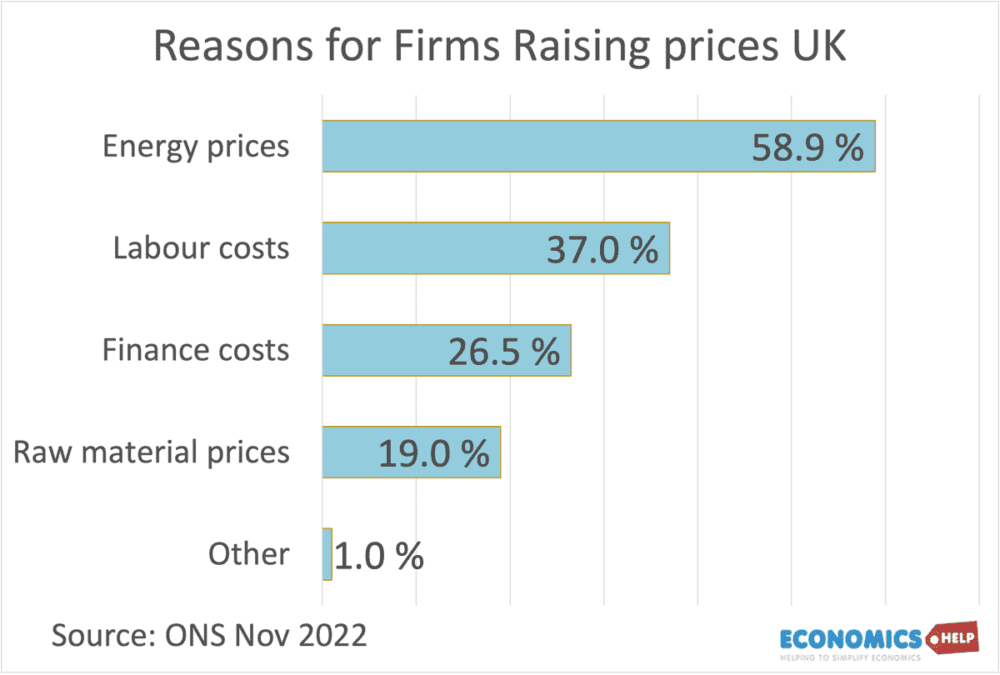

In the past, we have had oil spikes, but, we have never had such a sustained increase in gas prices, causing household bills to more than double. However, as we have learnt it is not just gas and oil prices that go up. When energy prices rise, it increases transport costs for all goods, and business costs generally increase. You can see here rising energy prices is given as the biggest reason for firms putting up prices

One of the biggest price rises outside energy is food prices. UK food prices have risen 16% in 12 months. And this is because the cost of producing food is closely related to oil and gas. With higher gas prices it is more expensive to heat greenhouses to grow tomatoes. It is more expensive to produce fertilisers which use gas as a raw material. It is more costly to transport food.

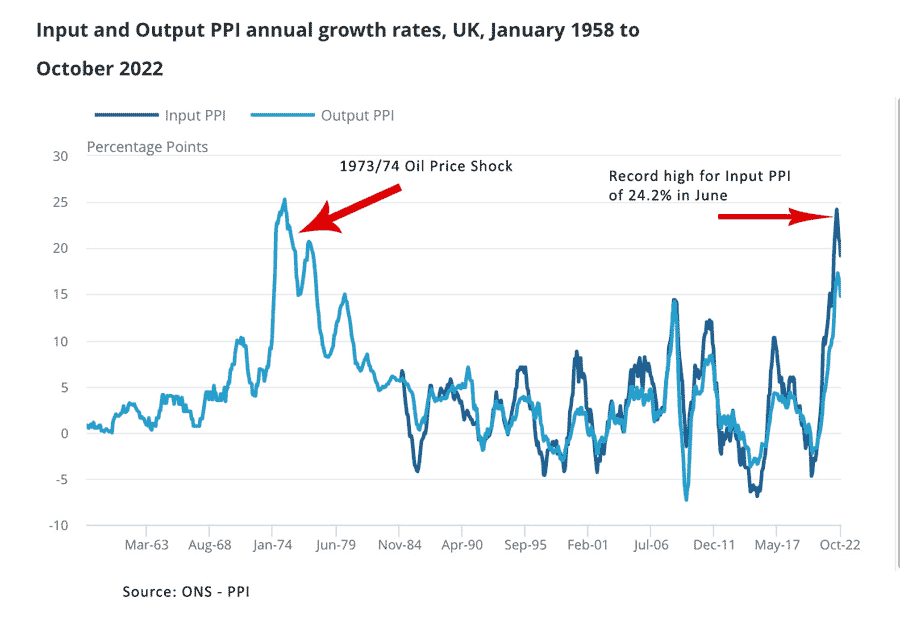

The rise in energy costs and input prices is seen in this graph of producer price inflation. In the summer at the height of oil and gas price rises, input PPI reached a record 24%. This inevitably leads to higher prices as firms have to pass some of the cost increases on.

A frequent claim is that inflation is due to rising wages, and this period of high inflation has led to calls for wage restraint – especially in the public sector. However, whilst rising wages contributed to the inflation of the 70s and early 80s, we are not seeing it today. Nominal wages are lagging behind inflation, with real wages falling by 4%. Real wages may have fallen further if it wasn’t for the fact, labour participation has been falling as people take early retirement, increase in long-term sickness and staff shortages related to Brexit.

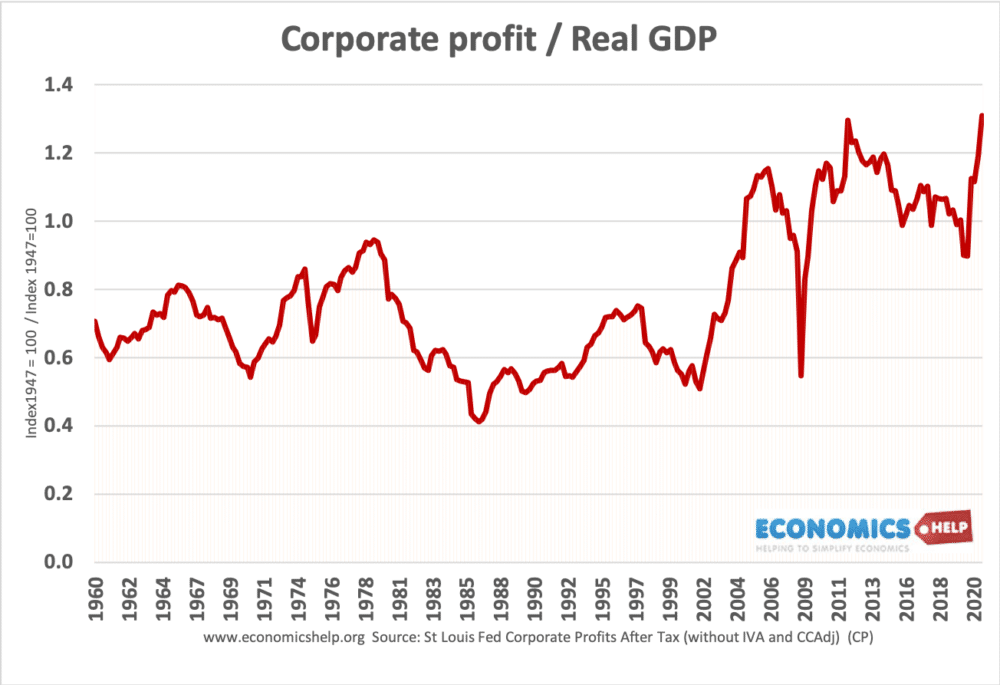

Many economists have pointed out a new cause of inflation – profit push inflation, with some large firms taking advantage of rising prices to push through higher prices and increase profit margins.

This is reflected in an increase in corporate profitability – especially in the US. This is particularly true for the big energy firms that are reporting record profits. Whilst large multinationals make higher profits, many smaller businesses are struggling to pass on cost increases to the consumer.

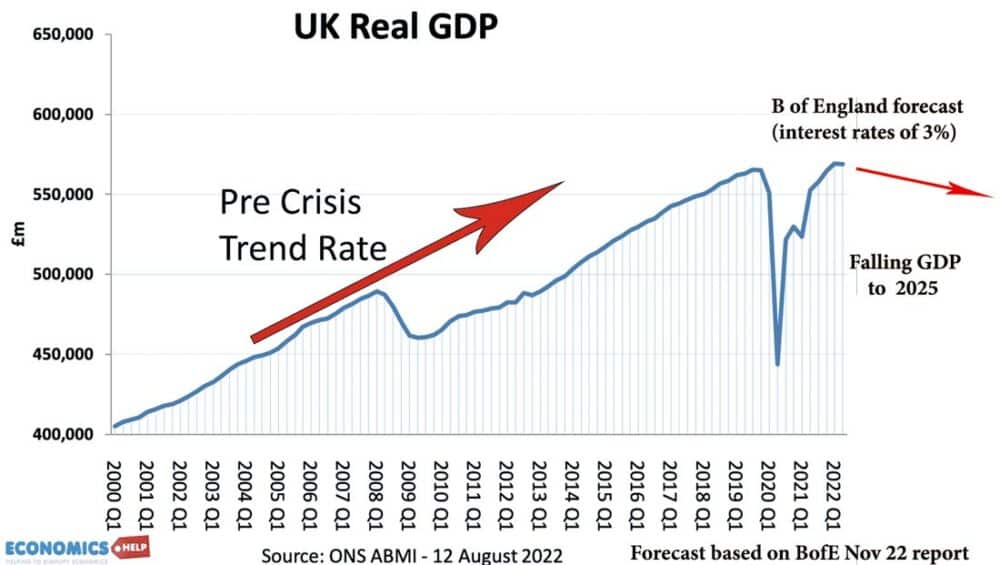

Another common cause of inflation is an overheating economy. When demand exceeds supply, this causes rising prices. Whilst, this is partly to blame for inflation in the US, there is little evidence of excess growth in the UK. In fact, the UK went into a technical recession earlier in the year, with small falls in GDP. This is not your classic demand-pull inflation.

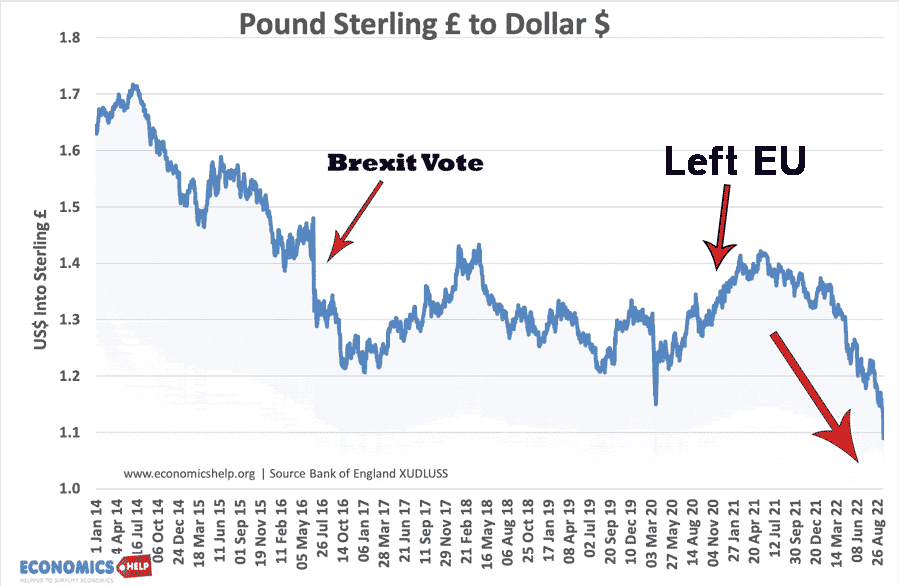

Another reason for inflation in the UK and Europe has been the strength of the dollar. The dollar has been strong because of high growth and the Fed increasing US interest rates. As US rates rise, this strengthened the dollar, weakening the Pound and Euro. The Pound Sterling has also weakened because of issues around Brexit and the loss of single market access.

This depreciation contributes to cost-push inflation because a weak Pound increases the price of imports. It is particularly relevant to oil and gas prices which are priced in dollars.

A final factor is rising housing costs. Mortgage payments have risen due to higher interest rates and rents have been rising, which squeezes living standards for many.

Is there any hope of falling inflation?

The good news is inflation should fall in 2023, the big question is how much – will it be enough to see rising real wages?

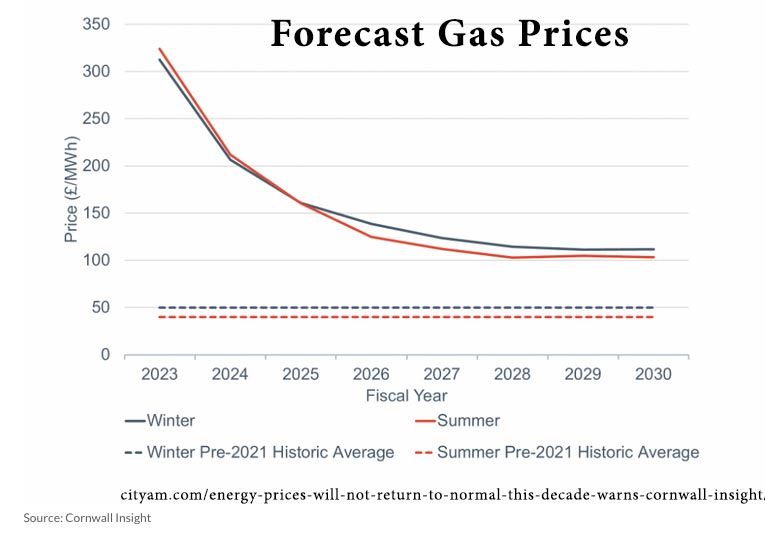

Firstly, gas and oil prices have started to come down since their summer peaks. The Russian military defeats were important for raising hopes that gas and oil supplies may improve. Gas prices have fallen quite significantly since a warm October reduced demand.

Gas analysts forecast prices will remain high for a considerable time and decline only slowly. There is always a risk Putin could go for broke in completely cut off gas supplies to Europe, which would cause prices to surge again. But the worst price increases are hopefully over. As long as energy prices don’t keep rising, the price increases will drop out of the inflation figures. However, UK consumers are likely to see higher energy prices in April, if the government doesn’t want to maintain very expensive energy price guarantees.

A key factor for global inflation is China’s producer price index. As the world’s largest manufacturer, its low inflation has been a key factor behind global low inflation. The good news is that the Chinese PPI has fallen considerably and this has a close link to US and UK inflation. This should put downward pressure on inflation in the near future.

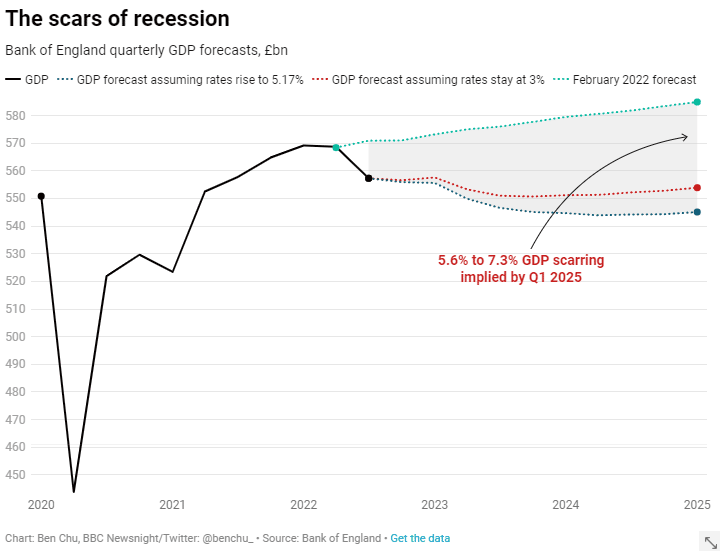

Another important factor is that the world and the UK especially are heading towards a deep and prolonged recession. This will put downward pressure on prices. It is true that the main inflation is cost-push so even a recession will be relatively weak in reducing energy prices, but it will prevent inflation expectations from rising and inflation from becoming embedded.

Some analysts say that on purchasing power parity, the dollar is overvalued and with the US economy slowing down the Fed may not increase interest rates as much as previous forecasts. This would weaken the dollar and reduce imported price pressures.

So inflation will fall, but it is not clear the misery index will. We will see inflation come down, but still be stubbornly high as the cost of living crisis continues and little hope for a sustained rise in real wages.

Further reading

Thanks for this informative and comprehensive analysis.

just one question: how are “Russian military defeats … important for raising hopes that gas and oil supplies may improve”?

Is there an expectation of normalisation of relationships with Russia following the end of war?

Yes. That is hope that if war ends, gas prices will come down.