Readers Question: Please is there any solution to national/public debt?

National (public sector) debt is the outstanding level of debt owed by the government to the private sector. It is the accumulation of annual budget deficits.

Do we need a solution?

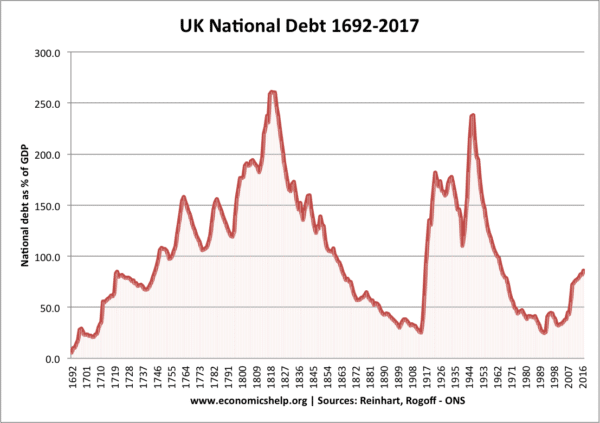

Firstly, it is worth evaluating whether we need an actual ‘solution.’ National debt has been a feature of economies for many centuries. The UK national debt goes back at least to the Seventeenth Century.

- National debt has been useful for dealing with national crisis. The Napoleonic Wars of the early 1800s, the First and Second World War. We are often told the national debt imposes a ‘burden’ on future generations. But, the post-war generation who ‘inherited’ national debt of over 250% saw rapidly rising living standards. In the post-war period, the national debt was not a barrier to strong economic growth and the debt rapidly fell.

- It is helpful to think of national debt like borrowing from within a family. If a younger member of a household needs to borrow to fund his education, it would make sense for him to borrow from his Grandpa who has unused savings. A family is not bankrupted because one part of the household borrows from another with surplus savings.

- It also depends on what the government borrowing is used for. National debt is not necessarily a burden on future generations if it is used to finance investment in the economy. For example, borrowing to finance better transport can help the long-term effects of the economy.

- Also, in a recession, government borrowing can help stabilise aggregate demand by making use of unused savings and providing employment for the unemployment.

- National debt tends to rise during economic downturns, but J.M. Keynes would argue this is desirable. In a recession, government borrowing can help to offset the rise in private sector saving and help to maintain demand. Promoting economic growth is one of the best ways to reduce debt to GDP in the long-term

Despite reservations about whether we need to solve national debt, there still needs to be an effort to maintain national debt at a sustainable level. Many economists would suggest a long-term target of national debt 60% of GDP or less is a good target to aim for. Given that debt in countries like UK and US is heading towards 90% of GDP, what are the solutions to reducing this national debt?

Solutions to reducing national debt

1. Avoid war/reduce military spending

The striking feature of UK national debt history is the impact of war on causing an explosion in debt. The main wars were Napoleonic Wars in the early Nineteenth Century, First World War (1914-18) and Second World War (1939-45). Periods of relative peace have enabled the national debt to decline. The recent rise in debt 2008-2017, is unusual in being caused by primarily non-military factors.

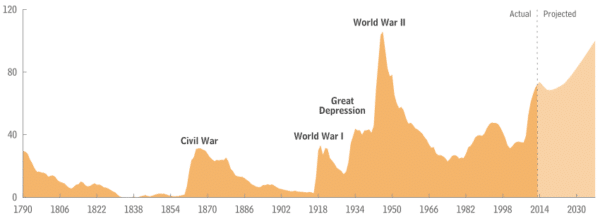

US national debt

In the US, it is a similar story, with World War II causing the largest spike in national debt.

In the post-war period, the US has maintained a high level of military spending, especially in conflicts, such as Korea, Vietnam, Iraq and Afghanistan.

In recent years, it is estimated that by the end of 2008, the U.S. had spent approximately $900 billion in direct costs of the wars in Iraq and Afghanistan. If the cost of injured servicemen is included, even conservative estimates suggest the cost rises to $1.3 trillion (Reuters). The US has a military budget of $637bn – cutting military spending is one way to reduce government borrowing.

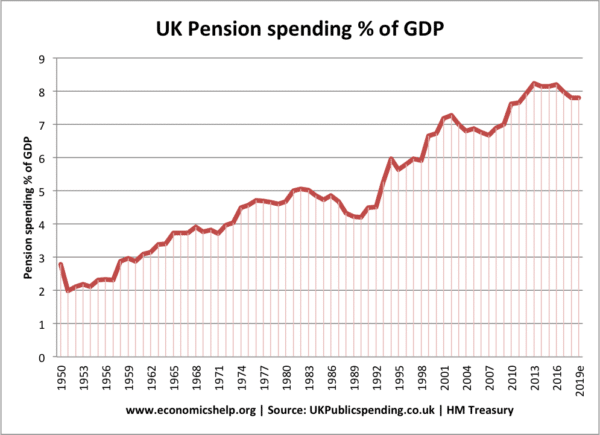

2. Raise pension age

One of the simplest ways to reduce government spending would be to raise the retirement age. Government pensions are one of biggest areas of government spending. In the UK, pension spending has risen to just below £160bn – more than a 100% increase in the past 15 years.

Raising the retirement age also has the added bonus of raising productivity and increasing the size of the work-force. It is a way to reduce spending commitments without any economic costs.

However, as a solution it does have drawbacks:

- It is perceived as ‘unfair’ by those who expected a certain retirement age and now have to work longer.

- It is likely to have unequal effects. Higher earners with generous private pensions can take early retirement. Low income-workers have no option to take early or partial retirement.

- Raising the retirement age has a bigger impact on those in manual labour, where it is maybe difficult to keep working.

3. Broaden the tax base

In recent years, some taxes have started to be less effective in raising revenue. (See falling tax revenue)

- Stamp duty on housing – revenue fell after financial crisis

- Petrol tax – cars more fuel efficient

- Cigarette tax – smoking rates declining

- Rising income inequality is reducing the relative amount of income tax paid by low income-earners.

- Corporation tax – Due to globalisation, more companies have the capacity to channel profit into overseas countries like Bermuda and Luxemburg. See company surpluses

With some tax revenues falling, new taxes may need to be introduced to take the place of ‘older taxes’

- Tax on company turnover – a possible way to collect more tax from online companies Apple, Amazon and Google – who have huge turnovers in UK, but pay very little corporation tax.

- Electronic road pricing – with a decline in petrol consumption, electronic road pricing will be a way to collect tax revenue from the new growth of electric cars.

- International co-operation on corporate tax rates to discourage ‘beggar my neighbour’ and tax avoidance.

4. Debt ceilings

The US has implemented a ‘debt ceiling’ which means Congress has to vote to raise the debt ceiling. This places a regulation on levels of government debt and forces Congress into limiting budget deficits – unless it can agree to raise the debt ceiling. However, it is often criticised by economists.

- It is too inflexible for recessions – when borrowing more is desirable for promoting economic growth. In a recession, automatic stabilisers (social security spending, unemployment benefits) rise, causing more borrowing – but these help to reduce the impact of recession and encourage economic growth. A debt ceiling can cause automatic stabilisers to become automatic destabilisers. – See Critique of balanced budget amendments. at Brooking.edu

- It can lead to easier projects being cut – like infrastructure investment rather than current spending plans. Infrastructure is easier to stop because there are few current beneficiaries – however, infrastructure investment is what the economy needs in the long-term.

5. Economic growth

The most striking feature of reductions in national debt is that they tend to occur during periods of economic growth, which reduces the debt to GDP ratio. The UK reduced its debt to GDP from 240% of GDP in 1950s to 40% of GDP in 2002 – despite rarely running a budget surplus. It was economic growth that led to rising tax revenues. The concern is that if we are entering a period of secular stagnation – then it will become harder to reduce debt to GDP.

- The problem is that ‘raising the rate of economic growth’ is not easy in practice. Governments are limited in how much they can influence long-term trends in technology and productivity. Though, they can play a role in providing counter-cyclical policy during economic downturns.

6. Land value tax

Many economists including Adam Smith, David Ricardo, and Henry George are supportive of a tax on land value. This tax is progressive as it takes the most from the wealthiest. It is also efficient as it doesn’t distort economic behaviour. It would also help to reduce the inequality of wealth that has increased in recent decades.

Related

Can u please further explain the land value tax? Please as i have to do presentation on this

Need to raise awareness of dangers of increase in National debts. Encourage general public to help out where we can. On the bright side Effective Corona Vaccines and healthy life style hold a lot of promise.

Make long term savings making savings according to the rate of inflation, make more money to pay the debt back to decrease the value of the currency only to trade more with nations with stronger currencies.reduce the cost of servicing the debt. Boost fiscal capacity through tax reform, promise a proportion year on year from tax exporting to pay off debt and/or replace the need for borrowing. Boost tax increases for private firms. Give everybody a tax refund to encourage more consumer spending.