Readers Comment. Why doesn’t the Bank of England just print the money instead of borrowing the money?

Printing more money doesn’t increase economic output – it only increases the amount of cash circulating in the economy. If more money is printed, consumers are able to demand more goods, but if firms have still the same amount of goods, they will respond by putting up prices. In a simplified model, printing money will just cause inflation.

Video explanation

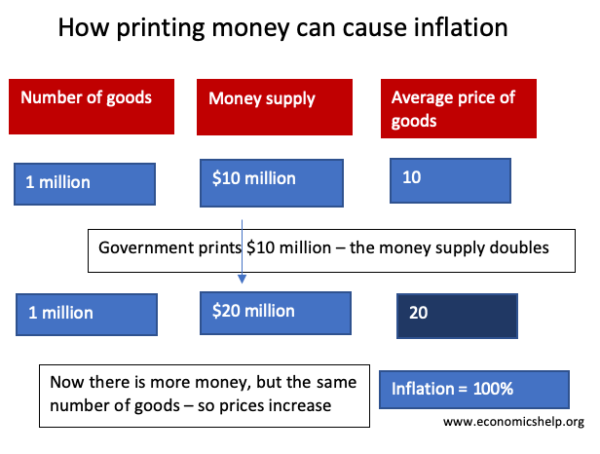

How printing money causes inflation – Example

- Suppose an economy produces $10 million worth of goods; e.g. 1 million books at $10 each. At this time the money supply will be $10 million.

- If the government doubled the money supply, we would still have 1 million books, but people have more money. Demand for books would rise, and in response to higher demand, firms would push up prices.

- The most likely scenario is that if the money supply were doubled, we would have 1 million books sold at $20. The economy is now worth $20 million rather than $10 million. But, the number of goods is exactly the same.

- We can say that the increase in GDP is a money illusion. – True you have more money, but if everything is more expensive, you are not any better off.

- In this simple model, printing more money has made goods more expensive, but hasn’t changed the quantity of goods.

Doubling the money supply, whilst output stays the same, leads to a doubling in price and inflation rate of 100%

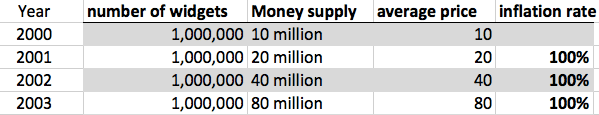

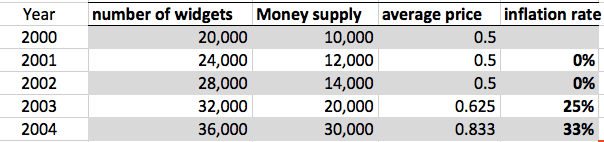

- From the year 2000 to 2001, the money supply increases without inflation.

- In 2001, the money supply increases 20%, and the number of widgets increases 20%. Therefore, prices stay the same – the extra money is matched by an equivalent rise in the money supply.

- It is only in 2003 when the money supply increases from 14,000 to 20,000 that the money supply increases at a faster rate than output and we start to get rising prices.

Problems of inflation

Why is inflation such a problem?

- Fall in value of savings. If people have cash savings, then inflation will erode the value of their savings. £1 million marks in 1921 was a lot. But, due to inflation, two years later, your savings would have become worthless. High inflation can also reduce the incentive to save.

- Menu costs. If inflation is very high, then it becomes harder to make transactions. Prices frequently change. Firms have to spend more on changing price lists. In the hyperinflation of Germany, prices rose so rapidly that people used to get paid twice a day. If you didn’t buy bread straight away, it would become too expensive, and this is destabilising for the economy.

- Uncertainty and confusion. High inflation creates uncertainty. Periods of high inflation discourage firms from investing and can lead to lower economic growth.

Printing money and national debt

Governments borrow by selling government bonds/gilts to the private sector. Bonds are a form of saving. People buy government because they assume a government bond is a safe investment. However, this assumes that inflation will remain low.

- If governments print money to pay off the national debt, inflation could rise. This increase in inflation would reduce the value of bonds.

- If inflation increases, people will not want to hold bonds because their value is falling. Therefore, the government will find it difficult to sell bonds to finance the national debt. They will have to pay higher interest rates to attract investors.

- If the government print too much money and inflation get out of hand, investors will not trust the government and it will be hard for the government to borrow anything at all.

- Therefore, printing money could create more problems than it solves.

- See also: Printing money and national debt

Hyperinflation in Germany during the 1920s

Inflation was so bad in Germany that money became worthless. Here a child is using money as a toy. Money was used as wallpaper and to make kites. Towards the end of 1923, so much money was needed, people had to carry it about in wheelbarrows. You hear stories of people stealing the wheelbarrow, but leaving the money.

Printing more money is exactly what Weimar Germany did in 1922. To meet Allied reparations, they printed more money; this caused the hyperinflation of the 1920s. The hyperinflation led to the collapse of the economy.

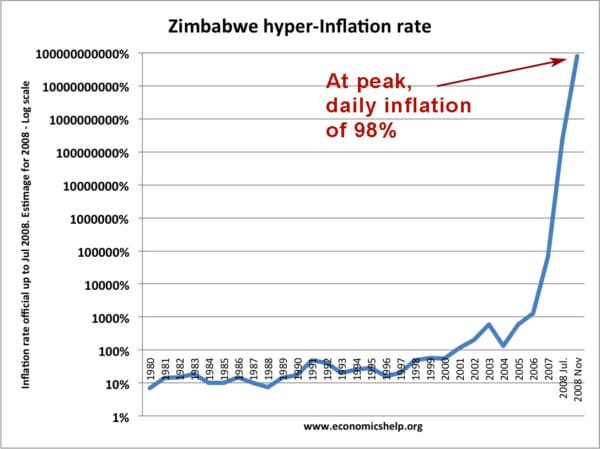

Hyperinflation also occurred in Zimbabwe in the 2000s.

Printing money and the value of a currency

If a country prints money and creates inflation, then there will be a decline in the value of the currency.

- Suppose inflation in Germany is 100%, and inflation in the UK is 0%.

- This means German prices are doubling compared to the UK.

- You will need twice as much German currency to buy the same quantity of goods.

- The purchasing power of the German currency is declining, therefore the value of mark will fall on exchange rates.

- See also: Printing money and the exchange rate

Value of one German Mark to US Dollar 1922-23

Hyperinflation in Germany causes a rapid fall in the value of the German mark to the dollar.

In a period of hyperinflation, investors will try and buy a stable foreign currency because that will hold its value much better.

Real Life example of Money Supply and Inflation

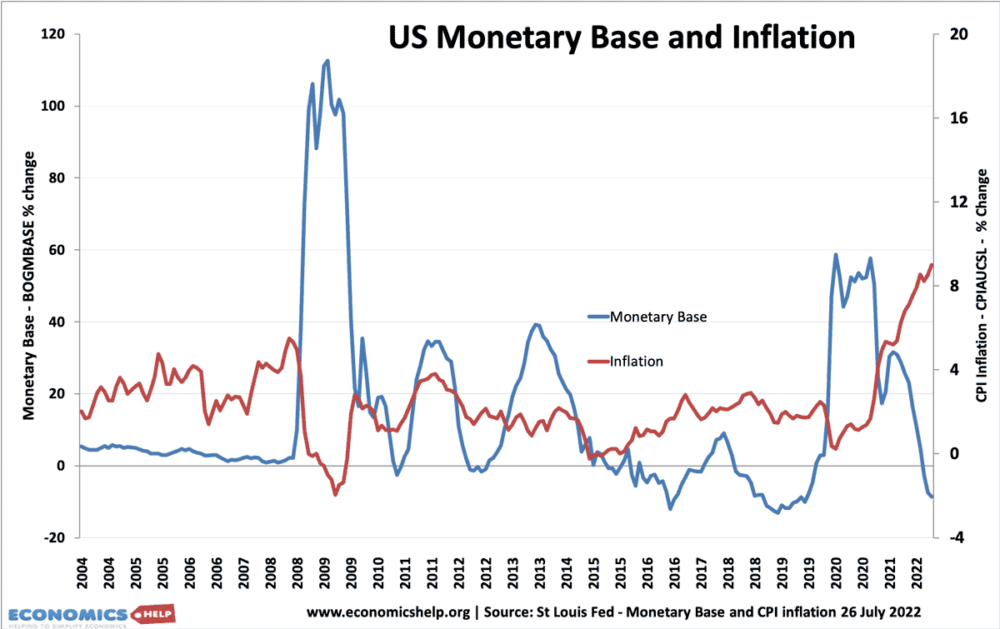

In a recession, with periods of deflation, it is possible to increase the money supply without causing inflation.

This is because the money supply depends not just on the monetary base, but also the velocity of circulation and the willingness of banks to lend. For example, if there is a sharp fall in transactions (velocity of circulation) then it may be necessary to print money to avoid deflation,

In the liquidity trap of 2008-2012, the Federal reserve pursued quantitative easing (increasing the monetary base) but this only had a minimal impact on underlying inflation. This is because although banks saw an increase in their reserves, they were reluctant to increase bank lending.

However, if a Central Bank pursued quantitative easing (increasing the money supply) during a normal period of economic activity then it would cause inflation. In 2020, quantitative easing was pursued and a year later, inflation in the US rose. (though inflation also rose due to higher oil prices)

Related

Last updated: 26th July 2022, Tejvan Pettinger, www.economicshelp.org, Oxford, UK

How can confidence be restored in the banking sector, when people are hording the money I their homes? People are restricted about what amount to withdraw.

By eradicating, eliminating Central Banks, also called Federal Reserve in US or Bank of England in the UK. They are the only ones which can create inflation; it is a tool for politician to use and abuse for their own interest. There should be what is called a Free Banking system

This is very important article more especially to us economics students, and it help us to know our country economy very well.pls continue doing very excellent job.

Thanks for this money printing enlightment

Q

“Why doesn’t the Bank of England just print the money instead of borrowing the money?”

A

It does.

The Bank of England never borrows money. It prints money then lends it to it’s government.

Governments are owned by the Central Banks and Federal Reserve which in turn are owned by private individuals who somehow forced this monopolistic extortion on society.

No – Central banks are institutions of government as are fiscal authorities. The only major central bank which is privately owned is the Swiss National Bank (SNB).

What about the Fed, that is a consortium of commercial banks, is it not?

This is what happens, for sure. Companies put prices up simply because they can. But should that be allowed when there are shortages? Seems to me they are just taking advantage of the situation.

Is that really what you think? Oh dear, Mike blew it

Increase in demand (through printing money) could also lead to increase in supply of goods. Simplistic and stupid to exclude this possibility.

It could increase the supply of goods. However, this pandemic has hindered and even stopped the availability of many goods.

The author did include that possibility:

“If more money is printed, consumers are able to demand more goods, but if firms have still the same amount of goods, they will respond by putting up prices. In a simplified model, printing money will just cause inflation.”

It appears that the only thing that is keeping the US economy from crashing is the injecting of monopoly money. Trying to avoid this crash for Federal Economist is like the greyhounds chasing the fake rabbit around the track. It’s a crazy and puzzling state of economic rational. This article states exactly where we’re at.

Complete novice on this so excuse any novice questions!!!

I get that if a country prints money the chances are that there will be inflation.

At the moment COP 26 is running and politicians are not keen on spending what is required to correct global warning and fund poorer countries to adapt.

Is it beyond the wit of man to save himself and come up with a financial solution?

My question is what would happen if EVERY country was able to “create” more money released by say the world bank to cover the cost of TOTAL global warming adaptation.

New big nuclear/small nuclear/wind/tidal/electric cars/batteries/ deforestation…..could go on….

Maybe if each richer country raised the same % gdp as each other and poorer countries a higher % gbp.

It could be the figure required to correct everyting over the next 20 years?

Over a reducing scale over 20 years-

Pay the coal producing countries an extra levy for the reduction in income from not supplying coal

Pay the de-forestation countrie to not cut down our forests

Pay the oil producing countries for the gradual loss of oil sales

Fund any other global warming problems I haven’t put down.

A one off World Reset funding operation, strict rules all overbthe world to combat any possible inflation, surely the politicians could get a grip of it to make it transparent/funded by the world bank and not over priced (they must know how much theses things cost and the price would come down dramatically if the whole world was doing the same thing!!!

Stupid and naive, or should we be asking more questions of our politicans/financial advisers! Do we let the money men win or save the planet for future generations….

I think you have to go back to the invention of money as a token of value that is fungible. That is a token (money) allows you to buy anything and allows you to receive tokens when you sell something (including your time).

Money is a convenience that allows us to buy and sell across wide geographic regions. Prior to money trading was done on a bartering basis with good being exchanged for good. So giving time in the field resulted in you getting a loaf of bread or flour to make the bread.

Your point about the global challenge of climate change is well founded and we need to find a new way of understanding value. That new way may result in some new form of token (money) being created that more accurately reflects the value and values that we ascribe to.

Yes; a Reset is very likely I think; linked with performance on aggressive international policies, international trading, and other requirements.

You would think that a growing population should have a higher money supply anyway.

Inflation then latter recession, I believe are the consequences of printing far too much money. Also there’s a real danger the currency will be valued blowing out the debt even further.

Allan at Ulladulla NSW Australia

A decade of the uk printing money with a once in a life time 0.5 percent interest rate, in a system that financially only rewards those in politics by serving the rich is immoral! The consequences of this is devastating and taking away opportunity for so many

The word ‘printing’ has little applicability – it is the spending that carries a potential inflation risk.

If additional spending from the state occurs at current prices it will not be inflationary. Only if the state competes with the private sector by raising its offer prices will the value of money be reduced.

http://moslereconomics.com/wp-content/uploads/2020/11/Weimar-Republic-Hyperinflation-through-a-Modern-Monetary-Theory-Lens.pdf

I Am:the above mentioned:turning an old thing into something been waited for;wold wide!!!

Thanks for the easy-to-understand content. I always thought that since there’s a PRINTER with the Government, why they don’t print more money to pay off the debt! Now I got to know how problematic it is to just print money.

Great Post!

But arguably the whole tax collection apparatus does not produce any significant economic output of any kind. I don’t see how this is that much worse than inflation.

This article enhances the understanding for pirinting money. Thanks you for this. Very informative