Readers Comment. Why doesn’t the Bank of England just print the money instead of borrowing the money?

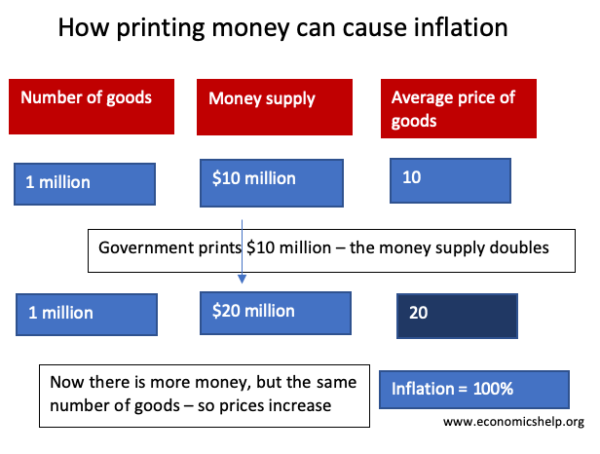

Printing more money doesn’t increase economic output – it only increases the amount of cash circulating in the economy. If more money is printed, consumers are able to demand more goods, but if firms have still the same amount of goods, they will respond by putting up prices. In a simplified model, printing money will just cause inflation.

Video explanation

How printing money causes inflation – Example

- Suppose an economy produces $10 million worth of goods; e.g. 1 million books at $10 each. At this time the money supply will be $10 million.

- If the government doubled the money supply, we would still have 1 million books, but people have more money. Demand for books would rise, and in response to higher demand, firms would push up prices.

- The most likely scenario is that if the money supply were doubled, we would have 1 million books sold at $20. The economy is now worth $20 million rather than $10 million. But, the number of goods is exactly the same.

- We can say that the increase in GDP is a money illusion. – True you have more money, but if everything is more expensive, you are not any better off.

- In this simple model, printing more money has made goods more expensive, but hasn’t changed the quantity of goods.

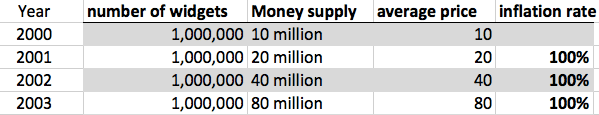

Doubling the money supply, whilst output stays the same, leads to a doubling in price and inflation rate of 100%

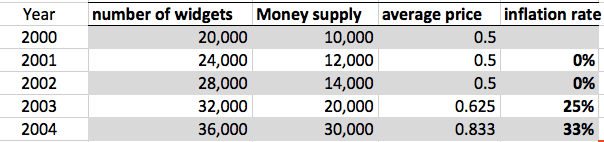

- From the year 2000 to 2001, the money supply increases without inflation.

- In 2001, the money supply increases 20%, and the number of widgets increases 20%. Therefore, prices stay the same – the extra money is matched by an equivalent rise in the money supply.

- It is only in 2003 when the money supply increases from 14,000 to 20,000 that the money supply increases at a faster rate than output and we start to get rising prices.

Problems of inflation

Why is inflation such a problem?

- Fall in value of savings. If people have cash savings, then inflation will erode the value of their savings. £1 million marks in 1921 was a lot. But, due to inflation, two years later, your savings would have become worthless. High inflation can also reduce the incentive to save.

- Menu costs. If inflation is very high, then it becomes harder to make transactions. Prices frequently change. Firms have to spend more on changing price lists. In the hyperinflation of Germany, prices rose so rapidly that people used to get paid twice a day. If you didn’t buy bread straight away, it would become too expensive, and this is destabilising for the economy.

- Uncertainty and confusion. High inflation creates uncertainty. Periods of high inflation discourage firms from investing and can lead to lower economic growth.

Printing money and national debt

Governments borrow by selling government bonds/gilts to the private sector. Bonds are a form of saving. People buy government because they assume a government bond is a safe investment. However, this assumes that inflation will remain low.

- If governments print money to pay off the national debt, inflation could rise. This increase in inflation would reduce the value of bonds.

- If inflation increases, people will not want to hold bonds because their value is falling. Therefore, the government will find it difficult to sell bonds to finance the national debt. They will have to pay higher interest rates to attract investors.

- If the government print too much money and inflation get out of hand, investors will not trust the government and it will be hard for the government to borrow anything at all.

- Therefore, printing money could create more problems than it solves.

- See also: Printing money and national debt

Hyperinflation in Germany during the 1920s

Inflation was so bad in Germany that money became worthless. Here a child is using money as a toy. Money was used as wallpaper and to make kites. Towards the end of 1923, so much money was needed, people had to carry it about in wheelbarrows. You hear stories of people stealing the wheelbarrow, but leaving the money.

Printing more money is exactly what Weimar Germany did in 1922. To meet Allied reparations, they printed more money; this caused the hyperinflation of the 1920s. The hyperinflation led to the collapse of the economy.

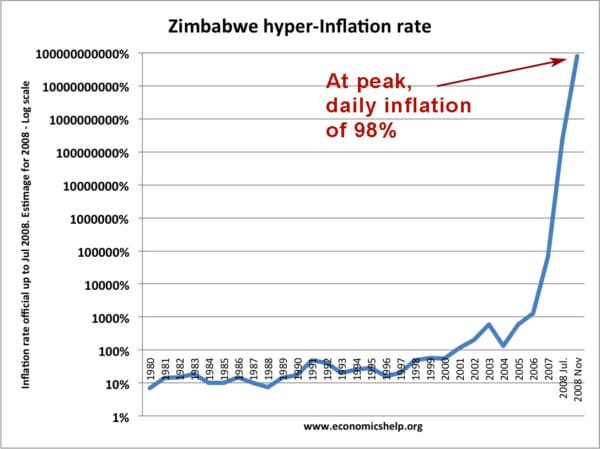

Hyperinflation also occurred in Zimbabwe in the 2000s.

Printing money and the value of a currency

If a country prints money and creates inflation, then there will be a decline in the value of the currency.

- Suppose inflation in Germany is 100%, and inflation in the UK is 0%.

- This means German prices are doubling compared to the UK.

- You will need twice as much German currency to buy the same quantity of goods.

- The purchasing power of the German currency is declining, therefore the value of mark will fall on exchange rates.

- See also: Printing money and the exchange rate

Value of one German Mark to US Dollar 1922-23

Hyperinflation in Germany causes a rapid fall in the value of the German mark to the dollar.

In a period of hyperinflation, investors will try and buy a stable foreign currency because that will hold its value much better.

Real Life example of Money Supply and Inflation

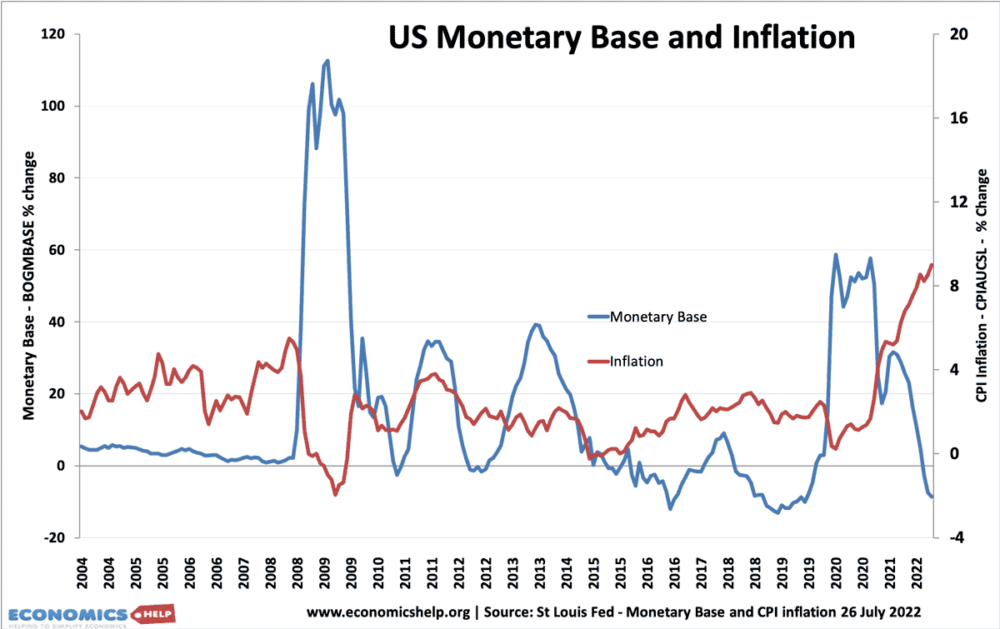

In a recession, with periods of deflation, it is possible to increase the money supply without causing inflation.

This is because the money supply depends not just on the monetary base, but also the velocity of circulation and the willingness of banks to lend. For example, if there is a sharp fall in transactions (velocity of circulation) then it may be necessary to print money to avoid deflation,

In the liquidity trap of 2008-2012, the Federal reserve pursued quantitative easing (increasing the monetary base) but this only had a minimal impact on underlying inflation. This is because although banks saw an increase in their reserves, they were reluctant to increase bank lending.

However, if a Central Bank pursued quantitative easing (increasing the money supply) during a normal period of economic activity then it would cause inflation. In 2020, quantitative easing was pursued and a year later, inflation in the US rose. (though inflation also rose due to higher oil prices)

Related

Last updated: 26th July 2022, Tejvan Pettinger, www.economicshelp.org, Oxford, UK

Books seem like a bad example to use. Most people can afford all the books that they need – an increase in money supply won’t lead them to buy more books. The only good example that I can think of is housing which is of course in very short supply. And as we have seen, house price inflation has been massive. If you don’t think that saving money will allow you to buy a house there is indeed little incentive to save. But house price inflation doesn’t lead to your “menu costs” or discouraging industry to invest.

Your statement “Governments borrow by selling government bonds/gilts to the private sector.” seems misleading when the Bank of England owns one third of all UK government debt.

Hey!! You commented on my 18th birthday!!!

It isn’t misleading.The central Bank would buy and sell as well as,domestic corporations,foreign entities and government owned entities….

It is argued that if an economy is operating at full capacity injecting more money will cause inflation. Broadly speaking this is true. But what if the economy is operating at below capacity and an injection of monetary stimulus did not increase output and reduce unemployment. But …

‘Stagflation’ occurs when a period of low growth spare capacity along with high unemployment does not necessarily respond to an increased injection of money and is very difficult to overcome using orthodox methods.

@frances lee, this is the best analogy I’ve read. The key phrase is “if an economy is operating at full capacity.” This pandemic certainly has redefined the law of supply and demand.

(An attempt to explain money and its printing in simple terms)

To understand the concept of money, let us keep the term “money” aside for a while and understand what money does for us in a society.

In this attempt, first lets revisit the concept of barter system.

Let us assume Mr. X need a service or product from Mr. Y. For this Mr. Y must puts his affords, his resources and his time to deliver it to Mr. X. In return Mr. Y need something which has a value for his inputs (his resources, affords, time etc.,) which he can trade within the society to fulfill his requirements. So either Mr. X can give him something that the society accepts as a standard or something that can hold the value of Mr. Y’s input.

So now this comes down to the point that Mr. X needs to provide something to Mr. Y that the society accepts has a standard. So, acceptance of the society is the key here.

Society is a large group of individuals interdependent on each other. So, lets analyze and understand this “acceptance” of the society.

To understand this let us consider a scenario. In this scenario we assume that society has a common requirement (like a bridge, a road, etc.,). It requires inputs in terms of service and products from different members of the society to fulfill this requirement. In return the society must provide these individuals services or products for their needs.

So now let us assume that the elected heads of the society, on behalf of the society, decides that the society will provide in return of their services or products, with vouchers bearing the value of their services. And these vouchers will be valued by the society to trade among the society for any future transactions. These vouchers, in practical, is a contract/agreement/promise between the society and the individual who receive it. So this voucher acts as a legal contract between the individual and the society. Based on this, vouchers are now printed and authorized by the heads of the society. And based on these vouchers the work begins (work on the common requirement of the society as mentioned above) and the vouchers are issued to those involved members in stages of completion and proportional to their work or service. This way the work (infrastructural) is completed in the society. Now the society gets an asset which will improve the life of its members and the contributing individuals get purchase power or trade power within this society through these vouchers. Now because there are new vouchers in the society, which the society values, economic activity will be stimulated. These vouchers are now transferred within the society to receive service or products from the society. This kicks off economic activity in the society.

Going forward if this concept is applied to all new common requirements of the society ex., infrastructure requirements, then this approach will kick start new economic activities in the society which will help grow the economy and provide enough employment and through it improve the life of the members of the society.

The limitation in this concept is the knowledge and resources of the society and that its members possess, to achieve their common requirement. If in any case they need the assistance from outside the society, then they need to provide those outsider with a value or valuable that the outsider can accept in return for their services.

But that is only when the society needs an outside help. Otherwise this concept gives enough strength for the society to have economic and social growth for its members within a reasonable limit.

Now replace this voucher with the concept of currency or money. So this is the point I try to make. With the acceptance of the society, if the elected heads can print currency to meet the common requirements of the society, then it will improve the society has a whole.

Main Points.

1. Money is a legal contract between the Society/Country and the individual who acquired (bears) it.

2. This new/additional money shall only be printed against major infrastructure project or similar requirements, not simply to distribute in public. Means, money is only printed against an ASSET BUILD.

3. Its not the printed currency that is important, but the contribution of each individual to the society/country. For this printed money and its assumed value just plays the role of a motivation or reward.

Additional points:

No Society can be termed poor or rich just based on the availability of money in the society. A Society can be rich, or poor based on the resources it possess. It can be its natural resource, it’s human resource, etc. In this the most valuable resource is human resource, which when interacts with the natural resources around him wisely and intelligently can find solutions to problems and make this world a better place.

What if the government initiate a lot of infrastructure project?

Does that stimulate the economy since the government is now allowed to print money based on how many asset they build ?

I like this.. good explanation

The Bank of Mauritius will print Rs60 billion to finance Government activities. This was announced by the Governor of the Bank on 26th of May. This is done amidst the Covid-19 crisis. Now it looks like many people working in the tourist industry would either lose jobs or work with a reduction in their salary. In the meantime the Us dollar was Rs 36.50 has now become Rs 40.50. I wonder what will happen next.

Too much negativity, if a developing country like Fiji wanted to invest in capital expenditure for eg making 10 bridges for 50 million dollars and hired NZ companies to make them why would printing 50 million and paying NZ companies cause a problem? Will the NZ company increase the price of bridges NO!!!!!! m sure tenders will be signed prior. Atleast the taxpayers money wont be used. Better infrastructure.

Its about where the printed money is used that matters.

“Better infrastructure.

Its about where the printed money is used that matters.”

This is one of the most important point. If the printed money is used to fuel agriculture, small & medium businesses, infra and the ‘debt’ element is spread over a number of such asset building activities, rather than only Housing and the stock market (which is what is happening in most countries), then we will be able to deal with recessions in a much better manner.

Instead we see printed money mostly invested into housing and real estate and gambling (stock markets) so the rich can get richer and fund their political partners in government.

Not saying that Real Estate/Stocks are bad, but if majority of printed money goes into that, you will always have debts that keep on swelling.

@Shawn I want to know too!

Printing money in big valuta as US dollars en Euro’s is parasiting on the rest of the world!

I feel very happy to share my great and wonderful testimony with everyone on this site..: I was married for 4 years to my husband and all of a sudden another woman came into the picture. He started hating me and he was abusive. but i still loved him with all my heart and wanted him at all costs…. He filed for divorce and my whole life was turning apart and i didn’t know what to do, he moved out of the house and abandoned me and the kids… My very close friend told me about trying spiritual means to get my husband back and introduced me to a spell caster so I decided to try it. although i didn’t believe in all those things then when he did the special prayers and spell, after 2 days, my husband came back and was pleading that he had realized his mistakes I just couldn’t believe it, anyway we are back together now and we are happy. In case anyone needs help here is his email address; [email protected] or connect him through website https://dragumbasolutioncent.wixsite.com/spell

Inflation is going to happen in San Francisco housing now and higher in 2021

There are no lots to build on

You need to tear down to build new

Contractors are raising prices sky high

Why talk about book prices

Even Amazon forgot about book

Say hello to Germany 1921

Fast Eddie SF

After reading first couple of sentences you will realise that economy is NOT a science 😉 It is a bunch of silly slogans

“in normal times” ha!

The problem with the economic orthodoxy is they think we are all rational actors. There is no normal. Models don’t match reality and the quantity theory of money is irrelevant to the real world.

Hi can I know how would increase in inflation would reduce the value of bonds ?

Our money today is a means of population control. It is backed by nothing tangible and exists because of network effects. The central bank IS the government.

It’s absurd to think the government is actually in debt to the CB (which is the government), denominated in money that the CB has the exclusive rights to make, with no upper limit on how much they can create.

I’m sick of this game they play to justify cutting benefits and increasing taxes to keep us in line.

One day in the not too distant future the veil will be removed and the CB & Treasury will be one and the same.

Earn > Save Cash Aggressively > Invest > Claim your freedom.

3EDZI

“Printing money doesn’t always cause inflation”

Exactly, all these keywords: “if” and “could” in this article. I think the Government would only do it to keep the economy the way it is cause they don’t want the poor to get more money than they deserve or the middle class to join ranks with the rich people. Therefore, will never change even if more money was produced.

Also, using books as an example was probably a poor choice. Perhaps, use TVs, computers, the latest iPhone, as a better example since technology items are in high demand.

I have seldom read so much nonsense on a web page. Money is created electronically by governments, talk of increased printing of money is nonesense. The UK government has increased its “debt” by over a trillion £’s in the last 12 years and yet inflation is 0.7%, if that doesn’t tell you that your theory is wrong I guess nothing will. It is a shortage of goods to buy that causes inflation not “printing money”

What’s the inflation rate now?