Readers Comment. Why doesn’t the Bank of England just print the money instead of borrowing the money?

Printing more money doesn’t increase economic output – it only increases the amount of cash circulating in the economy. If more money is printed, consumers are able to demand more goods, but if firms have still the same amount of goods, they will respond by putting up prices. In a simplified model, printing money will just cause inflation.

Video explanation

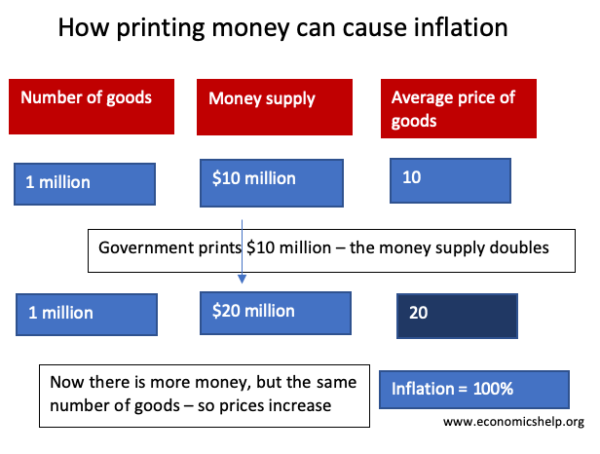

How printing money causes inflation – Example

- Suppose an economy produces $10 million worth of goods; e.g. 1 million books at $10 each. At this time the money supply will be $10 million.

- If the government doubled the money supply, we would still have 1 million books, but people have more money. Demand for books would rise, and in response to higher demand, firms would push up prices.

- The most likely scenario is that if the money supply were doubled, we would have 1 million books sold at $20. The economy is now worth $20 million rather than $10 million. But, the number of goods is exactly the same.

- We can say that the increase in GDP is a money illusion. – True you have more money, but if everything is more expensive, you are not any better off.

- In this simple model, printing more money has made goods more expensive, but hasn’t changed the quantity of goods.

Doubling the money supply, whilst output stays the same, leads to a doubling in price and inflation rate of 100%

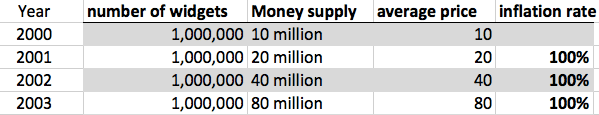

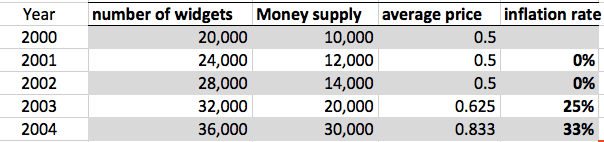

- From the year 2000 to 2001, the money supply increases without inflation.

- In 2001, the money supply increases 20%, and the number of widgets increases 20%. Therefore, prices stay the same – the extra money is matched by an equivalent rise in the money supply.

- It is only in 2003 when the money supply increases from 14,000 to 20,000 that the money supply increases at a faster rate than output and we start to get rising prices.

Problems of inflation

Why is inflation such a problem?

- Fall in value of savings. If people have cash savings, then inflation will erode the value of their savings. £1 million marks in 1921 was a lot. But, due to inflation, two years later, your savings would have become worthless. High inflation can also reduce the incentive to save.

- Menu costs. If inflation is very high, then it becomes harder to make transactions. Prices frequently change. Firms have to spend more on changing price lists. In the hyperinflation of Germany, prices rose so rapidly that people used to get paid twice a day. If you didn’t buy bread straight away, it would become too expensive, and this is destabilising for the economy.

- Uncertainty and confusion. High inflation creates uncertainty. Periods of high inflation discourage firms from investing and can lead to lower economic growth.

Printing money and national debt

Governments borrow by selling government bonds/gilts to the private sector. Bonds are a form of saving. People buy government because they assume a government bond is a safe investment. However, this assumes that inflation will remain low.

- If governments print money to pay off the national debt, inflation could rise. This increase in inflation would reduce the value of bonds.

- If inflation increases, people will not want to hold bonds because their value is falling. Therefore, the government will find it difficult to sell bonds to finance the national debt. They will have to pay higher interest rates to attract investors.

- If the government print too much money and inflation get out of hand, investors will not trust the government and it will be hard for the government to borrow anything at all.

- Therefore, printing money could create more problems than it solves.

- See also: Printing money and national debt

Hyperinflation in Germany during the 1920s

Inflation was so bad in Germany that money became worthless. Here a child is using money as a toy. Money was used as wallpaper and to make kites. Towards the end of 1923, so much money was needed, people had to carry it about in wheelbarrows. You hear stories of people stealing the wheelbarrow, but leaving the money.

Printing more money is exactly what Weimar Germany did in 1922. To meet Allied reparations, they printed more money; this caused the hyperinflation of the 1920s. The hyperinflation led to the collapse of the economy.

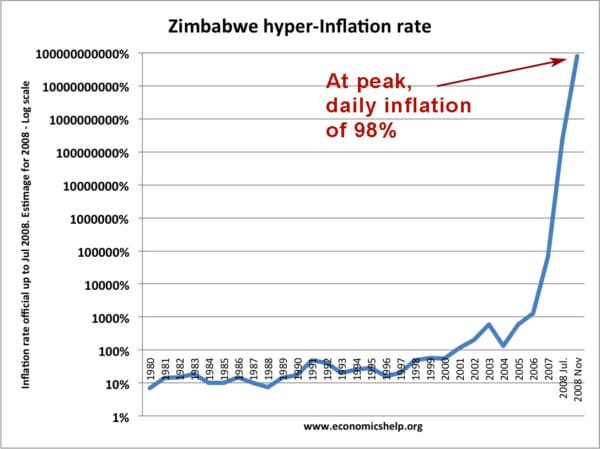

Hyperinflation also occurred in Zimbabwe in the 2000s.

Printing money and the value of a currency

If a country prints money and creates inflation, then there will be a decline in the value of the currency.

- Suppose inflation in Germany is 100%, and inflation in the UK is 0%.

- This means German prices are doubling compared to the UK.

- You will need twice as much German currency to buy the same quantity of goods.

- The purchasing power of the German currency is declining, therefore the value of mark will fall on exchange rates.

- See also: Printing money and the exchange rate

Value of one German Mark to US Dollar 1922-23

Hyperinflation in Germany causes a rapid fall in the value of the German mark to the dollar.

In a period of hyperinflation, investors will try and buy a stable foreign currency because that will hold its value much better.

Real Life example of Money Supply and Inflation

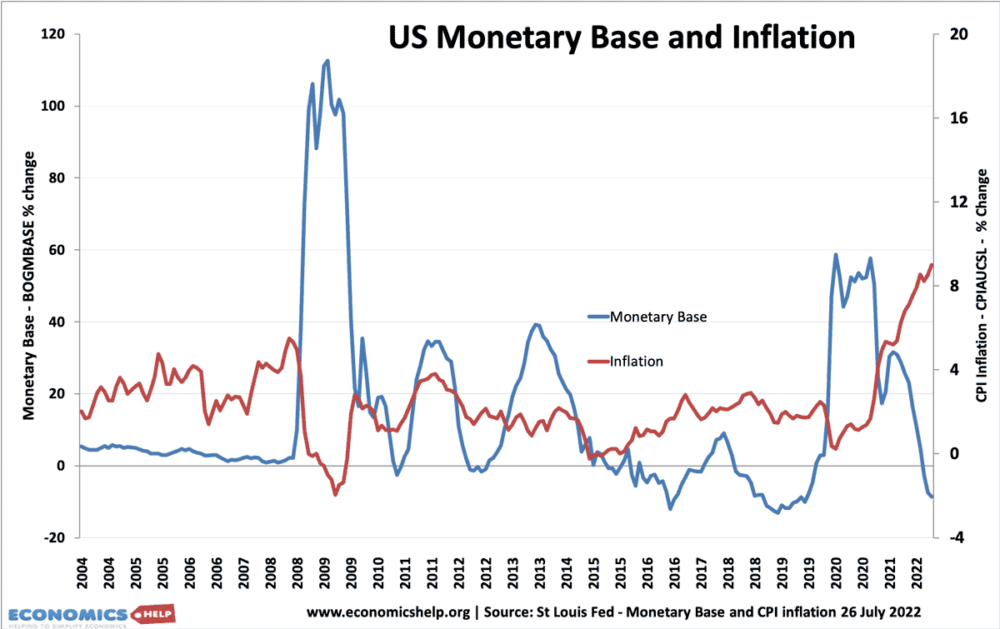

In a recession, with periods of deflation, it is possible to increase the money supply without causing inflation.

This is because the money supply depends not just on the monetary base, but also the velocity of circulation and the willingness of banks to lend. For example, if there is a sharp fall in transactions (velocity of circulation) then it may be necessary to print money to avoid deflation,

In the liquidity trap of 2008-2012, the Federal reserve pursued quantitative easing (increasing the monetary base) but this only had a minimal impact on underlying inflation. This is because although banks saw an increase in their reserves, they were reluctant to increase bank lending.

However, if a Central Bank pursued quantitative easing (increasing the money supply) during a normal period of economic activity then it would cause inflation. In 2020, quantitative easing was pursued and a year later, inflation in the US rose. (though inflation also rose due to higher oil prices)

Related

Last updated: 26th July 2022, Tejvan Pettinger, www.economicshelp.org, Oxford, UK

If govt prints money and use it to buy imports. The imported goods are used as free raw materials to produce cheap goods some of which are exported. The lower inflation (due to cheaper goods) will boost the exports and counter the downward pressure on currency caused from imports in the first place. It feels like a free lunch.

Thoughts?

Printing money will devalue the currency so imports become more expensive. – not cheaper.

The money won’t get devalued if it is used for exports.

Think about it this way..

Maybe the government borrows 500m dollars for importation of ambulances.

Why don’t it just print those monies and use it to import those stuff.

At least the printed money is out of the country and prices wouldn’t necessarily go up.

And maybe it can reduce it’s national debt.

I understand that printing more money would cause that currency circulation in the world economy to increase and devalue, but i think it wouldn’t have a major effect if the government introduces policies that would actually cause people outside the country to demand the currency more.

Example is very good tourism policies and investment

But when we import or export things and use printed money like you say,,The problem with that is we will have to make payment in US dollars so of course we will buy dollar meaning exchange money causing shortage of dollars in country and money back to community causing inflation and let’s say for the argument sake the country is able to make payment in their own currency for instance Rupee for export,, So money went out of the country and you bought some services.

But the problem is that money is bound to come back as those companies will take money and exchange in their country resulting money back to country causing inflation again

My point is the money went out of country cannot be used in their countries so eventually will be back to country once exchanges elsewhere.

If the money is used to pay for imports, the transaction would have been made in dollars. Lets assume payment was in rupees. In that case the exporter will have rupees which we will have to use. The only way he can use it is spend it in India or else where which will basically increase the currency supply & drive inflation. It does not matter where the money is spent.

Money with which you buy imports will again return to you by the same country as the country purchases your products. Just as the case in Iran when the USA imposed sanctions on it. India bought oil from Iran with Indian currency in exchange they bought our agriculture products. So in either way, the money which you print is again getting into the market which makes it surplus indirectly causing higher demand ultimately leading to inflation.

If I need to but imports in FX, then printing money locally will simply mean that I will have to pay the FX for more expensive. The good here is the FX which does not cause direct inflation but devaluation

The imports are in USD and as per my understanding other than US no other country can print the dollars whereas any country can print its own currency so to import they need to use their foreign reserves that’s USD so printing local currency will aid in inflation only

I’m in Seattle and here the housing prices have double in the last four years in many parts of the city. In fact it seems housing prices have gone up at least 50% all over the state. Is this due to the Fed and quantitative easing policy of injecting 100s of billions of money into the US economy? In spite of the rapid rise in housing prices salaries have remained nearly the same as they were four years ago except the minimum wage has gone from $8 per hour to $16 per hour. I don’t own a home and am wondering if I should buy at this time or just move to another country?

Bekaar hai yai Sara don’t see this

Printing money does not cause broad inflation because production costs keep going down, thanks to technology. Excess money goes to Real Estate, Stocks, and eventually gold. Don’t know how this ends in the long term.

In the long term it ends in broad inflation, just like it has every time printing more money has been put forward as the solution before. Read about the Weimar republic in the 1920s. Printing money was seen as the only way to pay the war reparations they were responsible for. Within a few years the money was totally worthless. People would get paid and run out right away to try to by bread. If they waited until the next day the price of bread went up and they couldn’t afford it. Read about the problems in the Roman empire during the forth century. Same deal the government was stamping out currency buy the ton. Things got so bad that for a while Roman currency was not accepted in wide areas inside the empire. Simply printing more money is a strategy that leads straight to massive inflation. It has happened repeatedly in the past and will have the same effect in the future.

I don’t believe it, Print more money Period. Everyone should get a Monthly Check, Less starving People, More Production to accommodate increase sales, More Wallmarts, more Jobs because working will still give you a Salary, thus spending more, Poorer will spend, Food, incentives to create their own Business, more money in Circulation doesn’t increase inflation, Inflation is caused by the working wanting Higher wages because of Products being inflated because of Greed and Profits due to Banks controlling the Outcome

Stimulus packages like we are seeing in the US and now also in Australia. This is new additional money printed and created digitally by the oligarch-owned financial institutions.

The problem I see is that it;

1. money cost almost nothing to create (made by the private oligarchs either printed or by a few keyboard strokes)

2. it is sold at full bank note value to our governments treasury (the citizens) to repay with interest

3. this increases national debt, scarcity and inflation.

Solution is:

1. create money and give it to where it is needed ie., as a basic wage for all to live (shelter, food, clothing), to make free all medical, dental, education – so this money circulates to needed infrastructure and industry

2. people are then able to have time be healthy, study and become more valuable contributors to society

3. Cap prices of all basic living things and gradually increase to standard of products and services and in-so doing the standard of living for all.

This is exactly what I’ve been trying to tell people – government just need a firm hand to guide and police the hand outs etc, we are technology advanced now there would easily be systems they can put in place to regulate how the money is spent by the individuals and contain the ‘inflation’ by the supplier

Agreed. If the velocity and supply of money goes down because 30% are not working then you print that amount fo money and give to those individuals..

The problem is you incur debt when you print money to balance the book.

This does not need to happen. The UN creats money and gives it to Individual govts as a percentage of their GDP. This is placed into individual account.s.

Would it not be better for the govt to print money instead of borrowing it,

especially where you have a depressed economy with large unemployment,

the extra money targeted properly could boost economic output without causing inflation without any debt to the country !

Doesn’t this seem logical ?

The value of currency is based on the country’s assets/wealth and it’s health. If more assets are acquired, such as finding more oil, gold, uranium or other precious reserves, then the currency value increases. This also applies to technologies, goods and services manufactured or acquired by such a country. All those things have physical worth, and therefore add wealth and strength to the currency. The value of the currency can be affected negatively if the country’s physical medical health is poor.

Some countries find reserves and keep quite. When the time arises where that country may profit from a spike in the currency value. The information is released. This allows such a country to devalue other country’s currency so they may take advantage of other countries.

Sometimes currency values are just an illusion due to a delayed reaction while it stabilizes after a major global economic upheaval, or countries printing more money adds to the illusion of higher currency values. The illusion continues until the rest of the world finds out. then the currency value stabilizes to a real value, generally lowering the country’s advertised currency value.

Banks are very good at creating illusions of currency value. For instance they can have lot’s of debts that are unpaid from lending money. The banks then sell those debts for real money to debt collection agencies. There are laws that state that a bank can lend more money than they have, and therefore create debt. In the end the Banks make money from imaginary money and sell it for real money. The debts that are being sold and resold eventually find there way to some poor individual who is stuck with it thinking it was an investment.

A debt is just a contract that enables the “creditor” holding such contract, to claim the money stated on the debt. If debts are sold for half price, they make an attractive incentive for the owners of the debt to make money by collecting such debt. This is a dangerous way to run finances as it can cause stock market crashes, and global financial disaster such as we have seen in the past.

Read John Maynard Keynes for a real economics lesson.

The present economic system of the consumerist society we live in is mostly a ponzi scheme, its time for a reset…everything that has a beginning has an end.

Its time for a new system and a new society (not an economy)

Id rather live in a society that is portrayed in Star trek not Blade runner

“Heaven is place with no advertising”

Yes, I agree – utopian maybe but a fiction attempting to address human greed.

As stated in the above article:

“…in response to higher demand, firms would push up prices.”

Why?

This, in economic terms, has never been adequately explained to me. It’s as if there is an invisible, irresistible, never to be argued with force that just compels firms/business owners to increase prices, “We can’t help it, it’s not our fault!”

I don’t buy it – it’s just plain greed.

Toilet paper anyone?

It is greed. The goal of private companies is to maximize the money they receive from the service and goods they offer.

Just making up an example here, if a hypothetical telephone manufacturing company has 500 phones to sell, it wants to get as much money out of that limited 500 that it can. If the company knows that it`s clientele consists of 250 people with 500$ each and another 250 people with 5000$ each, it could decide to sell each phone for 100$ ,which would represent 25% of the amount available to the first group to spend, it could then sell all 500 phones for a total return of 50000$.

Alternatively it could decide to sell the same phones for 1000$ each, doing this would price out the first group, but that 1000$ now represents 25% of the available money of the second group, which they would be just as willing to spend as if they were part of the first group in the previous scenario since it`s the same relative amount. In this scenario the company would sell 250 phones for a total revenu of 250000$.

This hypothical scenario help illustrate why when a private entity knows that the money supply of its customers is elevated, it can be beneficial for it to raise the prices of its good or services.

If there is more demand for books in a smaller amount of time, this puts pressure on the entire supply chain. So manufacturing those books, transporting them, stocking them etc… requires hiring more people, or paying workers overtime. As a result, you have to raise the prices to support the labour required. I don’t see it all being about greed.

hmm i dont understand. so lets say im a country like malaysia now

https://www.businessinsider.sg/malaysia-unveils-rm250-billion-economic-stimulus-package-to-help-nation-cope-with-covid-19-fallout

which apparently is in debt of over 1trillion RM but yet is able to unveil such a big budget. can this country just print 250 billion and support this budget?

Assuming these people dont spend these monies and hoard it inside their bank accounts or spend as per normal as like when they are still drawing their salaries, albeit lesser. will this impact the economy? since their isn’t an over excessive amount of the said currency flowing around?

So by that rationale, one million books at $10,$10 million dollars, why would the price go up? Seems like a pretty stupid thing to me. why not just make more books?

It can be difficult to increase output

Then let me ask you another question. If the reason why you are selling those books is to make money, why go through the trouble of making more when you can just increase the price of those books?

If you decide to make another million books, you now have double the number of books to sell, but your number of potential customers didn’t change. Do you see how this can be a problem?

It is much easier to increase the price of your goods than to find new customers to try and sell to. So when you increase the money supply of your current customers by giving them more money to spend (printing more money) it becomes a no brainer to just increase the price of your books by the same relative amount as the increase of money given to your customers.

Say your customers start out with 100$ to spend, your 10$ book costs them 10% of their available supply. If the government comes in and decides to give them all 100$ more, they now all have 200$ to spend. If you raise the price of your books to 20$ would they become reluctant to buy it? More than likely they would pay those extra 10$ because the book still costs 10% of their available money supply.

Dollars are international base currency so far that dollars in overseas countries are seen as safe investments. Then printing money without increase of productivity will mean that dollars will go out of US to pay for goods they (US) do not have. But dollars will have to be reinvested in US which means that more and more of US debt will be under foreign hands. And the real assets of US will have to non US owners. Then average Americans won’t be as rich, the others will be not as poor. And then how long can American investments be attractive?

The answer to counter inflation and still provide stimulus packages for the poor, vulnerable and emergency cases may be Crypto Currency.

Seperate to the main economy if used right then Block chain can help manage temporary to long term crisis.

Surely a government like the UK can inject more money by printing it, into the economy for targeted things. Pay of dept, build hospitals, pay living wage etc. If this is controlled properly then it could work. Many of the posts on here speak about extreme cases where a wheel barrow of money was required for a loaf. In a controlled process it will not get out of hand, except where those in finance cause it to!. They are scared in case their bubble bursts and they become joe public like most of us. It is more to do with the share of money in the country, not how much is circulating. An extra £500m printed for the NHS can be controlled surely!

Good exchange of ideas, Keynesian theory etc. I have a decent grasp of micro and macro economics, however, am not well-read on the subject of currency exchange (or just don’t remember from college).

My question for Tejvan is about our current crisis. We know from the 08/09 financial crisis that banks won’t necessarily distribute money that the government loans/gives in the U.S. and other countries. The direct payments to U.S. citizens which started a few weeks ago in addition to the increase in unemployment benefits will certainly be an interesting study in 12 months. With so many capital intensive industries around the world in serious “free fall”, what is your view on global inflation if world governments have to continually inject money for the next 4-6 quarters? What role does the IMF and World Bank play in attempting to “balance” such unprecedented government intervention? With each passing day, it seems that we are in for 20%-25% unemployment levels in a year or less without repeated government support. This support may take the form of “welfare/public assistance”, forgivable loans to corporations and concepts yet to be discovered and tested. Is the CV-19 pandemic calling for world governments to print money, sensibly distribute, track and keep inflation in check? Thanks

I think the main goal is to stave off serious depression and deflation. Printing money will be desirable because output will fall so much. It would require a lot of money printed before inflation is an issue.