Readers Comment. Why doesn’t the Bank of England just print the money instead of borrowing the money?

Printing more money doesn’t increase economic output – it only increases the amount of cash circulating in the economy. If more money is printed, consumers are able to demand more goods, but if firms have still the same amount of goods, they will respond by putting up prices. In a simplified model, printing money will just cause inflation.

Video explanation

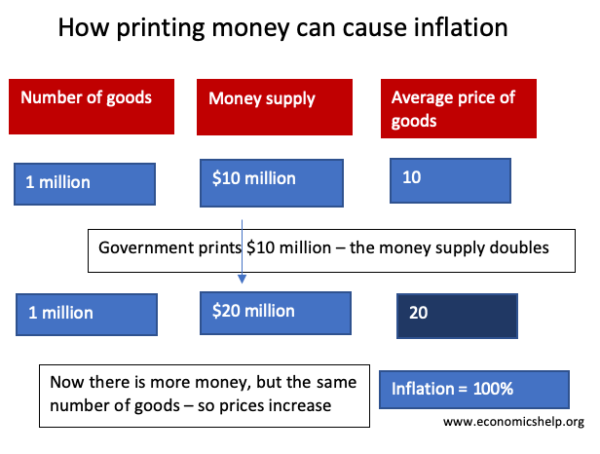

How printing money causes inflation – Example

- Suppose an economy produces $10 million worth of goods; e.g. 1 million books at $10 each. At this time the money supply will be $10 million.

- If the government doubled the money supply, we would still have 1 million books, but people have more money. Demand for books would rise, and in response to higher demand, firms would push up prices.

- The most likely scenario is that if the money supply were doubled, we would have 1 million books sold at $20. The economy is now worth $20 million rather than $10 million. But, the number of goods is exactly the same.

- We can say that the increase in GDP is a money illusion. – True you have more money, but if everything is more expensive, you are not any better off.

- In this simple model, printing more money has made goods more expensive, but hasn’t changed the quantity of goods.

Doubling the money supply, whilst output stays the same, leads to a doubling in price and inflation rate of 100%

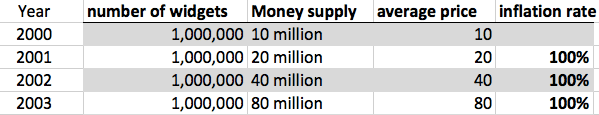

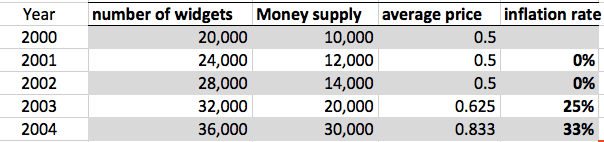

- From the year 2000 to 2001, the money supply increases without inflation.

- In 2001, the money supply increases 20%, and the number of widgets increases 20%. Therefore, prices stay the same – the extra money is matched by an equivalent rise in the money supply.

- It is only in 2003 when the money supply increases from 14,000 to 20,000 that the money supply increases at a faster rate than output and we start to get rising prices.

Problems of inflation

Why is inflation such a problem?

- Fall in value of savings. If people have cash savings, then inflation will erode the value of their savings. £1 million marks in 1921 was a lot. But, due to inflation, two years later, your savings would have become worthless. High inflation can also reduce the incentive to save.

- Menu costs. If inflation is very high, then it becomes harder to make transactions. Prices frequently change. Firms have to spend more on changing price lists. In the hyperinflation of Germany, prices rose so rapidly that people used to get paid twice a day. If you didn’t buy bread straight away, it would become too expensive, and this is destabilising for the economy.

- Uncertainty and confusion. High inflation creates uncertainty. Periods of high inflation discourage firms from investing and can lead to lower economic growth.

Printing money and national debt

Governments borrow by selling government bonds/gilts to the private sector. Bonds are a form of saving. People buy government because they assume a government bond is a safe investment. However, this assumes that inflation will remain low.

- If governments print money to pay off the national debt, inflation could rise. This increase in inflation would reduce the value of bonds.

- If inflation increases, people will not want to hold bonds because their value is falling. Therefore, the government will find it difficult to sell bonds to finance the national debt. They will have to pay higher interest rates to attract investors.

- If the government print too much money and inflation get out of hand, investors will not trust the government and it will be hard for the government to borrow anything at all.

- Therefore, printing money could create more problems than it solves.

- See also: Printing money and national debt

Hyperinflation in Germany during the 1920s

Inflation was so bad in Germany that money became worthless. Here a child is using money as a toy. Money was used as wallpaper and to make kites. Towards the end of 1923, so much money was needed, people had to carry it about in wheelbarrows. You hear stories of people stealing the wheelbarrow, but leaving the money.

Printing more money is exactly what Weimar Germany did in 1922. To meet Allied reparations, they printed more money; this caused the hyperinflation of the 1920s. The hyperinflation led to the collapse of the economy.

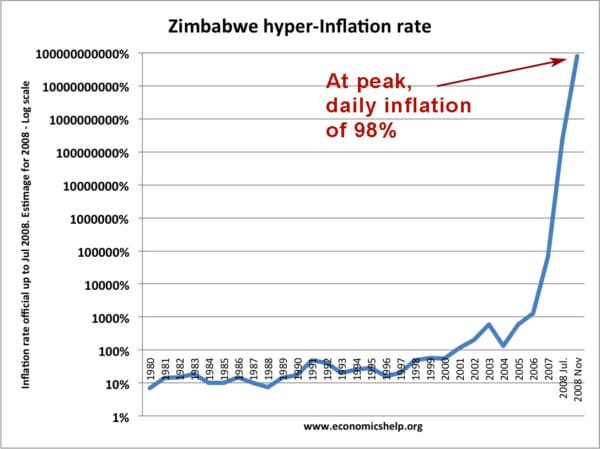

Hyperinflation also occurred in Zimbabwe in the 2000s.

Printing money and the value of a currency

If a country prints money and creates inflation, then there will be a decline in the value of the currency.

- Suppose inflation in Germany is 100%, and inflation in the UK is 0%.

- This means German prices are doubling compared to the UK.

- You will need twice as much German currency to buy the same quantity of goods.

- The purchasing power of the German currency is declining, therefore the value of mark will fall on exchange rates.

- See also: Printing money and the exchange rate

Value of one German Mark to US Dollar 1922-23

Hyperinflation in Germany causes a rapid fall in the value of the German mark to the dollar.

In a period of hyperinflation, investors will try and buy a stable foreign currency because that will hold its value much better.

Real Life example of Money Supply and Inflation

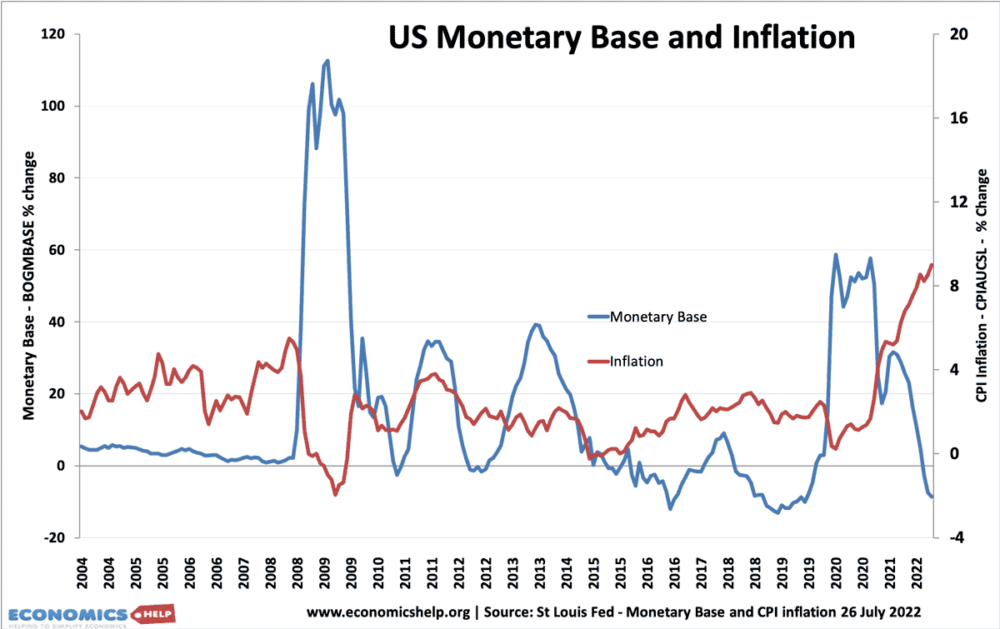

In a recession, with periods of deflation, it is possible to increase the money supply without causing inflation.

This is because the money supply depends not just on the monetary base, but also the velocity of circulation and the willingness of banks to lend. For example, if there is a sharp fall in transactions (velocity of circulation) then it may be necessary to print money to avoid deflation,

In the liquidity trap of 2008-2012, the Federal reserve pursued quantitative easing (increasing the monetary base) but this only had a minimal impact on underlying inflation. This is because although banks saw an increase in their reserves, they were reluctant to increase bank lending.

However, if a Central Bank pursued quantitative easing (increasing the money supply) during a normal period of economic activity then it would cause inflation. In 2020, quantitative easing was pursued and a year later, inflation in the US rose. (though inflation also rose due to higher oil prices)

Related

Last updated: 26th July 2022, Tejvan Pettinger, www.economicshelp.org, Oxford, UK

All of this sounds like a bunch of crap, we print money and then we borrow money, now you tell me, I make sand for the beaches around america but I also borrow sand from other countries, it doesn’t sound educated, the bottom line america stop listening to these pulpits or so economic advisors, like all of them they talk out the side of there mouth, we print up money and we can’t fix our problem and then you say inflation stop it prices would not go up and the money will be put back into the economy so all that crap you are saying is a bunch of b.s. people think about it, we print up money why borrow, because they don’t want us to ask questions.

The argument given in this article is like this:

1. ‘Printing money’ [this is actually just crediting accounts at the central bank] increases the money supply.

2. Increasing the money supply increases demand.

3. Faced with increasing demand, firms will only increase prices (inflation.)

4. Therefore, printing money causes inflation. QED.

The logic makes sense, the problem is the 1st and 3rd premises are rather contentious. I’ll start with the 3rd premise because it is the easiest to explain.

Faced with increasing demand, a profit-maximizing firm will either a) increase prices until demand = supply or b) increase production until supply = demand. With enough competition, firms will prefer b) since a slight increase in prices will drive almost all of their customers to a competitor. If one bookstore charges 10$/book and the one next door charges 8$, you won’t see 20% of customers switching, you’ll see nearly 100%. Bookstores will thus rationally order more books, so increasing demand will not just simply cause inflation (as long as machines are underutilized – i.e. there is unemployment and underemployment.)

The first premise is a bit more difficult. Any time someone lends money to the government by buying bonds, the central bank debits the bondholder’s bank and credits the government account. The government then spends that money by crediting banks and debiting it’s account. The net transaction is 0$ being created. When the government ‘prints money,’ on the other hand, it debits its account (which can overdraft indefinitely without default. Government cheques don’t bounce) and credits banks. This leaves excess reserves in the banks which they will lend out to other banks (driving the interest rate to the deposit rate, which might be 0%) or keep to back private loans. The article assumes that banks have a given amount of reserves and private entities will instantly take out loans until the bank meets its reserve ratio. That’s like saying that you will always max out your credit card.

The reality is different, though. Banks lend to whoever is credit worthy and at the end of the day make sure they have enough reserves. They do this by either borrowing from other banks or by borrowing from the central bank (i.e. having money printed for them.) So private sector demand for credit will determine the size of the money supply, not how much money is in central bank accounts (though the interest rate can affect this.)

Ultimately, the central bank prints money anyways to allow the money supply to accommodate increasing trade. So the operational reality of the government spending without issuing debt isn’t much different from spending with debt issuance, except for the fact that interest rates are driven down. The central bank can choose to control the interest rate directly by setting the deposit rate, or it can let it fall to 0% and the government could use taxation to control inflation. Using taxes to cool off the economy has the advantage that 1) it can be targeted to specific sectors and 2) the voters ultimately decide what the trade-off between standard of living and price stability should be, rather than unelected central bankers. There’s also the advantage that the economy can be allowed to grow to its full real potential without fear of having to ‘pay back’ anything.

If you want to learn more, this is called Modern Monetary Theory (MMT).

Nice, JC. Most of your comment I liked. I have trouble with: “…borrowing from the central bank (i.e. having money printed for them.)” and “private sector demand for credit will determine the size of the money supply.”

It seems to me that you are confusing money and credit. Any private sector “money” that costs interest and/or must be paid back, is CREDIT.

Any chance you would visit my blog & leave MMT links or info? What you said here is better than the hour I spent on Warren Mosler’s Dallas address. Thanks, bud.

Art

Any nation should go printing the currencies based on demand supply theory.

Value of goods worth is the equivallent of currency printing volume. Anything less or more will lead to deflation or inflation effecting the currency value.

It is like in physics “every action has a counter action”, It is like in Accounts ” every debit has a credit’. It is like in Maths “every positive number has an equivalent negative number”

At macro level, whatever we do any action will circle and end up at the origin with same level of questions again.

Philosophically speaking economic is also like the life….

….

printing new money is somewhat destructive bcz i we are nt increasing the output level then new money willl increase the prices of goods in the economy which leads to the inflation….

Money is scam plain and simple.

So why should any government borrow money when it can just print it ? Well regardless of borrowing it or printing it , it still inflates the economy that either receives the lent cash or prints the cash. However they get it , its inflation. Like a Balloon, its getting bigger. Now, you have too ask, why borrow it all when you can print it. Exactly why why WHY ? To keep you going to work and not fucking rioting in the street. Now that everyone is slowly working out that the money supply is a scam, watch them nuke everything and come up for air 12 months later. Back to reality. So now that you have realised that dumping money into an economy inflates its supply and devalues its worth, have a think about what giving 500 million dollars does to a small country if you give it AID $$$. So 50 countries donate 500 million dollars each once or twice a year to say Indonesia, no wonder their economy is worhtless , the other nations are deliberatley keeping it poor buy over inflatting its money supply in AID money.

So next time you hear on teh radio that someone donated some buck$ in AID , realise its a trick. And how exactly do they send one country Aid $$. How does America give American Dollars to Haiti when they have Haitian curency with prince pawpa printed on it. Antoehr good question ” me ” , do they type it into the IMF computer and spit out some hot haitian money. YEP !!!! Economic warfare. So anyway back to money . So does anyone else realise that China is busy printing money and just buying up fucking Europe. NOt bad for a guy that finished school at year 10 and I failed. Oh look at me Im Colonel Ghaddafi , Im going to print up some money and buy France. Whos going to stop me , how can they stop me, wait , who will stop me ? Does the IMF have and the world bank have an army ? Holy crap batman , people have been printing loads of money not backed buy anything but swiss chocolate and noodles and gone and bought up nuclear weapons and sharp point sticks , and worse still, they used credit and promised to pay us back in paper. OKay seriously, we had better print some BONDS and issue those straight away. INSERT MASSIVE LAUGH AT THE DUMB PEOPLE HERE *****

Ok…for all you people who keep making your explinations more and more complicated…

Here is the simplest explination which was always simple to start with before everyone started trying to explain the exact route a dollar travels ….

Dollars represent how much gold you have which is REALLY how much money you have. So for this example we are going to say that an apple is your gold and sliced apples are your money.

you go to the vender and get an apple…you cut it into 4 pieces. Your 4 pieces equal 1 apple. If you wanted to trade it back into the vender for another apple, how many pieces would you have to give the vender?? Right , 4 . Now suppose you cut each of those pieces in half? Now you have 8 pieces. How many pieces would you now have to trade in to get a new apple ? Right ,8.

No matter how many pieces you cut it into , that will become how many pieces it takes to trade it in for a new one.

Now, Moral = No matter how many dollars you print it still takes everyone of those dollars to equal the gold. Only way to spontainiously create more wealth in America is to create gold.

I wish i could just magic gold out of the air like certain leaderships do. Imagine if the US had to produce all the gold they had in relation to the amount of dollars floating around.. likely.. i think not.

Issuing more money causes inflation because we say it does. It’s supposed to be a cause for concern that an increase in demand will cause a decrease in availability. But that should only worry you if supply is not being kept at an artificial level in the first place, which it is, by for example international trade tariffs. There is more than one currency and each of them has to hold back on forging more money at an ever increasing speed because if everyone is rich then no one is poor. And who’s going to do the work then? The ones who want to work, of course. Moreover, if one currency end-boss issues a decree for an increase in the pool of available trade juice what’s to stop the other currency overlord to do the same? International payment processors keeping record of exchange rate fluctuations, of course. What’s to stop the world from having a million currencies? Nothing if you decide to peg your currency to another. In that way you’ll make two currencies the same currency and be right back where you started.

So let’s put this into practice: I now have a million currencies each printing a million units at a millionth of a fraction of a second. All I have to do now is move this money from the happy place in my mind to the minds of millions of other citizen’s who will the feel obliged, driven by their desire for competition, to outwit each other with my currency. It will be of the utmost importance to keep them interested.

A currency needs to be branded so that it can be cool. That is why the fading away of paper money is causing so much disloyalty amongst trade juice consumers. (They are RUNNING away from the $) No longer can you see the savior of your ideology or other symbols of high sentimental value combined with neat water marks. Now you live in a world of numbers. You don’t even know your hero’s, but trust me, they’re out there, and they’re watching 😉

Hey can anyone explain to me how does the US printing money leads to China’s inflation?

Printing money does not cause inflation once the amount printed is monitored. It does however cause a devaluation of the currency if the currency is a floating one. This is not necessarily a bad thing either because it increases exports and for export based economies like china that’s a good thing. To answer becons question, if US prints money it lowers its value against the Chinese yaun. This causes an increase in prices of Chinese goods being exported. Hence China maintains an artificially low value currency. Hope that helped.

The supplier of the answer only supplied us with half of the theory-and it’s even more complicated that that.

According to theory, the higher prices for books should encourage the printing of more of them. Now the more complicated part; when banks don’t lend, the money supply actually shrinks, lessening demand for books, causing the price of them to drop. This encourages the publishers to print fewer books. So our economy has less money and fewer books.

So how are we better off; having more books with somewhat higher prices, or having fewer books with lower prices?

If that truly were the only consideration more books or less books, it seems a locality would be better off having more books since in theory it would support more employment. Those bookmakers would spend their earnings in the locality on goods and services. Those receiving the bookmaker’s money for their goods and services would in turn buy goods and services… and so forth. I’ve heard there is a factor of 7 times, typically, before that money comes to a more restful state. The reverse would be true if demand dropped for books. Means fewer bookmakers were required to make fewer books. Things spiral down if there is no other job for the ex-bookmaker to jump over to.

However, the premise isn’t all that simple either. When higher prices attract more printing of books as mentioned. Eventually that more printing will typically over shoot demand and cause prices to drop. Being raised on the farm, you see this over the years with agricultural products. High cattle(or any other product) prices cause more people to raise them. The product supply grows and the prices come down causing some to raise less of that. Less supply causes the price to rise. All standard economics so far. But what happens to the equation when the bookmaker loses his job and can’t afford the beef even when the cycle of price is at a low? Well it means the supply/demand balance line has shifted downward. What happens when some govt weasel is handed a big bankroll and then gets his committee to allow foreign imported cattle? Shifting to another commodity more important to many because they need it drive to work and heat their homes. What if you have a lot of money and influence the media to make people believe their is a shortage of your product even though your supply is larger than ever? What happens if you can get your middle eastern monarch friends to gin up a war? Unfortunately it is very difficult to cover all aspects of the financial and monetary system without holding something constant so you don’t have to deal with its impacts on the equation.

Is printing money good or bad?

Some may ask what is wrong with printing money in hard times? My question is what is right with it?

Economics doesn’t have to be complicated at all if one could remove corruption out of the picture. How should a small town’s economic differ from that of a small family’s?

A county’s from a state’s or province’ a state from a country? They should all be managed identically to ensure solid economics. Too simplistic? Not at all. All the world’s economic problems would not have occurred and could be solved by not spending more than you have. Inflation occurs because people would rather pay more for something to get it sooner rather than save and buy it when they have the money. When banks are willing to loan most people money, there are more dollars chasing homes and home prices rise. If people waited until they could buy it for cash. Home prices wouldn’t obligate the average working man for the rest of his life. By taking the bait of a loan to get what you want now, you sacrifice your freedom. You feel you have to keep working at that crap job to make the mortgage payments and car payments and credit card payments.

Silly leaders of Countries did the same thing, they took the World Bank and/or IMF bait of money now, here have some more, so much that it will cause inflation and ruin your economy when the loans can’t be paid back. One certain way to keep the competition from another country from emerging. (Argentina some years back comes to mind) He who controls the debt makes the rules. Do you want to be ruled or free? Clearly the citizens of the usa voted in a President who wants to enslave them all. It seems the banker of the world want less freedom. It is definitely much easier to give away than to get back. Why do people not see this? That lack of debt is freedom and debt is control? I have friends who think they are getting informed by watching the TV. Yet who owns the media? It certainly isn’t the free press. Wake up world, shed your debt before its too late (maybe it is too late) or you will be slaves to an unkind master.

YESS THAT IS TRUE

from my own observation printing o money will cause inflation, because if government borrow it can repay back through taxation and other fiscal policy and the economic will stead stable but if government print money their will be nothing to repay and this will cause inflation in the country

hi..

i understand that printing currency does not solve the problem. Still

still If printed money needs to be backed by something like gold. Obviously this will put a restriction on the amount of currency to be printed. And what can this money be backed with?

Or

May be no backing up required. in that case bank is free to print as much as it want (it helps the country or not is another matter.)

Can you clear the smoke to make it clear?

Have a look at http://www.positivemoney.org.uk their videos will explain why the present system of creating money, by banks issuing it as debt, is hugely flawed and makes economies susceptible to booms and busts.