Readers Comment. Why doesn’t the Bank of England just print the money instead of borrowing the money?

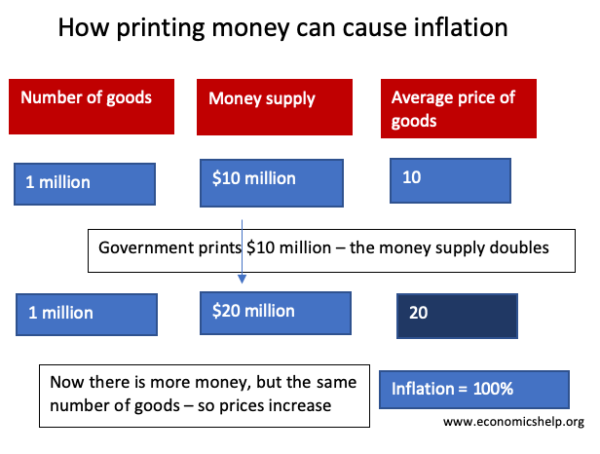

Printing more money doesn’t increase economic output – it only increases the amount of cash circulating in the economy. If more money is printed, consumers are able to demand more goods, but if firms have still the same amount of goods, they will respond by putting up prices. In a simplified model, printing money will just cause inflation.

Video explanation

How printing money causes inflation – Example

- Suppose an economy produces $10 million worth of goods; e.g. 1 million books at $10 each. At this time the money supply will be $10 million.

- If the government doubled the money supply, we would still have 1 million books, but people have more money. Demand for books would rise, and in response to higher demand, firms would push up prices.

- The most likely scenario is that if the money supply were doubled, we would have 1 million books sold at $20. The economy is now worth $20 million rather than $10 million. But, the number of goods is exactly the same.

- We can say that the increase in GDP is a money illusion. – True you have more money, but if everything is more expensive, you are not any better off.

- In this simple model, printing more money has made goods more expensive, but hasn’t changed the quantity of goods.

Doubling the money supply, whilst output stays the same, leads to a doubling in price and inflation rate of 100%

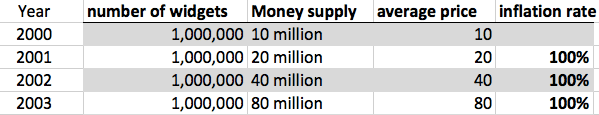

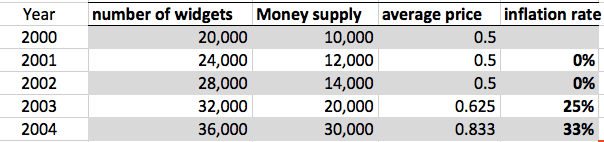

- From the year 2000 to 2001, the money supply increases without inflation.

- In 2001, the money supply increases 20%, and the number of widgets increases 20%. Therefore, prices stay the same – the extra money is matched by an equivalent rise in the money supply.

- It is only in 2003 when the money supply increases from 14,000 to 20,000 that the money supply increases at a faster rate than output and we start to get rising prices.

Problems of inflation

Why is inflation such a problem?

- Fall in value of savings. If people have cash savings, then inflation will erode the value of their savings. £1 million marks in 1921 was a lot. But, due to inflation, two years later, your savings would have become worthless. High inflation can also reduce the incentive to save.

- Menu costs. If inflation is very high, then it becomes harder to make transactions. Prices frequently change. Firms have to spend more on changing price lists. In the hyperinflation of Germany, prices rose so rapidly that people used to get paid twice a day. If you didn’t buy bread straight away, it would become too expensive, and this is destabilising for the economy.

- Uncertainty and confusion. High inflation creates uncertainty. Periods of high inflation discourage firms from investing and can lead to lower economic growth.

Printing money and national debt

Governments borrow by selling government bonds/gilts to the private sector. Bonds are a form of saving. People buy government because they assume a government bond is a safe investment. However, this assumes that inflation will remain low.

- If governments print money to pay off the national debt, inflation could rise. This increase in inflation would reduce the value of bonds.

- If inflation increases, people will not want to hold bonds because their value is falling. Therefore, the government will find it difficult to sell bonds to finance the national debt. They will have to pay higher interest rates to attract investors.

- If the government print too much money and inflation get out of hand, investors will not trust the government and it will be hard for the government to borrow anything at all.

- Therefore, printing money could create more problems than it solves.

- See also: Printing money and national debt

Hyperinflation in Germany during the 1920s

Inflation was so bad in Germany that money became worthless. Here a child is using money as a toy. Money was used as wallpaper and to make kites. Towards the end of 1923, so much money was needed, people had to carry it about in wheelbarrows. You hear stories of people stealing the wheelbarrow, but leaving the money.

Printing more money is exactly what Weimar Germany did in 1922. To meet Allied reparations, they printed more money; this caused the hyperinflation of the 1920s. The hyperinflation led to the collapse of the economy.

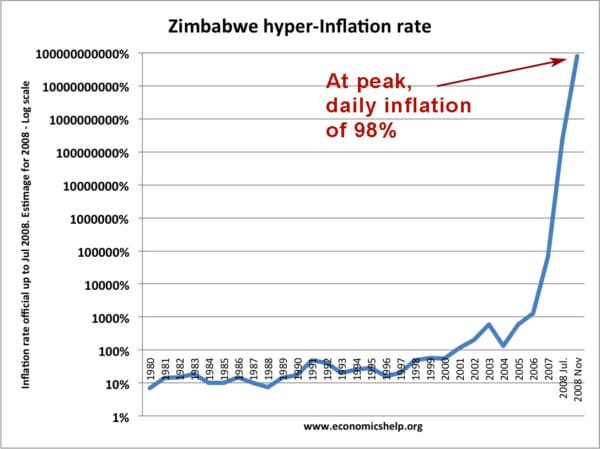

Hyperinflation also occurred in Zimbabwe in the 2000s.

Printing money and the value of a currency

If a country prints money and creates inflation, then there will be a decline in the value of the currency.

- Suppose inflation in Germany is 100%, and inflation in the UK is 0%.

- This means German prices are doubling compared to the UK.

- You will need twice as much German currency to buy the same quantity of goods.

- The purchasing power of the German currency is declining, therefore the value of mark will fall on exchange rates.

- See also: Printing money and the exchange rate

Value of one German Mark to US Dollar 1922-23

Hyperinflation in Germany causes a rapid fall in the value of the German mark to the dollar.

In a period of hyperinflation, investors will try and buy a stable foreign currency because that will hold its value much better.

Real Life example of Money Supply and Inflation

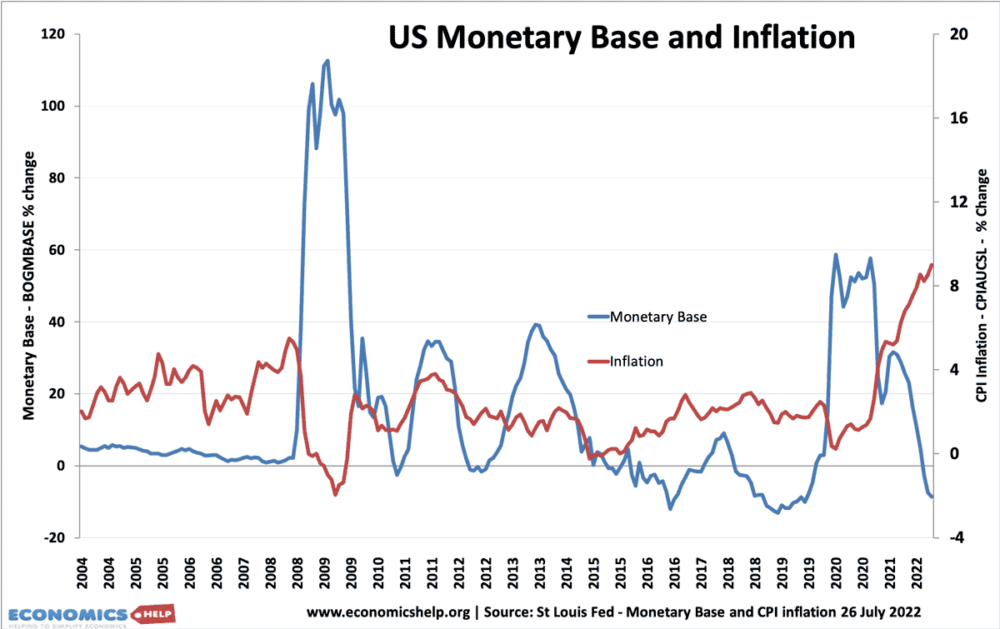

In a recession, with periods of deflation, it is possible to increase the money supply without causing inflation.

This is because the money supply depends not just on the monetary base, but also the velocity of circulation and the willingness of banks to lend. For example, if there is a sharp fall in transactions (velocity of circulation) then it may be necessary to print money to avoid deflation,

In the liquidity trap of 2008-2012, the Federal reserve pursued quantitative easing (increasing the monetary base) but this only had a minimal impact on underlying inflation. This is because although banks saw an increase in their reserves, they were reluctant to increase bank lending.

However, if a Central Bank pursued quantitative easing (increasing the money supply) during a normal period of economic activity then it would cause inflation. In 2020, quantitative easing was pursued and a year later, inflation in the US rose. (though inflation also rose due to higher oil prices)

Related

Last updated: 26th July 2022, Tejvan Pettinger, www.economicshelp.org, Oxford, UK

How is the creation of money by the government any more inflationary than the creation of money by the banks — which is what they do all the time? When my bank gives me a loan of $1,000 they don’t first check the vault to see if they have the money; they simply add it to the balance sheet. *They literally create that money out of thin air.*

When the govt wants to raise money they borrow from the banks who in turn can borrow from the government bank (a country’s central bank). So the govt is loaning money to the banks (essentially for nothing, considering the zero or near zero percent interest rates the central bank charges), only to borrow it back from them at far higher rates. Can somebody tell me why the govt shouldn’t just borrow directly from its own central bank? Not only would it cost the public far less, but the money would actually be returned to the public coffers (instead of to the financial elite). My understanding is that this was the practice in the post-war period through to the 1970s (in Canada at least – where I reside). The result was not only the paying down of the massive WW2 debt with ease but also the ushering in of the so-called golden age – the period of highest economic growth and greatest increase in economic well-being in the history of capitalism.

Can someone please tell me how the financing of public debt through the private sector is something other than a colossal scam to enrich the wealthy elite at the expense of the rest of us? Cuz it sure looks that way…..

Hii guys…

Thanks to all…. i got to know many things… but all got mixed up….

ok your all forgetting one major thing that affects every one in the country.

you all if lucky will retire and you pay into a pension fund correct?

now did you know that 15 years ago a pension pot of £100,000 would buy you a pension of £15000 per year.

now that same pension pot will only give you £5000!

all due to “qe” or for the older people “printing money” strange isnt it they change the name to confuse the youngsters.

also those that are about to retire and say in 10 years time pensions will be so badly affected that the young YOU! will have to pay via tax,s so that the elders can live!.

NOW REMEMBER THIS ITS NOT THE PENSIONERS FAULT ITS YOUR FOR ALLOWING THIS TO HAPPEN!

Read (Lesa vel) Ford og Edison

*

http://www.ismennt.is/not/jonasg/jg/jg06/debtslavery/debtslavery.html

In December 1921, the American industrialist Henry Ford and the inventor Thomas Edison

visited the Muscle Shoals nitrate and water power projects near Florence, Alabama.

****

They used the opportunity to articulate at length upon their alternative money theories,

which were published in 2 reports which appeared in The New York Times

on December 4, 1921 and December 6, 1921.

Read (Lesa vel) Ford og Edison

*

“All of the great public works cost more than twice the actual cost, on that account.

*

Under the present system of doing business we simply add 120 to 150 per cent, to the stated cost.”

*

(samtals 100%+(120% eða 150%)) það er 220% eða 250% kostnaður. jg)

*

“But here is the point:

*

If our nation can issue a dollar bond, it can issue a dollar bill.

*

The element that makes the bond good makes the bill good.

*

The difference between the bond and the bill is

*

***

that the bond lets the money brokers collect twice the amount of the bond

***

*

and an additional 20 per cent, whereas the currency pays nobody but

*

those who directly contribute to Muscle Shoals in some useful way.”

*

http://www.ismennt.is/not/jonasg/jg/jg06/debtslavery/debtslavery.html

It sure is convenient for banks that we should believe that governments (we the people) have to barrow their own money from private banks at interest. The threat of inflation exists solely as a volitional act by the merchant and ruling classes. They must make an observation of what their neighbors have to adjust their prices. Inflation occurs in order to maintain economic polarity. Some people will not be happy unless they have much more then everybody else.

If the argument that the relative numerical change in circulating currency is what is responsible for inflationary pressures is correct, then what necessitates that governments print currencies, give them to private banks for very little, and then barrow that money from those private banks at interest?

Governments (the US in this case) do not have to barrow their own currencies from private banks to avoid inflation. In addition, we do not need private banks telling us what the value of our currencies are. The government (we the people) can simply spend the currency directly both a public works or as low interest loans to natural born citizens. State banks would run the show and private banks should follow their lead.

In any case, high levels of economic polarity is the problem. Most of the “top” money takers (they couldn’t possibly earn it) are not exceptional people and therefore do not deserve to have so much more then the rest of everyone else. They hunger only for dominion over others. This is an impure goal and they are almost certain to pursue impure actions. There are far too many talented people who are subjected to the whims of a few power brokers.

There could be an infinite amount of currency in circulation and people could simply not raise their prices and not hoard. People at large are promoting the financial elite’s objectives by maintaining inflation. The more you struggle to be above your neighbor, the more you resent them and their stuff, the more the financial elite maintain.

I believe that government printing money is a money transfer: the government prints money, then it can pay to build a bridge or to pay social benefits or to pay for education. Inflation will surely occur, which is equivalent to a flat rate tax on everybody (who owns money). But the people that received directly the money from the government wil benefit. If done properly, it could be a transfer from the rich to the poor.

On the other hand, borrowing money at interest will benefit the lender because of the interest paid.

By the way, I don’t think it’s true that printing money is necessarily inflationary. If the new money is used by the government to invest on projects that make the economy grow, then it will not be inflationary.

In summary, I believe that forcing the government to borrow rather than to print money is a way for the rich to protect their money (and in fact, benefit from their accumulated money by receiving interest from money lent to the government). That’s all.

somehow confused becouse i think if the gorverment print more money it wil cause the money also to loss the value, how about that?

I think that is called socialism.

By the way, the articles says that “We can say that the increase in GDP is a money illusion. – True you have more money, but if everything is more expensive, you are not any better off.”

But then you are not worse off either. Inflation is not a problem. The problem is that merchants find very difficult to assign prices to their goods, because prices are changing so rapidly. But this is only a problem when hyperinflation happens (like in Weimar Germany). Hyperinflation is not always the case, though, and mild inflation is not particularly bad for the economy (read “23 things they don’t tell you about capitalism”).

Again, inflation caused by printing money is a way for the government to get money at the expense of everybody else. But if the money is employed for the public good, most people will benefit from it, except the rich, who don’t need benefits from the government. That is why governments are forced to borrow money, in order to protect the rich.

i understand that printing more money can cause inflation, but remember that lack of money or not enough money begets unimaginable poverty, how about printing enough money to buy machinery to work the land

how about building enough hospitals to care for the sick

how about housing project, and the list goes on and on..

guys let’s take the bull by the horn, printing too much could be a problem, but printing enough could solve a lot of problems

@ NEWGUY.100% , I Agree.

I don’t care if Dollar is Devalued, If homeless people have found a place to stay indoor.

If hungry people are fed.

If anything that benefits the people are done.

Let us use maneuver Money,not Money maneuver’s us

In the US, we already have enough machines to till the land, and there is already plenty of housing and lots of hospitals. What you’re proposing is a nation-wide welfare program were everyone gets everything for free. How well does that work in other countries? Not well at all. America wouldn’t be any different.

Anyway, the USA is already 1/2 welfare state, with half the citizens not paying any taxes at all. I’m in that below poverty income bracket myself, but if I ever hope to get out of it, this country needs to stay away from ideas like yours.

In a utopian society such as the one you describe, where the government provides everything to its citizens, who would bother working? There wouldn’t be enough doctors and nurses to man the hospitals, or enough builders to build the free housing. Farmers won’t bother tilling the land, either, if the common expectation is that the government will just hand us everything.

In that scenario, our Amercian spirit will die. We’ll no longer have the drive to make this country better for future generations. Instead, we’ll just stand around waiting for government hand outs and start riots and kill each other when the hand outs run out. We’ll become helpless, lazy, and irresponsible.

Do want to live in that kind of country? I don’t.

Utopian fantasies are just that: a fantasy. Prosperity only happens with hard work and smart choices. This country already has all that it needs. The problems we have are caused by distribution problems, laziness, ignorance, greed, and power struggles. Get rid of those things, and we’ll get as close to Utopia as any society can be.

Look printing money is really bad. If printing money would work then we could just print a train load of it and then we all just stop working and lay up and spend. That can not work. Who is going to grow our food? Money that is only brought into existence by labor will work. The printing will not.

The economic action, money printing, is key in different economic states.

That would lead to inflation indeed.

But, the money so printed has to be used in the production of necessary goods in a bid to halt inflation. That would really mean a no or meager inflation.

I learn t that even if money is printed but used in the creation of necessity goods, such spending even by a government, wouldn’t lead to inflation.

Eg: £100 is printed, and it is loaned to a bank and that bank in turn provides a loan for productive purpose, and if the production is the best one, that means a no or meager even if new money is printed!

Don’t you agree?

Couldnt the goverment just print money and keep it to themselves to pay off their national debt?

YES I AGREE ALLTHE ASPECTS DICUSSED HERE

The problem with inflation is two fold, if you allow too much inflation you will be un-competitive with the likes of China etc. this will mean more loss of employment.

To say even a meager amount of inflation is acceptable is nonsense. Inflation hits the lowest paid the hardest and it is these people who are the last to benefit from wage rises.

I agree with you as it is everything is going up in price all the time as well. As I see it we should stop the price increases because it is the greedy rich business owners that really gain take places like Woolworths and of course comet all just cover ups to make more money how can a company such as these go into administration yes bankruptcy close all their stores so they don’t have to pay wages anymore then trade online game have done it as it is if you become bankrupt you cannot even have a bank account and you cannot run a business for I think it is at least 5 years and you certainly cannot trade under them names so whose committing a crime and look at how much money they are making game as well they have done the same and our banks and law and government let them get away with it if it was us that were bankrupt it would be not a chance you can have a loan or an account and you couldn’t run a business look into it that’s your capitalists at work

You’re wrong, in selecting just one side of the equation for evaluation.

Like all economic commentators you have missed the other side of the equation and what action, it does not have to be the government, can be taken to adjust the balances to counter inflationary action of increased money supply.

That is the basis of my new work.