Readers Comment. Why doesn’t the Bank of England just print the money instead of borrowing the money?

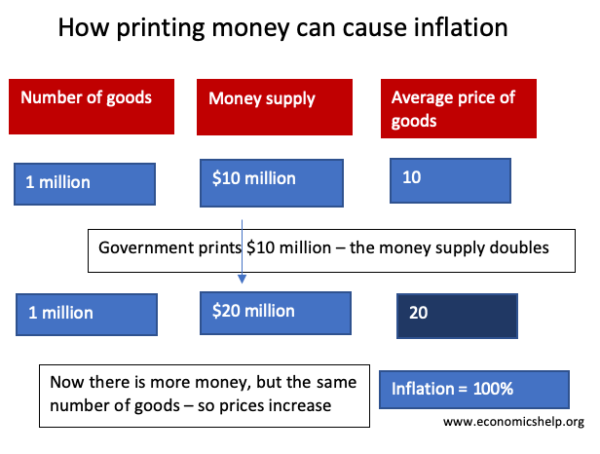

Printing more money doesn’t increase economic output – it only increases the amount of cash circulating in the economy. If more money is printed, consumers are able to demand more goods, but if firms have still the same amount of goods, they will respond by putting up prices. In a simplified model, printing money will just cause inflation.

Video explanation

How printing money causes inflation – Example

- Suppose an economy produces $10 million worth of goods; e.g. 1 million books at $10 each. At this time the money supply will be $10 million.

- If the government doubled the money supply, we would still have 1 million books, but people have more money. Demand for books would rise, and in response to higher demand, firms would push up prices.

- The most likely scenario is that if the money supply were doubled, we would have 1 million books sold at $20. The economy is now worth $20 million rather than $10 million. But, the number of goods is exactly the same.

- We can say that the increase in GDP is a money illusion. – True you have more money, but if everything is more expensive, you are not any better off.

- In this simple model, printing more money has made goods more expensive, but hasn’t changed the quantity of goods.

Doubling the money supply, whilst output stays the same, leads to a doubling in price and inflation rate of 100%

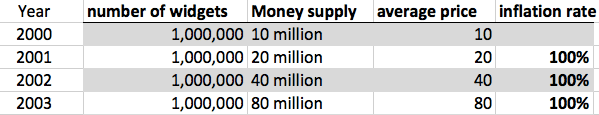

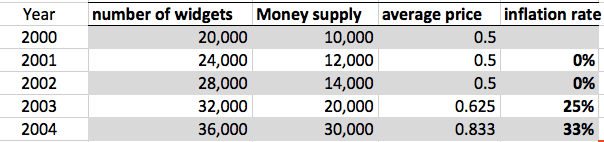

- From the year 2000 to 2001, the money supply increases without inflation.

- In 2001, the money supply increases 20%, and the number of widgets increases 20%. Therefore, prices stay the same – the extra money is matched by an equivalent rise in the money supply.

- It is only in 2003 when the money supply increases from 14,000 to 20,000 that the money supply increases at a faster rate than output and we start to get rising prices.

Problems of inflation

Why is inflation such a problem?

- Fall in value of savings. If people have cash savings, then inflation will erode the value of their savings. £1 million marks in 1921 was a lot. But, due to inflation, two years later, your savings would have become worthless. High inflation can also reduce the incentive to save.

- Menu costs. If inflation is very high, then it becomes harder to make transactions. Prices frequently change. Firms have to spend more on changing price lists. In the hyperinflation of Germany, prices rose so rapidly that people used to get paid twice a day. If you didn’t buy bread straight away, it would become too expensive, and this is destabilising for the economy.

- Uncertainty and confusion. High inflation creates uncertainty. Periods of high inflation discourage firms from investing and can lead to lower economic growth.

Printing money and national debt

Governments borrow by selling government bonds/gilts to the private sector. Bonds are a form of saving. People buy government because they assume a government bond is a safe investment. However, this assumes that inflation will remain low.

- If governments print money to pay off the national debt, inflation could rise. This increase in inflation would reduce the value of bonds.

- If inflation increases, people will not want to hold bonds because their value is falling. Therefore, the government will find it difficult to sell bonds to finance the national debt. They will have to pay higher interest rates to attract investors.

- If the government print too much money and inflation get out of hand, investors will not trust the government and it will be hard for the government to borrow anything at all.

- Therefore, printing money could create more problems than it solves.

- See also: Printing money and national debt

Hyperinflation in Germany during the 1920s

Inflation was so bad in Germany that money became worthless. Here a child is using money as a toy. Money was used as wallpaper and to make kites. Towards the end of 1923, so much money was needed, people had to carry it about in wheelbarrows. You hear stories of people stealing the wheelbarrow, but leaving the money.

Printing more money is exactly what Weimar Germany did in 1922. To meet Allied reparations, they printed more money; this caused the hyperinflation of the 1920s. The hyperinflation led to the collapse of the economy.

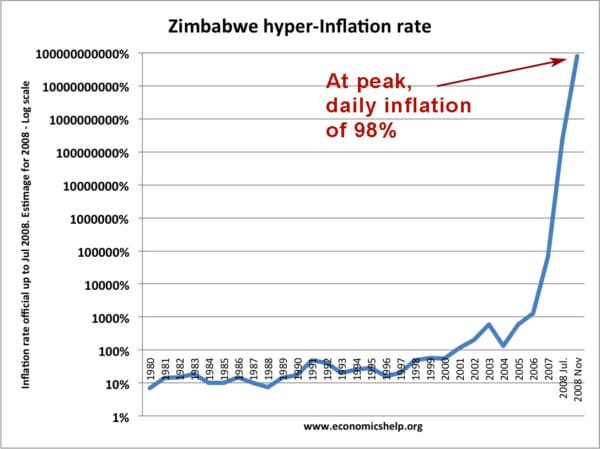

Hyperinflation also occurred in Zimbabwe in the 2000s.

Printing money and the value of a currency

If a country prints money and creates inflation, then there will be a decline in the value of the currency.

- Suppose inflation in Germany is 100%, and inflation in the UK is 0%.

- This means German prices are doubling compared to the UK.

- You will need twice as much German currency to buy the same quantity of goods.

- The purchasing power of the German currency is declining, therefore the value of mark will fall on exchange rates.

- See also: Printing money and the exchange rate

Value of one German Mark to US Dollar 1922-23

Hyperinflation in Germany causes a rapid fall in the value of the German mark to the dollar.

In a period of hyperinflation, investors will try and buy a stable foreign currency because that will hold its value much better.

Real Life example of Money Supply and Inflation

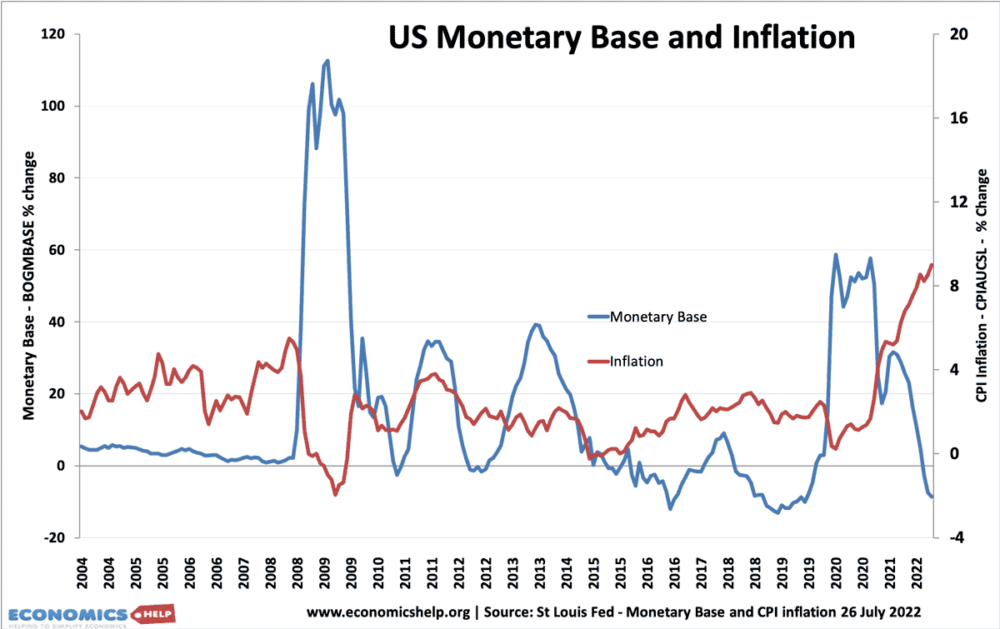

In a recession, with periods of deflation, it is possible to increase the money supply without causing inflation.

This is because the money supply depends not just on the monetary base, but also the velocity of circulation and the willingness of banks to lend. For example, if there is a sharp fall in transactions (velocity of circulation) then it may be necessary to print money to avoid deflation,

In the liquidity trap of 2008-2012, the Federal reserve pursued quantitative easing (increasing the monetary base) but this only had a minimal impact on underlying inflation. This is because although banks saw an increase in their reserves, they were reluctant to increase bank lending.

However, if a Central Bank pursued quantitative easing (increasing the money supply) during a normal period of economic activity then it would cause inflation. In 2020, quantitative easing was pursued and a year later, inflation in the US rose. (though inflation also rose due to higher oil prices)

Related

Last updated: 26th July 2022, Tejvan Pettinger, www.economicshelp.org, Oxford, UK

An other problem is keeping the books! The pun is intended.

In your first example model, the book stores and the citizens suddenly loose books. This is tangible wealth lost, in addition to prices rising. The books are lost by the citizens by czars buying the books. If the money supply doubled, and the prices doubled, half the books could be purchased by the czars. The czars buy tangible things with that printed currency. Tangible wealth is lost by the human and business sectors of the economy.

seriously. why couldn’t they just do this, but in a different way??? this article is only looking at one point of perspective and that is if the government prints sooo much money to the point money is value less. why don’t they just print some where it would be given to the homeless (I see much in cities such as LA) so they could have shelter, and some decent food? they don’t have to increase money for everyone, but the ones who are suffering and truly need it? yea its unfair to the rest of the US but at least there aren’t any getting sick OR ATACKKING anyone (saw it from a news a while ago, it was horrible cause he was ripping the victim’s eyes out urgh) print some money to help schools, charity, and any other kinds of programs that helps others. or to pay off part of that fat load of debt that US has gotten. or is all of this against the law.

Printing money is nothing more than counterfeiting. It is supply and demand. If I have one apple and 1000 people wanting apples then my apples would sell for a very high price. But if I have 1000 apples and only one person wants an apples then my apples are not worth much. So why would this not apply to money? It does apply to money. The more you print the less it is worth. The Fed has driven interest rates to near zero so the interest on our debt will not eat us alive. What is that doing to a person on a fixed income? It is robbing them. Same thing with inflation. Inflation kills a person on a fixed income. Think the Fed cares? No.

Printing money will eventually destroy our economy and our currency. Problem is, this is all the Fed has left. They have already pulled all of the rabbits out of the hat and printing money is the last rabbit.

“if I have 1000 apples and only one person wants an apples then my apples are not worth much”

This would be why you print money.

By giving people more money via printing you are increasing the number of people who can then purchase a apple from you.

It’s all about balance between supply and demand, printing money isn’t bad but the judgement of the people doing it can be.

If the Fed buys assets at a price above their ‘true’ value as I believe it did in 2009 and as I believe the ECB is going to do with OMT, then the central bank will just hold the asset to maturity, collecting interest income in the process. The point is, unless there is a default no one sees any transfer of income from the central bank to the bank. The Fed and the ECB can claim without anyone being able to definitely prove otherwise that they bought the assets at a fair price and that no transfer of income occurred.

But, of course, the Fed is also saying that it has lowered interest rates via lower risk premia and shifted private portfolio preferences. To me, this logic is prima facie evidence that the Fed wants to artificially impact asset prices, the ne result of which can only be a gain for private agents that would otherwise not exist.

What on earth are you saying here ?

We don’t need the voodoo of economics. Obama will save us by printing mass amounts of money from thin air.

If a country has 1000 money units, and the government prints another 1000 units, the value of a money unit will be halved. But the number of units has been doubled, so globally nothing happens!!

This is a simplistic assessment on a number of counts.

Firstly, a government would never want to “double” the supply of money in the economy. We are talking here about whether it is possible for a government to print enough money to cover its deficit, and therefore avoid national debt, and the crippling interest payments those debts incur over time. Even in the past four years, when government spending has rocketed due to the bank bailouts, the deficit as a percentage of M in your equation (generally considered to be M2) was still only 10%. Historically it has been closer to 2/3%, which is an entirely acceptable rate of inflation assuming V and Q remain constant.

The problem is that V and Q are not constant. The velocity circulation of money decreases during recessionary cycles, which means that M can be increased more without any change to P. That is Keynesian economics, that governments should increase spending during recessionary cycles. Also Q is not constant. The example you have given above is the Friedman “drop dollar bills from the sky” example, which is used specifically to inflate an economy i.e. to make inflation in a deflationary cycle. More likely would be that a government would use its spending to finance public works, i.e. creating employment (which would decrease unemployment and therefore lessen benefits payments and reduce the need in later years for more spending) and as you say, increasing demand in the economy. But this is where you get it most wrong. Historically, increases in demand do not lead to an increase in prices. They in fact lead to an increase in output as competitors come into the market in order to profit from the increases in demand. This in fact lowers prices. As prices are lowered, output increases even more as demand increases, and the velocity of money increases due to increased transactions in the economy, balancing the equation again.

There is zero reason why governments printing money would lead to inflation provided that governments used the increases for public works projects that paid the national average wage for such work. In fact, governments printing money and using it finance large scale public works could in fact control inflation much better than the current banking system. Of course the power could be abused, but at least we would have the ability to vote out the abusers, whereas we have no power to vote out the bankers who have abused their power so egregiously and caused a massive deflationary cycle combined with an explosion in government and deficit spending.

what if the government print more money, but doesn’t allow the prices to go up even if there is high demand? everyone will still make money and it will incentive others to create business to supply the high demand, or will give the opportunity to other business to sell more, as there will be no other choice for consumers than to get the brands or services that are a available.

In a normal economy (ie., not a recessionary environment, but near full employment) the money supply can only be increased to the extent that we have the productive capacity to meet the increased demand that money would create . If we just print money and have more money chasing the same amount of goods and services, the price must go up (i.e., $10 chasing 10 widgets = $1 per widget, but $20 chasing 10 widgets = $2 per widget). If the government were to impose price controls, either a black market will develop or there will be shortages. As you noted, production could be increased to meet increasing demand, but the money supply can only be increased to the point that production can be increased to meet it. The government can’t control production, it can only print the amount of money necessary to keep prices level given the level of production that exists.

Right now we are not at full employment, so by increasing the money supply the government is trying to stimulate demand and hence, production. It’s helping, but only slowly and very unevenly. But there is also a risk that if demand picks up too fast relative to production, the fed will need to reverse course and either slow the increase or actually reduce the money supply or inflation could get out of control. It really is a fine balancing act, and not as simple as it might seem.

Angela, When a capitalism government can control pricing? You need to have a basic understanding of economic, which seems you lack, to make comments on this topic

why doesn’t the uk secretly print US dollars? that way we can get goods in without damaging our own currency.

You are a very smart man, George. There was nobody in the UK could think of this before…If the US currency can be copied then you will have real money and fake money mixed and it will make the US currency …. VALUELESS.

Vey smart George, Very Smart. Your education level probably just a hair better than 1st grade.

actually that’s a good idea. let’s do it.

The author of the page claims: “The reason is that printing more money doesn’t increase economic output in any way – it merely causes inflation.”

A flawed claim. Only true, if you create masses of it, and give it away with nothing much in return.

If gov prints money against labour, it does increase economic output. For example, if gov prints the money to pay wages to gov workers and build infrastructure.

And further: money is constantly created without any economic output. Banks loan money against PROMISES to pay it back. However, often these promises cannot be kept, and people/businesses/countries get debted. Part of this is because of the system debts some people in anyway as it creates less money than debt, part of it because people just fail. And in addition, “funny money” is created all the time, papers, that the crerators claim have value, but do not. It is probably our biggest bubble waiting to burst.

And further: If the issuer of the money, can regulate the amounts of money in circulation, like for example government with taxation, there should be no inflation any greater than with current rate of money supply increase.

And further: the idea of money is not to create economic output. The idea of money is to make it easier to exchange labour. Money is a means of payment. It is labour that creates welfare and wealth, not money.

Hence, the idea is to get people make labour. And hopefully, labour that benefits the society. If government issued money

The dollar is not real money…it is only currency. The only reason why it has any value is because we have all decided to give it value. This article also fails to address the fact that the dollar is the world’s reserve currency. Which means whenever we print more dollars, the worlds reserves lose value. When reserves lose value…their exports become more expensive. The only way to counter this is to print more of your own currency to cancel out the effect. So when the US prints money…so must the world lest their exports become to expensive and cause a depression.

How about you print a load of money – set the inflation rate and make sure that everybody sticks to rate of inflation/by making this the law – and then the price of a book will by law will only be able to go up by the amount of inflation therefore the book will not cost double and there will still be more money to go around, why set an inflation rate anyway no one sticks to it, every day you go into the shop everything has gone up by way more than inflation