Readers Question: what are the policies that UK are using for the recovery of its economy?

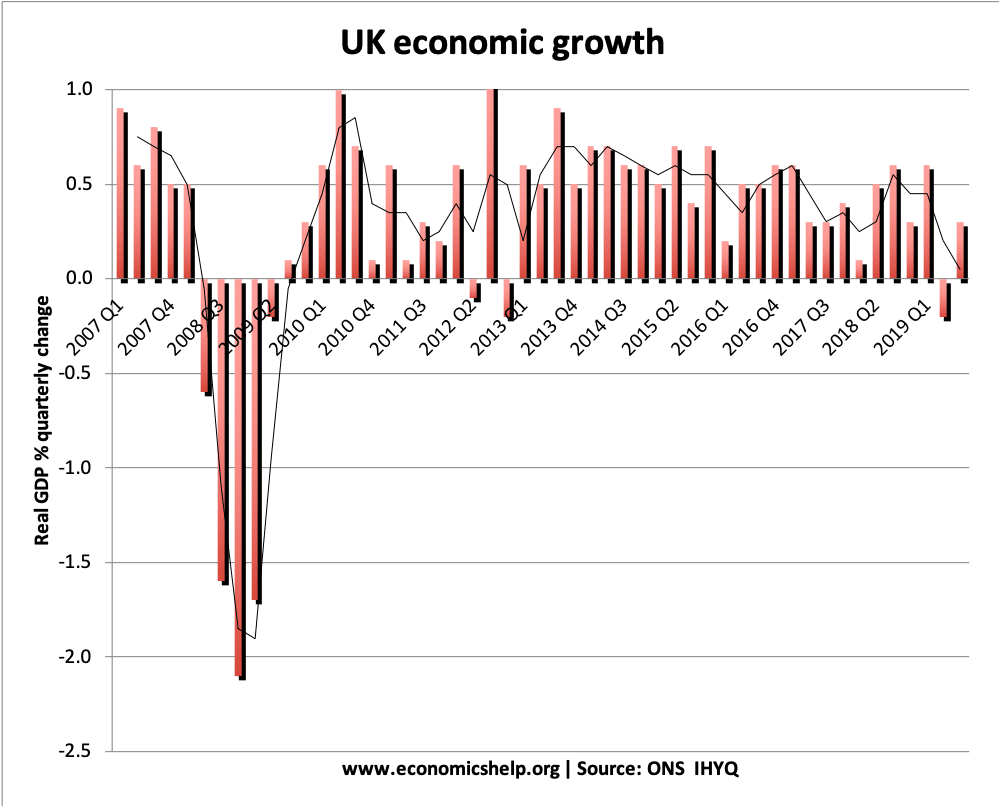

Since 2010, it is has seemed the government doesn’t really have a policy for economic recovery. The burden of recovery has fallen more on the Bank of England and monetary policy. – zero interest rates, quantitative easing, and allowing the depreciation of the Pound.

Fiscal policy has been the opposite of countercyclical since 2010. This means the government has sought to reduce the deficit through cutting government spending or, at least, reducing the growth of spending. In particular, public sector investment was cut. A few years ago, there was a brief attempt to argue that this deficit reduction strategy would help ‘improve confidence’. But, really the opposite occurred – confidence fell, with householders concerned about job losses.

Since 2012, the government has announced a reversal of its previous cuts to public sector investment. The government have announced investment of £28 billion to be spent on improving roads between 2014 to 2020 – including enough cash to resurface 21,000 miles – and that it would support £30 billion in rail investments. It is hoping that increasing public sector investment will create economic growth because:

- It is some positive news about trying to boost growth rather than the unrelenting talk of austerity post 2010.

- It is hoped that public sector investment (roads / railways) will help improve Britain’s creaking infrastructure and provide a supply side boost to the economy in the long run.

However, the decision to increase public sector investment in the next few years has been offset by the attempts to reduce public sector spending in other departments. Overall the fiscal situation will remain tight, with public spending squeezed on many fronts. The government still place great importance on reducing the size of the budget deficit.

In evaluation, the UK has avoided the much more painful austerity we’ve seen on the continent. The government are not pursuing expansionary fiscal policy, but spending is being maintained – it is not been savagely cut like Portugal or Italy. Whether you would call this a policy for economic recovery or a policy for avoiding a recession is a matter of opinion.

Monetary policy

With fiscal policy providing little comfort to the economy, the burden on recovery has fallen on monetary policy and the Bank of England.

The problem is that the Bank of England cut interest rates to 0.5% in March 2009. When this interest rate cut failed to create a strong economic recovery, they could not do any more with this traditional monetary instrument. Therefore, the Bank of England looked towards other ‘unconventional forms’ of monetary policy. In particular, they engaged in Quantitative easing – increasing the money supply to buy government bonds – hoping to lower bond yields and increase the money supply.

The impact of quantitative easing was disappointing, though some estimates suggests the recession could have been slightly deeper without it.

In recent months, the Bank has focused on trying to directly improve conditions for small businesses. Q.E. was very general and the extra money tended to lead to higher bank reserves, with little impact on actual bank lending. Funding for lending has been a Bank of England backed scheme which has sought to reduce the cost of bank lending to business – by enabling banks to finance loans at low cost.

Whether it is funding for lending or other factors, there has been a fall in bank rates (especially mortgage rates). This offers some hope that business may find it easier to access bank loans and this could improve investment. However, investment has been very poor.

Another policy the Bank might claim is that they have been willing to tolerate a higher inflation rate. In the recession, inflation has often increased above the government’s target of 2% due to cost-push factors. However, rather than try and keep inflation low, they have tolerated inflation and maintained monetary easing. If they had been stricter about keeping inflation low, monetary policy might have been reversed (like the ECB)

Exchange rate

This is not really a policy. But, as a consequence of quantitative easing and other factors, the Pound has weakened since the start of the recession. This should provide a boost to domestic demand as exports are cheaper and consumers are discouraged from buying imports.

Again, the impact of depreciation has been disappointing because export growth has been held back by a recession in Europe. But, if the UK had been in Euro, the recession would almost certainly have been more difficult to overcome.

Housing Market

Britain’s recent nascent recovery has tended to come from the old favourites – higher consumer spending. The housing market is showing signs of recovery, with rising house prices. In the last budget, the government announced help for home-buyers to get a mortgage.

This has been criticised for creating unbalanced growth and merely repeating the experience of previous housing booms and busts, but in the short term, rising house prices will boost wealth, confidence and spending.

Related

It’s very rare that I spot mistakes on this excellent blog, but the above article says,”Fiscal policy has been counter – cyclical since 2010. This means the government has sought to reduce the deficit through cutting government spending….”

Counter cyclical fiscal policy consists of INCREASING the deficit in a recession doesn’t it?

Thanks Ralph. Well spotted. I think I was planning on saying fiscal policy was counter (counter cyclical) i.e. the opposite of counter cyclical. Perhaps there is a more elegant way of saying it.