Readers Question: Would a cap on house prices work?

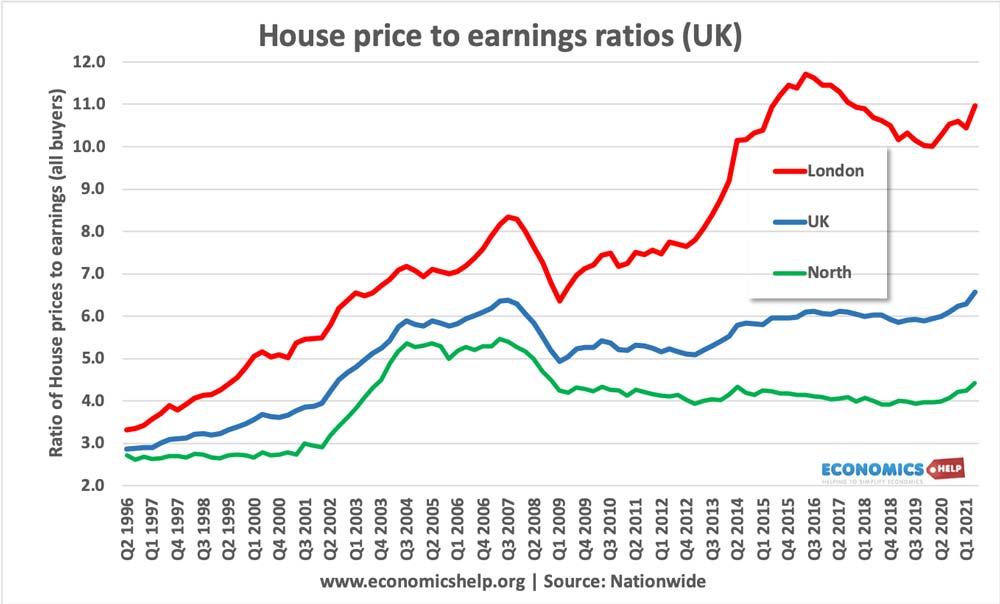

Despite the recession and credit crunch, UK house prices continue to rise. (See: Why are UK house prices so high?) This has caused record levels of house price to income multiples. For homebuyers in London, house prices are approaching a record seven times average earnings. Understandably many feel house prices are already too expensive, and there is a strong case for trying to limit future house price increases.

For example, the Royal Institution of Chartered Surveyors have suggested that the Bank of England impose a cap of 5% a year on house price growth. (Independent link)

Firstly, how would a house price cap work?

The Bank of England cannot influence supply in the short term. Therefore, they would have to influence demand through credit controls (e.g. limiting amount of mortgages) and possibly interest rates. Both have drawbacks and limitations.

1. Interest Rates

In theory, The Bank of England could use interest rates as a tool to influence house prices. A rise in interest rates, in the current climate, would inevitably cause an end to the house price growth as mortgages would become more expensive. Mortgage payments are a large % of disposable income, therefore any change in interest rates will have a significant impact on reducing housing affordability and housing demand.

However, the use of interest rates to control house prices has significant drawbacks.

- The main aim of monetary policy is the control of inflation and economic growth. If the Bank is asked to also target house prices, it would mean the Bank of England are placed in a difficult position. To prevent house price rises in London, may require higher interest rates. But, at this stage in the economy cycle, a small increase in interest rates could sniff out the recovery. Interest rates can only achieve so much.

- Time lags. A change in interest rates will take time to feed through into the housing market. Ideally, the Bank of England would anticipate house price changes, but in practise this is difficult to do. Few would have predicted the strong rise in house prices in recent years. If the Bank did increase interest rates to affect demand for houses and mortgages, it could easily get it wrong. By, the time mortgage rates rose, house prices may be falling anyway.

2. Mortgage regulation

A more realistic option is for the Bank of England to adopt new regulation which makes mortgage lending scarcer. If house prices are rising too quickly, the Bank of England could introduce controls which limit the availability of mortgages. This could involve insisting on certain size of deposits or limiting the size of income multiples.

In the boom period of 2000-2007, this kind of regulation may have been able to play a role in limiting the housing boom. But that was a period where income multiples rose to record levels (upto 5 times income), there was also a growth in self-certified mortgages and 100% mortgages.

In the current climate, mortgage lending is already quite scarce; banks are being quite conservative about mortgage lending. There is no current evidence of a return to the extravagant mortgage lending of the early 2000s.

Missing the Fundamental Problem

- Limitations on mortgage lending doesn’t address the fundamental problem in the UK housing market. House prices are not being driven higher by a mortgage boom. The problem is a disequilibrium of supply and demand – especially in certain areas of the country.

- The renewed rise in house prices is strongly influenced by supply side factors. In recent decades supply has simply been unable to keep up with rising demand. Trying to manage demand through credit controls doesn’t deal with this relative shortage of housing in the UK.

- Geographical variations. Since the credit crunch the north/south divide has widened – especially with London house prices rising rapidly. If we exclude London from the National house prices, the rise in house prices looks less significant. In some areas of the country, house prices are stagnant or even falling. The geographical variation again suggests it’s more to do with local supply side factors.

Ironically, the government recently announced a scheme to help first time buyers get a mortgage through government backed loans. Yet, a few weeks later, a body is suggesting the Bank of England cut back on mortgage lending. It shows the government’s piecemeal approach to the housing market.

Housing and mortgages as a macro economic variable

There are many difficulties of trying to limit house price inflation, especially in the short term. However, the housing market is very influential to the economy and standards of living. Given how expensive houses are, there is a case for the government limiting price increases in the long-term. But, here the solution needs to be more about increasing supply than managing demand.

There is still a strong case for monetary policy placing greater emphasis on the role of the housing market and mortgage lending. In the boom period of 2000-2007, low inflation gave an impression of a stable and sustainable economy. But, looking at the housing market and mortgage lending gave a clear indication there were signs of a real financial bubble. When this bubble broke, it had a damaging effect on the economy (and was much worse in countries like US and Ireland).

When house prices are rising at 15-20% a year, there is a case for the Bank of England seeking to limit house price increases through mortgage rationing and possibly interest rates. In the last boom, rapidly rising house prices were a problem for the UK economy.

However, in the current climate, we are a long way from a demand driven housing boom – micro-managing house prices through demand is unlikely to be too helpful.

Related