Forgive me, I’m not an economist, but I am a working woman and a taxpayer and a consumer. Lowering prices does NOT encourage us to put off spending…if I see something I want or need for a lower price you can bet your butt I’m getting it before the price goes back up!

When an economy experiences deflation (general fall in price level) we tend to also see:

- Falling revenues for firms (prices go down) therefore they get less revenue.

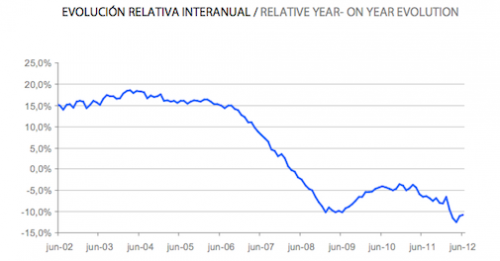

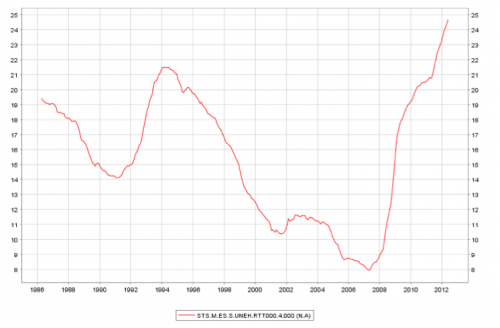

- Falling wages. Firms can’t afford wage increases, so wages start to fall (or stagnate) leading to lower income. For example, in Japan between 1997 and 2012 Average earnings fell 12.2 percent, while a core measure of consumer prices — excluding food and energy — fell 6.8%. (NY Times)

- Rise in unemployment. Often wages can’t fully adjust downwards, but firms can’t afford to pay workers. Therefore workers are made redundant and we get real wage unemployment.

If the price of a particular good goes down, this will increase demand for that good. (especially, if people think the price cut is temporary like a special offer)

However, deflation is a different situation. This is when all prices are falling (not necessarily all prices, but the average price level is falling). Furthermore, people expect prices to keep falling because of the deflationary pressures. If a TV has fallen 2%, but you expect a TV to fall another 2%, then you are more likely to delay buying because it will be cheaper next year.

An important factor here is that peoples expectations of inflation / deflation are closely related to current inflation. If current inflation is 3%, this is what people expect future inflation to be. If there is deflation of 2%, that will be people’s future expectations of deflation.

Another important factor is that deflation invariably means falling wages. So consumers have two factors which lead to lower spending during inflation

- The expectation prices will continue to fall.

- The fact nominal wages are falling and they have less income to purchase goods. In 2012, Japan, a survey of consumers found 94 % expected their wages to remain the same or fall, and 96% expected to maintain their spending levels or cut them. The survey has shown the same underlying trend for nearly 20 years.

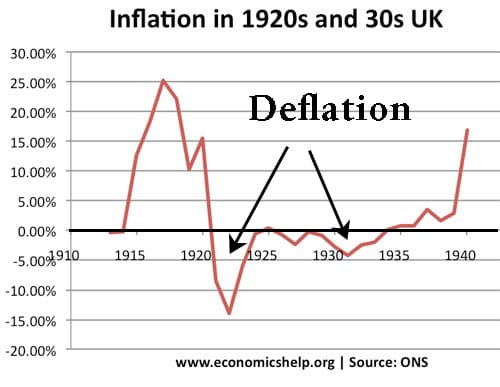

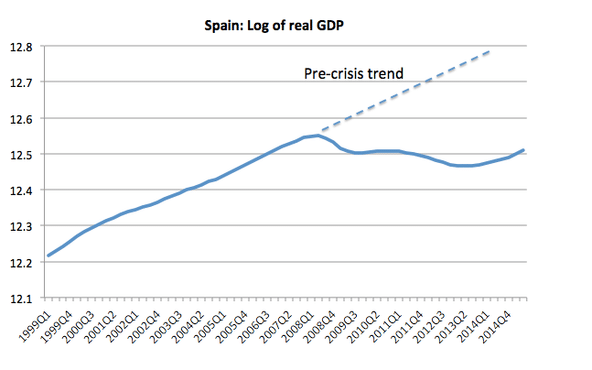

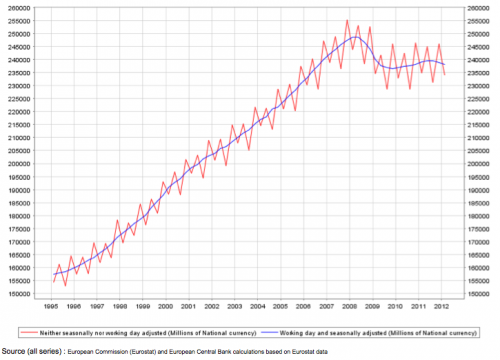

A good empirical example of the impact of deflation on consumer spending can be seen in the 1930s depression and Japan’s period of deflation during the 1990s and 2000s. Also, deflation during the 1920s was damaging for the UK economy.

Another real problem with deflation is that it is much harder to solve. E.g. the Central Bank can’t cut rates below zero. Therefore, once deflation is embedded, it becomes quite rational to expect continued deflation – this is one factor which makes deflation so damaging.

Why does Deflation increase the value of debt? It’s all just dollars and cents…if the value of our dollar goes up, yes the value of the debt does too so its still proportional to our currency value. So saying that the value of our debt goes up is a little misleading. It’s not going up independently and we suddenly don’t have the same amount of money.

The important feature is that deflation invariably means falling wages.

Suppose your mortgage payments are $500 a month, and your wage is $2000. You spend 25% of your disposable income on paying mortgage debt. However, if we have deflation and your nominal wages are being cut, then you have to spend a higher % of your income on paying your debt. If your wage fell to $1900, you would have to spend 26.3% of your income on your mortgage debt.