Veblen Goods

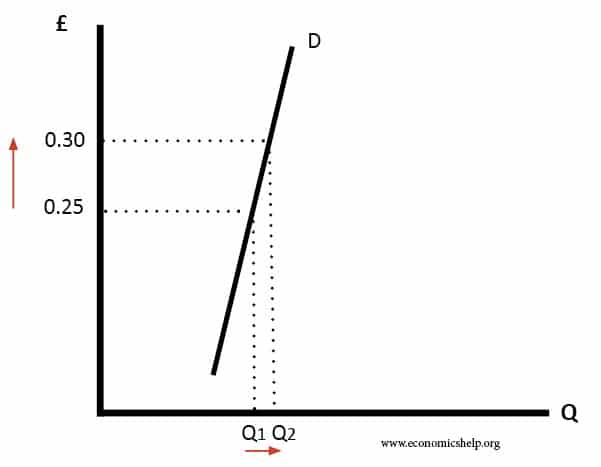

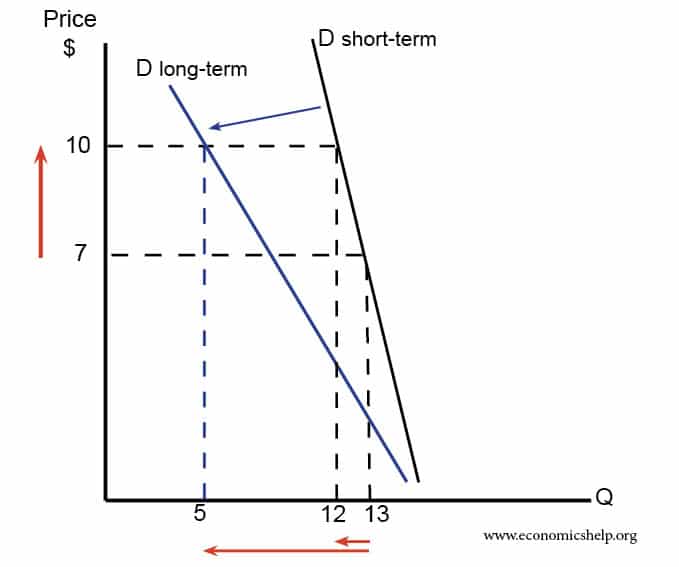

Definition of a Veblen Good. A Veblen good is a good where demand rises as price rises because people feel its higher price reflects greater status. Readers Question: I once ran across a term and now can’t find it. It’s the economic theory that consumers will purchase a product or service which cost more money …